`Storm clouds over the EMS`, from La Libre Belgique (29-30

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

... countries would have invested more in our industrial restructuring projects rather than buying gold or making very short-term dollar deposits. Therefore, the lack of an energy policy can only prolong the current mess. European countries do not react in the same way to global shocks, for both politic ...

I.Why RMB exchange rate issue

... the RMB exchange rate issue in Tokyo. ● In middle 2003,US and some other developed countries joined in pressuring RMB revaluation 3、The reasons to pressure the revaluation of RMB ● increase of BOP surplus,especially against the U.S.; trade surplus against U.S. reached as high as $100 billions ...

... the RMB exchange rate issue in Tokyo. ● In middle 2003,US and some other developed countries joined in pressuring RMB revaluation 3、The reasons to pressure the revaluation of RMB ● increase of BOP surplus,especially against the U.S.; trade surplus against U.S. reached as high as $100 billions ...

APS7 - Cornell

... attempt to rid the economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange mark ...

... attempt to rid the economy of inflation. Ultimately, the economy went into a deep recession, but before it did, interest rates went to record levels. a. Explain how this policy mix led to very high interest rates. b. Show graphically the effect of the high interest rates on the foreign exchange mark ...

Colombia_en.pdf

... direct investment flows into Colombia were significant, especially for the oil and mining sectors, with accumulated growth to October 2011 of 54.2% compared with the same period in 2010. Export and portfolio investment inflows were up sharply as well, by 28.7% and 10%, respectively. This all took pl ...

... direct investment flows into Colombia were significant, especially for the oil and mining sectors, with accumulated growth to October 2011 of 54.2% compared with the same period in 2010. Export and portfolio investment inflows were up sharply as well, by 28.7% and 10%, respectively. This all took pl ...

inter_fin_2009_l1_post

... • As in IS-LM model, in MF we examine equilibrium of financial and goods market – in this case output and exchange rate. • Equilibrium of IS$ and LM$ just like that in conventional IS-LM market, but emphasizes a different endogenous financial market (ex. rate. rather than int. rate) ...

... • As in IS-LM model, in MF we examine equilibrium of financial and goods market – in this case output and exchange rate. • Equilibrium of IS$ and LM$ just like that in conventional IS-LM market, but emphasizes a different endogenous financial market (ex. rate. rather than int. rate) ...

INTERNATIONAL FINANCE

... Average of Previous Year’s Exchange Rate: Note: Excluding F/X reports sales based on the previous year’s exchange rate ...

... Average of Previous Year’s Exchange Rate: Note: Excluding F/X reports sales based on the previous year’s exchange rate ...

The Foreign Currency Market

... Shifts of the Demand and Supply Curves for Currency (From 2007 Macroeconomics Exam, Form B) • Assume that the interest rate in both the United States and the European Union equals 4.5 percent. a) Assume that the real interest rate in the United States falls to 3.75 percent. (ii) Using a correctly l ...

... Shifts of the Demand and Supply Curves for Currency (From 2007 Macroeconomics Exam, Form B) • Assume that the interest rate in both the United States and the European Union equals 4.5 percent. a) Assume that the real interest rate in the United States falls to 3.75 percent. (ii) Using a correctly l ...

Chapter 6

... some governments intervened in an attempt to control their exchange rates. Find out more about the crisis (and the consequences of the intervention efforts) ...

... some governments intervened in an attempt to control their exchange rates. Find out more about the crisis (and the consequences of the intervention efforts) ...

INDICATIVE SOLUTION INSTITUTE OF ACTUARIES OF INDIA CT7 – Business Economics

... proceeds of indirect taxes. (C) Loss in producer surplus will be only ‘g’ [(e+f+g) – (e+g)] because producers are getting ‘e+f’ satisfaction from the law and order maintained by government from the proceeds of indirect taxes ...

... proceeds of indirect taxes. (C) Loss in producer surplus will be only ‘g’ [(e+f+g) – (e+g)] because producers are getting ‘e+f’ satisfaction from the law and order maintained by government from the proceeds of indirect taxes ...

Peru_en.pdf

... agreement with the United States entered into force, as did the economic complementarity agreement with Chile in March. A free trade agreement was also signed with China. During the first three quarters of 2009, GDP grew by 0.1% compared with the year-earlier period. This result reflected the contra ...

... agreement with the United States entered into force, as did the economic complementarity agreement with Chile in March. A free trade agreement was also signed with China. During the first three quarters of 2009, GDP grew by 0.1% compared with the year-earlier period. This result reflected the contra ...

Finland

... 1. What did Finland really believe it would gain by pegging the value of the Finnish Markka to the ECU? First of all, Finland had already participated in Western Europe’s integration for decades, both politically and by opening up its markets. With the exception of key agricultural goods, Finland’s ...

... 1. What did Finland really believe it would gain by pegging the value of the Finnish Markka to the ECU? First of all, Finland had already participated in Western Europe’s integration for decades, both politically and by opening up its markets. With the exception of key agricultural goods, Finland’s ...

International Trade and Globalization

... Impacts on Scale, Distribution, Efficiency and Democracy ...

... Impacts on Scale, Distribution, Efficiency and Democracy ...

Supply and Demand and the Value of the Dollar

... sometimes people want to protect the value of their assets by holding them in a currency with an increasing value (and conversely getting out of currencies with declining values). As a result of changing supply and demand conditions in the foreignexchange markets, the value of currencies is constant ...

... sometimes people want to protect the value of their assets by holding them in a currency with an increasing value (and conversely getting out of currencies with declining values). As a result of changing supply and demand conditions in the foreignexchange markets, the value of currencies is constant ...

德明技術學院九十六學年度服務業經營管理研究所碩士班招生考試

... Which of the following statements is true? (A) Fiscal policy is unambiguously more effective in influencing national income under flexible exchange rates than under fixed exchange rates. (B) Fiscal policy is unambiguously more effective in influencing national income under fixed exchange rates than ...

... Which of the following statements is true? (A) Fiscal policy is unambiguously more effective in influencing national income under flexible exchange rates than under fixed exchange rates. (B) Fiscal policy is unambiguously more effective in influencing national income under fixed exchange rates than ...

Chapter 9

... 3. Among the three segments of the traditional foreign exchange markets, the decline was most pronounced in ‘spot markets’, which held in 2001 32 per cent of the total market. ‘Foreign exchange swaps’ have occupied the first position among the traditional FX markets since 1995, reaching a share of 5 ...

... 3. Among the three segments of the traditional foreign exchange markets, the decline was most pronounced in ‘spot markets’, which held in 2001 32 per cent of the total market. ‘Foreign exchange swaps’ have occupied the first position among the traditional FX markets since 1995, reaching a share of 5 ...

AP Economics Final Exam

... Sole Proprietorship – Single ownership Partnership – Two or more owners Corporations – Legally formed organization, funds raised through sale of stock, double taxation LLC – Limited Liability Company Government intervenes in the form of transfer payments, restricting monopolies, & promoting stabilit ...

... Sole Proprietorship – Single ownership Partnership – Two or more owners Corporations – Legally formed organization, funds raised through sale of stock, double taxation LLC – Limited Liability Company Government intervenes in the form of transfer payments, restricting monopolies, & promoting stabilit ...

Chapter 4

... The CAPM extended to an International Context (continued) The domestic CAPM extension can be justified only with the addition of two unreasonable assumptions: Investors throughout the world have identical consumption baskets. Real prices of consumption goods are identical in every country. In ...

... The CAPM extended to an International Context (continued) The domestic CAPM extension can be justified only with the addition of two unreasonable assumptions: Investors throughout the world have identical consumption baskets. Real prices of consumption goods are identical in every country. In ...

Review: Short and Long Run Compared

... aggregate demand, and this stimulus to AD causes GDP and also the price level to rise. (Crowding out occurs here too, with the rise in Y and P raising the demand for money and thus the interest rate, which reduces investment partially offsetting the increase in aggregate demand. Increased income tax ...

... aggregate demand, and this stimulus to AD causes GDP and also the price level to rise. (Crowding out occurs here too, with the rise in Y and P raising the demand for money and thus the interest rate, which reduces investment partially offsetting the increase in aggregate demand. Increased income tax ...

Introduction to International Business

... which would turn out to be an annual rate of 51% ((1,013/4000) * 2). If, however, you could lock in these interest rates, then this method would also reduce any exchange rate risk. What you should do depends upon the interest rates available, the forward rates available, how large a risk you are wil ...

... which would turn out to be an annual rate of 51% ((1,013/4000) * 2). If, however, you could lock in these interest rates, then this method would also reduce any exchange rate risk. What you should do depends upon the interest rates available, the forward rates available, how large a risk you are wil ...

International Money and the International Monetary System

... IMF as well as a numeraire for IMF operations. ...

... IMF as well as a numeraire for IMF operations. ...

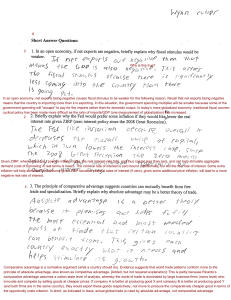

Why is this true? In an open economy, net exports being negative

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

Chapter 7_Problem set

... 9. The real exchange rate between the U.S. dollar and the Indian rupee is the: A) exchange rate between the dollar and the rupee. B) exchange rate between the dollar and the rupee divided by the price level in India. C) amount of Indian rupees per dollar multiplied by the relative price levels in th ...

... 9. The real exchange rate between the U.S. dollar and the Indian rupee is the: A) exchange rate between the dollar and the rupee. B) exchange rate between the dollar and the rupee divided by the price level in India. C) amount of Indian rupees per dollar multiplied by the relative price levels in th ...

International Lecture - Rockhurst University

... Stocks (measured at a point in time eg. Balance sheet items): ...

... Stocks (measured at a point in time eg. Balance sheet items): ...

FM11 Ch 26 Instructors Manual

... b. The exchange rate specifies the number of units of a given currency that can be purchased for one unit of another currency. The fixed exchange rate system was in effect from the end of World War II until August 1971. Under the system, the U. S. dollar was linked to gold at the rate of $35 per oun ...

... b. The exchange rate specifies the number of units of a given currency that can be purchased for one unit of another currency. The fixed exchange rate system was in effect from the end of World War II until August 1971. Under the system, the U. S. dollar was linked to gold at the rate of $35 per oun ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.