УДК 336.7 JEL Code G10 С.М. ДЕНЬГА (Полтавський університет

... implementation of certain operations. The market agent exposed every minute some risk because of their dependence on market factors such as interest rates, exchange rates and prices of goods. To avoid losses from foreign currency transactions, which expect a break in time of shipment and payment or ...

... implementation of certain operations. The market agent exposed every minute some risk because of their dependence on market factors such as interest rates, exchange rates and prices of goods. To avoid losses from foreign currency transactions, which expect a break in time of shipment and payment or ...

Long term spread option valuation and hedging

... correlated Wiener processes. This is the classical Gibson and Schwartz (1990) model for each commodity price in a complete market.3 The return correlation q13 := E[dW1,1 dW2,1]/dt plays a substantial role in valuing a spread option; trading a spread option is equivalent to trading the correlation be ...

... correlated Wiener processes. This is the classical Gibson and Schwartz (1990) model for each commodity price in a complete market.3 The return correlation q13 := E[dW1,1 dW2,1]/dt plays a substantial role in valuing a spread option; trading a spread option is equivalent to trading the correlation be ...

Decimalization, trading costs, and information transmission between

... where Pit is the transaction price for stock i at time t and Mit is the midpoint of the bid and ask prices of the quotes immediately prior to the transaction. The quote is required to be at least 5 seconds before the trade.5 Because quotes of index futures are not available, quoted and effective spr ...

... where Pit is the transaction price for stock i at time t and Mit is the midpoint of the bid and ask prices of the quotes immediately prior to the transaction. The quote is required to be at least 5 seconds before the trade.5 Because quotes of index futures are not available, quoted and effective spr ...

Stock price

... less than B, then the loan is satisfied by the bondholders taking over the firm. In this way, the bondholders are forced to “pay” B (in the sense that the loan is cancelled) in return for an asset worth only V. It is as though the bondholders wrote a put on an asset worth V, with exercise price B. A ...

... less than B, then the loan is satisfied by the bondholders taking over the firm. In this way, the bondholders are forced to “pay” B (in the sense that the loan is cancelled) in return for an asset worth only V. It is as though the bondholders wrote a put on an asset worth V, with exercise price B. A ...

RMTF - The Greeks - Society of Actuaries

... the other variables used in the pricing formula (option price, asset price, time to maturity, risk-free rate, and exercise price). Vega is not always appropriate for comparing the effect of a change in volatility on the price of different options because it measures absolute changes in volatility ra ...

... the other variables used in the pricing formula (option price, asset price, time to maturity, risk-free rate, and exercise price). Vega is not always appropriate for comparing the effect of a change in volatility on the price of different options because it measures absolute changes in volatility ra ...

CHAPTER 16 Futures Contracts

... originated in Japan during the early Tokugawa era, that is, the seventeenth century. As you might guess, these early Japanese futures markets were devoted to trading contracts for rice. Tokugawa rule ended in 1867, but active rice futures markets continue on to this day. The oldest organized futures ...

... originated in Japan during the early Tokugawa era, that is, the seventeenth century. As you might guess, these early Japanese futures markets were devoted to trading contracts for rice. Tokugawa rule ended in 1867, but active rice futures markets continue on to this day. The oldest organized futures ...

PDF

... institutions. The biggest drawback of volatility is the associated uncertainty of marketing production, investment in technology, innovation etc. Increasing risk would lead to inefficient resource allocation for producers, merchandisers, and speculators, it also has the potential to limit access to ...

... institutions. The biggest drawback of volatility is the associated uncertainty of marketing production, investment in technology, innovation etc. Increasing risk would lead to inefficient resource allocation for producers, merchandisers, and speculators, it also has the potential to limit access to ...

CME SPAN - CME Group

... • SPAN assesses the risk of a portfolio, by calculating the maximum likely ...

... • SPAN assesses the risk of a portfolio, by calculating the maximum likely ...

option

... Period over which a contract trades Derivatives contracts have one, two and three months expiry cycles Contracts expire on last Thursday New contracts are fired on Friday ...

... Period over which a contract trades Derivatives contracts have one, two and three months expiry cycles Contracts expire on last Thursday New contracts are fired on Friday ...

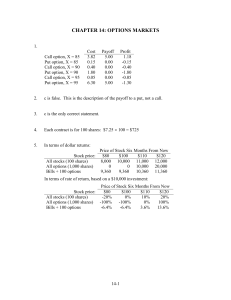

butterfly spread

... Buying an asset and a put generates the same profit as buying a call Short-selling an asset and buying a call generates the same profit as buying a put Writing a covered call generates the same profit as selling a put Writing a covered put generates the same profit as selling a call How to make the ...

... Buying an asset and a put generates the same profit as buying a call Short-selling an asset and buying a call generates the same profit as buying a put Writing a covered call generates the same profit as selling a put Writing a covered put generates the same profit as selling a call How to make the ...

Lecture Notes_Chapter 3

... A box spread is accomplished by using options to create a synthetic long forward at one price and a synthetic short forward at a different price Synthetic long forward: long a call and short a put with the same strike price The combination of payoff diagrams of a synthetic long forward and a synthet ...

... A box spread is accomplished by using options to create a synthetic long forward at one price and a synthetic short forward at a different price Synthetic long forward: long a call and short a put with the same strike price The combination of payoff diagrams of a synthetic long forward and a synthet ...

Document

... of the underlying's price market participants expect to prevail until expiration of the option.3 Over the last years a number of new techniques have been developed that allow for the extraction of considerably more information from option prices than just the expected value or the expected standard ...

... of the underlying's price market participants expect to prevail until expiration of the option.3 Over the last years a number of new techniques have been developed that allow for the extraction of considerably more information from option prices than just the expected value or the expected standard ...

Derivatives and Volatility on Indian Stock Markets

... This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found that in the post Index-future period the importance of ‘present news’ ...

... This study shows that unlike the findings by Antoniou and Holmes (1995) for the London Stock Exchange (LSE), the introduction of index future, per se, has actually reduced the stock price volatility. Bologna and Covalla also found that in the post Index-future period the importance of ‘present news’ ...

Full text - Высшая школа экономики

... short run means that even if price is way above the one dictated by fundamentals it can take a long time for it to affect inventory levels. The second major problem in the way of proving that speculators caused prices to change is providing a link between speculators and physical markets. Speculator ...

... short run means that even if price is way above the one dictated by fundamentals it can take a long time for it to affect inventory levels. The second major problem in the way of proving that speculators caused prices to change is providing a link between speculators and physical markets. Speculator ...

Investments

... underlying asset. At-the-money - The exercise price is equal to the spot price of the underlying asset. Out-of-the-money - The exercise price is more than the spot price of the underlying asset. ...

... underlying asset. At-the-money - The exercise price is equal to the spot price of the underlying asset. Out-of-the-money - The exercise price is more than the spot price of the underlying asset. ...

Chapter: 351 EXCHANGES (SPECIAL LEVY) ORDINANCE Gazette

... (1) Subject to subsection (2), the Secretary may by notice in the Gazette vary the amount or rate of the special levy payable under section 3 or 4. (2) The amount or rate of special levy, as the case may be, as varied under subsection (1) shall not exceed(a) in the case of the special levy under sec ...

... (1) Subject to subsection (2), the Secretary may by notice in the Gazette vary the amount or rate of the special levy payable under section 3 or 4. (2) The amount or rate of special levy, as the case may be, as varied under subsection (1) shall not exceed(a) in the case of the special levy under sec ...

advanced cotton futures and options strategies

... Cotton producers have used futures and options contracts as a price risk management tool for many years. These contracts, when used in their simplest form, provide the opportunity for producers to “lock-in” their price well ahead of harvest. “Locking-in” the price using futures contracts will involv ...

... Cotton producers have used futures and options contracts as a price risk management tool for many years. These contracts, when used in their simplest form, provide the opportunity for producers to “lock-in” their price well ahead of harvest. “Locking-in” the price using futures contracts will involv ...

MF2458 Grain Marketing Plans for Farmers

... challenge for grain marketers. Ongoing uncertainty about price prospects serves to emphasize the need to develop grain-marketing strategies with specific price goals and contingency plans. Without preset price goals based on-farm financial needs or some other farm business planning principle, grain ...

... challenge for grain marketers. Ongoing uncertainty about price prospects serves to emphasize the need to develop grain-marketing strategies with specific price goals and contingency plans. Without preset price goals based on-farm financial needs or some other farm business planning principle, grain ...

The information content of interest rate futures options

... the two nearest serial (non-quarterly) months. ED futures contracts are traded using a price index. The futures interest rate is calculated by subtracting the futures price from 100. For example, a ED price of 95.80 corresponds to a futures interest rate of 4.20 per cent. Thus if investors expect sh ...

... the two nearest serial (non-quarterly) months. ED futures contracts are traded using a price index. The futures interest rate is calculated by subtracting the futures price from 100. For example, a ED price of 95.80 corresponds to a futures interest rate of 4.20 per cent. Thus if investors expect sh ...

The information content of interest rate futures options

... the two nearest serial (non-quarterly) months. ED futures contracts are traded using a price index. The futures interest rate is calculated by subtracting the futures price from 100. For example, a ED price of 95.80 corresponds to a futures interest rate of 4.20 per cent. Thus if investors expect sh ...

... the two nearest serial (non-quarterly) months. ED futures contracts are traded using a price index. The futures interest rate is calculated by subtracting the futures price from 100. For example, a ED price of 95.80 corresponds to a futures interest rate of 4.20 per cent. Thus if investors expect sh ...

PDF

... riskier to trade than others due to inherent uncertainty regarding the contract's equilibrium value upon contract expiration. For example, futures which expire during the growing season may be particularly illiquid due to uncertainties regarding the size of the new crop and the demand for storage be ...

... riskier to trade than others due to inherent uncertainty regarding the contract's equilibrium value upon contract expiration. For example, futures which expire during the growing season may be particularly illiquid due to uncertainties regarding the size of the new crop and the demand for storage be ...

LDH161211

... • No chance of participating in market volatility • Profit/loss crystallized on the date of booking • The upside and downside (opportunity profit/loss) theoretically unlimited ...

... • No chance of participating in market volatility • Profit/loss crystallized on the date of booking • The upside and downside (opportunity profit/loss) theoretically unlimited ...

Financial Accounting and Accounting Standards

... Allied accumulates in equity the gain on the futures contract as part of other comprehensive income until the period when it sells the inventory. Appendix H-25 ...

... Allied accumulates in equity the gain on the futures contract as part of other comprehensive income until the period when it sells the inventory. Appendix H-25 ...