Document

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

... FUTURES CONTRACTS • WHAT ARE FUTURES? – Definition: an agreement between two investors under which the seller promises to deliver a specific asset on a specific future date to the buyer for a predetermined price to be paid on the delivery date ...

Risk management through introduction of futures contracts in tea

... variability. Theoretically, trading futures in tea would be a useful hedging instrument available to producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures co ...

... variability. Theoretically, trading futures in tea would be a useful hedging instrument available to producers to insure themselves against price risk. • However, informal systems of entering into forward contracts with reputed buyers of bulk tea already exist in the Indian market and for futures co ...

Derivative (finance)

... options/futures and swaps are among the most common. Options are contracts where one party agrees to pay a fee to another for the right (but not the obligation) to buy something from or sell something to the other. For example, a person worried that the price of his Microsoft stock may go down befor ...

... options/futures and swaps are among the most common. Options are contracts where one party agrees to pay a fee to another for the right (but not the obligation) to buy something from or sell something to the other. For example, a person worried that the price of his Microsoft stock may go down befor ...

Derivative (finance)

... options/futures and swaps are among the most common. Options are contracts where one party agrees to pay a fee to another for the right (but not the obligation) to buy something from or sell something to the other. For example, a person worried that the price of his Microsoft stock may go down befor ...

... options/futures and swaps are among the most common. Options are contracts where one party agrees to pay a fee to another for the right (but not the obligation) to buy something from or sell something to the other. For example, a person worried that the price of his Microsoft stock may go down befor ...

PART V - Georgia College & State University

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

... ownership of the underlying assets at the time the contract is initiated. A derivative represents an agreement to transfer ownership of underlying assets at a specific place, price, and time specified in the contract. Its value (or price) depends on the value of the underlying assets. The underlying ...

im09

... charge a premium to provide this insurance. Financial institutions can use options to hedge balance sheet risk, much as described above for futures contracts. Option prices rise when the price of the underlying security is more volatile or when the expiration date is further in the future, because t ...

... charge a premium to provide this insurance. Financial institutions can use options to hedge balance sheet risk, much as described above for futures contracts. Option prices rise when the price of the underlying security is more volatile or when the expiration date is further in the future, because t ...

Ch 7: 1.1-4

... a. The farmer would want to sell wheat futures. The farmer would sell 10 contracts. The contracts in total would value (10 contracts 5,000 bushels $2.75 per bushel) $137,500. b. In November, the farmer closes his position in the futures market by buying back the contracts at the current future ...

... a. The farmer would want to sell wheat futures. The farmer would sell 10 contracts. The contracts in total would value (10 contracts 5,000 bushels $2.75 per bushel) $137,500. b. In November, the farmer closes his position in the futures market by buying back the contracts at the current future ...

Conventional Wisdom and the Impact of Market Volatility

... the size of existing commodity futures markets ...

... the size of existing commodity futures markets ...

Presentation - NCDEX Institute of Commodity Markets and Research

... Both indices are not stationary in level form. First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

... Both indices are not stationary in level form. First Difference of log form, i.e., rates of growth series of these indices are stationary. It implies that while it may not be possible to predict future values, the rate of growth of either of the two series is predictable. ...

Options Contract Mechanics, Canola Futures

... Part of an option contract’s value is tied to volatility in the underlying futures market. The wider futures prices swing from day to day, the higher the likelihood of an option moving into-the-money before the contract expires. An option’s volatility value is measured by its ‘delta’, which is calc ...

... Part of an option contract’s value is tied to volatility in the underlying futures market. The wider futures prices swing from day to day, the higher the likelihood of an option moving into-the-money before the contract expires. An option’s volatility value is measured by its ‘delta’, which is calc ...

Document

... transportation costs in your area would be expected to have what effect on the basis: a) Weaken the basis b) Strengthen the basis ...

... transportation costs in your area would be expected to have what effect on the basis: a) Weaken the basis b) Strengthen the basis ...

2010-12 DC Bar 1256

... they are marked-to-market, they would meet the definition of regulated futures contract under Section 1256. But to date, IRS has held to the 1981 legislative history of the section which refers only to regulated futures contracts and does not include types of instruments added by Congress. Dodd-Fran ...

... they are marked-to-market, they would meet the definition of regulated futures contract under Section 1256. But to date, IRS has held to the 1981 legislative history of the section which refers only to regulated futures contracts and does not include types of instruments added by Congress. Dodd-Fran ...

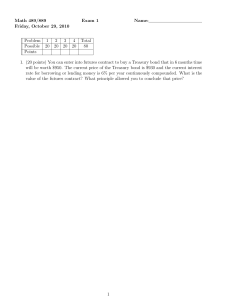

Fall 10 489f10t1.pdf

... Var [X] = 1002 . The company can afford some overstatements simply because it is cheaper to pay than it is to investigate and counter-claim to recover the overstatement. Given 100 claims in a month, the company wants to know what amount of reserve will give 95% certainty that the sum total of the ov ...

... Var [X] = 1002 . The company can afford some overstatements simply because it is cheaper to pay than it is to investigate and counter-claim to recover the overstatement. Given 100 claims in a month, the company wants to know what amount of reserve will give 95% certainty that the sum total of the ov ...

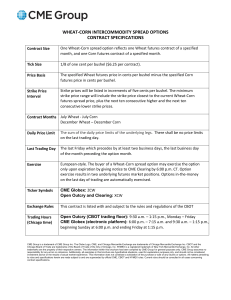

Wheat-Corn Intercommodity Spread Options Contract

... Open Outcry (CBOT trading floor): 9:30 a.m. – 1:15 p.m., Monday – Friday CME Globex (electronic platform): 6:00 p.m. – 7:15 a.m. and 9:30 a.m. – 1:15 p.m., beginning Sunday at 6:00 p.m. and ending Friday at 1:15 p.m. ...

... Open Outcry (CBOT trading floor): 9:30 a.m. – 1:15 p.m., Monday – Friday CME Globex (electronic platform): 6:00 p.m. – 7:15 a.m. and 9:30 a.m. – 1:15 p.m., beginning Sunday at 6:00 p.m. and ending Friday at 1:15 p.m. ...

FREE Sample Here

... The absence of a daily settlement is one of the factors distinguishing a forward contract from a futures contract. ...

... The absence of a daily settlement is one of the factors distinguishing a forward contract from a futures contract. ...

Chapter 15

... Futures Contract Valuation C. Gains and Losses against the position are recorded at the close of trading every day: marking-to-market. Futures are a zero sum game – losses = gains. a. ...

... Futures Contract Valuation C. Gains and Losses against the position are recorded at the close of trading every day: marking-to-market. Futures are a zero sum game – losses = gains. a. ...

Brief Overview of Futures and Options in Risk Management

... or indexes. The intent of traders in this market is to take one of three possible positions: (1) Speculate on anticipated price movements (2) Hedge an existing or anticipated position that they may have in the cash (spot) market (3) Arbitrage inconsistent prices among financial securities and depend ...

... or indexes. The intent of traders in this market is to take one of three possible positions: (1) Speculate on anticipated price movements (2) Hedge an existing or anticipated position that they may have in the cash (spot) market (3) Arbitrage inconsistent prices among financial securities and depend ...

ch01 - Class Index

... OTC derivatives are customized products that trade off the exchange and are individually negotiated between two parties Options are securities and are regulated by the Securities and Exchange Commission ...

... OTC derivatives are customized products that trade off the exchange and are individually negotiated between two parties Options are securities and are regulated by the Securities and Exchange Commission ...

Multiple-Choice Quiz (with answer key)

... Consider the fair value equation for a commodities future, relating the futures price to the risk-free interest rate, a positive storage cost, and the spot price. This fair value equation implies that futures prices should be increasing in the time to maturity. Does this necessarily imply that any b ...

... Consider the fair value equation for a commodities future, relating the futures price to the risk-free interest rate, a positive storage cost, and the spot price. This fair value equation implies that futures prices should be increasing in the time to maturity. Does this necessarily imply that any b ...

Commodity Marketing Activity

... • Private Speculator: try to make money buying & selling – Day Trader: close their position before the end of the trading day – Position Trader: take relatively large positions in market and hold their position for a long time ...

... • Private Speculator: try to make money buying & selling – Day Trader: close their position before the end of the trading day – Position Trader: take relatively large positions in market and hold their position for a long time ...