bastion worldwide flexible fund of funds bastion

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

... commissions is available on request from company/scheme. Commission and incentives may be paid and if so, are included in the overall cost. This fund may be closed to new investors. A fund of funds collective investments may invest in other collective investments, which levy their own charges, which ...

ab large cap growth fund

... hopes faded for a broad tax cut that would benefit smaller companies. Continuing their first-quarter trend, growth stocks outperformed their value counterparts across the market spectrum. Technology and healthcare stocks were strong in the quarter, although sharp swings in technology shares in the l ...

... hopes faded for a broad tax cut that would benefit smaller companies. Continuing their first-quarter trend, growth stocks outperformed their value counterparts across the market spectrum. Technology and healthcare stocks were strong in the quarter, although sharp swings in technology shares in the l ...

Havenport-Asia Pacific Ex Japan Market Commentary_Jun 15

... worst is behind us. Confidence remains fragile and recovery is nascent. While the nearer term direction for crude prices remains a subject of speculation, it is exhibiting far less volatility than 6 months ago. Contract negotiations and pricing terms are difficult to conclude when volatility is heig ...

... worst is behind us. Confidence remains fragile and recovery is nascent. While the nearer term direction for crude prices remains a subject of speculation, it is exhibiting far less volatility than 6 months ago. Contract negotiations and pricing terms are difficult to conclude when volatility is heig ...

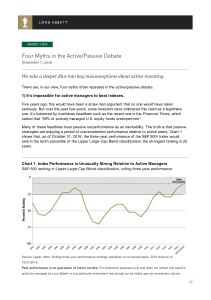

Four Myths in the Active/Passive Debate

... There is no guarantee that markets will perf orm in a similar manner under similar conditions in the f uture. Lipper Large-Cap Blend portf olios are Funds that, by portf olio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basi ...

... There is no guarantee that markets will perf orm in a similar manner under similar conditions in the f uture. Lipper Large-Cap Blend portf olios are Funds that, by portf olio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basi ...

View PDF

... Buried somewhere in the trash can at the manager’s office you might also find thirty of the least attractive securities. If you believe the manager has the skill to identify outperformers, then it stands to reason he or she can identify the underperformers as well. In a hedge fund format, the manage ...

... Buried somewhere in the trash can at the manager’s office you might also find thirty of the least attractive securities. If you believe the manager has the skill to identify outperformers, then it stands to reason he or she can identify the underperformers as well. In a hedge fund format, the manage ...

24 May 2007 - The Church of England

... consumer service stocks did well, the latter boosted by mergers and acquisitions. Our investments in global stocks and shares produced a 2.7% return, ahead of the 2.3% benchmark index. Equity markets have strengthened since the end of the quarter but returns in 2007 are likely to be moderate compare ...

... consumer service stocks did well, the latter boosted by mergers and acquisitions. Our investments in global stocks and shares produced a 2.7% return, ahead of the 2.3% benchmark index. Equity markets have strengthened since the end of the quarter but returns in 2007 are likely to be moderate compare ...

Munis and the Markets

... The Barclays High Yield Index is an unmanaged market-weighted index including only SEC registered and 144(a) securities with fixed (non-variable) coupons. The Barclays High Yield Municipal Bond Index is a rules-based, market-value-weighted index that measures the non-investment grade and non-rated U ...

... The Barclays High Yield Index is an unmanaged market-weighted index including only SEC registered and 144(a) securities with fixed (non-variable) coupons. The Barclays High Yield Municipal Bond Index is a rules-based, market-value-weighted index that measures the non-investment grade and non-rated U ...

HKO Private Equity and Hedge Funds

... • Montpelier Asset Management Limited on an investment by their discretionary client in China Water Affairs Group • Morgan Stanley Global Emerging Markets Inc. on its acquisition of a stake in Hengan International Group and its subsequent exit ...

... • Montpelier Asset Management Limited on an investment by their discretionary client in China Water Affairs Group • Morgan Stanley Global Emerging Markets Inc. on its acquisition of a stake in Hengan International Group and its subsequent exit ...

the great risk/return inversion - who loses out?

... themselves and for the economy at large. At the individual fund level, benchmarking obliges managers, on average and over time, to commit the largest weights to the least attractive investments, those offering high risk combined with low expected returns. The relative winners from this are the asset ...

... themselves and for the economy at large. At the individual fund level, benchmarking obliges managers, on average and over time, to commit the largest weights to the least attractive investments, those offering high risk combined with low expected returns. The relative winners from this are the asset ...

Local-Currency Debt`s Outlook Improving

... time and portfolio managers of other investment strategies may take an opposite opinion than those stated herein. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contain ...

... time and portfolio managers of other investment strategies may take an opposite opinion than those stated herein. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contain ...

Possible Benchmarks for Investment Plans (TT15)

... Teaching Tool 15 – Possible Benchmarks for Investment Plans Personal Finance: Another Perspective ...

... Teaching Tool 15 – Possible Benchmarks for Investment Plans Personal Finance: Another Perspective ...

Comment on a National Securities Regulator

... The trenchant analogy is a child with many parents, who don’t live together, who don’t particularly get along, and whose disagreements frequently play out on the field of the SRO’s regulation of its members. These regulatory issues are sometimes local, but more often what is at stake are issues that ...

... The trenchant analogy is a child with many parents, who don’t live together, who don’t particularly get along, and whose disagreements frequently play out on the field of the SRO’s regulation of its members. These regulatory issues are sometimes local, but more often what is at stake are issues that ...

Jumping In as Others Are Bailing Out

... not be felt until next year. If defined-contribution plans do pull Pimco Total Return or significantly trim their allocations, it could put a big dent in the fund’s assets, a move some ...

... not be felt until next year. If defined-contribution plans do pull Pimco Total Return or significantly trim their allocations, it could put a big dent in the fund’s assets, a move some ...

Selling an Idea or a Product

... Non-financial institutions: pension funds and endowment funds. (Baby boomer generation is putting billions of dollars into pension funds and mutual funds to save for retirement. Discuss lack of confidence in Social Security and subsequent need to increase personal savings.) ...

... Non-financial institutions: pension funds and endowment funds. (Baby boomer generation is putting billions of dollars into pension funds and mutual funds to save for retirement. Discuss lack of confidence in Social Security and subsequent need to increase personal savings.) ...

brexit: european equities positioning

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

... James’s Place (the latter is effectively a wealth manager). We believe however that the greater risk is posed by companies which are sensitive to the UK financial system (specifically the banks) and also exporters of products where there could be restrictions on trade. We have little exposure to the ...

1 - The North West Fund

... The Venture Fund is for start-ups and early-stage businesses under £1m turnover. The emphasis for this fund is on backing entrepreneurs who can demonstrate a flair for business. This fund operates across all sectors including technology and knowledge-based businesses (outside those targeted by the s ...

... The Venture Fund is for start-ups and early-stage businesses under £1m turnover. The emphasis for this fund is on backing entrepreneurs who can demonstrate a flair for business. This fund operates across all sectors including technology and knowledge-based businesses (outside those targeted by the s ...

Combining active and passive managements in a portfolio

... came from broad market exposure—something the funds could have achieved by indexing. However, the researchers found that active management played a much more significant role than market movements in explaining pension funds’ returns in hedge funds and other alternative asset classes. ...

... came from broad market exposure—something the funds could have achieved by indexing. However, the researchers found that active management played a much more significant role than market movements in explaining pension funds’ returns in hedge funds and other alternative asset classes. ...

Hong Kong Debt Market Development

... • Fixed-income debt securities issued by the HKSAR Government for the account of the Exchange Fund • Bear fixed rate of interest (coupon rate), calculated on an actual/365 day basis and payable semi-annually • Tenor: 2, 3, 5, 7, 10 years ...

... • Fixed-income debt securities issued by the HKSAR Government for the account of the Exchange Fund • Bear fixed rate of interest (coupon rate), calculated on an actual/365 day basis and payable semi-annually • Tenor: 2, 3, 5, 7, 10 years ...

BloombugCapitalWeeklyForecast8

... (US): General Motors) may be bankrupt, or the unemployment rate continues to rise. Rumors that the United States market AAA bond rating may have been lowered due to the high budget deficit, despite the US GOV officials try to maintain investor confidence of come forward to call, still resulted in U. ...

... (US): General Motors) may be bankrupt, or the unemployment rate continues to rise. Rumors that the United States market AAA bond rating may have been lowered due to the high budget deficit, despite the US GOV officials try to maintain investor confidence of come forward to call, still resulted in U. ...

profile portfolio performance manager`s commentary

... plenty of ammunition to further fuel investor anxiety over the Brexit negotiation process. That said, resulting sterling weakness was temporary. Indeed, it has been the dollar that has weakened as President Trump’s election promises continue to fade. June saw a further rotation in equity markets. Fi ...

... plenty of ammunition to further fuel investor anxiety over the Brexit negotiation process. That said, resulting sterling weakness was temporary. Indeed, it has been the dollar that has weakened as President Trump’s election promises continue to fade. June saw a further rotation in equity markets. Fi ...

Monthly Investment Report

... showed a division among Fed members about when the central bank should start unwinding its $4.5 trillion bond portfolio, built up from less than $1 trillion since 2008. “Several” members wanted to start the process “within a couple of months,” while “some others” favored “deferring the decision unti ...

... showed a division among Fed members about when the central bank should start unwinding its $4.5 trillion bond portfolio, built up from less than $1 trillion since 2008. “Several” members wanted to start the process “within a couple of months,” while “some others” favored “deferring the decision unti ...

Delta Strategy Group Summary of Open Meeting (October 13, 2016)

... management programs will ensure assets can be sold to meet redemption requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration o ...

... management programs will ensure assets can be sold to meet redemption requests. Funds must classify their assets into four categories, which are based on how quickly the asset can be sold for cash. Commissioner Piwowar: The liquidity risk management recommendation reflects thoughtful consideration o ...

School Funding Sources - Friess Lake School District

... assessed value of $175,000 located in a municipality with a total mill rate of $20.50 would have a property tax bill of $3,587.50 per year. Residential taxes may also change if there is a change in the assessment of the property. Assessment changes occur as the result of additions to the property or ...

... assessed value of $175,000 located in a municipality with a total mill rate of $20.50 would have a property tax bill of $3,587.50 per year. Residential taxes may also change if there is a change in the assessment of the property. Assessment changes occur as the result of additions to the property or ...

Charts That Got Us Thinking

... Business leaders are optimistic..................................................................................................................................................................................... 13 Market’s Fed funds expectations rising.............................................. ...

... Business leaders are optimistic..................................................................................................................................................................................... 13 Market’s Fed funds expectations rising.............................................. ...

Portfolio manager Liu-Er Chen leads Delaware Emerging Markets

... [email protected] The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may ...

... [email protected] The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may ...