Final Exam Preparation

... against an adverse interest-rate movement, the intermediary would hedge its position. The parties to swaps have to be concerned that the other party might default on its obligation. Although a default would not mean any principal was lost because the notional principal amount had not been exchanged ...

... against an adverse interest-rate movement, the intermediary would hedge its position. The parties to swaps have to be concerned that the other party might default on its obligation. Although a default would not mean any principal was lost because the notional principal amount had not been exchanged ...

Greeks- Theory and Illustrations

... many Euro dollar futures contracts are needed to hedge the portfolio? A Eurodollar contract has a face value of $ 1 million and a maturity of 3 months. If rates change by 1 basis point, the value changes by (1,000,000) (.0001)/4= $ 25. So the number of futures contracts needed = 1100/25=44 ...

... many Euro dollar futures contracts are needed to hedge the portfolio? A Eurodollar contract has a face value of $ 1 million and a maturity of 3 months. If rates change by 1 basis point, the value changes by (1,000,000) (.0001)/4= $ 25. So the number of futures contracts needed = 1100/25=44 ...

united states international university - africa

... lending and capital flows in the 1970s the debt crisis debt crisis and the policy response with hindsight central banks and international cooperation, the European monetary system international coordination ...

... lending and capital flows in the 1970s the debt crisis debt crisis and the policy response with hindsight central banks and international cooperation, the European monetary system international coordination ...

OPTIONS HEDGING AS A MEAN OF PRICE RISK ELIMINATION

... provide major buying orders. They are hoping to buy at depressed prices in order to sell when the market improves and in doing so they are relieving industry of the need to finance merchandise it does not need. Futures trading or stock exchange trading has already been used for more than a century, ...

... provide major buying orders. They are hoping to buy at depressed prices in order to sell when the market improves and in doing so they are relieving industry of the need to finance merchandise it does not need. Futures trading or stock exchange trading has already been used for more than a century, ...

Futurization of Swaps

... The revolution in securities trading advanced again last month with the announcement that the Intercontinental Exchange (ICE) had agreed to a friendly buyout of NYSE Euronext. In 2011, NYSE Euronext (a product of a cross-Atlantic merger involving the New York Stock Exchange) had tried and failed to ...

... The revolution in securities trading advanced again last month with the announcement that the Intercontinental Exchange (ICE) had agreed to a friendly buyout of NYSE Euronext. In 2011, NYSE Euronext (a product of a cross-Atlantic merger involving the New York Stock Exchange) had tried and failed to ...

CH05

... • Borrowed security sold in open market, to be repurchased later at an expected price lower than sale price • The investor profits from the difference between the price at which the borrowed stock was sold and the price at which it was purchased ...

... • Borrowed security sold in open market, to be repurchased later at an expected price lower than sale price • The investor profits from the difference between the price at which the borrowed stock was sold and the price at which it was purchased ...

QuizWeek06a

... plans to sell the commodity on July 31 at exit value based on an unknown exit value. The company acquires a forward contract (Call it Forward Contract 1) that expires on June 30 to lock in the net entry value of the purchase at $1,000,000. Assume hedge effectiveness is on the 80%-125% Delta test eac ...

... plans to sell the commodity on July 31 at exit value based on an unknown exit value. The company acquires a forward contract (Call it Forward Contract 1) that expires on June 30 to lock in the net entry value of the purchase at $1,000,000. Assume hedge effectiveness is on the 80%-125% Delta test eac ...

The Commodity Futures Modernization Act of 2000

... CFTC regulated exchange, unless a statutory exclusion or regulatory exemption from such requirement can be found. Thus, if a futures contract should, under the CEA, be traded only on a CFTC regulated exchange, but nonetheless is traded over–the–counter, that futures contract is illegal and unenforce ...

... CFTC regulated exchange, unless a statutory exclusion or regulatory exemption from such requirement can be found. Thus, if a futures contract should, under the CEA, be traded only on a CFTC regulated exchange, but nonetheless is traded over–the–counter, that futures contract is illegal and unenforce ...

U1S09_Su10_Lesson_04 - U1S09-2010

... minute. A company doing business abroad has to be able to assess the strength or weakness of the foreign exchange rates between their local currency and the currency of the foreign market(s). ...

... minute. A company doing business abroad has to be able to assess the strength or weakness of the foreign exchange rates between their local currency and the currency of the foreign market(s). ...

Optimal Hedge Ratio and Hedge Efficiency

... average (ARIMA) technique should be used to estimate the minimum risk hedge to account for the serial correlation of error terms (Herbst, Kare and Caples, 1989). The JSE model fails to appreciate the fact that futures prices converge to their spot/cash market price on the maturity date. HKM methodol ...

... average (ARIMA) technique should be used to estimate the minimum risk hedge to account for the serial correlation of error terms (Herbst, Kare and Caples, 1989). The JSE model fails to appreciate the fact that futures prices converge to their spot/cash market price on the maturity date. HKM methodol ...

1) If a bank manager chooses to hedge his portfolio of treasury

... A short contract requires that the investor sell securities in the future. buy securities in the future. hedge in the future. close out his position in the future. Question Status: Previous Edition A contract that requires the investor to sell securities on a future date is called a short contract. ...

... A short contract requires that the investor sell securities in the future. buy securities in the future. hedge in the future. close out his position in the future. Question Status: Previous Edition A contract that requires the investor to sell securities on a future date is called a short contract. ...

CHAPTER 13 Options on Futures

... strike price generally are 25 index points. Number of strike prices increases as expiration approaches and increments between strike prices is reduced to a minimum of 5 index points. Tick Size: .01 index points or $25.00. Price Quote: Price is quoted in terms of the IMM 3-month Eurodollar index, 100 ...

... strike price generally are 25 index points. Number of strike prices increases as expiration approaches and increments between strike prices is reduced to a minimum of 5 index points. Tick Size: .01 index points or $25.00. Price Quote: Price is quoted in terms of the IMM 3-month Eurodollar index, 100 ...

Price Discovery through Crude Palm Oil Futures: An

... market for wheat and maine potatoes during 1953-69. He found that storable commodity, in this case wheat, provides relatively reliable forecasts of cash prices at any point in time. Kofi also shows that the longer the horizon, the worse the futures market performs as a predictor of spot prices. Leut ...

... market for wheat and maine potatoes during 1953-69. He found that storable commodity, in this case wheat, provides relatively reliable forecasts of cash prices at any point in time. Kofi also shows that the longer the horizon, the worse the futures market performs as a predictor of spot prices. Leut ...

Derivatives and their feedback effects on the spot markets

... On the other hand, derivative instruments can also give rise to additional risks, such as counterparty risk and risks to financial market stability. The present report focuses on the latter, with regard to the potential feedback effects of derivatives markets on the underlying spot markets. One exam ...

... On the other hand, derivative instruments can also give rise to additional risks, such as counterparty risk and risks to financial market stability. The present report focuses on the latter, with regard to the potential feedback effects of derivatives markets on the underlying spot markets. One exam ...

Study Guide for Final

... CONCEPTS AND IDEAS: What is meant by the yield curve? Explain how a bond can be thought of as a portfolio of zero coupon instruments. How does this relate to the idea of the yield curve? What is meant by the “n-year spot interest rate”? What does the spot rate assume about the timing of coupon payme ...

... CONCEPTS AND IDEAS: What is meant by the yield curve? Explain how a bond can be thought of as a portfolio of zero coupon instruments. How does this relate to the idea of the yield curve? What is meant by the “n-year spot interest rate”? What does the spot rate assume about the timing of coupon payme ...

Chap024

... physical assets, debt contracts, currencies and equities Copyright © 2005 McGraw-Hill Ryerson Limited. All rights reserved. ...

... physical assets, debt contracts, currencies and equities Copyright © 2005 McGraw-Hill Ryerson Limited. All rights reserved. ...

No Slide Title

... If reference credit(s) default (or other credit event occurs), buyer receives payout equal to one of the following: – Physical settlement: Par value in return for delivery of reference obligation; or – Cash settlement: Post-event fall in price of reference obligation below par; or – Binary settlem ...

... If reference credit(s) default (or other credit event occurs), buyer receives payout equal to one of the following: – Physical settlement: Par value in return for delivery of reference obligation; or – Cash settlement: Post-event fall in price of reference obligation below par; or – Binary settlem ...

PowerPoint Slides

... on a notional principal amount • Typically, one interest rate is a floating rate and the other is the fixed rate • Markets refer to swap positions based on fixed vs. floating position – Purchasing a swap or being long a swap refers to paying the fixed rate (receiving floating) ...

... on a notional principal amount • Typically, one interest rate is a floating rate and the other is the fixed rate • Markets refer to swap positions based on fixed vs. floating position – Purchasing a swap or being long a swap refers to paying the fixed rate (receiving floating) ...

PowerPoint Slides

... on a notional principal amount • Typically, one interest rate is a floating rate and the other is the fixed rate • Markets refer to swap positions based on fixed vs. floating position – Purchasing a swap or being long a swap refers to paying the fixed rate (receiving floating) ...

... on a notional principal amount • Typically, one interest rate is a floating rate and the other is the fixed rate • Markets refer to swap positions based on fixed vs. floating position – Purchasing a swap or being long a swap refers to paying the fixed rate (receiving floating) ...

forward contract

... commodity to the buyer at some point in the future. • Organized futures exchanges with standardized futures contracts: – Reduce credit risk through: • Clearing corporation being the counterparty in all transactions • margin requirements (both initial and maintenance margins) and • daily mark-to-mark ...

... commodity to the buyer at some point in the future. • Organized futures exchanges with standardized futures contracts: – Reduce credit risk through: • Clearing corporation being the counterparty in all transactions • margin requirements (both initial and maintenance margins) and • daily mark-to-mark ...

Chapter 3: How Securities are Traded

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

... • Commission: fee paid to broker for making the transaction • Spread: cost of trading with dealer – Bid: price dealer will buy from you – Ask: price dealer will sell to you – Spread: ask - bid • Combination: on some trades both are paid ...

OPTIONS AND FUTURES CONTRACTS IN ELECTRICITY FOR

... If a futures market were available, a broad range of trade could be conceived. The futures market allows the participant to go long or short, that is, changing positions, by buying or selling futures contracts at any time. At the end, the ultimate buyers and sellers of electricity will trade the phy ...

... If a futures market were available, a broad range of trade could be conceived. The futures market allows the participant to go long or short, that is, changing positions, by buying or selling futures contracts at any time. At the end, the ultimate buyers and sellers of electricity will trade the phy ...

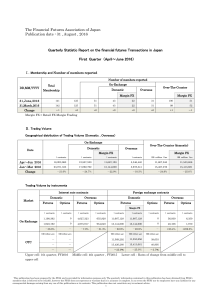

The Financial Futures Association of Japan Publication date : 31

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

... Open position of the overall FX margin trading transactions at the end of the first quarter was down due to Brexit shock. On the other hand, the open interest both of on-exchange currency related options and interest related options increased from the previous term. ...

The Treasury Bill Futures Market and Market Expectations of Interest

... for a particular commodity is utilized by market participants when determining the price at which they are willing to buy or sell futures contracts, If a trader projects that a commodity’s price will be different in the future than at the present time, he will buy or sell contracts for delivery of t ...

... for a particular commodity is utilized by market participants when determining the price at which they are willing to buy or sell futures contracts, If a trader projects that a commodity’s price will be different in the future than at the present time, he will buy or sell contracts for delivery of t ...