Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

... players for business. Gradually, almost all sectors of Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options avai ...

... players for business. Gradually, almost all sectors of Indian economy were opened one by one and many are in pipeline. Financial sector was also one of the part of it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only few investment options avai ...

the full document

... Collective investment schemes (CISs) are generally medium- to long-term investments and the manager gives no guarantee with respect to the capital or the return of the funds. CISs are traded at ruling prices and can engage in scrip lending. A schedule of charges, fees and advisor fees is available o ...

... Collective investment schemes (CISs) are generally medium- to long-term investments and the manager gives no guarantee with respect to the capital or the return of the funds. CISs are traded at ruling prices and can engage in scrip lending. A schedule of charges, fees and advisor fees is available o ...

LoneStar 529 Fund Allocation Sheet

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...

... risks inherent to international investing, including currency, political, social and economic risks. Investments in growth stocks may be more volatile than other securities. With value investing, if the marketplace does not recognize that a security is undervalued, the expected price increase may no ...

Bonds Without Borders: The Case for Going Global

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate, and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted ...

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate, and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted ...

What Might Investors Expect from US High Yield?

... The current yield spread of 425–450 bps is narrower than the 20-year high-yield index median of 573 bps, but this level may not represent extraordinary overvaluation, nor may it imply an imminent reversion to the mean. During past credit cycles in 1987, 1997–98, and in 2005–07, spreads on the high- ...

... The current yield spread of 425–450 bps is narrower than the 20-year high-yield index median of 573 bps, but this level may not represent extraordinary overvaluation, nor may it imply an imminent reversion to the mean. During past credit cycles in 1987, 1997–98, and in 2005–07, spreads on the high- ...

nikko am australian share concentrated fund

... nature only and is not personal advice. It does not take into account the objectives, financial situation or needs of any individual. Investors should consult a financial adviser as well as the information contained in the Fund's current Product Disclosure Statement (PDS) and the 'Additional Informa ...

... nature only and is not personal advice. It does not take into account the objectives, financial situation or needs of any individual. Investors should consult a financial adviser as well as the information contained in the Fund's current Product Disclosure Statement (PDS) and the 'Additional Informa ...

as PDF for Printing

... Disclaimer: Investing in mid-cap stocks is riskier and more volatile than investing in large-cap stocks. The intrinsic value of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. A ...

... Disclaimer: Investing in mid-cap stocks is riskier and more volatile than investing in large-cap stocks. The intrinsic value of the stocks in which the portfolio invests may never be recognized by the broader market. Investing in equity stocks is risky and subject to the volatility of the markets. A ...

Investment Companies Insights

... comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by many to be introducing a new price war. For much of the past year the references to costs an ...

... comment. Investors will only be able to invest in Vanguards own funds, mostly passive funds, at an average price of 0.14% of invested amount. By selling its funds directly to UK investors Vanguard is seen by many to be introducing a new price war. For much of the past year the references to costs an ...

Document

... 401(k) contributions if eligible. Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningsta ...

... 401(k) contributions if eligible. Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningsta ...

Title of Presentation Here - University of Utah Continuing Education

... Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2012. Data are as of 3/31/13. ...

... Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2012. Data are as of 3/31/13. ...

Sequence contains no elements

... Annual Management Charge (AMC) covers the cost of the manager’s investment management services, such as research analysis and portfolio management. The fee is deducted from the fund and is levied as a percentage of the value of the fund’s assets. Ongoing Charge Figure (OCF) represents the ongoing co ...

... Annual Management Charge (AMC) covers the cost of the manager’s investment management services, such as research analysis and portfolio management. The fee is deducted from the fund and is levied as a percentage of the value of the fund’s assets. Ongoing Charge Figure (OCF) represents the ongoing co ...

Investing in Bond Funds

... available for purchase and will accept a large number of investors. In contrast, hedge funds are not subject to the strict regulations that apply to mutual funds. Hedge funds are not required to register with the SEC, they are not legally required to publicly disclose performance and fee information ...

... available for purchase and will accept a large number of investors. In contrast, hedge funds are not subject to the strict regulations that apply to mutual funds. Hedge funds are not required to register with the SEC, they are not legally required to publicly disclose performance and fee information ...

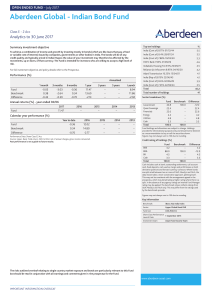

Aberdeen Global - Indian Bond Fund

... produce a higher level of income usually also carry greater risk as such bond issuers may not be able to pay the bond income as promised or could fail to repay the capital amount used to purchase the bond. Where a bond market has a low number of buyers and/or a high number of sellers, it may be hard ...

... produce a higher level of income usually also carry greater risk as such bond issuers may not be able to pay the bond income as promised or could fail to repay the capital amount used to purchase the bond. Where a bond market has a low number of buyers and/or a high number of sellers, it may be hard ...

PORT MELBOURNE PRIMARY SCHOOL NO 3932

... Funds required to meet the immediate ongoing expenses of the School will be kept in an Operating Account. This will be an interest bearing cheque account with a bank regulated by the Australian Federal Government. ...

... Funds required to meet the immediate ongoing expenses of the School will be kept in an Operating Account. This will be an interest bearing cheque account with a bank regulated by the Australian Federal Government. ...

Money Market Regulations

... Do these regulations affect investors? With the greater transparency of risk associated with pricing using floating net asset value (FNAV), investors are better able to evaluate institutional funds. Investors should also realize there is a lower incentive to redeem their shares ahead of others, part ...

... Do these regulations affect investors? With the greater transparency of risk associated with pricing using floating net asset value (FNAV), investors are better able to evaluate institutional funds. Investors should also realize there is a lower incentive to redeem their shares ahead of others, part ...

FTSE Value-Stocks Index Series Extended with a New

... About FTSE Group FTSE is a global leader in indexing and analytical solutions. FTSE calculates thousands of unique indices that measure and benchmark markets and asset classes in more than 80 countries around the world. FTSE indices are used extensively by market participants worldwide for investmen ...

... About FTSE Group FTSE is a global leader in indexing and analytical solutions. FTSE calculates thousands of unique indices that measure and benchmark markets and asset classes in more than 80 countries around the world. FTSE indices are used extensively by market participants worldwide for investmen ...

1 NASDAQ US Dividend Achievers™ 50 Index Methodology

... February. The top 50 securities are included in the Index, as long as no sector has no more than 12 securities. In the event there are more than 12 eligible securities in a single sector, the top 12 securities by dividend yield are included. Security additions and deletions are made effective after ...

... February. The top 50 securities are included in the Index, as long as no sector has no more than 12 securities. In the event there are more than 12 eligible securities in a single sector, the top 12 securities by dividend yield are included. Security additions and deletions are made effective after ...

Math Club Meeting #4 Friday, March 12th, 2010

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

... His talk was titled Math Finance and Quantitative Trading Strategies. The talk can be summarized in a few sentences said by Arindam Kundu himself: “In the last decade, mathematical and computational engineers have devised innovative strategies to generate consistent returns in the markets using a co ...

The Asian Bond Fund initiative

... correlations between an EMEAP basket and their home currency bond returns make a strong case for diversification. Even among components within the Asian basket, there is a good case for diversification via capital flows across the region. ...

... correlations between an EMEAP basket and their home currency bond returns make a strong case for diversification. Even among components within the Asian basket, there is a good case for diversification via capital flows across the region. ...

Presentation - Kerns Capital Management, Inc.

... Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category received 5 stars, the next 22. ...

... Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of the funds in each category received 5 stars, the next 22. ...

ICE FUTURES EQUITY INDEX FUTURES: PRIMARY MARKET

... The Exchange will apply per lot Exchange and Clearing fee reductions to all of the PMM’s proprietary business booked to the Market Making “M” accounts and executed on screen or via ICE Block. A PMM who has performed his market obligation for the relevant period during the trading day will pay an eff ...

... The Exchange will apply per lot Exchange and Clearing fee reductions to all of the PMM’s proprietary business booked to the Market Making “M” accounts and executed on screen or via ICE Block. A PMM who has performed his market obligation for the relevant period during the trading day will pay an eff ...

November13th 2014 STRATEGY NOTE WHY A SAUDI PETRO

... Hypothetical Scenario. This Presentation includes a discussion of an example of the type of investment that may be purchased by the Fund. This discussion is intended to illustrate the types of analysis that may be conducted by Derived Advantage in investing the Fund. It should not be assumed that t ...

... Hypothetical Scenario. This Presentation includes a discussion of an example of the type of investment that may be purchased by the Fund. This discussion is intended to illustrate the types of analysis that may be conducted by Derived Advantage in investing the Fund. It should not be assumed that t ...

Global Absolute Return Strategies Fund

... market positions. The fund uses a combination of traditional assets (such as equities and bonds) and investment strategies based on advanced derivative techniques, resulting in a highly diversified portfolio. The fund can take long and short positions in markets, securities and groups of securities ...

... market positions. The fund uses a combination of traditional assets (such as equities and bonds) and investment strategies based on advanced derivative techniques, resulting in a highly diversified portfolio. The fund can take long and short positions in markets, securities and groups of securities ...

NEST Higher Risk Fund

... markets, with the FTSE All Share growing by just 0.2 per cent in the quarter compared with 3.7 per cent in the FTSE All World Developed. This is due in part to the strength of sterling, which rose by 3 per cent on a trade-weighted basis. ...

... markets, with the FTSE All Share growing by just 0.2 per cent in the quarter compared with 3.7 per cent in the FTSE All World Developed. This is due in part to the strength of sterling, which rose by 3 per cent on a trade-weighted basis. ...