- Advisor To Client

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

... To make it easier for you to prepare meeting materials, we’ve developed these slides about the 5 types of hedge funds. The presentation is in a Word file to make it simpler to customize content to meet your clients’ information needs. ...

day 6

... • The potential gain or loss in value of the derivative is huge. – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per year change in cash flows. A very small ...

... • The potential gain or loss in value of the derivative is huge. – If the underlying asset is volatile, the derivative is even more volatile because it is so leveraged. – For the interest rate swap, a 1% interest rate change can cause thousands of dollars per year change in cash flows. A very small ...

Extension and Outreach/Department of Economics

... Has some unique features due to the nature of agricultural businesses Supply comes online a few times during the year So at harvest, supply spikes, then diminishes until the next harvest Production decisions are based price forecasts Planting decisions can be made a full year (or more) before t ...

... Has some unique features due to the nature of agricultural businesses Supply comes online a few times during the year So at harvest, supply spikes, then diminishes until the next harvest Production decisions are based price forecasts Planting decisions can be made a full year (or more) before t ...

Total Return Swap

... FRA is not a future, but a mechanism of trading provided by BM&F where each trade is broken and registered as a pair of opposite DDI trades ...

... FRA is not a future, but a mechanism of trading provided by BM&F where each trade is broken and registered as a pair of opposite DDI trades ...

colour ppt

... • Subject to default risk. If in a years time interest rates rise so the price of the 8s bonds falls, Jimbo PLC may default of the forward contract because it can buy other bonds at a lower price than the agreed price. • Due to default risk, adverse selection and moral hazard, there are high costs f ...

... • Subject to default risk. If in a years time interest rates rise so the price of the 8s bonds falls, Jimbo PLC may default of the forward contract because it can buy other bonds at a lower price than the agreed price. • Due to default risk, adverse selection and moral hazard, there are high costs f ...

VALUATION IN DERIVATIVES MARKETS

... IAS sets out a hierarchy for the determination of fair value: a) For instruments traded in active markets, use a quoted price. b) For instruments for which there is not an active market, use a recent market transaction. c) For instruments for which there is neither an active market nor a recent mark ...

... IAS sets out a hierarchy for the determination of fair value: a) For instruments traded in active markets, use a quoted price. b) For instruments for which there is not an active market, use a recent market transaction. c) For instruments for which there is neither an active market nor a recent mark ...

1 The Greek Letters

... Delta, D, can be changed by taking a position in the underlying asset To adjust gamma, G, and vega, n, it is necessary to take a position in an option or other derivative ...

... Delta, D, can be changed by taking a position in the underlying asset To adjust gamma, G, and vega, n, it is necessary to take a position in an option or other derivative ...

Chapter 4: Using Futures Markets

... company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquire in the future. If you are a new silver mining company and just have initiated mining operations. You expect to acquire/have silver in the future. 3. An anticipatory hedge: a commodity t ...

... company and have silver stored. You own the commodity. 2. An anticipatory hedge: a commodity that you will acquire in the future. If you are a new silver mining company and just have initiated mining operations. You expect to acquire/have silver in the future. 3. An anticipatory hedge: a commodity t ...

Emerging Derivative Markets

... 7. Derivatives driven by distortionary taxation and weak underlying issues may substitute for cash markets. 8. Management of counter-party risk may need to be enhanced (ISDA master, central clearing and counterparty). 9. Margin systems could be tightened for leveraged members (dynamic, insurance). ...

... 7. Derivatives driven by distortionary taxation and weak underlying issues may substitute for cash markets. 8. Management of counter-party risk may need to be enhanced (ISDA master, central clearing and counterparty). 9. Margin systems could be tightened for leveraged members (dynamic, insurance). ...

nymex 1090 - CME Group

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

... The provisions of these rules shall apply to all contracts bought or sold on the Exchange for cash settlement based on the Floating Price. ...

The Greek Letters

... Using Futures for Delta Hedging • The delta of a futures contract is e(r-q)T times the delta of a spot contract • The position required in futures for delta hedging is therefore e-(r-q)T times the position required in the corresponding ...

... Using Futures for Delta Hedging • The delta of a futures contract is e(r-q)T times the delta of a spot contract • The position required in futures for delta hedging is therefore e-(r-q)T times the position required in the corresponding ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Supportive evidence for LOP with regard to specific commodities and ...

... Supportive evidence for LOP with regard to specific commodities and ...

Document

... • Value is depends directly on, or is derived from, the value of another security or commodity, called the underlying asset • Forward and Futures contracts are agreements between two parties - the buyer agrees to purchase an asset from the seller at a specific date at a price agreed to now • Options ...

... • Value is depends directly on, or is derived from, the value of another security or commodity, called the underlying asset • Forward and Futures contracts are agreements between two parties - the buyer agrees to purchase an asset from the seller at a specific date at a price agreed to now • Options ...

Post-Harvest Marketing Alternatives

... the producer to use the remainder of the cash to pay off debt, reinvest in the farm, etc. ...

... the producer to use the remainder of the cash to pay off debt, reinvest in the farm, etc. ...

ch11 - U of L Class Index

... Hedging With Eurodollar Futures (cont’d) Hedging Example Assume you are a portfolio managers for a university’s endowment fund which will receive $10 million in 3 months. You would like to invest the money now, as you think interest rates are going to decline. Because you want a money market invest ...

... Hedging With Eurodollar Futures (cont’d) Hedging Example Assume you are a portfolio managers for a university’s endowment fund which will receive $10 million in 3 months. You would like to invest the money now, as you think interest rates are going to decline. Because you want a money market invest ...

Chapter 24

... Consider two bonds that have the same coupon, time to maturity and price. One is a B-rated corporate bond. The other is a CAT bond. An analysis based on historical data shows that the expected losses on the two bonds in each year of their life is thesame. Which bond would you advise a portfolio mana ...

... Consider two bonds that have the same coupon, time to maturity and price. One is a B-rated corporate bond. The other is a CAT bond. An analysis based on historical data shows that the expected losses on the two bonds in each year of their life is thesame. Which bond would you advise a portfolio mana ...

Ethan Frome - Eurex Exchange

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

... determining a particular opening price, additional orders and quotes may be entered until a time established by the Boards of Management of the Eurex Exchanges; a preliminary opening price will be continuously displayed during this period (the ”Pre-Opening Period”). Quotes may be individually cancel ...

Hedging with Interest Rate Futures

... Rate Futures (11) Another alternative would be to do the basic hedge by selling 20 Dec futures As this is using earlier dated contracts, the short hedger will now have to do a number of long spread trades ...

... Rate Futures (11) Another alternative would be to do the basic hedge by selling 20 Dec futures As this is using earlier dated contracts, the short hedger will now have to do a number of long spread trades ...

FINANCIAL MARKETS AND INSTITIUTIONS: A Modern Perspective

... specified price within a specified period of time • A call option is an option that gives the purchaser the right, but not the obligation, to buy the underlying security from the writer of the option at a specified exercise price on (or up to) a specified date • A put option is an option that gives ...

... specified price within a specified period of time • A call option is an option that gives the purchaser the right, but not the obligation, to buy the underlying security from the writer of the option at a specified exercise price on (or up to) a specified date • A put option is an option that gives ...

Derivative Financial instrument whose payoff depends on the value

... Financial instrument whose payoff depends on the value of the underlying asset. Derivative can be used to hedge risk because there is a correlation with the underlying. Also reflect a view on the future, speculate, arbitrage profit, change the nature of the liability/investment. Forward OTC agreemen ...

... Financial instrument whose payoff depends on the value of the underlying asset. Derivative can be used to hedge risk because there is a correlation with the underlying. Also reflect a view on the future, speculate, arbitrage profit, change the nature of the liability/investment. Forward OTC agreemen ...

Trading Corner - Eurex Exchange

... At maturity, the value of the receivables has diminished by EUR 423,446.16 (EUR 7,830,853.56 at a rate of 1.2770 compared to EUR 7,407,407.41 at a rate of 1.3500). At the same time, the futures contracts have generated a profit of USD 7,300 per contract – a total of USD 569,400 or EUR 421,777.78 at ...

... At maturity, the value of the receivables has diminished by EUR 423,446.16 (EUR 7,830,853.56 at a rate of 1.2770 compared to EUR 7,407,407.41 at a rate of 1.3500). At the same time, the futures contracts have generated a profit of USD 7,300 per contract – a total of USD 569,400 or EUR 421,777.78 at ...

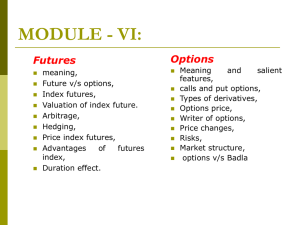

Derivatives - WordPress.com

... Derivative products in some form or the other have existed for centuries. ...

... Derivative products in some form or the other have existed for centuries. ...

ITEM

... for options and also up-front amount paid / received for swaps. Amount of profit and loss arising from the derivative since inception (not profit and loss accounted for in financial statements). For closed / matured contracts corresponds to the realized profit or loss at the closing/maturing date. N ...

... for options and also up-front amount paid / received for swaps. Amount of profit and loss arising from the derivative since inception (not profit and loss accounted for in financial statements). For closed / matured contracts corresponds to the realized profit or loss at the closing/maturing date. N ...

The Futures Market

... 3. The relationship between supply and demand come together to create a price. a. Supply increases if people are willing and able to supply more of a product or service at every price. For example, supply would increase if farmers were willing to produce 8,000 pounds of milk every day if the price w ...

... 3. The relationship between supply and demand come together to create a price. a. Supply increases if people are willing and able to supply more of a product or service at every price. For example, supply would increase if farmers were willing to produce 8,000 pounds of milk every day if the price w ...