Options on Futures Contracts - Feuz Cattle and Beef Market Analysis

... Buyers and Sellers Put Options Buyers: can exercise the right to a short position in futures at the strike price anytime before the option expires. For this right, they pay the option premium. Sellers (writers): must provide the option buyer with a short futures position if the option is exerc ...

... Buyers and Sellers Put Options Buyers: can exercise the right to a short position in futures at the strike price anytime before the option expires. For this right, they pay the option premium. Sellers (writers): must provide the option buyer with a short futures position if the option is exerc ...

Forward and Futures Contracts

... Counterparty risk Definition: A futures contract is an exchange-traded, standardized, forward-like contract that is marked to market daily. This contract can be used to establish a long (or short) position in the underlying asset. Features of Futures Contracts Standardized contracts: – Underlyin ...

... Counterparty risk Definition: A futures contract is an exchange-traded, standardized, forward-like contract that is marked to market daily. This contract can be used to establish a long (or short) position in the underlying asset. Features of Futures Contracts Standardized contracts: – Underlyin ...

Chapter 17

... improve gamma and vega As portfolio becomes larger hedging becomes less expensive ...

... improve gamma and vega As portfolio becomes larger hedging becomes less expensive ...

An approach on how to trade in commodities market

... You can start your investment with an amount as low as say Rs 25,000. All you need is money for margins payable upfront to exchanges through brokers. Generally commodity futures require an initial margin between 5-10% of the contract value. The exchanges levy higher additional margin in case of exc ...

... You can start your investment with an amount as low as say Rs 25,000. All you need is money for margins payable upfront to exchanges through brokers. Generally commodity futures require an initial margin between 5-10% of the contract value. The exchanges levy higher additional margin in case of exc ...

24. Portfolio Insurance and Synthetic Options

... the return on an option. The key variable in this strategy is the delta value, which measures the change in the price of an option with respect to the change in the value of the portfolio of risky stocks. The delta of an option, Δ, is defined as the rate of change of the option price respected to th ...

... the return on an option. The key variable in this strategy is the delta value, which measures the change in the price of an option with respect to the change in the value of the portfolio of risky stocks. The delta of an option, Δ, is defined as the rate of change of the option price respected to th ...

National Institute of Securities Markets

... Explain the basics of cash and carry / Non-arbitrage model for futures pricing Describe the expectancy model of futures pricing Understand concept of convergence of cash and futures prices 3.2.3 Basic differences in Commodity, Equity and Index Futures 3.3 Exchange Traded Currency Futures 3.3.1 Termi ...

... Explain the basics of cash and carry / Non-arbitrage model for futures pricing Describe the expectancy model of futures pricing Understand concept of convergence of cash and futures prices 3.2.3 Basic differences in Commodity, Equity and Index Futures 3.3 Exchange Traded Currency Futures 3.3.1 Termi ...

Volatility and Risk Management

... Futures contracts provide an effective day-to-day risk management tool for players between the two ends of the supply chain. These typically are wholesale and retail distributors who make buy-sell transactions in the cash market as they move a commodity through the supply chain. They are in the busi ...

... Futures contracts provide an effective day-to-day risk management tool for players between the two ends of the supply chain. These typically are wholesale and retail distributors who make buy-sell transactions in the cash market as they move a commodity through the supply chain. They are in the busi ...

Chapter 5

... $1.4 and a December settlement date. Current spot price as of that date is $1.39. He pays a premium of $0.12 per unit for the call option. Just before the expiration date, the spot rate of the British pound is $1.41.At that time, he exercises the call option and sells the pounds at the spot rate to ...

... $1.4 and a December settlement date. Current spot price as of that date is $1.39. He pays a premium of $0.12 per unit for the call option. Just before the expiration date, the spot rate of the British pound is $1.41.At that time, he exercises the call option and sells the pounds at the spot rate to ...

Allan Thomson, CEO, Dreadnought Capital, South Africa

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

... In August of 2001 the JSE Securities Exchange purchased the South African Futures Exchange (SAFEX). Allan joined the JSE primarily to manage the smooth integration of the equities and Equity Derivatives market. He has a passion for new and exciting products, and has been instrumental in developing t ...

Chpt 6 - Glen Rose FFA

... If the value is above $0, he can offset it by selling it back and MAY gain a profit No Margin Deposit is required ...

... If the value is above $0, he can offset it by selling it back and MAY gain a profit No Margin Deposit is required ...

Chapter 305 British Pound Sterling/Japanese Yen (GBP/JPY) Cross

... British Pound Sterling/Japanese Yen (GBP/JPY) Cross Rate Futures ...

... British Pound Sterling/Japanese Yen (GBP/JPY) Cross Rate Futures ...

LMAX EXCHANGE Wall Street 30 (Mini) Contract Terms

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

CE91 - MexDer

... Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading at Daily Settlement Price and auctions convened by MexDer in accordance with provisions of point (IV.3.d ...

... Trading hours for the 91-Day Cetes Futures Contract will be Bank Business Days from 7:30 to 14:00 hours, Mexico City time. Also, trading hours will be understood to include the period for trading at Daily Settlement Price and auctions convened by MexDer in accordance with provisions of point (IV.3.d ...

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

Answers to Chapter 23 Questions

... 5. The expected change in the spot position = -8 (.01/1.07) 10,400,000 = -$777,570. This would mean a price change from 104 to 96.2243 per $100 face value. By entering into a two month forward contract to sell a $10,000,000 of 15 year bonds at 104, the FI will have hedged its spot position. If r ...

... 5. The expected change in the spot position = -8 (.01/1.07) 10,400,000 = -$777,570. This would mean a price change from 104 to 96.2243 per $100 face value. By entering into a two month forward contract to sell a $10,000,000 of 15 year bonds at 104, the FI will have hedged its spot position. If r ...

Institute of Actuaries of India INDICATIVE SOLUTION

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

... borrowed and repaid later incurring a loss of interest on this amount which would push down the cash flow in six months time. It is likely that the broker may allow the brokerage on stocks to be adjusted with the margin but not on the futures in which case it will only be the interest on Rs 10. All ...

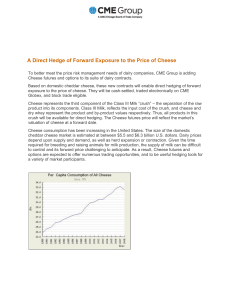

A Direct Hedge of Forward Exposure to the Price of Cheese

... Cheese represents the third component of the Class III Milk “crush” – the separation of the raw product into its components. Class III Milk, reflects the input cost of the crush, and cheese and dry whey represent the product and by-product values respectively. Thus, all products in this crush will b ...

... Cheese represents the third component of the Class III Milk “crush” – the separation of the raw product into its components. Class III Milk, reflects the input cost of the crush, and cheese and dry whey represent the product and by-product values respectively. Thus, all products in this crush will b ...

SU54 - CMAPrepCourse

... its cost to the company will not rise and cut into profits. Accordingly, the automobile company uses the futures market to create a long hedge, which is a futures contract that is purchased to protect against price increases. ...

... its cost to the company will not rise and cut into profits. Accordingly, the automobile company uses the futures market to create a long hedge, which is a futures contract that is purchased to protect against price increases. ...

Changes to Result in Better Framework and Incentive Structure for

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

... scheme for MMs trading in stock index futures or options. Under existing HKFE Rules, Registered Traders (RTs) in a stock index futures or options market enjoy discounted trading fees in that market when trading for their own market making accounts. In addition, they enjoy discounted trading fees whe ...

Set 8 - Matt Will

... traditional basis spread between index prices and index futures prices The basis spread between the index and index futures contract should be constant. Spreads which are larger or smaller than normal will result in arbitrage opportunities. ...

... traditional basis spread between index prices and index futures prices The basis spread between the index and index futures contract should be constant. Spreads which are larger or smaller than normal will result in arbitrage opportunities. ...

Financial Markets in Electricity: Introduction to Derivative Instruments

... generator may wish to wishes to guarantee a minimum difference between the cost of his fuel and the price of electricity in his region. For example, by selling his electricity output in a forward contract while simultaneously buying a forward contract for the fuel, the generator can lock in a guaran ...

... generator may wish to wishes to guarantee a minimum difference between the cost of his fuel and the price of electricity in his region. For example, by selling his electricity output in a forward contract while simultaneously buying a forward contract for the fuel, the generator can lock in a guaran ...

Lecture 3

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

... Inland farmers came to east coast to sell their grain to dealers who, in turn, shipped it all over the country. Too much supply right after the harvest. Unpurchased crops were left to rot. In the off-season price became too high when crops were unavailable. Not good for both the farmers and the deal ...

Derivatives Market in inDia: a success story

... This amount is known as the option premium. In the event that options are not exercised at expiration, the ...

... This amount is known as the option premium. In the event that options are not exercised at expiration, the ...