The Case for the Japan Hedged Equity Fund (DXJ)

... WisdomTree Japan Hedged Equity Index: Designed to provide exposure to Japanese equity markets while at the same time neutralizing exposure to fluctuations of the Japanese yen movements relative to the U.S. dollar. MSCI Japan Index: A free-float adjusted market capitalization-weighted index designed ...

... WisdomTree Japan Hedged Equity Index: Designed to provide exposure to Japanese equity markets while at the same time neutralizing exposure to fluctuations of the Japanese yen movements relative to the U.S. dollar. MSCI Japan Index: A free-float adjusted market capitalization-weighted index designed ...

Weekly Commentary 11-24-14 PAA

... are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features. * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market ...

... are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features. * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market ...

for immediate release

... (USCOX) ranked #20 overall in total return, according to the WSJ. More than 6,300 distinct mutual funds have a one-year track record, according to the latest available data from Principia. “This time last year, many pundits were warning investors to get out of China, saying that its strong growth wa ...

... (USCOX) ranked #20 overall in total return, according to the WSJ. More than 6,300 distinct mutual funds have a one-year track record, according to the latest available data from Principia. “This time last year, many pundits were warning investors to get out of China, saying that its strong growth wa ...

PPT

... that mimic a broad market index. Key U.S. indexes: DJIA: Dow-Jones Industrial Average (30 large, publicly-owned companies) S&P 500: Standard and Poor’s 500 (500 large publicly held companies) NASDAQ: largest electronic screen-based equity securities trading market in the United States (3,700 compani ...

... that mimic a broad market index. Key U.S. indexes: DJIA: Dow-Jones Industrial Average (30 large, publicly-owned companies) S&P 500: Standard and Poor’s 500 (500 large publicly held companies) NASDAQ: largest electronic screen-based equity securities trading market in the United States (3,700 compani ...

Document 1 - Hallandale Beach

... Standard & Poor's 500 Index is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. The MSCI ACWI (All Country World (ex.U.S.) Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity mar ...

... Standard & Poor's 500 Index is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market. The MSCI ACWI (All Country World (ex.U.S.) Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity mar ...

Royce Total Return Fund

... expectations for the stocks we buy; and we have a long-term investment horizon for the dividend-paying companies that we own and the portfolio itself.”—Chuck Royce ...

... expectations for the stocks we buy; and we have a long-term investment horizon for the dividend-paying companies that we own and the portfolio itself.”—Chuck Royce ...

summary sheet

... best strategy is to just reinvest the dividend reinvestment. This is the best strategy because it gives you the advantage of compound income profits. Basically you make much more money in a shorter amount of time. Your money is always available making it easy to get your money back. The funds are ob ...

... best strategy is to just reinvest the dividend reinvestment. This is the best strategy because it gives you the advantage of compound income profits. Basically you make much more money in a shorter amount of time. Your money is always available making it easy to get your money back. The funds are ob ...

managed futures strategy fund

... a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it would not be subject to, if it invested directly in the securities and commodities un ...

... a percentage of its assets in derivatives, such as commodities, futures and options contracts. The use of such derivatives and the resulting high portfolio turn-over, may expose the Fund to additional risks that it would not be subject to, if it invested directly in the securities and commodities un ...

Pengana Capital Funds

... they do not depend on market direction and they are uncorrelated or lowly correlated to market indices, a leading fund manager advises. Pengana Capital’s Damian Crowley says that ‘beta-investment strategies which generate returns mainly due to the market are unlikely to perform as well in the next t ...

... they do not depend on market direction and they are uncorrelated or lowly correlated to market indices, a leading fund manager advises. Pengana Capital’s Damian Crowley says that ‘beta-investment strategies which generate returns mainly due to the market are unlikely to perform as well in the next t ...

Afghanistan`s only private equity fund launched InFrontier

... “Private sector investment is the most effective and sustainable form of development in a post-conflict economy such as Afghanistan,” asserts Felix von Schubert, Director at InFrontier Ltd. “This is a landmark Fund that will enable InFrontier to build on three years of investment track record in Afg ...

... “Private sector investment is the most effective and sustainable form of development in a post-conflict economy such as Afghanistan,” asserts Felix von Schubert, Director at InFrontier Ltd. “This is a landmark Fund that will enable InFrontier to build on three years of investment track record in Afg ...

Legg Mason Western Asset US Money Market Fund

... Source: Legg Mason, as of 31 December 2014. Class A Acc performance is net of fees and is calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities hel ...

... Source: Legg Mason, as of 31 December 2014. Class A Acc performance is net of fees and is calculated on a NAV to NAV basis (USD). Performance for periods greater than one year is cumulative. Performance is based on reinvestment of any income and capital gains distribution derived from securities hel ...

Statement of Investment Objectives, Policies and Guidelines For The

... the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to the Consumer Price Index (CPI). The Reserve Fund’s total real return over a five year period should equal or exce ...

... the principal to protect against unforeseen expenses. The benefit needs to accrue for the long term and keep up with inflation. Thus, the growth of principal must be measured relative to the Consumer Price Index (CPI). The Reserve Fund’s total real return over a five year period should equal or exce ...

greatlink - Great Eastern Life

... # Information refers to Fidelity Funds – Emerging Markets Fund SR-ACC-SGD DISCLAIMER: This factsheet is compiled by Great Eastern Life. The information presented is for informational use only. A product summary and a Product Highlights Sheet in relation to the Fund may be obtained through Great East ...

... # Information refers to Fidelity Funds – Emerging Markets Fund SR-ACC-SGD DISCLAIMER: This factsheet is compiled by Great Eastern Life. The information presented is for informational use only. A product summary and a Product Highlights Sheet in relation to the Fund may be obtained through Great East ...

RTF - OTC Markets

... Large-Capitalization Securities Risk: Returns on investments in securities of large companies could trail the returns on investments in securities of smaller and mid-sized companies. Larger companies may be unable to respond as quickly as smaller and mid-sized companies to competitive challenges or ...

... Large-Capitalization Securities Risk: Returns on investments in securities of large companies could trail the returns on investments in securities of smaller and mid-sized companies. Larger companies may be unable to respond as quickly as smaller and mid-sized companies to competitive challenges or ...

Premier Multi-Asset Distribution Fund

... In an area of the market seeing secular growth, these long-duration logistic assets, with good secure income, have attracted buoyant investor interest of late having successfully completed an additional capital raise in October to grow further. Subsequently, when the share price of the fund moved si ...

... In an area of the market seeing secular growth, these long-duration logistic assets, with good secure income, have attracted buoyant investor interest of late having successfully completed an additional capital raise in October to grow further. Subsequently, when the share price of the fund moved si ...

Summary Prospectus - Select Sector SPDRs

... degree of correlation with the Index), the Fund's return may not match or achieve a high degree of correlation with the return of the Index due to operating expenses, transaction costs, cash flows, regulatory requirements and operational inefficiencies. For example, the Adviser anticipates that it m ...

... degree of correlation with the Index), the Fund's return may not match or achieve a high degree of correlation with the return of the Index due to operating expenses, transaction costs, cash flows, regulatory requirements and operational inefficiencies. For example, the Adviser anticipates that it m ...

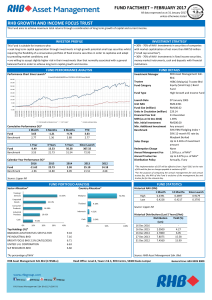

RHB Growth And Income Focus Trust

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

Investment Outlook

... • Equities still outperform for long-term investors • Retirement real estate could regain traction after market digests 2003-04 run-up ...

... • Equities still outperform for long-term investors • Retirement real estate could regain traction after market digests 2003-04 run-up ...

Emerging Market Equity Fund Investor: SEMNX SEMNX | Advisor: SEMVX SEMVX

... Important Information: Source: Schroders. Morningstar: The Investor Shares of the Emerging Market Equity Fund was rated 4 stars overall (out of 591 funds), 3 stars for the 3 year period (out of 591 funds), 3 stars for the 5 year period (out of 410 funds), 4 stars for the 10 year period (out of 179 f ...

... Important Information: Source: Schroders. Morningstar: The Investor Shares of the Emerging Market Equity Fund was rated 4 stars overall (out of 591 funds), 3 stars for the 3 year period (out of 591 funds), 3 stars for the 5 year period (out of 410 funds), 4 stars for the 10 year period (out of 179 f ...

patience abounds in wait-and-see game

... company’s quarterly revenue. Among the banks, Commonwealth Bank was down 10c at $81.26, ANZ dipped 2c to $33.37, National Australia Bank eased 5c to $34.20 and Westpac added 4c to ...

... company’s quarterly revenue. Among the banks, Commonwealth Bank was down 10c at $81.26, ANZ dipped 2c to $33.37, National Australia Bank eased 5c to $34.20 and Westpac added 4c to ...

Last quarter, we cautioned that conditions were right for a

... Higher yields generally come with stronger growth, but Japan their reliance on monetary policy to fundamentals. cannot afford higher yields! At yields of 3.6%, debt service would Portfolio Positioning − For now our broad, balanced positioning reconsume 100% of tax revenues, so with the current rate ...

... Higher yields generally come with stronger growth, but Japan their reliance on monetary policy to fundamentals. cannot afford higher yields! At yields of 3.6%, debt service would Portfolio Positioning − For now our broad, balanced positioning reconsume 100% of tax revenues, so with the current rate ...

Current Conditions Index - Legacy Financial Planning

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

MetInvest Gratuity April 2017

... equity markets. The RBI’s monetary policy stance, specifically focus on liquidity management, is likely to impact yield movement in the near-term. Emerging markets rally for the third consecutive month EM equities continued the strong show led by robust participation of foreign institutional investo ...

... equity markets. The RBI’s monetary policy stance, specifically focus on liquidity management, is likely to impact yield movement in the near-term. Emerging markets rally for the third consecutive month EM equities continued the strong show led by robust participation of foreign institutional investo ...

MESSAGE TO INVESTORS Year 2003 in Review The year 2003

... a total return of 22.9% in 2003. Our other mutual funds that were overweight income trusts also generated strong total returns, including Income Plus Class and Enhanced Yield Fund, which recorded total returns of 22.7% and 22.5%, respectively. As a result of this performance, these funds earned Glob ...

... a total return of 22.9% in 2003. Our other mutual funds that were overweight income trusts also generated strong total returns, including Income Plus Class and Enhanced Yield Fund, which recorded total returns of 22.7% and 22.5%, respectively. As a result of this performance, these funds earned Glob ...