Quarterly Update

... Emerging markets in particular have reaped a large share of the benefits of global trade (mostly via their cheap exports) and should a bout of protectionism overtake world leaders in the next one to two years, those benefits may lessen. For now, we think a high quality approach that adds exposure to ...

... Emerging markets in particular have reaped a large share of the benefits of global trade (mostly via their cheap exports) and should a bout of protectionism overtake world leaders in the next one to two years, those benefits may lessen. For now, we think a high quality approach that adds exposure to ...

INTRODUCING THE PRODUCER PRICE INDEX FOR SRI LANKA

... those assets rather than by using the historic cost (the price at which the asset was originally purchased). In current cost accounting, the price index used should not be a general price index but should be specific to the asset being used. Thus the PPI can be used to estimate the current value of ...

... those assets rather than by using the historic cost (the price at which the asset was originally purchased). In current cost accounting, the price index used should not be a general price index but should be specific to the asset being used. Thus the PPI can be used to estimate the current value of ...

Key Investor Information

... The fund aims to provide income and capital growth by investing in equities of companies worldwide. Investment Policy The fund invests at least 80% of its assets in equities of companies worldwide which offer sustainable dividend payments. The fund seeks to invest in a diversified portfolio of equit ...

... The fund aims to provide income and capital growth by investing in equities of companies worldwide. Investment Policy The fund invests at least 80% of its assets in equities of companies worldwide which offer sustainable dividend payments. The fund seeks to invest in a diversified portfolio of equit ...

Key investor information.

... charge upon request to the registered office of the management company. • Other information on the fund, including the latest share prices, can be found at www.triodos.com. • The assets and liabilities of each sub-fund are segregated by law. The sub-fund may offer other share classes. Information ...

... charge upon request to the registered office of the management company. • Other information on the fund, including the latest share prices, can be found at www.triodos.com. • The assets and liabilities of each sub-fund are segregated by law. The sub-fund may offer other share classes. Information ...

Analysts foresee boost in market activities this week

... from gains in the previous week; the last two days however, saw gains on revived investor interest, and as a result, the index finished the week up by 1.1 per cent. “Therefore, the nearing full year 2011 earnings season is bound to sustain buying momentum in equities market this week, especially amo ...

... from gains in the previous week; the last two days however, saw gains on revived investor interest, and as a result, the index finished the week up by 1.1 per cent. “Therefore, the nearing full year 2011 earnings season is bound to sustain buying momentum in equities market this week, especially amo ...

THE EXTRAORDINARY DIVIDEND

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

Monthly Commentary—Artisan International Small

... Index measures the performance of developed markets, excluding the US and Canada. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment. For the purpose of determining the Fund’s holdings, securities of the same is ...

... Index measures the performance of developed markets, excluding the US and Canada. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment. For the purpose of determining the Fund’s holdings, securities of the same is ...

Recent Portfolio Theory - Advice in a Multifactor World John H

... Look at apparent free lunches with healthy skeptism Never forget that for every investor who is buying a stock or asset class for its risk premium, there is another investor who is avoiding it because he feels that the risk is too high. This is an issue that is really on the front edge of the index ...

... Look at apparent free lunches with healthy skeptism Never forget that for every investor who is buying a stock or asset class for its risk premium, there is another investor who is avoiding it because he feels that the risk is too high. This is an issue that is really on the front edge of the index ...

Value drivers

... following two manners: Reduction in the cost of acquisition of the underlying securities. It helps generating money for institutions and their investors, while holding the underlying. ...

... following two manners: Reduction in the cost of acquisition of the underlying securities. It helps generating money for institutions and their investors, while holding the underlying. ...

Target Date Funds Can Help Investors Diversify

... To achieve its objective, a target date fund moves along a glide path that adjusts its portfolio over time, away from an asset allocation that may be considered riskier to one that is intended to be more conservative. In fact, the fund continues along its glide path after the target date – in many c ...

... To achieve its objective, a target date fund moves along a glide path that adjusts its portfolio over time, away from an asset allocation that may be considered riskier to one that is intended to be more conservative. In fact, the fund continues along its glide path after the target date – in many c ...

Stockmarket Linked Savings Bond (Issue 35) Term Sheet – 6 years

... 0870 607 6000. Calls may be recorded or monitored. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, except in respect of its consumer credit products for which Santander UK plc is licensed and regulated by the ...

... 0870 607 6000. Calls may be recorded or monitored. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, except in respect of its consumer credit products for which Santander UK plc is licensed and regulated by the ...

Complexity of the global economy

... payment of commissions is like equity, and since equity commissions are higher, more commissions are doled out. It’s more effective to separate debt money from equity money. 6. Certain Real-estate funds indicate >20% p.a. return in the 7-10 year time-frame of investment. On closer inspection, one fi ...

... payment of commissions is like equity, and since equity commissions are higher, more commissions are doled out. It’s more effective to separate debt money from equity money. 6. Certain Real-estate funds indicate >20% p.a. return in the 7-10 year time-frame of investment. On closer inspection, one fi ...

Invesco Core Plus Bond Fund investment philosophy and process

... securities, mortgage-backed securities (MBS) and asset backed securities (ABS). The Fund may also invest up to 30% of its total assets in foreign debt securities, up to 20% in high yield debt securities (junk bonds), up to 30% in developing markets debt securities and up to 20% in currencies other t ...

... securities, mortgage-backed securities (MBS) and asset backed securities (ABS). The Fund may also invest up to 30% of its total assets in foreign debt securities, up to 20% in high yield debt securities (junk bonds), up to 30% in developing markets debt securities and up to 20% in currencies other t ...

Prudential QMA Stock Index Fund Fact Sheet

... 401(k), IRAs). Class Z shares are available to institutional investors through certain retirement, mutual fund wrap and asset allocation programs and to institutions at an investment minimum of $5,000,000. All data is unaudited and subject to change. The Fund may not be available for sale through yo ...

... 401(k), IRAs). Class Z shares are available to institutional investors through certain retirement, mutual fund wrap and asset allocation programs and to institutions at an investment minimum of $5,000,000. All data is unaudited and subject to change. The Fund may not be available for sale through yo ...

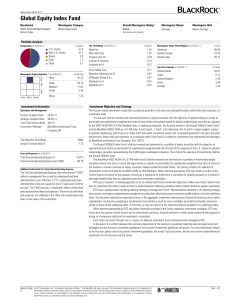

Global Equity Index Fund

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

... investment objective. An investment in the Fund is not a bank deposit, is not guaranteed by BlackRock, Inc. or any of its affiliates, and is not insured by the Federal Deposit Insurance Corporation or any other agency of the U.S. government. Equity Investment Risk: The price of an equity security fl ...

Long-term Investing as asset prices rise

... weakness. There is considerable investor unease however at present, in significant measure because the unconventional methods being deployed by the world’s key Central Banks are untested and there is a broad range of potential consequences. The ECB’s quantitative easing is already evident with negat ...

... weakness. There is considerable investor unease however at present, in significant measure because the unconventional methods being deployed by the world’s key Central Banks are untested and there is a broad range of potential consequences. The ECB’s quantitative easing is already evident with negat ...

Chilean tax ruling may affect foreign institutional investors

... for use by the securities commission of each province in which the securities are sold, before the document can be used for that purpose. A similar disclosure requirement would be needed for any exchange traded funds and closed end funds that trade on an exchange. There is no minimum dollar investm ...

... for use by the securities commission of each province in which the securities are sold, before the document can be used for that purpose. A similar disclosure requirement would be needed for any exchange traded funds and closed end funds that trade on an exchange. There is no minimum dollar investm ...

Factsheet Floating Rate Income Trust USD

... Premium-discount graph illustrates the amount by which the market price trades above or below net asset value. ...

... Premium-discount graph illustrates the amount by which the market price trades above or below net asset value. ...

Government Bonds

... Storebrand aims to invest in corporations and countries that contribute actively to sustainable development. We believe such practices – when integrated in core business – will be financially rewarded. Based on this, Storebrand will not invest in government bonds from countries that a. Are systemati ...

... Storebrand aims to invest in corporations and countries that contribute actively to sustainable development. We believe such practices – when integrated in core business – will be financially rewarded. Based on this, Storebrand will not invest in government bonds from countries that a. Are systemati ...

Chapter 17

... Should assist users in assessing the level of service provided and Government’s ability to meet its obligation ...

... Should assist users in assessing the level of service provided and Government’s ability to meet its obligation ...

Select Consulting, Inc.

... negatively to this policy, the stock market will remain the primary beneficiary. The performance of the stock market throughout the rest of the year is highly dependent upon the Federal Reserve. One major concern will be how the stock market reacts when they end QE. Since the bull market began in 20 ...

... negatively to this policy, the stock market will remain the primary beneficiary. The performance of the stock market throughout the rest of the year is highly dependent upon the Federal Reserve. One major concern will be how the stock market reacts when they end QE. Since the bull market began in 20 ...

OneEarth ETF - Morgan Stanley Sustainable Investing Challenge

... demonstrates how an investor can construct a portfolio of multiple assets that maximize returns for a given level of risk. By tracking the S&P 500, ONEE offers investors the benefits of a broad, diverse portfolio at a low cost, and the ability to hold the market while voting for impact. This impact ...

... demonstrates how an investor can construct a portfolio of multiple assets that maximize returns for a given level of risk. By tracking the S&P 500, ONEE offers investors the benefits of a broad, diverse portfolio at a low cost, and the ability to hold the market while voting for impact. This impact ...

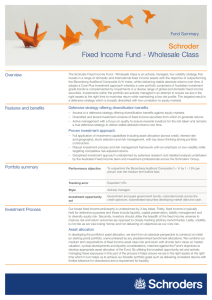

Schroder Fixed Income Fund - Wholesale Class Fund Summary Overview

... grade bonds is complemented by investments in a diverse range of global and domestic fixed income securities. Investments within the portfolio are actively managed in an attempt to ensure we are in the right assets at the right time to maximise return while maintaining a low risk profile. The target ...

... grade bonds is complemented by investments in a diverse range of global and domestic fixed income securities. Investments within the portfolio are actively managed in an attempt to ensure we are in the right assets at the right time to maximise return while maintaining a low risk profile. The target ...

UNIVERSITY OF NORTH FLORIDA

... amount of capital placed in the energy market migrated to the next market poised to move. The equity markets were an attractive option as they spent the previous few months consolidating. With S&P500 earnings on the rise, investors found the fundamental justification needed to invest into equities. ...

... amount of capital placed in the energy market migrated to the next market poised to move. The equity markets were an attractive option as they spent the previous few months consolidating. With S&P500 earnings on the rise, investors found the fundamental justification needed to invest into equities. ...