RMS Policy - Adinath Capital Services Limited

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying: A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first t ...

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying: A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first t ...

Currency derivatives Currency derivatives are a contract between

... Currency Options SEBI and RBI permitted introduction of USDINR options on stock exchange from July 30 2010. SEBI approved it via SEBI Circular No. SEBI/CIR/DNPD/5/2010 dated July 30 2010 and RBI approved it via RBI Circular No RBI/2010-11/147 A.P. (DIR Series) Circular No. 5 dated July 30 2010. Per ...

... Currency Options SEBI and RBI permitted introduction of USDINR options on stock exchange from July 30 2010. SEBI approved it via SEBI Circular No. SEBI/CIR/DNPD/5/2010 dated July 30 2010 and RBI approved it via RBI Circular No RBI/2010-11/147 A.P. (DIR Series) Circular No. 5 dated July 30 2010. Per ...

Institute of Actuaries of India May 2013 Examinations INDICATIVE SOLUTIONS

... Now create an alternative portfolio using forward. Suppose the forward price at the end of day 0 is G0 . Strategy 2 is to take a long position of contracts in end forwards at the start of the contract (the end of day 0) and to invest G0 in a risk-free zero-coupon bond. By the end of day n (ie time T ...

... Now create an alternative portfolio using forward. Suppose the forward price at the end of day 0 is G0 . Strategy 2 is to take a long position of contracts in end forwards at the start of the contract (the end of day 0) and to invest G0 in a risk-free zero-coupon bond. By the end of day n (ie time T ...

The COT reports consist of three different reports

... including New York’s ICE Arabica contract. They allow us to see the scale of involvement of speculators in the market, who have played a major role in the 2014 Arabica price rally and will remain a major influence in the market going forward. Participants on commodity exchanges are either dealing wi ...

... including New York’s ICE Arabica contract. They allow us to see the scale of involvement of speculators in the market, who have played a major role in the 2014 Arabica price rally and will remain a major influence in the market going forward. Participants on commodity exchanges are either dealing wi ...

Title goes here This is a sample subtitle

... • Highly volatile with no natural hedge • Spoilable and difficult to stockpile • Actively traded on an established exchange ...

... • Highly volatile with no natural hedge • Spoilable and difficult to stockpile • Actively traded on an established exchange ...

contracts 9,899,780,283 traded

... exchange-traded futures and options are perfect vehicles for trading. In addition to commodity trading advisors, two groups that have been a major force in our markets have been hedge funds and long-only commodity funds. Both groups have attracted large amounts of money, and each has had a major inf ...

... exchange-traded futures and options are perfect vehicles for trading. In addition to commodity trading advisors, two groups that have been a major force in our markets have been hedge funds and long-only commodity funds. Both groups have attracted large amounts of money, and each has had a major inf ...

C14_Reilly1ce

... • Futures exchange requires each customer to post an initial margin account in the form of cash or government securities when the contract is originated • The margin account is marked to market at the end of each trading day according to that day’s price movements • Forward contracts may not require ...

... • Futures exchange requires each customer to post an initial margin account in the form of cash or government securities when the contract is originated • The margin account is marked to market at the end of each trading day according to that day’s price movements • Forward contracts may not require ...

PDF

... when added back in, would bring the hedge and cash prices even closer together. The nominal variability of cash prices at Omaha was greater than for annual hedge prices as shown by the standard deviation of 113.4¢ compared to 79.5¢, respectively. An “F” test showed the variances were not significan ...

... when added back in, would bring the hedge and cash prices even closer together. The nominal variability of cash prices at Omaha was greater than for annual hedge prices as shown by the standard deviation of 113.4¢ compared to 79.5¢, respectively. An “F” test showed the variances were not significan ...

WNE UW - Derivatives Markets

... investment opportunities, used to transfer risks in mortgages from the original lenders to investors, and so on. It is important for those who work in finance, need to understand how derivatives work, how they are used, and how they are priced. The derivatives market is huge - much bigger than the s ...

... investment opportunities, used to transfer risks in mortgages from the original lenders to investors, and so on. It is important for those who work in finance, need to understand how derivatives work, how they are used, and how they are priced. The derivatives market is huge - much bigger than the s ...

The Role of Positions and Activities In Derivative Pricing A

... VIX futures is not only the most actively traded vol derivatives on the most active index (hence economically significant), but it is also the hub of many connections, and thus the perfect test bed for demand and pricing propagations. The term structure: Hedging a futures contracts with a nearby fut ...

... VIX futures is not only the most actively traded vol derivatives on the most active index (hence economically significant), but it is also the hub of many connections, and thus the perfect test bed for demand and pricing propagations. The term structure: Hedging a futures contracts with a nearby fut ...

notes - University of Essex

... – In frictionless market: futures contract could be sold without loss – In a frictionless market: payoff from selling option ≥ exercise Why? For American call options, C ≥ f − X, where the futures contract, with price f , plays the role of the underlying asset. Hence, sale of the option for C yields ...

... – In frictionless market: futures contract could be sold without loss – In a frictionless market: payoff from selling option ≥ exercise Why? For American call options, C ≥ f − X, where the futures contract, with price f , plays the role of the underlying asset. Hence, sale of the option for C yields ...

The Hunger-Makers: How Deutsche Bank, Goldman

... Futures prices at the exchanges for physical trade serve as reference prices for buyers and sellers of commodities. It would make no economic sense for a grain producer to sell goods significantly cheaper than the price guaranteed by futures one or two months ahead. Similarly, it makes no sense for ...

... Futures prices at the exchanges for physical trade serve as reference prices for buyers and sellers of commodities. It would make no economic sense for a grain producer to sell goods significantly cheaper than the price guaranteed by futures one or two months ahead. Similarly, it makes no sense for ...

Energy Derivatives

... A utility in the west who uses natural gas to produce electricity is notified by its supplier that due to a pipeline maintenance outage in July, alternate routing will be needed to deliver the gas at an increased cost. This renders natural gas uneconomic as power generation fuel. The utility’s trade ...

... A utility in the west who uses natural gas to produce electricity is notified by its supplier that due to a pipeline maintenance outage in July, alternate routing will be needed to deliver the gas at an increased cost. This renders natural gas uneconomic as power generation fuel. The utility’s trade ...

RMS Policy - Dyna Securities Ltd.

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

... purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first transaction would ...

chapter overview

... risk, (2) differences in the degree of liquidity and (3) differences in tax obligations. The next section discusses ways in which investors can hedge against interest rate risk using derivatives. The section points out that forward exchange contracts are simply one example of a derivative security. ...

... risk, (2) differences in the degree of liquidity and (3) differences in tax obligations. The next section discusses ways in which investors can hedge against interest rate risk using derivatives. The section points out that forward exchange contracts are simply one example of a derivative security. ...

The Nasdaq-100 Index Option - The New York Stock Exchange

... Price (NOOP) for each of the component securities on the last business day before the expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official Opening Price on Settlement Day, the closing price from the previous trading day will be ...

... Price (NOOP) for each of the component securities on the last business day before the expiration date (usually a Friday). In the event a component security in the NASDAQ 100 Index does not have a NASDAQ Official Opening Price on Settlement Day, the closing price from the previous trading day will be ...

Hedge Accounts - Dorman Trading

... following commodities and futures contracts for Customer’s account will represent “hedging” transactions and positions as defined in Commodity Futures Trading Commission Regulation 1.3(z) (reprinted below) as such regulation currently exists or may hereafter be amended: ...

... following commodities and futures contracts for Customer’s account will represent “hedging” transactions and positions as defined in Commodity Futures Trading Commission Regulation 1.3(z) (reprinted below) as such regulation currently exists or may hereafter be amended: ...

Valuing Stock Options: The Black-Scholes

... Fundamentals of Futures and Options Markets, 7th Ed, Ch 13, Copyright © John C. Hull 2010 ...

... Fundamentals of Futures and Options Markets, 7th Ed, Ch 13, Copyright © John C. Hull 2010 ...

Chapter 1: An Introduction to Corporate Finance

... • The only difference between the spot price (S) and the forward price (F) should be the cost of carry, which is interest costs on financing the purchase and storage costs of the commodity • Commodities are things that can be traded based solely on price, because they are undifferentiated and do not ...

... • The only difference between the spot price (S) and the forward price (F) should be the cost of carry, which is interest costs on financing the purchase and storage costs of the commodity • Commodities are things that can be traded based solely on price, because they are undifferentiated and do not ...

Understanding Different Contracting Methods for Marketing

... lower prices during harvest and putting grain on Delayed Pricing. 3) Track all of your sales you make during the year and figure out the average price you are receiving for the grain. By figuring out your average, this can be used as a level whether or not to sell more grain. (If prices are above yo ...

... lower prices during harvest and putting grain on Delayed Pricing. 3) Track all of your sales you make during the year and figure out the average price you are receiving for the grain. By figuring out your average, this can be used as a level whether or not to sell more grain. (If prices are above yo ...

New EDHEC-Risk Institute research examines dynamic hedging of

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

... other reasons. If the substitute asset were perfectly correlated with the actual underlying asset, no further risk would be introduced, since one could offset any gain or loss in the option position by dynamically trading the substitute asset. In general, however, correlation is not perfect, and the ...

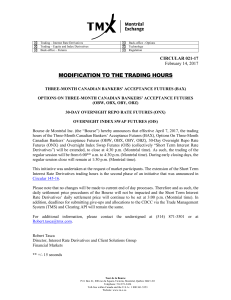

Modification to the Trading Hours

... the rate applicable on the previous business day for which a rate was reported. For example, Friday’s rate is used for Saturday and Sunday rates. The daily overnight repo rate (CORRA) is calculated and reported by the Bank of Canada. ...

... the rate applicable on the previous business day for which a rate was reported. For example, Friday’s rate is used for Saturday and Sunday rates. The daily overnight repo rate (CORRA) is calculated and reported by the Bank of Canada. ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...