NBER Reporter Summary of My Commodity Research

... speculation. Like financial traders who might have hedging needs, hedgers may also engage in speculative trading. In a recent study, Cheng and I specifically analyze whether hedging motives can sufficiently explain trading by hedgers in futures contracts of four agricultural commodities: wheat, corn ...

... speculation. Like financial traders who might have hedging needs, hedgers may also engage in speculative trading. In a recent study, Cheng and I specifically analyze whether hedging motives can sufficiently explain trading by hedgers in futures contracts of four agricultural commodities: wheat, corn ...

File

... because the parties to the original contract and reversing contract are same. The accounts between the parties are therefore settled by receipt/payment of price differential. Since actual delivery is not intended, the underlying asset for a future or option can be market index, which cannot be deliv ...

... because the parties to the original contract and reversing contract are same. The accounts between the parties are therefore settled by receipt/payment of price differential. Since actual delivery is not intended, the underlying asset for a future or option can be market index, which cannot be deliv ...

An Equilibrium Model of Catastrophe Insurance Futures and Spreads

... appear to be getting closer and closer to a complete Arrow-Debreu market. The present article presents a situation where the underlying stochastic dynamics is assumed to allow for unpredictable jumps at random time points. In particular, we have in mind claims caused by accidents in an insurance fra ...

... appear to be getting closer and closer to a complete Arrow-Debreu market. The present article presents a situation where the underlying stochastic dynamics is assumed to allow for unpredictable jumps at random time points. In particular, we have in mind claims caused by accidents in an insurance fra ...

Financial Derivatives - William & Mary Mathematics

... How much will you win/lose if the Patriots win/lose? – Pats win, you win $1,000 - $500 = $500 – Pats lose, you lose $4,000 – $4,000 - $500 = -$500 ...

... How much will you win/lose if the Patriots win/lose? – Pats win, you win $1,000 - $500 = $500 – Pats lose, you lose $4,000 – $4,000 - $500 = -$500 ...

Securities Markets Primary Versus Secondary Markets How

... How much can the stock price rise before a margin call? Since Initial margin plus sale proceeds = ...

... How much can the stock price rise before a margin call? Since Initial margin plus sale proceeds = ...

Information to clients concerning the properties and special

... Correspondingly, in the case of a fall in price, the seller in a forward transaction has a potential for gain that is calculated as the forward/futures price minus the value of the underlying financial instruments. The seller also runs the credit risk relating to the buyer being able to settle the a ...

... Correspondingly, in the case of a fall in price, the seller in a forward transaction has a potential for gain that is calculated as the forward/futures price minus the value of the underlying financial instruments. The seller also runs the credit risk relating to the buyer being able to settle the a ...

Option Derivatives in Electricity Hedging

... The result is that the intended hedging transaction becomes to speculative position after a margin call that we are not able to pay for. In the second case, we can consider an unhedged price risk, which results from inadequate hedging of open positions. This case very often occurs and is associated ...

... The result is that the intended hedging transaction becomes to speculative position after a margin call that we are not able to pay for. In the second case, we can consider an unhedged price risk, which results from inadequate hedging of open positions. This case very often occurs and is associated ...

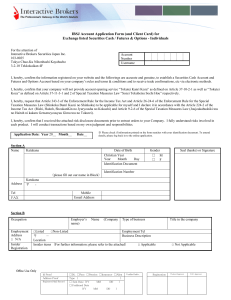

IBSJ Account Application Form (and Client Card) for Exchange listed

... Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain seconda ...

... Although we believe our failure rate is among the lowest in the industry, any system may fail at one time or another, often by reason of forces beyond human control. IB is not liable for system or network failures, and customers who require the highest level of reliability, agree to maintain seconda ...

Storage costs in commodity option pricing

... describing the benefit or premium associated with holding an underlying product or physical good rather than a financial contract (convenience yield arguments). This benefit may depend on the inventory levels since the marginal yield of the physical stock decreases as the quantity approaches a level la ...

... describing the benefit or premium associated with holding an underlying product or physical good rather than a financial contract (convenience yield arguments). This benefit may depend on the inventory levels since the marginal yield of the physical stock decreases as the quantity approaches a level la ...

The Black-Scholes

... After the options have been issued it is not necessary to take account of dilution when they are valued Before they are issued we can calculate the cost of each option as N/(N+M) times the price of a regular option with the same terms where N is the number of existing shares and M is the number of n ...

... After the options have been issued it is not necessary to take account of dilution when they are valued Before they are issued we can calculate the cost of each option as N/(N+M) times the price of a regular option with the same terms where N is the number of existing shares and M is the number of n ...

pdf

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

... 1. You suspect that Delta airlines will merge with Northwest Airlines in the coming month. Delta stock is trading at $0.85. We assume that the forward price equals the stock price. There is a 60% chance that the merger will occur, in which case the stock will be worth $1.20. There is a 40% chance th ...

The Black-Scholes

... After the options have been issued it is not necessary to take account of dilution when they are valued Before they are issued we can calculate the cost of each option as N/(N+M) times the price of a regular option with the same terms where N is the number of existing shares and M is the number of ...

... After the options have been issued it is not necessary to take account of dilution when they are valued Before they are issued we can calculate the cost of each option as N/(N+M) times the price of a regular option with the same terms where N is the number of existing shares and M is the number of ...

In segregating responsibilities, this office reconciles payments with

... 43. Which of the following statements is NOT true? (A) Volume measures the number of contracts traded and is a good indication of the intensity of a move reflecting the demand and supply. (B) When prices are rising and volume increasing , we expect the trend to continue. (C) If prices are rising and ...

... 43. Which of the following statements is NOT true? (A) Volume measures the number of contracts traded and is a good indication of the intensity of a move reflecting the demand and supply. (B) When prices are rising and volume increasing , we expect the trend to continue. (C) If prices are rising and ...

VPFF Risk Derivates

... purchase/sell the underlying asset at a predetermined price, with delivery or other performance, for example, cash settlement, of the contract on the date stated in the contract. No premiums are paid since both parties have equal obligations under a futures contract. A swap agreement means that the ...

... purchase/sell the underlying asset at a predetermined price, with delivery or other performance, for example, cash settlement, of the contract on the date stated in the contract. No premiums are paid since both parties have equal obligations under a futures contract. A swap agreement means that the ...

Contract Specifications for Option Contract on EURUSD

... Deep-out-of-the-money short options may show zero or minimal Scan Risk given the price and volatility moves in the 16 market scenarios, yet still present risk in the event that these options move closer-to-the-money or in-the-money, thereby generating potentially large losses. Hence a Short Option M ...

... Deep-out-of-the-money short options may show zero or minimal Scan Risk given the price and volatility moves in the 16 market scenarios, yet still present risk in the event that these options move closer-to-the-money or in-the-money, thereby generating potentially large losses. Hence a Short Option M ...

Derivatives - Karvy Fortune

... that futures prices normally exceed spot prices. Cost of carry: The relationship between futures prices and spot prices can be summarized in terms of what is known as the cost of carry. This measures the storage cost plus the interest that is paid to finance the asset less the income earned on t ...

... that futures prices normally exceed spot prices. Cost of carry: The relationship between futures prices and spot prices can be summarized in terms of what is known as the cost of carry. This measures the storage cost plus the interest that is paid to finance the asset less the income earned on t ...

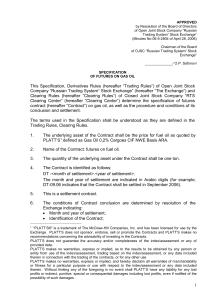

С П Е Ц И Ф И К А Ц И Я

... day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset (Gas Oil 0,2% Cargoes CIF NWE Basis ARA) on the Contract settlement date with ...

... day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset (Gas Oil 0,2% Cargoes CIF NWE Basis ARA) on the Contract settlement date with ...

The Greek Letters

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

... A portfolio manager is often interested in acquiring a put option on his or her portfolio. The provides protection against market declines while preserving the potential for a gain if the market does well. Options markets don’t always have the liquidity to absorb the trades required by managers of l ...

Options

... • A move large enough in the direction you want it too, the OTM option can deliver large gains • But if the move is against you, the loss will be less than ATM and ITM • OTM near expiration dates tends to fare well ...

... • A move large enough in the direction you want it too, the OTM option can deliver large gains • But if the move is against you, the loss will be less than ATM and ITM • OTM near expiration dates tends to fare well ...

Derivatives markets, products and participants

... company for a boat in 12 months. Suppose the spot exchange rate is 1,200 won per dollar today. Should the won appreciate by 10 per cent against the dollar over the next year, the Korean shipbuilder will receive only 1,090 million of won (some 109 million of won less than he would have received today ...

... company for a boat in 12 months. Suppose the spot exchange rate is 1,200 won per dollar today. Should the won appreciate by 10 per cent against the dollar over the next year, the Korean shipbuilder will receive only 1,090 million of won (some 109 million of won less than he would have received today ...

Hedging

... Options are traded the same way futures contracts are traded, with the exception of margin requirements. Most option buyers and sellers elect to liquidate their option positions by an offsetting sale or purchase at or prior to expiration. ...

... Options are traded the same way futures contracts are traded, with the exception of margin requirements. Most option buyers and sellers elect to liquidate their option positions by an offsetting sale or purchase at or prior to expiration. ...

BAML Partners with Thesys on New High-Speed Trading

... which is based on the Liffe Connect technology, is currently used for the trading of options. TSE said the migration will dramatically improve the exchange’s capacity to process trades and reduce latency to less than 10 milliseconds. The exchange also said it will leverage the capabilities of the Td ...

... which is based on the Liffe Connect technology, is currently used for the trading of options. TSE said the migration will dramatically improve the exchange’s capacity to process trades and reduce latency to less than 10 milliseconds. The exchange also said it will leverage the capabilities of the Td ...

PDF

... for a lot of live cattle that meets all futures contract specifications (including place and time of delivery). Results of the analysis suggest that, during the delivery period, par-delivery-point basis values for live cattle frequently differ from zero by more than the transaction costs associated ...

... for a lot of live cattle that meets all futures contract specifications (including place and time of delivery). Results of the analysis suggest that, during the delivery period, par-delivery-point basis values for live cattle frequently differ from zero by more than the transaction costs associated ...

18Future Contracts,Options and Swaps

... A futures contract is a type of derivative instrument, or financial contract, in which two parties agree to transact a set of financial instruments or physical commodities for future delivery at a specified price, traded on an exchange. The terms "futures contract" and "futures" refer to essentially ...

... A futures contract is a type of derivative instrument, or financial contract, in which two parties agree to transact a set of financial instruments or physical commodities for future delivery at a specified price, traded on an exchange. The terms "futures contract" and "futures" refer to essentially ...

RMS Policy ESTEE ADVISORS PRIVATE LTD. RMS PROCESS

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first ...

... risk of auction. A purchase transaction in the cash segment would fall into one or more of the following categories: 2 .3) Sell against Buying : A purchase order executed on the Exchange today and the (undelivered) purchased stock sold in its entirety on the next trading day. In this case the first ...