Suriname_en.pdf

... The Surinamese economy posted growth of 2.9% in 2013, the first time since the global crisis that it had been below 3%. The projections for 2014 and 2015 are of 3.5% and 3.6%, respectively. In light of the decline in commodity prices and the economy’s high dependence on commodity exports, a return t ...

... The Surinamese economy posted growth of 2.9% in 2013, the first time since the global crisis that it had been below 3%. The projections for 2014 and 2015 are of 3.5% and 3.6%, respectively. In light of the decline in commodity prices and the economy’s high dependence on commodity exports, a return t ...

AP Macroeconomics

... 1. To make sure you understand the components of the current account, the capital account and the difference between credit (transaction that earns foreign exchange) and a debit (transaction that uses foreign currency), identify each of the following transactions on the U.S. balance of payments. Com ...

... 1. To make sure you understand the components of the current account, the capital account and the difference between credit (transaction that earns foreign exchange) and a debit (transaction that uses foreign currency), identify each of the following transactions on the U.S. balance of payments. Com ...

Currencies: Should There Be Five or One Hundred and Five?

... move freely across borders, so countries could control both exchange rates and interest rates. Under the influence of economist John Maynard Keynes, monetary policy was thought of as an instrument to dampen cyclical booms and recessions. It was monetary policy as speed control: Interest rates were i ...

... move freely across borders, so countries could control both exchange rates and interest rates. Under the influence of economist John Maynard Keynes, monetary policy was thought of as an instrument to dampen cyclical booms and recessions. It was monetary policy as speed control: Interest rates were i ...

FINANCIAL MARKE TS SOLUTIONS MA Y 2010

... K1.00 below, which symbolizes that more difficult times have been experienced by the company. This can be due to many factors such as global crisis (global melt down), interest rate fluctuation, inflation, exchange rate fluctuations etc. Observation: marks shall also be awarded accordingly to any st ...

... K1.00 below, which symbolizes that more difficult times have been experienced by the company. This can be due to many factors such as global crisis (global melt down), interest rate fluctuation, inflation, exchange rate fluctuations etc. Observation: marks shall also be awarded accordingly to any st ...

relationship of exchange rate with macro economic variables

... introduced an exchange rate system that remained in effect till 1971. ...

... introduced an exchange rate system that remained in effect till 1971. ...

Open-Economy Macroeconomics: Basic Concepts

... in two markets would necessarily converge, and exchange rates move to ensure that a currency would have the same purchasing power in all countries. ...

... in two markets would necessarily converge, and exchange rates move to ensure that a currency would have the same purchasing power in all countries. ...

+ NX(ε) - BrainMass

... relationship so I(r) is negatively sloped. As “r” increases “I” decreases. In this case however it is the world interest rate (r*) that dominates the small open economy. Much like a perfect competitor is a price taker the small open economy is an interest rate taker. Domestic investors always have a ...

... relationship so I(r) is negatively sloped. As “r” increases “I” decreases. In this case however it is the world interest rate (r*) that dominates the small open economy. Much like a perfect competitor is a price taker the small open economy is an interest rate taker. Domestic investors always have a ...

AP Macro reminders

... • Loanable funds market – upward sloping S • Foreign exchange – if D for one increases or decreases, S for the other does the same • If one currency appreciates, the other depreciates • Comparative advantage – OOO, IOU • Money creation – if original deposit is new $, it must be added to created $ to ...

... • Loanable funds market – upward sloping S • Foreign exchange – if D for one increases or decreases, S for the other does the same • If one currency appreciates, the other depreciates • Comparative advantage – OOO, IOU • Money creation – if original deposit is new $, it must be added to created $ to ...

Unit 3 Review Game

... A measure of how much of the goods and services that the people of a place have that they need is called ________ ___ ________. ...

... A measure of how much of the goods and services that the people of a place have that they need is called ________ ___ ________. ...

Why Dollarization Is More Straitjacket Than Salvation

... The recent wave of financial crises has prompted some observers to argue that developing countries should abandon their own currencies and instead adopt the U.S. dollar (or perhaps the euro or yen, depending on their location). This conclusion is unwarranted, even reckless. Dollarization is an extre ...

... The recent wave of financial crises has prompted some observers to argue that developing countries should abandon their own currencies and instead adopt the U.S. dollar (or perhaps the euro or yen, depending on their location). This conclusion is unwarranted, even reckless. Dollarization is an extre ...

CHAP1.WP (Word5)

... This depreciation means that foreign assets held by Canada were rising in value in local terms while foreign liabilities were primarily in Canadian dollars. This valuation effect could reduce the net foreign debt. Such an impact is seen less if some of the foreign liabilities are denominated in fore ...

... This depreciation means that foreign assets held by Canada were rising in value in local terms while foreign liabilities were primarily in Canadian dollars. This valuation effect could reduce the net foreign debt. Such an impact is seen less if some of the foreign liabilities are denominated in fore ...

Slide 1

... can be thought of as stable. If the price ratio is higher than its ‘equilibrium’ value the production of high tech. goods grow faster than that of low-tech goods, giving rise to an excess supply of high tech goods which pushes down the relative price of high tech goods in terms of low tech goods. Li ...

... can be thought of as stable. If the price ratio is higher than its ‘equilibrium’ value the production of high tech. goods grow faster than that of low-tech goods, giving rise to an excess supply of high tech goods which pushes down the relative price of high tech goods in terms of low tech goods. Li ...

AD-AS_Questions

... inflation falls from 45 to 2% whilst money wages rise by 4% over the same time period ...

... inflation falls from 45 to 2% whilst money wages rise by 4% over the same time period ...

Problem Set #1 - Wharton Finance Department

... Identify the inflation adjusted exchange rate levels using WPI for May 2004. Compare this with the nominal rate at this time. Determine the % over or under valuation for the nominal exchange rate. (% overvaluation of MXP = [NXR(USD/MXP) – IAXR(USD/MXP))/IAXR(USD/MXP)] Compare this value to the exten ...

... Identify the inflation adjusted exchange rate levels using WPI for May 2004. Compare this with the nominal rate at this time. Determine the % over or under valuation for the nominal exchange rate. (% overvaluation of MXP = [NXR(USD/MXP) – IAXR(USD/MXP))/IAXR(USD/MXP)] Compare this value to the exten ...

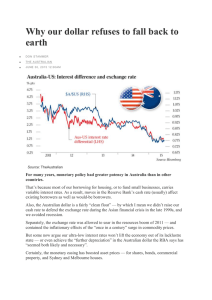

Why our dollar refuses to fall back to earth

... For our dollar to decline usefully against the greenback, we may have to wait for expectations the US will soon raise its cash rate — or cut our interest rates and live with a housing bubble in the two biggest cities. Even then, the Australian dollar may not move as low as many people now wish for. ...

... For our dollar to decline usefully against the greenback, we may have to wait for expectations the US will soon raise its cash rate — or cut our interest rates and live with a housing bubble in the two biggest cities. Even then, the Australian dollar may not move as low as many people now wish for. ...

Problem Set 1 Econometria - MFEE - FGV Cecilia

... indicating equilibrium (the NAIRU – Non-Accelerating Inflation Rate of Unemployment). Under the assumption of static expectations ( = p –1), i.e., that you expect this period's inflation rate to hold for the next ...

... indicating equilibrium (the NAIRU – Non-Accelerating Inflation Rate of Unemployment). Under the assumption of static expectations ( = p –1), i.e., that you expect this period's inflation rate to hold for the next ...

14.02 Macroeconomics May 18, 2006 Practice Question: Mundell-Fleming Model Managing Vermont’s Economy

... Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US. Please note that the ...

... Y U S : Real GDP of the US T : Vermont’s Taxes i : Vermont’s nominal interest rate iU S : Nominal interest rate of the US E : VT$ in terms of US$ E e : Expected future VT$ in terms of US$ M : Vermont’s stock of money in circulation The only trading partner of Vermont is the US. Please note that the ...

FedViews

... prices resumed their downturn near the end of 2015 in response to additional weak news about Chinese economic fundamentals, particularly in its manufacturing sector. Technical factors, such as the on-off use of “circuit breakers” to limit sharp price changes, also appear to have exacerbated equity m ...

... prices resumed their downturn near the end of 2015 in response to additional weak news about Chinese economic fundamentals, particularly in its manufacturing sector. Technical factors, such as the on-off use of “circuit breakers” to limit sharp price changes, also appear to have exacerbated equity m ...

14 Currency markets

... Many people today argue that currency speculators rather than governments or central banks are able to determine exchange rates, interest rates, and levels of investment, trade and growth. Around the world, over $1.8 trillion dollars are traded every day by currency speculators. Opponents of currenc ...

... Many people today argue that currency speculators rather than governments or central banks are able to determine exchange rates, interest rates, and levels of investment, trade and growth. Around the world, over $1.8 trillion dollars are traded every day by currency speculators. Opponents of currenc ...

Chapter 7 presentation.

... of another: ETL/USD = 1.75 TL/dollar Foreign exchange market—the financial market where exchange rates are determined Spot transaction—immediate (two-day) exchange of bank deposits at spot exchange rate Forward transaction—the exchange of bank deposits at some specified future date at the agreed for ...

... of another: ETL/USD = 1.75 TL/dollar Foreign exchange market—the financial market where exchange rates are determined Spot transaction—immediate (two-day) exchange of bank deposits at spot exchange rate Forward transaction—the exchange of bank deposits at some specified future date at the agreed for ...

Nicaragua_en.pdf

... The Nicaraguan economy felt the toll of the international financial crisis and, particularly, of the recession in the United States in 2009. The primary transmission channels were weaker external demand, a decrease in the flow of remittances and shrinking foreign direct investment (FDI). The economi ...

... The Nicaraguan economy felt the toll of the international financial crisis and, particularly, of the recession in the United States in 2009. The primary transmission channels were weaker external demand, a decrease in the flow of remittances and shrinking foreign direct investment (FDI). The economi ...

Economics Study Guide November 2011 exam

... We ran out of time to review Chapter 11, so the exam will be primarily on Chapters 10, 12, and 16. Chapter 11 will be tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag mo ...

... We ran out of time to review Chapter 11, so the exam will be primarily on Chapters 10, 12, and 16. Chapter 11 will be tested on the final exam in December. Please focus your review these next two nights on 10, 12, and 16. Know the following terms: inside lag monetarism monetary policy outside lag mo ...

Unit 5 Demographic/ Economic Development Vocabulary Birthrate

... Infant mortality- the number of deaths among infants under age one as measured per thousand live births. Life expectancy- the average period that a person my expect to live. Literacy Rate - number of people who are able to read and write. Middle income- relating to people whose income falls in the m ...

... Infant mortality- the number of deaths among infants under age one as measured per thousand live births. Life expectancy- the average period that a person my expect to live. Literacy Rate - number of people who are able to read and write. Middle income- relating to people whose income falls in the m ...

Exchange rate

.jpg?width=300)

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, FX rate or Agio) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an interbank exchange rate of 119 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥119 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥119. In this case it is said that the price of a dollar in terms of yen is ¥119, or equivalently that the price of a yen in terms of dollars is $1/119.Exchange rates are determined in the foreign exchange market, which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveler's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions has been justified to compensate for the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.