Zimbabwe bids “good bye” to its own currency!

... The 35 Zimbabwe quadrillion US dollar rate is applicable only to those citizens with accounts having more than 175 quadrillion. Those who have less money will see their money fetch less American dollars. To make it clear: 175 quadrillion Zimbabwe dollars will get five US dollars. On the other hand, ...

... The 35 Zimbabwe quadrillion US dollar rate is applicable only to those citizens with accounts having more than 175 quadrillion. Those who have less money will see their money fetch less American dollars. To make it clear: 175 quadrillion Zimbabwe dollars will get five US dollars. On the other hand, ...

24 Facing the Open Economy Trilemma in Post

... Faced with a rapidly depreciating South African Rand, associated with the negative contagion effects rolling-over emerging markets due to the 1998 Asian crisis, the South African authorities attempted not only to keep the capital account open and conduct autonomous monetary policy, but also to inter ...

... Faced with a rapidly depreciating South African Rand, associated with the negative contagion effects rolling-over emerging markets due to the 1998 Asian crisis, the South African authorities attempted not only to keep the capital account open and conduct autonomous monetary policy, but also to inter ...

Lecture-31

... across countries; constant returns to scale; fixed stocks of resources; and no effects on income distribution within countries. ...

... across countries; constant returns to scale; fixed stocks of resources; and no effects on income distribution within countries. ...

Answers - University of California, Berkeley

... also, since we are holding it constant (for now). Note that the domestic interest rate is endogenous because it is determined in the bottom part of the diagram. (b) What we know today is that the Euro area interest rate is “likely” to change, that means it is just expected to go up in the future. Si ...

... also, since we are holding it constant (for now). Note that the domestic interest rate is endogenous because it is determined in the bottom part of the diagram. (b) What we know today is that the Euro area interest rate is “likely” to change, that means it is just expected to go up in the future. Si ...

INTERNATIONAL FACTOR MOVEMENT

... Basic idea: let exchange rates vary around parity values to a much greater extent (say 10% instead of ...

... Basic idea: let exchange rates vary around parity values to a much greater extent (say 10% instead of ...

Argentina

... Devaluation Fears ◦ Run on the Banks $3.6 Billion Withdrawn 6% of Deposit Base Withdrawn in 2 Days Deposits fell from $85B to $15B by July 2002 ...

... Devaluation Fears ◦ Run on the Banks $3.6 Billion Withdrawn 6% of Deposit Base Withdrawn in 2 Days Deposits fell from $85B to $15B by July 2002 ...

PROBLEM SET 6 14.02 Macroeconomics May 3, 2006 Due May 10, 2006

... a. What is GDP in each economy? If the total value of production is consumed, how much will consumers in each economy spend on each of the goods? b. What will be the trade balance in each country? What will be the pattern of trade in this world (i.e., which good will each country export and to whom) ...

... a. What is GDP in each economy? If the total value of production is consumed, how much will consumers in each economy spend on each of the goods? b. What will be the trade balance in each country? What will be the pattern of trade in this world (i.e., which good will each country export and to whom) ...

Monetary Policy - ais

... RBA not only considers the current inflation rate and the state of the economy it will also consider all economic indicators that can influence future inflation eg ...

... RBA not only considers the current inflation rate and the state of the economy it will also consider all economic indicators that can influence future inflation eg ...

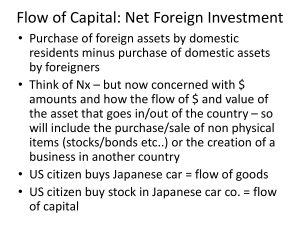

A Macroeconomic Theory of the Open Economy

... Implications for the economy experiencing capital flight: Increase in NFI, increases supply of domestic currency (though in this case, a large portion of the supply of domestic currency comes from sale of domestic assets). RER depreciates. Capital flight from a country increases the domestic i ...

... Implications for the economy experiencing capital flight: Increase in NFI, increases supply of domestic currency (though in this case, a large portion of the supply of domestic currency comes from sale of domestic assets). RER depreciates. Capital flight from a country increases the domestic i ...

Spring 2007

... seems the most likely explanation of this fact? a) The Federal Reserve Bank is less subject to political pressure than Congress. b) Most economists do not believe that contractionary fiscal policy would work to lower aggregate expenditures. c) Large deficits have limited the use of monetary policy t ...

... seems the most likely explanation of this fact? a) The Federal Reserve Bank is less subject to political pressure than Congress. b) Most economists do not believe that contractionary fiscal policy would work to lower aggregate expenditures. c) Large deficits have limited the use of monetary policy t ...

Why Did the Fed Raise Rates in October 1931?

... the Chinese and/or Saudi central banks to eliminate the pegs of their currencies to the greenback. Now, what would motivate these central banks to sever the peg? The desire to rein in their domestic inflation. In an environment in which the dollar is under downward pressure, the by-product of peggin ...

... the Chinese and/or Saudi central banks to eliminate the pegs of their currencies to the greenback. Now, what would motivate these central banks to sever the peg? The desire to rein in their domestic inflation. In an environment in which the dollar is under downward pressure, the by-product of peggin ...

Document

... 4. Jack and Jill both obey the two-period model of consumption. Jack earns $200 in the first period and $200 in the second period. Jill earns nothing in the first period and $420 in the second period. Both of them can borrow or lend at the interest rate. r? a. You observe both Jack and Jill consumin ...

... 4. Jack and Jill both obey the two-period model of consumption. Jack earns $200 in the first period and $200 in the second period. Jill earns nothing in the first period and $420 in the second period. Both of them can borrow or lend at the interest rate. r? a. You observe both Jack and Jill consumin ...

Case K12 - Pearson

... There are two major problems with G8 agreements. The first is that they are not binding. If governments are not prepared to give up national sovereignty and submit to international control, they are always likely to put purely national interests first. For example, the USA may unilaterally cut inter ...

... There are two major problems with G8 agreements. The first is that they are not binding. If governments are not prepared to give up national sovereignty and submit to international control, they are always likely to put purely national interests first. For example, the USA may unilaterally cut inter ...

Economics Principles and Applications

... • Since many imported goods are used as inputs by U.S. firms (such as oil from the Middle East and Mexico, or computer screens from Japan), a drop in exchange rate will cause a rise in U.S. price level • If exchange rate is too volatile, it can make trading riskier or require traders to acquire spec ...

... • Since many imported goods are used as inputs by U.S. firms (such as oil from the Middle East and Mexico, or computer screens from Japan), a drop in exchange rate will cause a rise in U.S. price level • If exchange rate is too volatile, it can make trading riskier or require traders to acquire spec ...

Exchange Rate Regimes

... • So e must collapse at earliest date at which there is no capital gain – So e collapses before all reserves are depleted • Why not sell before tc ? • Because then they incur capital loss ...

... • So e must collapse at earliest date at which there is no capital gain – So e collapses before all reserves are depleted • Why not sell before tc ? • Because then they incur capital loss ...

Chapter 11

... • Financial integration is a substitute for fiscal integration • It provides for risk sharing • In US this is twice as important than risk sharing through the government budget ...

... • Financial integration is a substitute for fiscal integration • It provides for risk sharing • In US this is twice as important than risk sharing through the government budget ...

5. CH 29 NFI and B O P notes

... firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and lending. • = THE BALANCE B/W ALL PAYMENTS THE U.S. RECEIVES FROM FOREIGNERS and ALL PAYMENTS MADE TO FOREIGNERS ...

... firms, payments are sent back and forth through major banks around the world. ………= • A country’s balance of payments accounts : record its international trading, borrowing, and lending. • = THE BALANCE B/W ALL PAYMENTS THE U.S. RECEIVES FROM FOREIGNERS and ALL PAYMENTS MADE TO FOREIGNERS ...

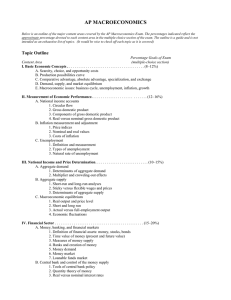

Formulas for Macro AP

... Monetary multiplier = 1/RRR Total addition to banking system = 1st loan x money multiplier + initial deposit IF IT’S NEW $ • Amt. of $ a bank can loan = excess reserves = total reserves – (RRR x checkable deposits) • Real interest rate = nominal interest rate – expected inflation rate ...

... Monetary multiplier = 1/RRR Total addition to banking system = 1st loan x money multiplier + initial deposit IF IT’S NEW $ • Amt. of $ a bank can loan = excess reserves = total reserves – (RRR x checkable deposits) • Real interest rate = nominal interest rate – expected inflation rate ...

Currency Board and Crawling Peg

... Smoothing Adjustment by a Crawling Peg A crawling peg is situated somewhere between fixed and flexible exchange rates. The continual rise of the central rate allows for an adjustment of inflation differentials, but only along a predetermined, nonstochastic path. Suppose that consumer prices rise by ...

... Smoothing Adjustment by a Crawling Peg A crawling peg is situated somewhere between fixed and flexible exchange rates. The continual rise of the central rate allows for an adjustment of inflation differentials, but only along a predetermined, nonstochastic path. Suppose that consumer prices rise by ...

The South African Rand

... want to have an open long position in Rand because the currency is strengthening. If they hold a short they want to cover their short position. • Based on Balance of Payments a currency trader would want to have an open short position in Rand. Due to this method predicting a weakening of the rand ov ...

... want to have an open long position in Rand because the currency is strengthening. If they hold a short they want to cover their short position. • Based on Balance of Payments a currency trader would want to have an open short position in Rand. Due to this method predicting a weakening of the rand ov ...

Bank of Slovenia`s Operational Monetary Policy

... ERM II: rate of national currency is set against the euro (central parity rate) – allowed fluctuation 15% (standard fluctuation band), exchange rate intervention Conditions for accession to the EMU: fulfilled nominal convergence criteria based on Maastricht criteria: ...

... ERM II: rate of national currency is set against the euro (central parity rate) – allowed fluctuation 15% (standard fluctuation band), exchange rate intervention Conditions for accession to the EMU: fulfilled nominal convergence criteria based on Maastricht criteria: ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.