Renuka Ramnath-led Multiples PE`s AUM cross $1

... The second fund would be fully deployed in the next two-and-a-half years in 10-12 companies, Ramnath said. It will invest in the $50-100 million range against a ticket size of $20-25 million for its first fund, she added. It has already made investments in three companies from the new fund, includin ...

... The second fund would be fully deployed in the next two-and-a-half years in 10-12 companies, Ramnath said. It will invest in the $50-100 million range against a ticket size of $20-25 million for its first fund, she added. It has already made investments in three companies from the new fund, includin ...

Wells Fargo Funds to merge certain funds

... In connection with the proposed transactions, in March, the merging funds will file a preliminary prospectus/proxy statement with the Securities and Exchange Commission (SEC). All shareholders are advised to read the prospectus/proxy statement—when available—in its entirety because it will contain i ...

... In connection with the proposed transactions, in March, the merging funds will file a preliminary prospectus/proxy statement with the Securities and Exchange Commission (SEC). All shareholders are advised to read the prospectus/proxy statement—when available—in its entirety because it will contain i ...

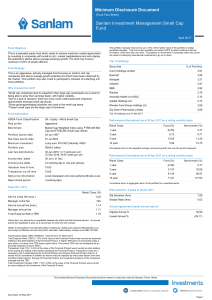

Sanlam Investment Management Small Cap Fund

... Capital appreciation is the profit made on an investment, measured by the increase in its market value over the invested amount or cost price. It is also called capital growth. ...

... Capital appreciation is the profit made on an investment, measured by the increase in its market value over the invested amount or cost price. It is also called capital growth. ...

Investment Choice by Plan Members in OECD Countries with

... The main emphasis of regulation was on coherence with the investment regulation (limits and SIP), expensing and disclosure. The rules of operating multiple portfolio system in the pension plan must be approved by the General Assembly and licensed by the HFSA. All portfolios should adhere to the glob ...

... The main emphasis of regulation was on coherence with the investment regulation (limits and SIP), expensing and disclosure. The rules of operating multiple portfolio system in the pension plan must be approved by the General Assembly and licensed by the HFSA. All portfolios should adhere to the glob ...

Word document - Benefits and Pensions Monitor

... activity, the potential universe of companies worthy of investment remains largely untapped. There are more than 100,000 private companies in the United States versus only roughly 10,000 to 12,000 public companies and the universe of attractive private equity targets expands even further when genera ...

... activity, the potential universe of companies worthy of investment remains largely untapped. There are more than 100,000 private companies in the United States versus only roughly 10,000 to 12,000 public companies and the universe of attractive private equity targets expands even further when genera ...

CREF Social Choice

... broad-based market indices. You cannot invest directly in any index. Index returns do not reflect a deduction for fees or expenses. The Russell 3000 Index measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. Index returns do not ...

... broad-based market indices. You cannot invest directly in any index. Index returns do not reflect a deduction for fees or expenses. The Russell 3000 Index measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. Index returns do not ...

Canadian Responsible Investment Mutual Funds Risk / Return

... 2014, RI assets stood at more than $1 trillion, a remarkable 68% increase in two years. The RIA report also showed that growth in Responsible Investment mutual fund assets outpaced non-RI mutual funds — 52% vs. ...

... 2014, RI assets stood at more than $1 trillion, a remarkable 68% increase in two years. The RIA report also showed that growth in Responsible Investment mutual fund assets outpaced non-RI mutual funds — 52% vs. ...

Political uncertainty makes gold great again

... authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX. This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation ...

... authorised intermediary for the offering of CDIs over the US Fund’s shares and issuer in respect of the CDIs and corresponding Fund’s shares traded on ASX. This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation ...

... great job of marking tops and bottoms of Secular Bulls and Secular Bears, did not get down to the single-digit range that has marked the end of Bear Markets for a hundred years, but the Bull proponents say that significantly higher new highs are de-facto evidence of a Secular Bull, regardless of the ...

Stable Value Fund

... guarantee the performance of the underlying securities or default by the issuer of the underlying securities. Periodically, the Synthetic GIC’s rate of return is adjusted to reflect market value gains and losses subject to a minimum rate of return of zero. Under some scenarios it is possible for par ...

... guarantee the performance of the underlying securities or default by the issuer of the underlying securities. Periodically, the Synthetic GIC’s rate of return is adjusted to reflect market value gains and losses subject to a minimum rate of return of zero. Under some scenarios it is possible for par ...

Emerging Market Equity: Private Equity, Public Equity, Risks

... Emerging Market Private Equity is an Opportunity that has Come of Age ….. - Relative to Private Equity in Developed Markets - Relative to Public Equity in Emerging Markets ...

... Emerging Market Private Equity is an Opportunity that has Come of Age ….. - Relative to Private Equity in Developed Markets - Relative to Public Equity in Emerging Markets ...

Review Questions

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

... from property provides a steady, dependable stream of income for investors. Some REITs either make or purchase mortgage loans on comm ercial property, and some do both. Individual REITs have different characteristics and may be highly specialized, depending on the investment strategy and management ...

5vcforum - Attica Ventures

... Statistical data (source: Venture Economic, Salomon, MSCI) show a low correlation between profits and return on investments on Stock Exchanges and investments in non-listed companies (investments made by VC funds). Small investments in PE Funds compared to overall cash available and spread across ma ...

... Statistical data (source: Venture Economic, Salomon, MSCI) show a low correlation between profits and return on investments on Stock Exchanges and investments in non-listed companies (investments made by VC funds). Small investments in PE Funds compared to overall cash available and spread across ma ...

ICICI Prudential AMC launches ICICI Prudential Dividend Yield

... Mr.Vinay Sharma, Fund Manager, ICICI Prudential AMC. The fund would invest predominantly in companies that have dividend yield greater than the dividend yield of CNX Nifty Index (last released /published by NSE), at the time of investment. Speaking on the launch of this fund and the thought behind i ...

... Mr.Vinay Sharma, Fund Manager, ICICI Prudential AMC. The fund would invest predominantly in companies that have dividend yield greater than the dividend yield of CNX Nifty Index (last released /published by NSE), at the time of investment. Speaking on the launch of this fund and the thought behind i ...

Q1 Global Brief 2014

... Rand hedge: An offshore investment allows investors to diversify out of rand into hard currency. This is of particular benefit for high net worth individuals who have an international presence or children living abroad and hence non ZAR liabilities. The rand is a very liquid currency in internationa ...

... Rand hedge: An offshore investment allows investors to diversify out of rand into hard currency. This is of particular benefit for high net worth individuals who have an international presence or children living abroad and hence non ZAR liabilities. The rand is a very liquid currency in internationa ...

finding value in bonds. - The Institute of Financial Planning

... as in the euro or US dollar markets and, increasingly, that’s where sterling bond managers should be looking (the currency risk can easily be hedged out). This provides better diversification and also improved liquidity. What is more, the ability to invest globally and across currencies gives fund m ...

... as in the euro or US dollar markets and, increasingly, that’s where sterling bond managers should be looking (the currency risk can easily be hedged out). This provides better diversification and also improved liquidity. What is more, the ability to invest globally and across currencies gives fund m ...

Private Equity Funds in Namibia: Venturing Forth

... • Reluctance of insurance companies and pension funds to allow investment due to valuation problems and lack of liquidity • High proportion (19%) in manufacturing • Low number and value of exits • Trade sales rather than IPOs ...

... • Reluctance of insurance companies and pension funds to allow investment due to valuation problems and lack of liquidity • High proportion (19%) in manufacturing • Low number and value of exits • Trade sales rather than IPOs ...

Hot Wire - December 2011

... higher interest than short-term loans to the government as investors expect some inflation during periods of growth and demand a premium for tying up their money for a long time. In the graph on the opposite page, these normal conditions are represented by the points where the percentage spread is g ...

... higher interest than short-term loans to the government as investors expect some inflation during periods of growth and demand a premium for tying up their money for a long time. In the graph on the opposite page, these normal conditions are represented by the points where the percentage spread is g ...

ab global high yield portfolio

... 1 Bloomberg Barclays Global High Yield Bond Index (USD hedged) provides a broad-based measure of the global high-yield fixed income market. An investor cannot invest directly in an index, and their results are not indicative of the performance for any specific investment, including an AB fund. Indic ...

... 1 Bloomberg Barclays Global High Yield Bond Index (USD hedged) provides a broad-based measure of the global high-yield fixed income market. An investor cannot invest directly in an index, and their results are not indicative of the performance for any specific investment, including an AB fund. Indic ...

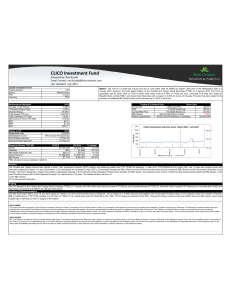

CLICO Investment Fund

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

... RBL's market price is TTD115.00 resulting in a CIF NAV of TTD26.17. At a listed share price of TTD22.65 on the TTSE, CIF is trading at a discount to the NAV. Through the listing, investors will have indirect access to RBL shares, which have usually high in demand but short in supply on the market. ...

After some market stumbles in recent weeks that erased earlier

... Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets The Standard & Poor's 500 (S&P 500) is an unmanage ...

... Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets The Standard & Poor's 500 (S&P 500) is an unmanage ...

THE DREYFUS CORPORATION August 11, 2016 Mr. Dale

... that, under the Amended Rule, money market funds will be permitted to impose a temporary redemption gate of up to 10 days: “Changes in rules adopted by the SEC affect other NAIC requirements as well; notably, the requirement for redemption on demand and within 7 days (under the new rules redemptions ...

... that, under the Amended Rule, money market funds will be permitted to impose a temporary redemption gate of up to 10 days: “Changes in rules adopted by the SEC affect other NAIC requirements as well; notably, the requirement for redemption on demand and within 7 days (under the new rules redemptions ...