contract design, arbitrage, and hedging in the eurodollar futures

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

Amendments to the Operational Trading Procedures for

... If there is any change to the corporate action events announced by the company after the underlying stock has traded ex-all entitlements, the Exchange, in consultation with SEOCH and where applicable the Commission, will determine on a case by case basis any necessary further action. ...

... If there is any change to the corporate action events announced by the company after the underlying stock has traded ex-all entitlements, the Exchange, in consultation with SEOCH and where applicable the Commission, will determine on a case by case basis any necessary further action. ...

New Evidence on the Financialization of Commodity Markets*

... CLN issues cause other market participants to make inferences about the issuers’ information. Third, the offering documents include the CLNs’ pricing and determination dates and indicate they were priced at the close of regular trading in the underlying commodity futures. Since the issuers pass inve ...

... CLN issues cause other market participants to make inferences about the issuers’ information. Third, the offering documents include the CLNs’ pricing and determination dates and indicate they were priced at the close of regular trading in the underlying commodity futures. Since the issuers pass inve ...

Price Discovery in Iran Gold Coin Market

... the literature. Despite this initial similarity, the IS and PT models use different definitions of price discovery. Hasbrouck (1995) defines price discovery in terms of the variance of the innovations to the common factor. Thus the IS model measures each market’s relative contribution to this varia ...

... the literature. Despite this initial similarity, the IS and PT models use different definitions of price discovery. Hasbrouck (1995) defines price discovery in terms of the variance of the innovations to the common factor. Thus the IS model measures each market’s relative contribution to this varia ...

T No Theory? No Evidence? No Problem!

... permit the buyer (seller) to take (or make) delivery of the underlying commodity. Such “cash-settled” contracts are purely financial instruments with a payoff that is derived from the price from some other market (which in energy is typically a delivery-settled futures contract). The mechanism where ...

... permit the buyer (seller) to take (or make) delivery of the underlying commodity. Such “cash-settled” contracts are purely financial instruments with a payoff that is derived from the price from some other market (which in energy is typically a delivery-settled futures contract). The mechanism where ...

Chapter 3: Over-the-Counter Derivatives

... Finally, OTC derivatives markets represent an alternative channel for finding willing counterparties, also known as “accessing liquidity.” Some transactions generally lack liquidity because of their unique economic terms, such as currency types, contract amounts, maturities, delivery locations, and ...

... Finally, OTC derivatives markets represent an alternative channel for finding willing counterparties, also known as “accessing liquidity.” Some transactions generally lack liquidity because of their unique economic terms, such as currency types, contract amounts, maturities, delivery locations, and ...

Index Derivatives Reference Manual

... Put another way, the S&P/TSX 60 index is an equity portfolio composed of 60 highly liquid Canadian equities and selected as a representative sampling of sectors of the Canadian market: materials, industrials, telecommunications, consumer discretionary, energy, financials, health care, technology, ut ...

... Put another way, the S&P/TSX 60 index is an equity portfolio composed of 60 highly liquid Canadian equities and selected as a representative sampling of sectors of the Canadian market: materials, industrials, telecommunications, consumer discretionary, energy, financials, health care, technology, ut ...

Price Volatility, Trading Activity and Market Depth

... The purpose of this work extends previous research and further examines the relationships between price volatility, trading activity and market depth in TAIFEX and SGX-DT Taiwan Stock Index Futures markets using two different methodologies for testing the robustness of our results. This paper provid ...

... The purpose of this work extends previous research and further examines the relationships between price volatility, trading activity and market depth in TAIFEX and SGX-DT Taiwan Stock Index Futures markets using two different methodologies for testing the robustness of our results. This paper provid ...

March - sibstc

... The surveillance and disclosures of transactions in the currency futures market shall be carried out in accordance with the guidelines issued by the SEBI. Authorisation to Currency Futures Exchanges / Clearing Corporations Recognized stock exchanges and their respective Clearing Corporations / Clear ...

... The surveillance and disclosures of transactions in the currency futures market shall be carried out in accordance with the guidelines issued by the SEBI. Authorisation to Currency Futures Exchanges / Clearing Corporations Recognized stock exchanges and their respective Clearing Corporations / Clear ...

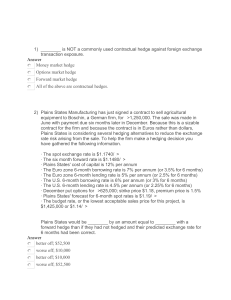

______ is NOT a commonly used contractual hedge against foreign

... Oregon Transportation Inc. (OTI) has just signed a contract to purchase light rail cars from a manufacturer in Germany for 25,000,000. The purchase was made in June with payment due six months later in December. Because this is a sizable contract for the firm and because the contract is in euros rat ...

... Oregon Transportation Inc. (OTI) has just signed a contract to purchase light rail cars from a manufacturer in Germany for 25,000,000. The purchase was made in June with payment due six months later in December. Because this is a sizable contract for the firm and because the contract is in euros rat ...

Does Equity Derivatives Trading Affect the Systematic Risk of the

... uncharacteristic increase in stock price volatility and trading volumes. After the inclusion (exclusion) of a stock in an index, there is a temporary rise (fall) in demand for the stock over a short period because of heavy trading caused by the rebalancing of the index tracking funds. Once these abn ...

... uncharacteristic increase in stock price volatility and trading volumes. After the inclusion (exclusion) of a stock in an index, there is a temporary rise (fall) in demand for the stock over a short period because of heavy trading caused by the rebalancing of the index tracking funds. Once these abn ...

The Greek Letters

... A bank has sold for $300,000 a European call option on 100,000 shares of a non-dividend paying stock. The points that will be made apply to other types of options and derivatives. S0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks (0.3846 years), m = 13% The Black-Scholes-Merton value of the option is $ ...

... A bank has sold for $300,000 a European call option on 100,000 shares of a non-dividend paying stock. The points that will be made apply to other types of options and derivatives. S0 = 49, K = 50, r = 5%, s = 20%, T = 20 weeks (0.3846 years), m = 13% The Black-Scholes-Merton value of the option is $ ...

EURO STOXX 50® Total Return Futures

... • TRFs allow synthetic buying of the underlying assets without the need for portfolio management of the individual components ...

... • TRFs allow synthetic buying of the underlying assets without the need for portfolio management of the individual components ...

Derivatives Markets for Home Prices

... he remarked on the multitude of tricks that econometricians use to get the results they want, and what they sometimes seem to want is just to come up with a different result. . Hedonic variables can come into significance in a regression for spurious reasons. For example, it has been reported that ...

... he remarked on the multitude of tricks that econometricians use to get the results they want, and what they sometimes seem to want is just to come up with a different result. . Hedonic variables can come into significance in a regression for spurious reasons. For example, it has been reported that ...

Anatomy of a Bond Futures Contract Delivery Squeeze

... nonperformance. Futures exchanges levy heavy fines on contract shorts that fail to deliver against an outstanding short position. No such fines exist for traders who “fail” in the cash bond and bond repurchase agreement markets. We show that this has important implications for cross-market cash-futu ...

... nonperformance. Futures exchanges levy heavy fines on contract shorts that fail to deliver against an outstanding short position. No such fines exist for traders who “fail” in the cash bond and bond repurchase agreement markets. We show that this has important implications for cross-market cash-futu ...

The synchronized and long-lasting structural change on

... entitled “Facts and Fantasies about Commodities” supported this diversification strategy. Using monthly returns spanning the period from July 1959 to March 2004, the authors found that commodity futures have historically offered the same return and Sharpe ratio as equities but are negatively correla ...

... entitled “Facts and Fantasies about Commodities” supported this diversification strategy. Using monthly returns spanning the period from July 1959 to March 2004, the authors found that commodity futures have historically offered the same return and Sharpe ratio as equities but are negatively correla ...

2 Introduction to Option Management

... The prize must be worth the toil when one stakes one’s life on fortune’s dice. Dolon to Hector, Euripides (Rhesus, 182) In this chapter we discuss the basic concepts of option management. We will consider both European and American call and put options and practice concepts of pricing, look at arbit ...

... The prize must be worth the toil when one stakes one’s life on fortune’s dice. Dolon to Hector, Euripides (Rhesus, 182) In this chapter we discuss the basic concepts of option management. We will consider both European and American call and put options and practice concepts of pricing, look at arbit ...

handbook(2014.10)

... A futures contract is an agreement to buy or sell the specified asset of a specific volume at the predetermined price on a specific future date. Futures transactions were introduced to the financial market with a background where adoption of floating rate system for US dollar and interest-rate liber ...

... A futures contract is an agreement to buy or sell the specified asset of a specific volume at the predetermined price on a specific future date. Futures transactions were introduced to the financial market with a background where adoption of floating rate system for US dollar and interest-rate liber ...

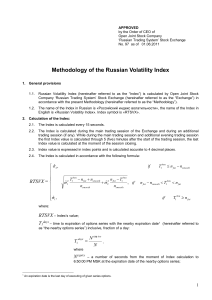

Methodology of the Volatility Index Calculation

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

... price of a futures contract, which is an underlying asset for nearby/next options series (hereinafter referred to as the “underlying futures contract”). ...

ACCT5341 SP05 Exam 1a 031405

... 8. (05 Points) Suppose that a change in the price of a lumber inventory forecasted sale is hedged by a put option designated in advance as a cash flow hedge. An ineffective hedge will result in which of the following outcomes relative to an effective hedge in periods prior to the sale of the invent ...

... 8. (05 Points) Suppose that a change in the price of a lumber inventory forecasted sale is hedged by a put option designated in advance as a cash flow hedge. An ineffective hedge will result in which of the following outcomes relative to an effective hedge in periods prior to the sale of the invent ...

JSE Equity Options Brochure

... further mitigated by a process called “Novation” where the clearing house becomes the counterparty to every trade and uses its financial assets to guarantee each trade. The JSE’s futures clearing house is called SAFCOM. There are two types of margin associated with options: Initial margin – This is ...

... further mitigated by a process called “Novation” where the clearing house becomes the counterparty to every trade and uses its financial assets to guarantee each trade. The JSE’s futures clearing house is called SAFCOM. There are two types of margin associated with options: Initial margin – This is ...

08 Managing Financial Risk

... In the medium-to-long run, the changes in exchange rates, through their impact on prices will also affect demand. If the dollar appreciates against the rupee, US imports into India will become more expensive. As a result, the demand will decrease. The quantum of decrease would depend on the price el ...

... In the medium-to-long run, the changes in exchange rates, through their impact on prices will also affect demand. If the dollar appreciates against the rupee, US imports into India will become more expensive. As a result, the demand will decrease. The quantum of decrease would depend on the price el ...

derivatives_general_paper

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

... - futures: the parties agree about quality and price but for delivery in the future, typically a few months later. The biggest futures’ market is the one for foreign exchange, but futures are also widespread on fixed income markets (i.e. bonds), equities and commodities; - options: in the simplest f ...

Derivatives in India

... 5 Customers post margin (security) deposits with brokers to ensure that they can cover a specified loss on the position. A futures position is marked-to-market by realizing any trading losses in cash on the day they occur. 6 “Badla” allowed investors to trade single stocks on margin and to carry for ...

... 5 Customers post margin (security) deposits with brokers to ensure that they can cover a specified loss on the position. A futures position is marked-to-market by realizing any trading losses in cash on the day they occur. 6 “Badla” allowed investors to trade single stocks on margin and to carry for ...

CGZ CGF CGB

... (CGB). Since the introduction of its CGB contract, MX continued developing the Canadian yield curve by launching the Two-Year (CGZ), Five-Year (CGF) and 30-Year (LGB) Government of Canada Bond Futures. Accompanying the 10-year futures contracts are the options on CGBs (OGB), adding more flexibility ...

... (CGB). Since the introduction of its CGB contract, MX continued developing the Canadian yield curve by launching the Two-Year (CGZ), Five-Year (CGF) and 30-Year (LGB) Government of Canada Bond Futures. Accompanying the 10-year futures contracts are the options on CGBs (OGB), adding more flexibility ...