Admission Examination in Economics

... 1. A foreign tourist spends an equivalent of 100 dollars for goods and serviced in your country. If marginal propensity to consume is 0.75, calculate the maximum potential increase in your country’s GDP resulting from the tourist’s spending. ...

... 1. A foreign tourist spends an equivalent of 100 dollars for goods and serviced in your country. If marginal propensity to consume is 0.75, calculate the maximum potential increase in your country’s GDP resulting from the tourist’s spending. ...

Colombia_en.pdf

... reference rate by 650 basis points, from 10% to 3.5%. Monetary policy transmission was rapidly reflected in other market rates, which fell sharply, except for the rate for consumer lending, which is perceived as higher-risk. Lending overall continued to slow, owing mainly to the performance of the c ...

... reference rate by 650 basis points, from 10% to 3.5%. Monetary policy transmission was rapidly reflected in other market rates, which fell sharply, except for the rate for consumer lending, which is perceived as higher-risk. Lending overall continued to slow, owing mainly to the performance of the c ...

real exchange rate

... converge. According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

... converge. According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

real exchange rate

... converge. According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

... converge. According to the theory of purchasingpower parity, a currency must have the same purchasing power in all countries and exchange rates move to ensure that. ...

Hyperinflation in Zimbabwe

... Year-on-year inflation exceeds 1,000%. New banknotes, with three [zeros] deleted from their values, are introduced in August. 9/2006 Riot police disrupt a planned demonstration against the government's handling of the economic crisis. Union leaders are taken into custody and later hospitalized, alle ...

... Year-on-year inflation exceeds 1,000%. New banknotes, with three [zeros] deleted from their values, are introduced in August. 9/2006 Riot police disrupt a planned demonstration against the government's handling of the economic crisis. Union leaders are taken into custody and later hospitalized, alle ...

The Nominal Exchange Rate is 11 Mexican Pesos for 1 US Dollar

... The Nominal Exchange Rate is 11 Mexican Pesos for 1 US Dollar A bottle of vanilla in the US is $15 A bottle of vanilla in Mexico is 140 Pesos Do the following to calculate the Real Exchange Rate: Converting US price to foreign currency, you have: _$15 * 11 = 165 pesos_ Spending that foreign currency ...

... The Nominal Exchange Rate is 11 Mexican Pesos for 1 US Dollar A bottle of vanilla in the US is $15 A bottle of vanilla in Mexico is 140 Pesos Do the following to calculate the Real Exchange Rate: Converting US price to foreign currency, you have: _$15 * 11 = 165 pesos_ Spending that foreign currency ...

East Asian Financial Crisis

... Productivity: economic expansion before crisis later explained by the rapid growth of production inputs (capital and labor) – but relatively little increase in productivity 2. Banking Regulation: Ineffective government supervision 3. Exchange rate regimes- Mostly pegged exchange rate system 4. Legal ...

... Productivity: economic expansion before crisis later explained by the rapid growth of production inputs (capital and labor) – but relatively little increase in productivity 2. Banking Regulation: Ineffective government supervision 3. Exchange rate regimes- Mostly pegged exchange rate system 4. Legal ...

Cours 4

... persisted after the adoption of floating exchange rates in 1970 ’s and 1980 ’s. Changes in prices caused by depreciation may not alter demand for the product (ex. Switzerland, Germany, Japan), in particular for high quality goods with few substitutes. Monetary autonomy ? UK example in 1979-1981 wh ...

... persisted after the adoption of floating exchange rates in 1970 ’s and 1980 ’s. Changes in prices caused by depreciation may not alter demand for the product (ex. Switzerland, Germany, Japan), in particular for high quality goods with few substitutes. Monetary autonomy ? UK example in 1979-1981 wh ...

Focus 1 Euro-dollar -- what does PPP say?

... Just how high could the euro climb? Over the long term, PPP argues for further increases. The monetary and fiscal policy mix in the USA is fundamentally more inflationary than in the euro zone with substantial government deficits, abundantly monetised by the Federal Reserve, which now holds 14% of t ...

... Just how high could the euro climb? Over the long term, PPP argues for further increases. The monetary and fiscal policy mix in the USA is fundamentally more inflationary than in the euro zone with substantial government deficits, abundantly monetised by the Federal Reserve, which now holds 14% of t ...

The Exchange Rate Mechanism and the Ruble Devaluation of 1998

... But why do different currencies have different value? And, why do these values change in relation to other currencies? Purchasing Power Parity (PPP): Is the relationship between the currencies of two or more countries and the commodities that can be purchased. Parity suggests that, products that are ...

... But why do different currencies have different value? And, why do these values change in relation to other currencies? Purchasing Power Parity (PPP): Is the relationship between the currencies of two or more countries and the commodities that can be purchased. Parity suggests that, products that are ...

Chapter 6

... rate system, exchange rates are allowed to move freely on a daily basis and no official boundaries exist. However, governments may intervene to prevent the rates from moving too much in a certain direction. ...

... rate system, exchange rates are allowed to move freely on a daily basis and no official boundaries exist. However, governments may intervene to prevent the rates from moving too much in a certain direction. ...

Objective of MP - qazieconometrics

... appreciation of the domestic currency in foreign exchange markets. ...

... appreciation of the domestic currency in foreign exchange markets. ...

1) An updated version of estimation of what is the actual Chinese

... economy like Hong Kong, one can hope to achieve equilibrium by adjusting domestic wages and prices, and to preserve the advantages of a fixed exchange rate. An economy as large as China, however, needs its own currency. There was a time when capital controls could play the role of second policy inst ...

... economy like Hong Kong, one can hope to achieve equilibrium by adjusting domestic wages and prices, and to preserve the advantages of a fixed exchange rate. An economy as large as China, however, needs its own currency. There was a time when capital controls could play the role of second policy inst ...

... invited Costa Rica to embark on the process of accession. On trade policy, negotiations for a free trade agreement with the Republic of Korea were launched, as part of a government strategy to diversify its trading partners, particularly targeting Asia. In the first 10 months of the year, goods expo ...

Chapter 3 The International Monetary System

... – Floating rates would offset international differences in inflation. – Real exchange rates would stabilize given gradual changes in underlying conditions affecting trade and productivity of capital. – Nominal exchange rates would stabilize if countries coordinated their monetary policies to achieve ...

... – Floating rates would offset international differences in inflation. – Real exchange rates would stabilize given gradual changes in underlying conditions affecting trade and productivity of capital. – Nominal exchange rates would stabilize if countries coordinated their monetary policies to achieve ...

Macro Final Topic Review

... You usually do not have to shift MD The Fed. Controls MS and that moves with monetary policy ...

... You usually do not have to shift MD The Fed. Controls MS and that moves with monetary policy ...

Loanable Funds Market

... Loanable Funds Market -Represents money in commercial banks and lending institutions that is available to finance investment or consumption ...

... Loanable Funds Market -Represents money in commercial banks and lending institutions that is available to finance investment or consumption ...

Ecuador

... Dollarization helps to limit currency and balance of payments crises. Without a domestic currency there is no possibility of a sharp depreciation, or of sudden capital outflows motivated by fears of devaluation. ...

... Dollarization helps to limit currency and balance of payments crises. Without a domestic currency there is no possibility of a sharp depreciation, or of sudden capital outflows motivated by fears of devaluation. ...

Chile_en.pdf

... further rate rises if hikes in the prices of certain goods (foodstuffs, fuels) were to spread to other prices or to wages, thereby altering expectations. The central bank argues that the monetary policy rate is still below the neutral level and therefore has stimulated demand in practical terms; fut ...

... further rate rises if hikes in the prices of certain goods (foodstuffs, fuels) were to spread to other prices or to wages, thereby altering expectations. The central bank argues that the monetary policy rate is still below the neutral level and therefore has stimulated demand in practical terms; fut ...

Chapter17

... In the end, the law of one price tells us that a dollar must buy the same amount of coffee in all countries. Implication of Purchasing-power parity • What does the theory of purchasing-power parity say about exchange rates? It tells us that the nominal exchange rate between the currencies of two co ...

... In the end, the law of one price tells us that a dollar must buy the same amount of coffee in all countries. Implication of Purchasing-power parity • What does the theory of purchasing-power parity say about exchange rates? It tells us that the nominal exchange rate between the currencies of two co ...

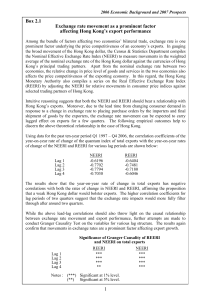

Exchange rate movement as a prominent factor affecting Hong

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

... Kong’s principal trading partners. Apart from the nominal exchange rate between two economies, the relative change in price level of goods and services in the two economies also affects the price competitiveness of the exporting economy. In this regard, the Hong Kong Monetary Authority also compiles ...

Nominal Exchange Rate and Real Exchange Rate

... The views expressed in this lesson are for information purposes only and do not construe to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of ...

... The views expressed in this lesson are for information purposes only and do not construe to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of ...

Economics for Today by Irvin B. Tucker 2003

... An exchange rate is the price of one nation’s currency in terms of another nation’s currency. Foreigners who wish to purchase U.S. goods, services, and financial assets demand dollars. The supply of dollars reflects the desire of U.S. citizens to purchase foreign goods, services and financial asset ...

... An exchange rate is the price of one nation’s currency in terms of another nation’s currency. Foreigners who wish to purchase U.S. goods, services, and financial assets demand dollars. The supply of dollars reflects the desire of U.S. citizens to purchase foreign goods, services and financial asset ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.