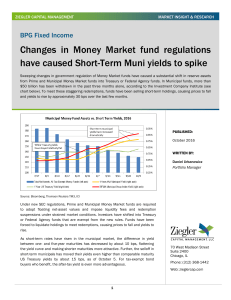

Changes In Money Market Fund Regulations

... This commentary expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. Information contained in this report was obtained from sources usually deemed reliable, but ZCM does not guarantee or imply its ...

... This commentary expresses opinions about the direction of market, investment sector, and other trends. The opinions should not be considered predictions of future results. Information contained in this report was obtained from sources usually deemed reliable, but ZCM does not guarantee or imply its ...

Diversified Growth Funds – What are they?

... to a variety of return sources and this is the main reason to invest in such a fund. The theory is that if equities were to fall significantly that a DGF would not fall by as much (or would recover more quickly) because of the variety of asset classes (return sources) within the fund. DGF returns sh ...

... to a variety of return sources and this is the main reason to invest in such a fund. The theory is that if equities were to fall significantly that a DGF would not fall by as much (or would recover more quickly) because of the variety of asset classes (return sources) within the fund. DGF returns sh ...

Quick Market Update. Six Possible Surprises for 2014

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

... Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth ...

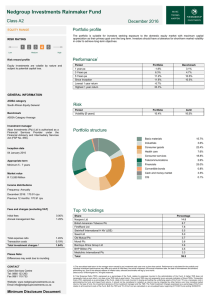

Fact sheets - Nedgroup Investments

... holdings in Steinhoff (+12.3%), Barclays Africa (+7.2%) and FirstRand (+5.3%) enhanced the Fund’s performance in December while our holdings in BHP Billiton (-6.5%), Mondi (-2.2%) and British American Tobacco (-0.4%) detracted from performance. Market volatility, low economic growth as well as local ...

... holdings in Steinhoff (+12.3%), Barclays Africa (+7.2%) and FirstRand (+5.3%) enhanced the Fund’s performance in December while our holdings in BHP Billiton (-6.5%), Mondi (-2.2%) and British American Tobacco (-0.4%) detracted from performance. Market volatility, low economic growth as well as local ...

the document - Lyxor Asset Management

... to a final offering memorandum. No advisory relationship is created by the receipt of this material. This material should not be construed as legal, business or tax advice. A more robust discussion of the risks and tax considerations involving in investing in a fund is available from the more comple ...

... to a final offering memorandum. No advisory relationship is created by the receipt of this material. This material should not be construed as legal, business or tax advice. A more robust discussion of the risks and tax considerations involving in investing in a fund is available from the more comple ...

Dreyfus Emerging Markets Debt U.S. Dollar Fund

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Derivatives Risk: A small investmen ...

... Bond Risk: Bonds are subject generally to interest rate, credit, liquidity, call and market risks, to varying degrees. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes and rate increases can cause price declines. Derivatives Risk: A small investmen ...

CC Marsico Global Fund APIR CHN0002AU

... pressure on equities. Meanwhile, sovereign debt markets soared around the globe, with many government bond issues registering new low yields. For the quarter, the S&P 500 Index rose by 5.9% (in Australian dollar terms), while the NASDAQ Composite Index gained 3.1%. The MSCI ACWI Index rose by 4.3%. ...

... pressure on equities. Meanwhile, sovereign debt markets soared around the globe, with many government bond issues registering new low yields. For the quarter, the S&P 500 Index rose by 5.9% (in Australian dollar terms), while the NASDAQ Composite Index gained 3.1%. The MSCI ACWI Index rose by 4.3%. ...

Summer KiwiSaver Scheme Summer Listed Property

... data for the five years to 31 March 2017. While risk indicators are usually relatively stable, they do shift from time to time. The risk indicator will continue to be updated in future fund updates. ...

... data for the five years to 31 March 2017. While risk indicators are usually relatively stable, they do shift from time to time. The risk indicator will continue to be updated in future fund updates. ...

Is the Mug Half Full? Or Is the Mug Half Empty?

... finished its best six months since 1933, FDR’s first year in office, jumping back 53% from those March lows. Should history be a guide, then that strong recovery might suggest that the market can go higher still. Since World War Two, and not counting the 2009 rise, there have been eight periods when ...

... finished its best six months since 1933, FDR’s first year in office, jumping back 53% from those March lows. Should history be a guide, then that strong recovery might suggest that the market can go higher still. Since World War Two, and not counting the 2009 rise, there have been eight periods when ...

FUND FACTSHEET – APRIL 2016 RHB MALAYSIA DIVA FUND

... fragile and could be derailed by quicker pace of normalization of monetary policy. The state of China economy, crude oil prices and strength of dollar will come under scrutiny for spillover effects on asset allocation and capital flows. Global portfolio adjustments would continue from bonds to equit ...

... fragile and could be derailed by quicker pace of normalization of monetary policy. The state of China economy, crude oil prices and strength of dollar will come under scrutiny for spillover effects on asset allocation and capital flows. Global portfolio adjustments would continue from bonds to equit ...

duETS™ US Commercial Property 2X

... in this document. The securities may only be purchased and traded by “Qualified Institutional Buyers,” as defined in Rule 144A under the Securities Act of 1933 (“1933 Act”), or investors who are not “U.S. Persons,” as defined in Regulation S under the 1933 Act and pursuant to the terms of Regulation ...

... in this document. The securities may only be purchased and traded by “Qualified Institutional Buyers,” as defined in Rule 144A under the Securities Act of 1933 (“1933 Act”), or investors who are not “U.S. Persons,” as defined in Regulation S under the 1933 Act and pursuant to the terms of Regulation ...

Fund Change Notice

... The MSCI All Country World Ex-US Index is a recognized benchmark of non-U.S. stock markets. It is an unmanaged market value-weighted index composed of a sample of companies representative of the market structure of 49 countries and includes reinvestment of all dividends. The MSCI AC World Ex-US In ...

... The MSCI All Country World Ex-US Index is a recognized benchmark of non-U.S. stock markets. It is an unmanaged market value-weighted index composed of a sample of companies representative of the market structure of 49 countries and includes reinvestment of all dividends. The MSCI AC World Ex-US In ...

Financial News - Locker Capital Management

... percent, while sales are projected to fall 15 percent, according to the average analyst estimates. Both are the steepest declines since at least 2009 with Samsung to announce results tomorrow. Samsung is fighting to retain its dominance after Apple introduced bigger-screen iPhones and Xiaomi began s ...

... percent, while sales are projected to fall 15 percent, according to the average analyst estimates. Both are the steepest declines since at least 2009 with Samsung to announce results tomorrow. Samsung is fighting to retain its dominance after Apple introduced bigger-screen iPhones and Xiaomi began s ...

C/o Lies Craeynest Development and Environment Group (DEG) of

... • How is the governance of this fund envisaged? There is reference to ensuring that developing countries take the lead, what are the mechanisms to make this happen? • What does it mean to have mechanisms that generate ‘reflows for capital subscribers, who acquire an equity stake as do contributors t ...

... • How is the governance of this fund envisaged? There is reference to ensuring that developing countries take the lead, what are the mechanisms to make this happen? • What does it mean to have mechanisms that generate ‘reflows for capital subscribers, who acquire an equity stake as do contributors t ...

Account Code

... – Some areas still use the older 4 digit funds beginning with a 3 and a unique Org code to define their account, although we are migrating these to the unique fund model. ...

... – Some areas still use the older 4 digit funds beginning with a 3 and a unique Org code to define their account, although we are migrating these to the unique fund model. ...

Deconstructing the time in the market mantra

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

... ‘Time in the market’ used to be the rationale why investors should hang on to equities come hell or high water. However this mantra rings hollow to many investors who have seen the value of their equity portfolios halved over the last year. While investing is still about taking a long term view what ...

Trade Log - Portfolio Strategies Investment Managers

... slowdown in Q1 reflected the temporary drag from the coldest winter on record in the Northeast and from the dockworkers’ strike in Los Angeles. Soft global demand and the appreciating $U.S. are taking their toll on the manufacturing sector. But in a relatively closed service-based economy like the U ...

... slowdown in Q1 reflected the temporary drag from the coldest winter on record in the Northeast and from the dockworkers’ strike in Los Angeles. Soft global demand and the appreciating $U.S. are taking their toll on the manufacturing sector. But in a relatively closed service-based economy like the U ...

Mnyl - Funds-apr 2010

... • Strong short term upside potential with profit booking • Core sectors and Infra based stocks • Strongly linked to market sentiment that form a part of Indices and seasonality • Short term and long term horizons taken into consideration ...

... • Strong short term upside potential with profit booking • Core sectors and Infra based stocks • Strongly linked to market sentiment that form a part of Indices and seasonality • Short term and long term horizons taken into consideration ...

Atlantic Bridge Dr Helen McBreen, INVESTMENT DIRECTOR Best

... University Bridge Fund seeks to invest in companies built from research generated at all Irish Universities (7) and Institutes of Technology (13) ...

... University Bridge Fund seeks to invest in companies built from research generated at all Irish Universities (7) and Institutes of Technology (13) ...

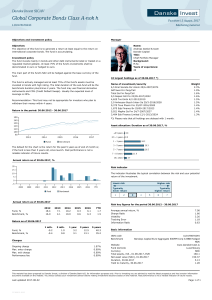

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

Mutual Fund Intermediation, Equity Issues, and the Real Economy

... I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk following new equity issues (Eckbo, Masulis and Norli 2000 ...

... I Aggregate issues predict lower stock returns (Pontiff and Woodgate 2008) I Long-run underperformance is more pronounced when institutions increase their holdings around the issue (Edelen, Ince and Kadlec 2013) I Maybe due to change in risk following new equity issues (Eckbo, Masulis and Norli 2000 ...

Technical Analysis

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

... file current financial statements with the SEC or a banking or insurance regulator. There are no listing requirements, such as those found on the Nasdaq and New York Stock Exchange, for a company to start trading on the OTCBB. It is important to note that companies listed on the OTCBB are not a part ...

Call: June 19, 2015 AFFIDAVIT SAMPLE Contact Person

... Please include Attachment d.2) investment team member’s resumes (partner / director) for those team members with experience investing in Spain. 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well ...

... Please include Attachment d.2) investment team member’s resumes (partner / director) for those team members with experience investing in Spain. 4. - The fund has at least 20% of the target fund size in hard commitments from investors, as included in the table below. Portfolio contributions, as well ...