global health investment fund

... The fund was sponsored by the Bill & Melinda Gates Foundation, uniquely endowed by KfW with a cornerstone investment from IFC Government’s of Sweden and Canada also partnered via GCC and SIDA Key stakeholders have crowded in Industry and Private Investors in a unique partnership ...

... The fund was sponsored by the Bill & Melinda Gates Foundation, uniquely endowed by KfW with a cornerstone investment from IFC Government’s of Sweden and Canada also partnered via GCC and SIDA Key stakeholders have crowded in Industry and Private Investors in a unique partnership ...

What Is Diversification?

... One key to successful investing is managing risk while maintaining the potential for adequate returns on your investments. One of the most effective ways to help manage your investment risk is to diversify. Diversification is an investment strategy aimed at managing risk by spreading your money acro ...

... One key to successful investing is managing risk while maintaining the potential for adequate returns on your investments. One of the most effective ways to help manage your investment risk is to diversify. Diversification is an investment strategy aimed at managing risk by spreading your money acro ...

Ch 11: 1.1

... securities together with an agreement for the seller to buy back the securities at a slightly higher price either the next day or within a few days. Repos are short-term loans with the securities serving as collateral. Leverage is the financing of investments by borrowing rather than using capital. ...

... securities together with an agreement for the seller to buy back the securities at a slightly higher price either the next day or within a few days. Repos are short-term loans with the securities serving as collateral. Leverage is the financing of investments by borrowing rather than using capital. ...

Overview FTSE All-World Ex CW Climate Balanced Factor Index

... of the FTSE All-World, Ex Controversial Weapons Climate Balanced Factor Index or the fitness or suitability of the index for any particular purpose to which it might be put. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice a ...

... of the FTSE All-World, Ex Controversial Weapons Climate Balanced Factor Index or the fitness or suitability of the index for any particular purpose to which it might be put. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice a ...

Kenya February 2017 Markets update PDF

... This document was produced by STANLIB Kenya Ltd (‘STANLIB’) with the greatest of care and to the best of its knowledge and belief. However, STANLIB provides no guarantee with regard to its content and completeness and does not accept any liability for losses which might arise from making use of this ...

... This document was produced by STANLIB Kenya Ltd (‘STANLIB’) with the greatest of care and to the best of its knowledge and belief. However, STANLIB provides no guarantee with regard to its content and completeness and does not accept any liability for losses which might arise from making use of this ...

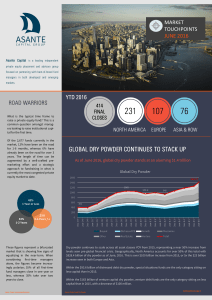

global dry powder continues to stack up

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

File - Hallett Advisors

... cushion and are positive whether stock returns are positive or negative. The image compares the total return and income return for the S&P 500 index, Dividend Composite index, Dividend Leaders index, and REITs for the past two recessions in 2001 and 2007. As seen in the image, dividendpaying stocks ...

... cushion and are positive whether stock returns are positive or negative. The image compares the total return and income return for the S&P 500 index, Dividend Composite index, Dividend Leaders index, and REITs for the past two recessions in 2001 and 2007. As seen in the image, dividendpaying stocks ...

October 2, 2015

... The major market indexes were mixed as worries over China’s economic slowdown and potential new rules in drug pricing gave way to a strong Friday afternoon rally that allowed many indexes to regain positive territory for the week. The Dow Jones Industrial Average gained 157 points for the week to cl ...

... The major market indexes were mixed as worries over China’s economic slowdown and potential new rules in drug pricing gave way to a strong Friday afternoon rally that allowed many indexes to regain positive territory for the week. The Dow Jones Industrial Average gained 157 points for the week to cl ...

Month-End Portfolio Data Now Available for Federated Investors

... (PITTSBURGH, Pa., March 15, 2017) -- Federated Investors, Inc. today announced that monthly fund composition and performance data for Federated Premier Municipal Income Fund (NYSE: FMN) and Federated Premier Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the ...

... (PITTSBURGH, Pa., March 15, 2017) -- Federated Investors, Inc. today announced that monthly fund composition and performance data for Federated Premier Municipal Income Fund (NYSE: FMN) and Federated Premier Intermediate Municipal Income Fund (NYSE: FPT) as of Feb. 28, 2017, are now available in the ...

10 Reasons to Consider Adding Managed Futures to

... *1) Managed Futures: CASAM CISDM CTA Equal Weighted; 2) Stocks: MSCI World; ...

... *1) Managed Futures: CASAM CISDM CTA Equal Weighted; 2) Stocks: MSCI World; ...

Stable Value Fund

... average interest rates over a period of several years, the fund’s income yield may remain above or stay below current market yields during some time periods. Income risk will be moderately high for the fund. Inflation Risk: The chance that fund returns will not keep pace with the cost of living. Mar ...

... average interest rates over a period of several years, the fund’s income yield may remain above or stay below current market yields during some time periods. Income risk will be moderately high for the fund. Inflation Risk: The chance that fund returns will not keep pace with the cost of living. Mar ...

Templeton Latin America Fund

... value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated ...

... value of shares in the Fund and income received from it can go down as well as up, and investors may not get back the full amount invested. Past performance is no guarantee of future performance. Currency fluctuations may affect the value of overseas investments. When investing in a fund denominated ...

22 July 2016 Dear Sir/Madam Change in management fee

... assess the viability of the Fund. The review identified that the Fund can no longer be managed in a cost efficient manner due to very low assets under management and changing investor appetites. The flow of assets under management has been out of the strategy for an extended period of time and has f ...

... assess the viability of the Fund. The review identified that the Fund can no longer be managed in a cost efficient manner due to very low assets under management and changing investor appetites. The flow of assets under management has been out of the strategy for an extended period of time and has f ...

Emerging markets in 2017

... jurisdictions outside of North America. Fidelity International does not offer investment advice based on individual circumstances. Any service, security, investment, fund or product mentioned or outlined in this document may not be suitable for you and may not be available in your jurisdiction. It i ...

... jurisdictions outside of North America. Fidelity International does not offer investment advice based on individual circumstances. Any service, security, investment, fund or product mentioned or outlined in this document may not be suitable for you and may not be available in your jurisdiction. It i ...

Municipal Bond Funds Commentary

... be taxable. Bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, changing market perceptions of the risk of default, changes in government intervention, and factors related to a specific issuer. These factors may also lead to periods of h ...

... be taxable. Bond prices may fall or fail to rise over time for several reasons, including general financial market conditions, changing market perceptions of the risk of default, changes in government intervention, and factors related to a specific issuer. These factors may also lead to periods of h ...

Notes: All index returns exclude reinvested dividends, and the 5

... Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks su ...

... Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets. International investing involves special risks su ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... Purchasing Managers Index (PMI) is a compilation of the 5 components listed above weighted by the given percentages. The PMI is a diffusion index, showing changes in month to month activity, but not actual levels of production. Component number = % reporting rising + ½ % reporting no change PMI is a ...

... Purchasing Managers Index (PMI) is a compilation of the 5 components listed above weighted by the given percentages. The PMI is a diffusion index, showing changes in month to month activity, but not actual levels of production. Component number = % reporting rising + ½ % reporting no change PMI is a ...

Lazard Emerging Markets Equity Portfolio

... Standard deviation measures the dispersion or “spread” of individual observations around their mean. Standard deviation of returns measures a fund’s historical volatility, where a higher number is evidence of greater volatility (i.e., higher risk). Equity securities will fluctuate in price; the valu ...

... Standard deviation measures the dispersion or “spread” of individual observations around their mean. Standard deviation of returns measures a fund’s historical volatility, where a higher number is evidence of greater volatility (i.e., higher risk). Equity securities will fluctuate in price; the valu ...

Daily Liquid Assets - Goldman Sachs Asset Management

... An investment in a money market portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market portfolio seeks to preserve the value of an investment at $1.00 per share, it is possible to lose money by investing in a money ...

... An investment in a money market portfolio is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although a money market portfolio seeks to preserve the value of an investment at $1.00 per share, it is possible to lose money by investing in a money ...

Download attachment

... 237 million people also topped all other Dow Jones Islamic Market indexes in its year-to-date performance with a very impressive 96.57% increase. Indonesia was followed by the DJIM South Korea Index, which added 14.02%, closing at 631.57 points. The DJIM Hong Kong Index posted the third largest ad ...

... 237 million people also topped all other Dow Jones Islamic Market indexes in its year-to-date performance with a very impressive 96.57% increase. Indonesia was followed by the DJIM South Korea Index, which added 14.02%, closing at 631.57 points. The DJIM Hong Kong Index posted the third largest ad ...

wells fargo/ galliard ultra short bond fund

... Galliard is one of the nation’s largest stable value fixed income managers1 with $84.8 billion in assets under management. As part of Galliard’s stable value management capability, we currently manage approximately $38.4 billion in short-duration fixed income management. Galliard’s Fixed Income Team ...

... Galliard is one of the nation’s largest stable value fixed income managers1 with $84.8 billion in assets under management. As part of Galliard’s stable value management capability, we currently manage approximately $38.4 billion in short-duration fixed income management. Galliard’s Fixed Income Team ...

Royal London US Growth Trust (Income

... but less volatile than shares. This Fund has historically been primarily invested in shares. The indicator has been calculated using historical data and may not be a reliable indication of the future risk profile of the Fund. The indicator is calculated using a standard methodology that is used by a ...

... but less volatile than shares. This Fund has historically been primarily invested in shares. The indicator has been calculated using historical data and may not be a reliable indication of the future risk profile of the Fund. The indicator is calculated using a standard methodology that is used by a ...

Governmental Accounting

... Fund Types and Classifications • All funds can be classified into one of 11 different fund types. • These 11 fund types, in turn, can be classified into three broad categories of funds. • Governmental Funds – typically are used to account for tax-supported (I.e., governmental) activities. • Proprie ...

... Fund Types and Classifications • All funds can be classified into one of 11 different fund types. • These 11 fund types, in turn, can be classified into three broad categories of funds. • Governmental Funds – typically are used to account for tax-supported (I.e., governmental) activities. • Proprie ...

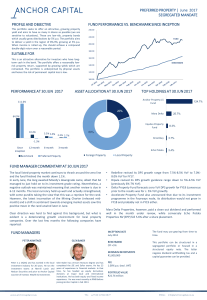

fund performance vs. benchmark since inception

... The local listed-property market continues to thrash around the zero line and the fund finished the month down 1.1%. In early June, the long awaited Moody’s downgrade came, albeit that SA managed to just hold on to its investment grade rating. Nevertheless, a negative outlook was maintained meaning ...

... The local listed-property market continues to thrash around the zero line and the fund finished the month down 1.1%. In early June, the long awaited Moody’s downgrade came, albeit that SA managed to just hold on to its investment grade rating. Nevertheless, a negative outlook was maintained meaning ...