Monthly Investment Commentary

... could be especially high for investors in the many funds that were marketed as absolute return, a moniker that implies that positive returns could be captured in any environment. While we believed a diversified portfolio of hedge funds should hold up much better than stocks in a bad bear market, we ...

... could be especially high for investors in the many funds that were marketed as absolute return, a moniker that implies that positive returns could be captured in any environment. While we believed a diversified portfolio of hedge funds should hold up much better than stocks in a bad bear market, we ...

A Tropical Forest and Agriculture focused fund

... Norwegian governments’ International Climate and Forest Initiative (NICFI), based on a 2020 capitalization target for the Fund of 400 million USD, to be drawn from bilateral and multilateral public donors as well as private sector partners. By 2020, more than 20 production and forest protection proj ...

... Norwegian governments’ International Climate and Forest Initiative (NICFI), based on a 2020 capitalization target for the Fund of 400 million USD, to be drawn from bilateral and multilateral public donors as well as private sector partners. By 2020, more than 20 production and forest protection proj ...

Silicon Hills Client Newsletter - Silicon Hills Wealth Management

... One of our partners, Pam Friedman, said “I do” to Mitch Sundet in a beautiful backyard setting amongst a small group of family and friends in April. Pam beamed with excitement and happiness and was the epitome of a blushing, blissful bride. During the groom’s speech, a dashing Mitch couldn’t resist ...

... One of our partners, Pam Friedman, said “I do” to Mitch Sundet in a beautiful backyard setting amongst a small group of family and friends in April. Pam beamed with excitement and happiness and was the epitome of a blushing, blissful bride. During the groom’s speech, a dashing Mitch couldn’t resist ...

Test Presentation Line 2

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

... Epworth range of funds • Common Investment and Common Deposit Funds ◦ Affirmative Equity Fund ◦ Affirmative Fixed Interest Fund ◦ Affirmative Corporate Bond Fund ◦ Affirmative Deposit Fund • UCITS Umbrella Unit Trust Scheme ◦ Epworth UK Equity Fund ◦ Epworth European Fund ...

Emerging Market Overview_March 2016

... Templeton Investments’ fund ranges. Nothing in this document should be construed as investment advice. ...

... Templeton Investments’ fund ranges. Nothing in this document should be construed as investment advice. ...

to 30 April 2016 - Allianz Global Investors

... The Allianz Japan Fund aimed to achieve capital growth through investment in leading Japanese shares and other permitted equity based investment instruments. The Fund’s main emphasis was on companies with larger market capitalisation. Exposure to smaller companies may be obtained either through the ...

... The Allianz Japan Fund aimed to achieve capital growth through investment in leading Japanese shares and other permitted equity based investment instruments. The Fund’s main emphasis was on companies with larger market capitalisation. Exposure to smaller companies may be obtained either through the ...

Asset Management Fees and the Growth of Finance

... holds all the funds in some, usually broad, stock-market index) was established by the Vanguard Group of Investment Companies in the late 1970s. While competition in the actively managed segment of the mutual fund market has primarily taken the form of product differentiation, the generic index fund ...

... holds all the funds in some, usually broad, stock-market index) was established by the Vanguard Group of Investment Companies in the late 1970s. While competition in the actively managed segment of the mutual fund market has primarily taken the form of product differentiation, the generic index fund ...

TCW Concentrated Core (Large Cap Growth)

... • Despite a dearth of progress in Washington related to President Trump’s ambitious agenda, the stock market continued its march higher as economic data continued to firm and consumer confidence remained on solid ground. The second quarter began with a sluggish nonfarm payroll print (+98k vs. +180k ...

... • Despite a dearth of progress in Washington related to President Trump’s ambitious agenda, the stock market continued its march higher as economic data continued to firm and consumer confidence remained on solid ground. The second quarter began with a sluggish nonfarm payroll print (+98k vs. +180k ...

information

... See above. 4. Opportunities for further research Find out about the companies included in the different FTSE Indices which the BGI investments track. There are certain funds which I have been unable to find a contact for JF Pacific Equity Fund Cedar Rock Capital Fund Did the original response from t ...

... See above. 4. Opportunities for further research Find out about the companies included in the different FTSE Indices which the BGI investments track. There are certain funds which I have been unable to find a contact for JF Pacific Equity Fund Cedar Rock Capital Fund Did the original response from t ...

Market Vectors Small Cap Dividend Payers ETF (ASX Code: MVS)

... Exchange traded funds are growing in popularity and new ETFs are coming onto the Australian market every month. Much of the growth has been a result of the innovation in index investing known as ‘smart beta’. ETFs are managed funds that are traded on ASX just like shares. Buying an ETF gives you exp ...

... Exchange traded funds are growing in popularity and new ETFs are coming onto the Australian market every month. Much of the growth has been a result of the innovation in index investing known as ‘smart beta’. ETFs are managed funds that are traded on ASX just like shares. Buying an ETF gives you exp ...

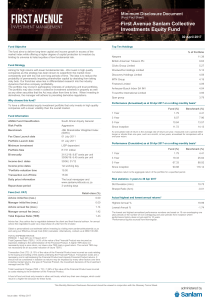

First Avenue Sanlam Collective Investments Equity Fund

... growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include ...

... growth over the long term (greater than 5 years). It is designed to substantially outperform the markets and therefore carries a long-term investment horizon (5 years and upwards). The portfolio will be diversified across all major asset classes with significant exposure to equities, and may include ...

December 16, 2016

... the central bank raised its key short-term interest rate a quarter point to a range of 0.5%-0.75%. The vote was unanimous. In addition, the Fed’s so-called “dot plot” indicated the central bank plans three additional rate hikes next year instead of the prior forecast’s two. Myles Clouston, senior di ...

... the central bank raised its key short-term interest rate a quarter point to a range of 0.5%-0.75%. The vote was unanimous. In addition, the Fed’s so-called “dot plot” indicated the central bank plans three additional rate hikes next year instead of the prior forecast’s two. Myles Clouston, senior di ...

Data Sources and Methods

... The values of rented way and structures and rented equipment are constructed by computing current dollar net rents from lease rental, joint facility rent, and other rent operating expenses.3 The quantities of rented capital input are obtained by dividing the rented capital input values by the prices ...

... The values of rented way and structures and rented equipment are constructed by computing current dollar net rents from lease rental, joint facility rent, and other rent operating expenses.3 The quantities of rented capital input are obtained by dividing the rented capital input values by the prices ...

MACAF ONE PAGER.cdr

... Mirae Asset China Advantage Fund (An open ended fund of funds scheme): Investment Objective: The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in units of Mirae Asset China Sector Leader Equity Fund and/or units of other mutual fund schem ...

... Mirae Asset China Advantage Fund (An open ended fund of funds scheme): Investment Objective: The investment objective of the scheme is to generate long-term capital appreciation by investing predominantly in units of Mirae Asset China Sector Leader Equity Fund and/or units of other mutual fund schem ...

letter to shareholders

... with examples of the perishable margin. Place this in context with valuation levels that remain slightly greater than the historic median and you can see why we have some issue with aggressively putting capital to work today. We believe that dividends will have greater importance to future market re ...

... with examples of the perishable margin. Place this in context with valuation levels that remain slightly greater than the historic median and you can see why we have some issue with aggressively putting capital to work today. We believe that dividends will have greater importance to future market re ...

What`s so smart about smart beta?

... Note: Not all products, materials or services available at all firms. Advisors, please contact your home office. Price-to-book (P/B) ratio is the market price of a stock divided by the book value per share. Alternative products typically hold more non-traditional investments and employ more comple ...

... Note: Not all products, materials or services available at all firms. Advisors, please contact your home office. Price-to-book (P/B) ratio is the market price of a stock divided by the book value per share. Alternative products typically hold more non-traditional investments and employ more comple ...

Consumer Discretionary and Technology were April`s top performing

... application of the index methodology and selection of index constituents in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors related to the equities, fixed income, or commodities markets in general wh ...

... application of the index methodology and selection of index constituents in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. For example, there are numerous factors related to the equities, fixed income, or commodities markets in general wh ...

Royal London Sterling Extra Yield Bond Fund

... Going forward, the fund’s actual volatility could be higher or lower, and its rated risk/reward profile could change. The lowest risk category does not mean the investment is risk free. The risk indicator does not adequately capture the following risks, which are materially relevant to the fund: Cre ...

... Going forward, the fund’s actual volatility could be higher or lower, and its rated risk/reward profile could change. The lowest risk category does not mean the investment is risk free. The risk indicator does not adequately capture the following risks, which are materially relevant to the fund: Cre ...

The Post-2008 Economic Soft Depression and Your Portfolio

... ENR 2015 Investment Summary • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • In the four times since 1970 when the S&P 500 ...

... ENR 2015 Investment Summary • Global risk assets will grow more volatile as earnings shift lower in the US but accelerate overseas. Both Europe and Japan are primed for sizable gains at a time when US profits will slow, mainly due to a strong dollar; • In the four times since 1970 when the S&P 500 ...

FUND FACTSHEET – JULY 2016 RHB DANA HAZEEM (formerly

... region, while UK’s exit from the European Union will be on a gradual path, with regulation in place to guide the departure, hence will not be as disruptive. The major central bankers and governments will continue to support the economy through accommodative monetary and fiscal policies, thus maintai ...

... region, while UK’s exit from the European Union will be on a gradual path, with regulation in place to guide the departure, hence will not be as disruptive. The major central bankers and governments will continue to support the economy through accommodative monetary and fiscal policies, thus maintai ...

Closed-End Fund GGM Guggenheim Credit Allocation Fund

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

Deutsche Invest I Top Asia - Deutsche Asset Management

... Measures the average dividend amount, based on the current share price. This figure is calculated based on the shares (including ADRs/GDRs > Depositary receipts) and REITs contained in a fund. Average market capitalization Measures the average market capitalization of the shares, REITs and ADRs/GDRs ...

... Measures the average dividend amount, based on the current share price. This figure is calculated based on the shares (including ADRs/GDRs > Depositary receipts) and REITs contained in a fund. Average market capitalization Measures the average market capitalization of the shares, REITs and ADRs/GDRs ...

NVIT Large Cap Growth Fund — Class I

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

... NVIT Large Cap Growth Fund — Class I Investment Strategy from investment’s prospectus The investment seeks long-term capital growth. The fund invests at least 80% of its net assets in common stocks issued by large-cap companies, utilizing a growth style of investing. It seeks companies whose earning ...

Venture Capital Market in Poland and Polish government activities

... There was no single transaction carried by VC in 2004 and the only investments in 2005 which amounted to 0,66 mln EUR applied to start-ups. At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased ...

... There was no single transaction carried by VC in 2004 and the only investments in 2005 which amounted to 0,66 mln EUR applied to start-ups. At the same time (in 2005) total investments made by private equity (PE) including venture capital investments in Poland amounted to EUR 154 million, increased ...

Investing In Canadian Dividend Stocks

... portfolio of high-yielding Canadian blue-chip companies. Another indicator of good quality dividend stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a reasonable price is another important consideration. It is a truism that stocks of good companie ...

... portfolio of high-yielding Canadian blue-chip companies. Another indicator of good quality dividend stocks is the frequency and amount by which they increase their dividends. Purchasing these stocks at a reasonable price is another important consideration. It is a truism that stocks of good companie ...