NEST Higher Risk Fund

... markets, with the FTSE All Share growing by just 0.2 per cent in the quarter compared with 3.7 per cent in the FTSE All World Developed. This is due in part to the strength of sterling, which rose by 3 per cent on a trade-weighted basis. ...

... markets, with the FTSE All Share growing by just 0.2 per cent in the quarter compared with 3.7 per cent in the FTSE All World Developed. This is due in part to the strength of sterling, which rose by 3 per cent on a trade-weighted basis. ...

Institutional Investor magazine`s 2015 US Investment Management

... *In May 2015, Institutional Investor's 6th Annual U.S. Investment Management Awards recognize U.S. institutional investors whose innovative strategies and fiduciary savvy resulted in impressive returns in 2014, as well as U.S. money managers in 36 asset classes who stood out in the eyes of the inves ...

... *In May 2015, Institutional Investor's 6th Annual U.S. Investment Management Awards recognize U.S. institutional investors whose innovative strategies and fiduciary savvy resulted in impressive returns in 2014, as well as U.S. money managers in 36 asset classes who stood out in the eyes of the inves ...

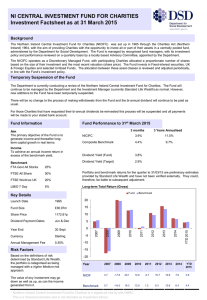

NORTHERN IRELAND CENTRAL INVESTMENT FUND FOR CHARITIES

... China continues to face a period of transition from an economy driven by exports and infrastructure spend to one focused on the domestic market and consumers. With this change of focus comes a slowing in economic expansion and although most developed countries would be envious of China’s high growth ...

... China continues to face a period of transition from an economy driven by exports and infrastructure spend to one focused on the domestic market and consumers. With this change of focus comes a slowing in economic expansion and although most developed countries would be envious of China’s high growth ...

Economic and market snapshot for April 2017

... data to date. Moreover, the effect of the US dollar’s earlier ...

... data to date. Moreover, the effect of the US dollar’s earlier ...

January 2012 - Appropriate Balance Financial Services

... consideration for taxable accounts. Actual individual client returns usually differ somewhat, depending on such factors as each client’s beginning date, transaction costs (which vary by account size), additions and withdrawals during the period, etc. Data for the “Vanguard Index 500” Fund (VFINX), ...

... consideration for taxable accounts. Actual individual client returns usually differ somewhat, depending on such factors as each client’s beginning date, transaction costs (which vary by account size), additions and withdrawals during the period, etc. Data for the “Vanguard Index 500” Fund (VFINX), ...

News Release Nomura Asset Management Nomura`s NEXT FUNDS

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

class9n4 - Duke University

... follow that it will go up or down in the future. Reason: If technical rules worked, everyone would use them. As a result they would not work anymore. This does not imply: Prices are “uncaused”. Markets do not behave according to rules. Investors are incompetent. ...

... follow that it will go up or down in the future. Reason: If technical rules worked, everyone would use them. As a result they would not work anymore. This does not imply: Prices are “uncaused”. Markets do not behave according to rules. Investors are incompetent. ...

Prudential Short Duration High Yield Income Fund

... net operating expenses and maximum sales charges are imposed. All returns assume share price changes as well as the compounding effect of reinvested dividends and capital gains. Returns may reflect fee waivers and/or expense reimbursements. Without such, returns would be lower. All returns 1-year or ...

... net operating expenses and maximum sales charges are imposed. All returns assume share price changes as well as the compounding effect of reinvested dividends and capital gains. Returns may reflect fee waivers and/or expense reimbursements. Without such, returns would be lower. All returns 1-year or ...

Neuberger Berman Millennium Fund

... Because the prices of most growth stocks are based on future expectations, these stocks tend to be more "sensitive than value stocks to bad economic news and negative earnings surprises. Bad economic news or changing investor perceptions can negatively affect growth stocks across several industries ...

... Because the prices of most growth stocks are based on future expectations, these stocks tend to be more "sensitive than value stocks to bad economic news and negative earnings surprises. Bad economic news or changing investor perceptions can negatively affect growth stocks across several industries ...

Activity 2:

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

... Slovakia is one of the following states of the Czechoslovak republic and was for more than 40 years negatively affected by the communist system, which has deeply destroyed the economic and social system. The country became a NATO and an EU member state last year but is still in a middle of the trans ...

Empirical Research: The Discontinuity in Pooled Distribution

... measure of discontinuity kink. For abnormal funds in Table 3A, the Sharpe ratio is -0.2202 in pre and 0.2160 in post. The relevant kink falls from 0.2300 to 0.0329. For abnormal funds in Table 3B, the Sharpe ratio is 0.3584 in pre and 0.0896 in post. The relevant kink rises from 0.0122 to 0.1402.Two ...

... measure of discontinuity kink. For abnormal funds in Table 3A, the Sharpe ratio is -0.2202 in pre and 0.2160 in post. The relevant kink falls from 0.2300 to 0.0329. For abnormal funds in Table 3B, the Sharpe ratio is 0.3584 in pre and 0.0896 in post. The relevant kink rises from 0.0122 to 0.1402.Two ...

Economic Update - IMA Michigan Council

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

... construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained her ...

HSBC Money Market Fund

... to the funds, and you should not expect that the sponsor will provide financial support to the funds at any time. Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus contains this and other information ...

... to the funds, and you should not expect that the sponsor will provide financial support to the funds at any time. Investors should consider the investment objectives, risks, charges and expenses of the investment company carefully before investing. The prospectus contains this and other information ...

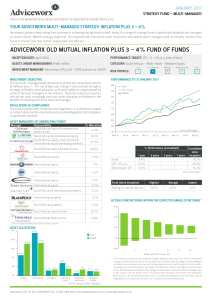

adviceworx old mutual inflation plus 3

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

... With effect from 1 January 2016, a new methodology in respect of the calculation of total expense ratios (TERs) was implemented by the unit trust industry. The key change in the methodology is that TERs used to be calculated on a rolling one-year basis, which has now moved to a rolling three-year ba ...

KIID LU1335425580 en LU

... You can convert shares of the Fund into shares of the other subfunds of Hereford Funds. More detailed information can be found in section Conversion of the Fund's prospectus, available from the registered office of Hereford Funds. ...

... You can convert shares of the Fund into shares of the other subfunds of Hereford Funds. More detailed information can be found in section Conversion of the Fund's prospectus, available from the registered office of Hereford Funds. ...

RBC High Yield Bond Fund - RBC Global Asset Management

... position. The fund benefitted from its exposure to high yield bonds in general, while its conservative cash position reduced volatility but also served as a drag on performance. Demand for higher bond yields and a healthy economic backdrop should continue to support corporate bonds. Given that centr ...

... position. The fund benefitted from its exposure to high yield bonds in general, while its conservative cash position reduced volatility but also served as a drag on performance. Demand for higher bond yields and a healthy economic backdrop should continue to support corporate bonds. Given that centr ...

Fact Sheet

... This material is for informational purposes only and is not intended to be a complete and full description of the products of BNP Paribas and its affiliates or the risks they involve. Additional information is available upon request. Neither the information nor any opinion contained in this material ...

... This material is for informational purposes only and is not intended to be a complete and full description of the products of BNP Paribas and its affiliates or the risks they involve. Additional information is available upon request. Neither the information nor any opinion contained in this material ...

Prepare your portfolio for rising interest rates

... Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund’s income may decline when interest rates fall because most of the debt instruments held by the Fund will have floating or variable rates. NE ...

... Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. The Fund’s income may decline when interest rates fall because most of the debt instruments held by the Fund will have floating or variable rates. NE ...

Press Release – Solactive US Preferred Share Select Indices

... higher dividend paying US-listed preferred shares that have been selected based on a set of market-cap, quality and liquidity screenings. The Solactive US Preferred Share Select Hedged to CAD Index takes the concept a step further by adding a currency hedging to Canadian Dollars through FX forward c ...

... higher dividend paying US-listed preferred shares that have been selected based on a set of market-cap, quality and liquidity screenings. The Solactive US Preferred Share Select Hedged to CAD Index takes the concept a step further by adding a currency hedging to Canadian Dollars through FX forward c ...

REX Shares Introduces VolMAXXTM Family of VIX

... and expenses before investing. This and additional information can be found in the Funds’ prospectus, which may be obtained by calling 1-844REX-1414. Read the prospectus carefully before investing. Investing involves risk, including the possible loss of principal. These Funds are actively managed an ...

... and expenses before investing. This and additional information can be found in the Funds’ prospectus, which may be obtained by calling 1-844REX-1414. Read the prospectus carefully before investing. Investing involves risk, including the possible loss of principal. These Funds are actively managed an ...

Fourth Quarter 2016

... less regulation and lower taxes. Developed international equities (MSCI EAFE) also rallied 2.0% post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on ...

... less regulation and lower taxes. Developed international equities (MSCI EAFE) also rallied 2.0% post-election. With these growth bursts and the anticipation of imminent rising rates, the bond market took a hit of 2.3% 2. We will discuss this further later in this report. Growth expectations based on ...

Performance of Private Equity Real Estate Funds

... • Managers should not focus on growing assets under management (fund size) but on quality investments. • Investors should pay a lot attention on the performance of past investments in their due diligence while choosing new funds to their portfolios. • Market timing is of certain importance and funds ...

... • Managers should not focus on growing assets under management (fund size) but on quality investments. • Investors should pay a lot attention on the performance of past investments in their due diligence while choosing new funds to their portfolios. • Market timing is of certain importance and funds ...

PDF - Faircourt Asset Management

... Ltd., continue to grow the NAV of the Fund and will continue to make up a healthy weighting in the portfolio going forward. Dollarama Inc., the largest operator of dollar stores in Canada, returned 19% during the quarter. All stores are corporate owned and offer consumers a strong value proposition ...

... Ltd., continue to grow the NAV of the Fund and will continue to make up a healthy weighting in the portfolio going forward. Dollarama Inc., the largest operator of dollar stores in Canada, returned 19% during the quarter. All stores are corporate owned and offer consumers a strong value proposition ...

Key Investor Information Franklin U.S. Dollar Liquid Reserve Fund

... The Fund maintains a weighted average maturity of one year or less. You may request the sale of your shares on any Luxembourg business day. The income received from the Fund's investments is accumulated with the result of increasing the value of the shares. ...

... The Fund maintains a weighted average maturity of one year or less. You may request the sale of your shares on any Luxembourg business day. The income received from the Fund's investments is accumulated with the result of increasing the value of the shares. ...

Economic Indicator Descriptions

... forward mandatory (e.g. gross note rate would be RNY plus .250% for servicing). All other loan level adjustments would apply. Average Hourly Earnings: A monthly reading by the Bureau of Labor Statistics (BLS) of the earnings of hourly plant and nonsupervisory workers in the private sector. AHE exclu ...

... forward mandatory (e.g. gross note rate would be RNY plus .250% for servicing). All other loan level adjustments would apply. Average Hourly Earnings: A monthly reading by the Bureau of Labor Statistics (BLS) of the earnings of hourly plant and nonsupervisory workers in the private sector. AHE exclu ...