Carbaugh, International Economics 9e, Chapter 16

... difficult in an economy with high inflation A number of nations use a crawling peg, under which the fixed rate is frequently adjusted to account for inflation or other factors Frequent changes keep pegged rates from becoming unrealistic, and unannounced changes keep speculators at bay Carbaugh, ...

... difficult in an economy with high inflation A number of nations use a crawling peg, under which the fixed rate is frequently adjusted to account for inflation or other factors Frequent changes keep pegged rates from becoming unrealistic, and unannounced changes keep speculators at bay Carbaugh, ...

Finance & Accounting

... • 1990s saw growth of emerging economies, with liberalized markets and high growth rates which attracted investors • But underlying weaknesses: • Build-up of debt, often in dollars; weak banking systems • Asian financial crisis • Southeast Asian countries enjoyed export-led economic development – bu ...

... • 1990s saw growth of emerging economies, with liberalized markets and high growth rates which attracted investors • But underlying weaknesses: • Build-up of debt, often in dollars; weak banking systems • Asian financial crisis • Southeast Asian countries enjoyed export-led economic development – bu ...

Good societies

... (proportion of economy devoted to taxes and state expenditures) • U.S. = lighter tax burden than other rich democracies; smaller public sector • Sweden = state revenues and spending amount to more than half of GDP ...

... (proportion of economy devoted to taxes and state expenditures) • U.S. = lighter tax burden than other rich democracies; smaller public sector • Sweden = state revenues and spending amount to more than half of GDP ...

PRESS - RELEASE №38 Transition towards

... As its new policy interest rate, the National Bank will use the overnight repo rate (Tenge Overnight Index Average), supported by open market operations, to signal the stance of monetary policy as indicated by the National Bank’s policy rate announcements. The National Bank’s own overnight deposit ...

... As its new policy interest rate, the National Bank will use the overnight repo rate (Tenge Overnight Index Average), supported by open market operations, to signal the stance of monetary policy as indicated by the National Bank’s policy rate announcements. The National Bank’s own overnight deposit ...

Turkish Crisis of 2001

... Exchange rate Regime Summary Prior to 2001, lira was under a predetermined crawling peg Used inflation targeting to determine exchange rate policy In 2001, lira was floated and lost half of its value ...

... Exchange rate Regime Summary Prior to 2001, lira was under a predetermined crawling peg Used inflation targeting to determine exchange rate policy In 2001, lira was floated and lost half of its value ...

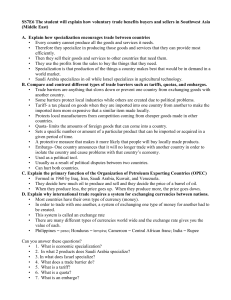

The student will explain how voluntary trade benefits

... • When they produce less, the price goes up. When they produce more, the price goes down. D. Explain why international trade requires a system for exchanging currencies between nations. • Most countries have their own type of currency (money). • In order to trade with one another, a system of exchan ...

... • When they produce less, the price goes up. When they produce more, the price goes down. D. Explain why international trade requires a system for exchanging currencies between nations. • Most countries have their own type of currency (money). • In order to trade with one another, a system of exchan ...

Section One - Pearson Education

... major contract to be awarded in three months’ time. The customer is a Saudi company and the major competitors are based in Germany and the US. The subsidiary is anxious to secure the business, but needs to ensure some, if minimal, level of profit. Make recommendations outlining the currency consider ...

... major contract to be awarded in three months’ time. The customer is a Saudi company and the major competitors are based in Germany and the US. The subsidiary is anxious to secure the business, but needs to ensure some, if minimal, level of profit. Make recommendations outlining the currency consider ...

Advantages of Fixed Exchange Rates

... on capital flows to and from their economy. This helps the government or the central bank to limit inflows and outflows of currency that might destabilise the fixed exchange rate target, The Chinese Renminbi is essentially fixed at 8.28 renminbi to the US dollar. Currency transactions involving trad ...

... on capital flows to and from their economy. This helps the government or the central bank to limit inflows and outflows of currency that might destabilise the fixed exchange rate target, The Chinese Renminbi is essentially fixed at 8.28 renminbi to the US dollar. Currency transactions involving trad ...

Currency Sovereignty And Policy Independence

... Still others peg the exchange rate to a foreign currency, but hold less than 100% reserve backing. In practice, this is a very risky proposition if the exchange rate is fixed and conversion on demand is permitted. Hence, the behavior of a prudent government operating with less than 100% reserves wou ...

... Still others peg the exchange rate to a foreign currency, but hold less than 100% reserve backing. In practice, this is a very risky proposition if the exchange rate is fixed and conversion on demand is permitted. Hence, the behavior of a prudent government operating with less than 100% reserves wou ...

probsetFinance3

... sum of the surpluses in the private and foreign sectors. Why is this? If government purchases rise to increase the budget deficit, how do income changes act to generate offsetting increases in the surpluses of the other sectors? 2. What is the small-open-country multiplier? Why is it less than the c ...

... sum of the surpluses in the private and foreign sectors. Why is this? If government purchases rise to increase the budget deficit, how do income changes act to generate offsetting increases in the surpluses of the other sectors? 2. What is the small-open-country multiplier? Why is it less than the c ...

download... - Stewart Financial

... Britain for example) were fixed to the price of gold; at any time, paper money could be exchanged for bullion. The exchange rate between currencies under this system was limited to how profitably someone could physically export or import gold from one country to another. For example, the cost of ins ...

... Britain for example) were fixed to the price of gold; at any time, paper money could be exchanged for bullion. The exchange rate between currencies under this system was limited to how profitably someone could physically export or import gold from one country to another. For example, the cost of ins ...

Chapter 32 1. This problem is composed of the examples found in

... funds shifts left. Panel (b), NCO shifts left because of a decrease in NCO at each interest rate causing the supply of pounds in the foreign currency exchange market to shift left and the exchange rate to rise. The result is: real interest rate down; NCO and NX down; value of the pound up; increase ...

... funds shifts left. Panel (b), NCO shifts left because of a decrease in NCO at each interest rate causing the supply of pounds in the foreign currency exchange market to shift left and the exchange rate to rise. The result is: real interest rate down; NCO and NX down; value of the pound up; increase ...

Ch10

... • Fixed exchange rate system: The value of a nation’s money is defined in terms of a fixed amount of a commodity (e.g., gold) or of another currency (e.g., U.S. dollar); the Gold standard exchange rate system • Flexible (floating) exchange rate system: The value of the currency is allowed to float u ...

... • Fixed exchange rate system: The value of a nation’s money is defined in terms of a fixed amount of a commodity (e.g., gold) or of another currency (e.g., U.S. dollar); the Gold standard exchange rate system • Flexible (floating) exchange rate system: The value of the currency is allowed to float u ...

Exchange Rate Determination: The Theoretical Thread

... exchange rate is found when currency flows match up vis-à-vis current and financial account activities. – This framework has wide appeal as BOP transaction data is readily available and widely reported. – Critics may argue that this theory does not take into account stocks of money or financial asse ...

... exchange rate is found when currency flows match up vis-à-vis current and financial account activities. – This framework has wide appeal as BOP transaction data is readily available and widely reported. – Critics may argue that this theory does not take into account stocks of money or financial asse ...

Chapter 18

... foreign currency may achieve major cost reductions, but is subject to the possibility of incurring high costs if the borrowed currency appreciates over time. ...

... foreign currency may achieve major cost reductions, but is subject to the possibility of incurring high costs if the borrowed currency appreciates over time. ...

6.1 – Overview 6.2 – Money and the Neutrality Principle

... - The Law of One Price asserts that domestic and foreign prices are equal when converted in the same currency. It can apply good by good or to a basket of goods - Arbitrage is the simultaneous purchase and sale of assets of identical characteristics to earn a profit without risk-taking: spatial arbi ...

... - The Law of One Price asserts that domestic and foreign prices are equal when converted in the same currency. It can apply good by good or to a basket of goods - Arbitrage is the simultaneous purchase and sale of assets of identical characteristics to earn a profit without risk-taking: spatial arbi ...

Slide 1

... of exchanges rates exceeded 2%. ◦ The average absolute monthly percentage change in wholesale and consumer price indices and for the ratios of national price levels were only half that of the corresponding exchange rates. ...

... of exchanges rates exceeded 2%. ◦ The average absolute monthly percentage change in wholesale and consumer price indices and for the ratios of national price levels were only half that of the corresponding exchange rates. ...

Slide 1

... reserves in vain attempt to defend unrealistic exchange rate Strengthen domestic financial sector, especially banks (capital adequacy, prudential norms, etc) Prudential limit for exposure of banks to speculative markets (stocks, real estates). Keep current account deficit of BOP at manageable levels ...

... reserves in vain attempt to defend unrealistic exchange rate Strengthen domestic financial sector, especially banks (capital adequacy, prudential norms, etc) Prudential limit for exposure of banks to speculative markets (stocks, real estates). Keep current account deficit of BOP at manageable levels ...

LMAX EXCHANGE Wall Street 30 (Mini) Contract Terms

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

Output, the Interest Rate, and the Exchange Rate

... that a cut in tax rates would boost economic activity. High output growth and dollar appreciation during the early 1980s resulted in an increase in the trade deficit. A higher trade deficit, combined with a large budget deficit, became know as the twin deficits of the 1980s. ...

... that a cut in tax rates would boost economic activity. High output growth and dollar appreciation during the early 1980s resulted in an increase in the trade deficit. A higher trade deficit, combined with a large budget deficit, became know as the twin deficits of the 1980s. ...

PDF Download

... first quarter of 2002 compared to the first quarter of 2001. This follows corresponding growth rates of 0.4% and 0.6% respectively in the preceding quarter. Greece and Spain were the countries with the best performance, followed by Denmark and the UK. In a quarter to quarter comparison, consumption ...

... first quarter of 2002 compared to the first quarter of 2001. This follows corresponding growth rates of 0.4% and 0.6% respectively in the preceding quarter. Greece and Spain were the countries with the best performance, followed by Denmark and the UK. In a quarter to quarter comparison, consumption ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.