“You can`t build a wall around a village. The sun and the wind will

... another pressure point on emerging market nations. An allocation to emerging market equities can benefit investment portfolios over the long term through their diversification properties and their prospects for faster growth relative to developed economies. However, volatility can be quite high with ...

... another pressure point on emerging market nations. An allocation to emerging market equities can benefit investment portfolios over the long term through their diversification properties and their prospects for faster growth relative to developed economies. However, volatility can be quite high with ...

The Merciless Math of Loss - CMG AdvisorCentral

... management over broad-market indexes that have no ability to navigate risk.” The bottom line: The markets are an everchanging complex of opportunity and risk. By nimbly maneuvering through the markets, active managers can help to provide increased portfolio stability. And that can help to lay the ...

... management over broad-market indexes that have no ability to navigate risk.” The bottom line: The markets are an everchanging complex of opportunity and risk. By nimbly maneuvering through the markets, active managers can help to provide increased portfolio stability. And that can help to lay the ...

ALLIANCE HEALTHCARE AND BOOTS RETIREMENT SAVINGS

... You can, however, change the way your pension pot and/or contributions are invested at any time and as often as you want. Legal & General does not currently make a charge for this. However, this could change in the future. You should also be aware that the default investment option may change in the ...

... You can, however, change the way your pension pot and/or contributions are invested at any time and as often as you want. Legal & General does not currently make a charge for this. However, this could change in the future. You should also be aware that the default investment option may change in the ...

Investment Strategies and Alternative Investments in Insurance and

... One of Canada’s largest and most diversified institutional investment managers with more than $84 billion of assets under management • A crown corporation responsible for the investments of 27 pension, endowment and government funds in Alberta and work closely with our clients to ensure our strategi ...

... One of Canada’s largest and most diversified institutional investment managers with more than $84 billion of assets under management • A crown corporation responsible for the investments of 27 pension, endowment and government funds in Alberta and work closely with our clients to ensure our strategi ...

Bond ladders may not be the best investment strategy

... holders of the top-quality shorter maturities. In addition, yield differentials between bonds purchased in small lots and bonds purchased in institutional-sized lots are much greater now than precrisis. Those changes typically favor large-scale institutionally managed portfolios over relatively smal ...

... holders of the top-quality shorter maturities. In addition, yield differentials between bonds purchased in small lots and bonds purchased in institutional-sized lots are much greater now than precrisis. Those changes typically favor large-scale institutionally managed portfolios over relatively smal ...

2017.03 Economic Advantage ProcessFINALv2[17156].ai

... Issued by Liontrust Investment Partners LLP, authorised and regulated by the Financial Conduct Authority (518552). Past performance is not a guide to future performance. Do remember that the value of an investment and the income from it can fall as well as rise and you may not get back the amount or ...

... Issued by Liontrust Investment Partners LLP, authorised and regulated by the Financial Conduct Authority (518552). Past performance is not a guide to future performance. Do remember that the value of an investment and the income from it can fall as well as rise and you may not get back the amount or ...

SPDR® Bloomberg Barclays Short Term High Yield

... applicable to the Index, and incurs costs in buying and selling securities. In addition, the Fund may not be fully invested at times, generally as a result of cash flows into or out of the Fund or reserves of cash held by the Fund to meet redemptions. The Adviser may attempt to replicate the Index r ...

... applicable to the Index, and incurs costs in buying and selling securities. In addition, the Fund may not be fully invested at times, generally as a result of cash flows into or out of the Fund or reserves of cash held by the Fund to meet redemptions. The Adviser may attempt to replicate the Index r ...

Real Assets and Inflation Hedging Strategies

... expressed or implied will be realized or successful or that the activities or any described performance will continue in the same manner or at all. Only investors who can withstand the loss of all or a substantial part of their investment should consider investing in any of the strategies described ...

... expressed or implied will be realized or successful or that the activities or any described performance will continue in the same manner or at all. Only investors who can withstand the loss of all or a substantial part of their investment should consider investing in any of the strategies described ...

sygnia skeleton worldwide flexible fund

... considered in isolation as returns may be impacted by many other factors over time including market returns, the type of financial product, the investment decisions of the investment manager and the TER. Since Fund returns are quoted after the deduction of these expenses, the TER and Transaction cos ...

... considered in isolation as returns may be impacted by many other factors over time including market returns, the type of financial product, the investment decisions of the investment manager and the TER. Since Fund returns are quoted after the deduction of these expenses, the TER and Transaction cos ...

Finance Glossary of Terms

... General Endowment Pool (GEP) – The UC Regents’ primary investment vehicle for endowed funds. Established in 1933, and unitized in 1958, the GEP is a balanced investment portfolio that provides excellent diversification, risk management, and expense economies of scale. The UC GEP contains domestic, g ...

... General Endowment Pool (GEP) – The UC Regents’ primary investment vehicle for endowed funds. Established in 1933, and unitized in 1958, the GEP is a balanced investment portfolio that provides excellent diversification, risk management, and expense economies of scale. The UC GEP contains domestic, g ...

DESJARDINS CANADIAN EQUITY VALUE FUND

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

... The Desjardins Funds are not guaranteed, their value fluctuates frequently and their past performance is not indicative of their future returns. The indicated rates of return are the historical annual compounded total returns as indicated the date of the present document including changes in securit ...

S&P/Case-Shiller US Home Price Index

... Food Price Inflation A New Threat Food prices up over 80% in past three years Rioting in Egypt, Senegal, Ethiopia, Mexico & Haiti World Bank says 33 countries at risk of social unrest – ...

... Food Price Inflation A New Threat Food prices up over 80% in past three years Rioting in Egypt, Senegal, Ethiopia, Mexico & Haiti World Bank says 33 countries at risk of social unrest – ...

Daily Equity Report - Highlight Investment Research

... in near-term. The fall was on expected lines. It is part of the regular bull market that we are going through. I don’t think there is any cause for worry, instead, it is time to get investors to get their shopping list out,” Sanjay Dutt, Director, Quantum Securities said in an interview with CNBC-TV ...

... in near-term. The fall was on expected lines. It is part of the regular bull market that we are going through. I don’t think there is any cause for worry, instead, it is time to get investors to get their shopping list out,” Sanjay Dutt, Director, Quantum Securities said in an interview with CNBC-TV ...

Schroder Singapore Trust A Distribution Share Class June 2016

... available and may be obtained from Schroder Investment Management (Singapore) Ltd and its appointed distributors. Investors should read the prospectus/offering document before deciding to invest. The value of units/shares and the income from them may fall as well as rise. Past performance figures, a ...

... available and may be obtained from Schroder Investment Management (Singapore) Ltd and its appointed distributors. Investors should read the prospectus/offering document before deciding to invest. The value of units/shares and the income from them may fall as well as rise. Past performance figures, a ...

ECONOMY: US GROWTH SLOWS AS ECONOMIC

... 11.1% in January, in what ended as the worst month for the asset class since the financial crisis. On a positive note, the final two weeks of the month did see positive returns. The primary driver of returns in January was oil, as fundamental news in the sector could be construed as positive. As ear ...

... 11.1% in January, in what ended as the worst month for the asset class since the financial crisis. On a positive note, the final two weeks of the month did see positive returns. The primary driver of returns in January was oil, as fundamental news in the sector could be construed as positive. As ear ...

How an ETF works - VanEck ETFs Website

... Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevan ...

... Issued by VanEck Investments Limited ABN 22 146 596 116 AFSL 416755 (‘VanEck’). This is general information only and not financial advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision, you should read the relevan ...

Newsletter April 2010 - PNM Financial Management

... the end of a six month slide that saw the index of the UK’s biggest companies lose 37 percent over its value as the financial crisis took hold. UK Equities have rebounded strongly since then and the FTSE has risen by over 60%. Over the medium term UK Equities still remain attractive despite the size ...

... the end of a six month slide that saw the index of the UK’s biggest companies lose 37 percent over its value as the financial crisis took hold. UK Equities have rebounded strongly since then and the FTSE has risen by over 60%. Over the medium term UK Equities still remain attractive despite the size ...

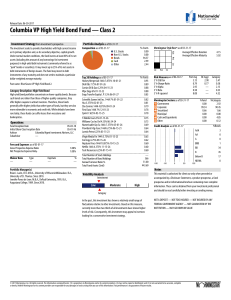

Columbia VP High Yield Bond Fund — Class 2

... Under normal market conditions, the fund invests at least 80% of its net assets (including the amount of any borrowings for investment purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of forei ...

... Under normal market conditions, the fund invests at least 80% of its net assets (including the amount of any borrowings for investment purposes) in high-yield debt instruments (commonly referred to as "junk" bonds or securities). It may invest up to 25% of its net assets in debt instruments of forei ...

DC after the Budget: is your default dangerous?

... level of growth over most periods than gilts and gilt-like investments on their own, while providing suitable diversification against many risks. Adopted as a default fund, possibly with some level of additional insurance against significant loss, we believe it is likely to be far more suited to the ...

... level of growth over most periods than gilts and gilt-like investments on their own, while providing suitable diversification against many risks. Adopted as a default fund, possibly with some level of additional insurance against significant loss, we believe it is likely to be far more suited to the ...

Common Sense Economics -

... 17. It is often substantially cheaper to own and operate a used car rather than a new one because a. the interest rate on a used car loan is generally lower. b. the maintenance cost of a new car is generally higher. c. the depreciation cost for a new car will almost always be substantially higher. ...

... 17. It is often substantially cheaper to own and operate a used car rather than a new one because a. the interest rate on a used car loan is generally lower. b. the maintenance cost of a new car is generally higher. c. the depreciation cost for a new car will almost always be substantially higher. ...

Key Investor Information Document

... The fund invests at least two-thirds of its assets in equities of large and mid-sized companies listed in Europe. These are companies which, at the time of purchase, are considered to be in the top 90% by market capitalisation of the European equities market. The fund may use derivatives with the ai ...

... The fund invests at least two-thirds of its assets in equities of large and mid-sized companies listed in Europe. These are companies which, at the time of purchase, are considered to be in the top 90% by market capitalisation of the European equities market. The fund may use derivatives with the ai ...

![2017.03 Economic Advantage ProcessFINALv2[17156].ai](http://s1.studyres.com/store/data/019095547_1-a901fcc214a4c2f19d62e00613571f15-300x300.png)