* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Energy Derivatives

Black–Scholes model wikipedia , lookup

Employee stock option wikipedia , lookup

Greeks (finance) wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Gasoline and diesel usage and pricing wikipedia , lookup

Option (finance) wikipedia , lookup

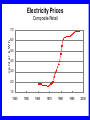

Commodity market wikipedia , lookup

ENERGY DERIVATIVES Econ 3385 – Economics of Energy S. Gürcan Gülen, Ph.D. Cash Markets Conduct Normal Business Activity Face Risks Price Risk Management Using Derivatives OTC Forwards Options - Swaps Organized Exchanges Futures - Options - Swaps Markets •Price an indicator of the relative balance between the supply of and the demand for a particular product or commodity. •Commodity a product over which the producer has lost control of the price. •Derivative a product whose price is derived from the price of something else, which is referred to as the underlying commodity. Markets Spot Market • Immediate Physical Delivery and immediate payment Derivative Markets • Deferred Physical Delivery • Financially Settled Arrangements Economic Purpose • Hedging • Price discovery Coal Prices F.O.B Minem outh 30.00 25.00 $ /t o n 20.00 15.00 10.00 5.00 0.00 1940 1950 1960 1970 1980 1990 2000 Crude Oil Prices Wellhead / First Sale 35.00 30.00 $/ Bbl 25.00 20.00 15.00 10.00 5.00 0.00 1940 1950 1960 1970 1980 1990 2000 Gasoline Prices Retail 140.0 c e n ts / g a l l o n 120.0 100.0 80.0 60.0 40.0 20.0 1940 1950 1960 1970 1980 1990 2000 Natural Gas Prices Wellhead 3.00 $ /M M B tu 2.50 2.00 1.50 1.00 0.50 0.00 1940 1950 1960 1970 1980 1990 2000 Electricity Prices Composite Retail 7.0 c ents / k W h 6.0 5.0 4.0 3.0 2.0 1.0 1940 1950 1960 1970 1980 1990 2000 Risk and Risk Management: Strategic Implications What is risk management? Active identification and unbundling of the risks (exposures) a company faces in order to profit from exposures a company is well equipped to handle and mitigate potential losses from other risks. What is strategic risk management? Use of risk management to alter fundamentally a company’s equity valuation through optimizing capital structure, enhancing risk/return profile of company’s businesses and facilitating profitable pursuit of new opportunities. Derivatives A set of tools- forwards, futures, options, swaps and enhanced vehicles - that allow management to keep and add to those risks it seeks, and to shed those risks it chooses not to bear. These tools, which are traded in financial markets, allow management to focus on its core competencies in pursuit of its principal goal - maximizing returns while minimizing the variance of those returns. They are only part of the risk management tool set, along with operational efficiencies, competitive strategy, and so on. Markets Requisites for a Futures Market Characteristics of the underlying cash commodity • Price Volatility • Active market • Open market (no government controls) Jun-98 Nov-97 Apr-97 Sep-96 Feb-96 Jul-95 Dec-94 May- Oct-93 Mar-93 Aug-92 Jan-92 Jun-91 Nov-90 Apr-90 Sep-89 50.00 Feb-89 Jul-88 Dec-87 May- Oct-86 Mar-86 Aug-85 $/Bbl Crude Oil Futures Price - NYMEX August 1985 - August 1998 40.00 30.00 20.00 10.00 0.00 Aug-98 Feb-98 Aug-97 Feb-97 Aug-96 Feb-96 Aug-95 Feb-95 Aug-94 Feb-94 Aug-93 Feb-93 Aug-92 Feb-92 Aug-91 Feb-91 Aug-90 Feb-90 Aug-89 Feb-89 Aug-88 Feb-88 Aug-87 Feb-87 Aug-86 Feb-86 Aug-85 ¢/Gallon Gasoline Futures Prices - NYMEX August 1985 - August 1998 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Aug-98 Feb-98 Aug-97 Feb-97 Aug-96 Feb-96 Aug-95 Feb-95 Aug-94 Feb-94 Aug-93 Feb-93 Aug-92 Feb-92 Aug-91 Feb-91 Aug-90 Feb-90 Aug-89 Feb-89 Aug-88 Feb-88 Aug-87 Feb-87 Aug-86 Feb-86 Aug-85 ¢/Gallon Heating Oil Futures Prices - NYMEX August 1985 - August 1998 1.20 1.00 0.80 0.60 0.40 0.20 0.00 A pr A -90 ug D 90 ec A 90 pr A -91 ug D 91 ec A 91 pr A -92 ug D 92 ec A 92 pr A -93 ug D 93 ec A 93 pr A 94 ug D 94 ec A 94 pr A -95 ug D 95 ec A 95 pr A -96 ug D 96 ec A 96 pr A -97 ug D 97 ec A 97 pr A -98 ug -9 8 $/MM Btu Natural Gas Futures Prices - NYMEX April 1990 - August 1998 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 Price Theory Forward Curve The price of a commodity over time. Two different shapes: • Contango • Backwardated Price Theory Futures v. Cash Prices If the futures price is greater than the cash price, then: Futures Price = Cash Price + Storage Price Theory Contango Price time • Forward prices are successively higher over time • Today’s price is the lowest • Current supply exceeds demand Price Theory Futures v. Cash Prices If the cash price is greater than the futures price, then: Futures Price = Cash Price + Storage - Convenience Yield Price Theory Backwardation Price time Forward prices are successively lower over time • Today’s price is the highest • Current demand exceeds supply NYMEX Crude Oil Prices Forward Curve on February 3, 1997 25 24 $ /B b l 23 22 21 20 19 Mar-97 Aug-97 Jan-98 Jun-98 Nov -98 Apr-99 Dec-2001 NYMEX Electricity Prices (COB) Forw ard Curve on February 3, 1997 20 18 $/M W H r 16 14 12 10 8 Mar-97 May-97 Jul-97 Sep-97 Nov-97 Jan-98 Mar-98 May-98 Jul-98 NYMEX Organization 816 seats, 749 individual members Board NYMEX Membership of Directors COMEX Membership 772 seats, 663 individual members Chairmen of the Board Executive committee President Planning & Compliance Clearing development Market Surveillance Financial surveillance Trade Surveillance Strategic Planning Research Marketing Banking & Delveries Position processing Futures Exchange Characteristics: •Liquidity •Safety •Flexibility •Ingenuity Futures Exchange Forward A bilateral commitment to buy or sell an agreed upon asset for a predetermined price on a specific future date. Futures A standardized forward contract which is traded on an organized futures exchange. Futures Exchange Standard Contract Terms • Size • Quality • Point of Delivery • Time of Delivery • Payment • Disputes Futures Exchange Variable Contract Terms • Price • Number of contracts orders • Delivery Month Futures Exchange Rules of Operation • • • • • • • Times and days of business Position limits Daily price limits Margin requirements Delivery procedures Payment Disputes Natural Gas Futures - NYMEX April 1990 - August 1998 1,800,000 1,600,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 M ay No 90 vM 90 ay No 91 vM 91 ay No 92 vM 92 ay No 93 vM 93 ay No 94 vM 94 ay No 95 vM 95 ay No 96 vM 96 ay No 97 vM 97 ay -9 8 Number of Contracts 1,400,000 Volume Open Interest p M -85 ay Ja 86 nSe 8 7 pM 87 ay Ja 88 nSe 8 9 p M -89 ay Ja 90 nSe 9 1 pM 91 ay Ja 92 nSe 9 3 p M -93 ay Ja 94 nSe 9 5 p M -95 ay Ja 96 nSe 9 7 p M -97 ay -9 8 Se Number of Contracts Heating Oil Futures - NYMEX August 1985 - August 1998 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0 Volume Open Interest Volume Open Interest Jul-98 Dec-97 May-97 Oct-96 Mar-96 Aug-95 Jan-95 Jun-94 Nov-93 Apr-93 Sep-92 Feb-92 Jul-91 Dec-90 May-90 Oct-89 Mar-89 Aug-88 Jan-88 Jun-87 Nov-86 Apr-86 Sep-85 Number of Contracts Gasoline Futures - NYMEX August 1985 - August 1998 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 p M -85 ay Ja 86 nSe 8 7 pM 87 ay Ja 88 nSe 8 9 p M -89 ay Ja 90 nSe 9 1 pM 91 ay Ja 92 nSe 9 3 p M -93 ay Ja 94 nSe 9 5 p M -95 ay Ja 96 nSe 9 7 p M -97 ay -9 8 Se Number of Contracts Crude Oil Futures - NYMEX August 1985 - August 1998 3,500,000 3,000,000 2,500,000 2,000,000 1,500,000 1,000,000 500,000 0 Volume Open Interest 97%-98% OF ALL FUTURES ARE NOT DELIVERED in other words: ONLY 2%-3% OF THE CONTRACTS TRADED ARE DELIVERED! EXAMPLE: IN 1990: 719,000 CRUDE OIL NYMEX CONTRACTS WERE ACTUALLY DELIVERED OUT OF 23 MILLION: ABOUT 3.126% QUESTION: WHAT DOES THIS MEAN? ACTIVITIES IN THE FUTURES MARKETS ARE MOSTLY FOR PURPOSES OTHER THAN PURCHASE AND SALE OF COMMODITY: FINANCIAL GOALS AND RISK MANAGEMENT GOALS. QUESTION: HOW IS IT POSSIBLE FOR 98% OF EXISTING CONTRACTS TO DISAPPEAR? ANSWER: THE CLEARINGHOUSE REGULATION AND ACCOUNTING METHODS. THE CLEARINGHOUSE A NON-PROFIT MEMBERSHIP CLUB. THE CLEARINGHOUSE IS THE OMNIPOTENT GUARANTOR OF ALL CONTRACTS. * CLEARINGHOUSE GURANTEE: TO THE LONG - NO DEFAULT ON THE SELLING SIDE. TO THE SHORT - NO DEFAULT ON THE BUYING SIDE. * THE CLEARINGHOUSE DOES NOT GURANTEE THE MARKET ! * THE CLEARINGHOUSE NEVER TAKES A POSITION. * THE CLEARINGHOUSE MAKES SURE THAT ALL TRADES MATCH. I.E., THAT ALL THE POSITIONS MUST ADD UP TO ZERO EVERY TRADING DAY. Clearinghouse Exchange Corporation Exchange Members Clearing Members Futures Commission Merchants (FCMs) Nonclearing Members FCM Customers Futures Exchange Types of Positions • Long - a commitment to buy; benefits if prices rise • Short - a commitment to sell; benefits if prices fall Buyer Member Firm Seller Buying Floor Broker Selling Floor Broker Member Firm Trading Ring Buying: floor broker confirms purchase Member firm Confirms purchase Buyer now long 1 contract Orders executed by open outcry by buying and selling floor brokers, recorded and placed on ticker Reports purchase Reports sale Clearinghouse 1 1 obligation obligation long short Total open interest: 1 contract Selling: floor broker confirms sale Member firm Confirms sale Seller now short 1 contract Seller - long with obligation to pay for and take delivery Member Firm Buyer - short with obligation to deliver Selling Floor Broker Buying Floor Broker Member Firm Trading Ring Selling floor broker confirms purchase Member firm Confirms sale Buyer has offset obligation by sale – no market position Orders executed by open outcry by buying and selling floor brokers, recorded and placed on ticker Reports sale Reports purchase Clearinghouse 1 Obligation 1 Obligation or short purchased or long sold canceling sell canceling obligation buy obligation Total open interest: 0 contract Buying floor broker confirms sale Member firm Confirms purchase Seller has offset obligation by purchase no market position Futures Exchange Delivery Procedure Short Long Intention to Accept Delivery Intention to Make delivery Clearinghouse Matches Seller with Buyer Delivery Seller Deposits margin Clearing Broker Payment Buyer Deposits full margin Clearing Broker Futures Exchange Margins • Initial Margin A cash deposit • Variation Margin A margin call Outside Customers ... A B FCM a C FCM b Clearing member 1 D FCM c E ... Customer margins Clearing member 2 Clearing margins Clearinghouse B Clearinghouse A Futures Exchange Initial Margin Requirements NYMEX Crude Oil Heating Oil Gasoline Natural Gas Electricity $/Contract 2,200 2,000 2,000 6,300 * / 4,000 1,900 + Effective January 7, 1997 * for the Feb and Mar contracts only Futures Exchange •Marking-to Market The process that realizes all gains and losses. •Settlement Price The benchmark against which all accounts are marked-to-market. Futures Exchange Marking-to-Market Example: Commodity Gasoline Heating Oil Gasoline Crude Light Electricity Transaction Settlement Price Price Change 64.00 58.00 66.00 25.60 21.00 65.50 56.00 65.50 25.50 19.90 1.50+ 2.00+ 0.500.101.10+ JUNE WTI FUTURES (1,000 bbls PER CONTRACT) DATE PARTY NUM PRICE Th.5.16 A:LONG 10 $20 CH C:LONG 25 $21 CH 5.16 5.16 SETTLE Fr.5.17 E:LONG 10 5.17 SETTLE Mo.5.20 D:LONG 25 5.20 B:LONG 10 5.20 SETTLE Tu.5.21 F:LONG 10 5.21 SETTLE We.5.22 F:LONG 10 5.22 SETTLE * PARTY NUM PRICE OI* B:SHORT 10 $20 10 D:SHORT 25 $21 35 $21 $22 $21 CH A:SHORT 10 $22 $22 35 $22 $22.5 CH F:SHORT 25 $22.5 35 $21.5 CH C:SHORT 10 $21.5 25 $21.5 $21 $21.5 CH E:SHORT 10 $21 $20 $20 OI = Open Interest $21 15 $21 CH C:SHORT 10 $20 $20 5 CLEARINGHOUSE ACCOUNTING A: LONG 10; SHORT 10 : OUT B: SHORT 10; LONG 10 : OUT C: LONG 25; SHORT 10; SHORT 10 C remains LONG 5. D: SHORT 25; LONG 25 : OUT E: LONG 10; SHORT 10 : OUT F: SHORT 25; LONG 10 : LONG 10 F remains 5.23 SHORT 5. F DECIDES TO DELIVER 5 FUTURES C ACCEPTS DELIVERY OF 5 CONTRACTS. The actual delivery is now scheduled for June 23. CLEARINGHOUSE PROFIT/LOSS = ZERO* LONG PRICE SHORT PRICE TOTAL PROFIT A 10 $20 10 $22 $20,000 B 10 $21.5 10 $20 -$15,000 C 10 $21 10 $21.5 10 $20 -$10,000 $5,000 D 25 $22.5 25 $21 -$37,500 E 10 $22 10 $21 -$10,000 F 10 $21 25 $22.5 10 $20 $15,000 $25,000 TOTAL C TAKES DELIVERY 5 PAYS $21 : F DELIVERS 5 RECEIVES $22.5 : TOTAL * -$7,500 -$105,000 $112,500 $7,500 0 This calculation accounts for buying and selling only. It does not account for cash movements resulting from the daily marking-to-market process. The following exhibits illustrate the activity in the margin account of each of the traders focusing only on cash flow resulting from the daily marking-to-market process. Thus, possible margin calls are ignored. PARTY A: DATE ACTION 5.16 LONG 10 PRICE SETTLE CASH FLOW POSITION $20 Initial margin LONG 10 +$10,000 LONG 10 +$10,000 0 $20,000 $21 5.17 SHORT 10 $22 TOTAL A’s profit is = $20,000 PARTY B: DATE ACTION 5.16 5.17 5.20 SHORT 10 PRICE SETTLE $20 $21 $22 LONG 10 $21.5 TOTAL CASH FLOW POSITION Initial margin -$10,000 -$10,000 +$5,000 -$15,000 B’s loss is = $15,000 SHORT 10 SHORT 10 SHORT 10 0 PARTY C: DATE ACTION 5.16 5.17 5.20 5.21 5.22 5.23 LONG 25 PRICE SETTLE $21 $21 $22 CASH FLOW POSITION Initial margin +$25,000 SHORT 10 $21.5 -$5,000 $21.5 -$7,500 $20.5 -$15,000 SHORT 10 $20 -$5,000 $20 -$2,500 TAKE DELIVERY OF 5,000 BARRELS for $20/bbl -$100,000 LONG 25 LONG 15 LONG 15 LONG 5 0 C’s total loss up to and and including 5.22 is $10,000. Note that the 5 contracts that were delivered has accumulated the following amount over the period: 5.17 5.20 5.21 5.22 5.23 (5,000)($1) = $5,000 (5,000)(-$.5) = -$2,500 (5,000)(-$1) = -$5,000 (5,000)(-$.5) = -$2,500 (5,000)(-$20) = -$100,000 Payment upon delivery TOTAL………….-$105,000 The five contracts have accumulated total payment of $105,000 (Note: $105,000/5,000 = $21/bbl). PARTY D: DATE ACTION 5.16 SHORT 25 PRICE SETTLE CASH FLOW POSITION $21 $21 Initial margin SHORT 25 0 SHORT 25 $22 $22.5 TOTAL -$25,000 -$12,500 -$37,500 5.17 5.20 LONG 25 SHORT 25 0 D’s total loss is = $37,500 PARTY E: DATE ACTION 5.17 5.20 5.21 LONG 10 PRICE SETTLE CASH FLOW POSITION $22 $22 $21.5 SHORT 10 $21 TOTAL Initial margin 0 -$5,000 -$5,000 -$10,000 E’s total loss is = $10,000 LONG 10 LONG 10 LONG 10 0 PARTY F: DATE ACTION 5.20 5.21 5.22 5.23 PRICE SETTLE CASH FLOW POSITION SHORT 25 $22.5 SHORT 25 Initial margin $21.5 +$25,000 LONG 10 $21 +$5,000 $20.5 +$15,000 LONG 10 $20 +$5,000 $20 +$2,500 DELIVER 5,000 BARRELS for $20/bbl +$100,000 SHORT 15 SHORT 5 0 F’s total profit up to and including 5.22 is $52,500. Note that the 5 contracts that were delivered has accumulated the following amount over the period: 5.20 5.21 5.22 5.23 (5,000)($1) (5,000)($1) (5,000)($.5) (5,000)($20) = $5,000 = $5,000 = $2,500 = $100,000 Payment upon delivery TOTAL…………..$112,500 The five contracts that F delivers accumulated a total of $112,500 (Note: $112,500/5,000 = $22.5/bbl) Futures Trading The Trading Participants • Hedgers • Speculators • Arbitrageurs Futures Trading Speculation • A transaction whose sole purpose is to achieve gain. A speculative transaction can be consummated in any market. Speculators (scalpers, day traders, position traders) • Volatility sensitive • Many transactions • Short-term trades (seconds to days) Futures Trading Example of Speculation (long and short) Outright Position Price Action . Pe up long 10 Mar COB Pr down short 10 Mar COB @ $10.25 @ $11.00 loss $0.75 / MWHr Pe up short Apr PV @ $16.00 Pr down long 50 Apr PV @ $14.25 profit $1.75 / MWHr Futures Trading Example of Speculation (long and short) Spread Position Price difference either widens or narrows: Price Action . Pe widened long 25 Dec NG short 25 Jun NG @ $0.35 Pr widened short 25 Dec NG long 25 Jun NG @ $0.45 Pe narrow short 10 May HU long 10 May HO @ 2.00 cpg Pr widened long 10 May HU short 10 May HO @ 2.75cpg Hedging Primary Goals: • reduce or eliminate price risk • lower expected transaction costs • reduce the probability of bankruptcy • reduce expected tax liabilities •signal to creditors that the firm is safer Hedger • Price level sensitive • Few transactions • Long-term trade (weeks or months) Hedging Types of Hedge Positions Long Hedge A long derivative position ( benefits if prices rise ) Short Hedge A short derivative position ( benefits if prices fall ) Hedging Long Hedge Action now later P P Cash Sell cash buy cash LOSS GAIN Futures long futures short futures GAIN LOSS Hedging Long Hedge - Anticipatory Action now later P P Cash nothing buy cash 0 0 Futures long futures short futures GAIN LOSS Hedging Long Hedge - Fixed Price Prices Prices Action Increase Decrease sales price $ 28.00 $ 28.00 establish long hedge 25.00 25.00 conclude physical purchase 29.00 24.00 close hedge position 29.00 - 24.00 - Effective Purchase Cost Margin Gain or loss on futures Gain or loss on cash $ $ $ $ 25.00 3.00 4.00 1.00 - $ $ $ $ 25.00 3.00 1.00 4.00 Hedging Long Hedge - Floating Pric Prices Action establish long hedge Increase Prices Decrease $ 25.00 $ 25.00 conclude physical purchase 26.00 24.00 close hedge position 26.00- 24.00- Effective Purchase Cost $ 25.00 Gain on Futures $ 1.00 Loss on Futures $ 25.00 $ 1.00 LONG HEDGE LDC PERSPECTIVE An LDC has to buy 10,000 MMBtu a day or 300,000 MMBtu a month to supply residential customers and is concerned about rising natural gas prices. Therefore, the LDC decides to hedge its purchases by buying natural gas futures to lock in the purchase price of December natural gas or execute a LONG HEDGE. Note: 10,000 MMBTU = 1 NYMEX contract for natural gas 300,000 MMBTU = 30 contracts Step 1: In August, it buys 30 contracts of December natural gas futures at an average price of $2.662 per MMBtu. The LDC now has a long position of 30 contracts. Step 2: In late November, the LDC buys 300,000 MMBtu of natural gas from a marketer for $2.83 an MMBtu to meet its December demand. Step 3: Simultaneously, the LDC liquidates the futures hedge or offsets the long position by selling futures. (The hedge was originally initiated by buying futures) The LDC sells 30 contracts on NYMEX for an average price of $2.83 since prices have risen as the LDC anticipated. FUTURES: ($2.662) 2.380 0.168 Long hedge average price per MMBTU futures sold at current price hedge gain PHYSICAL: $2.83 -( .168) 2.662 purchase price per MMBTU futures gain Final adjusted price to the LDC LONG HEDGE UTILITY PERSPECTIVE: A utility in the west who uses natural gas to produce electricity is notified by its supplier that due to a pipeline maintenance outage in July, alternate routing will be needed to deliver the gas at an increased cost. This renders natural gas uneconomic as power generation fuel. The utility’s trader decides to buy from Power Marketer X a 25 MW block of firm, on-peak (“6-by-16”) electrical energy in order to meet its anticipated load requirements, but naturally is very concerned about rising electricity prices. Therefore, the utility decides to hedge this purchase by buying July futures, or executing a long hedge, to lock in the purchase price of the electricity. Jul power purchase = 25 MW *26 on-peak days * 16 on-peak hours per day = 10,400 Mwh 1 NYMEX contract = 736 Mwh Contracts to hedge = 10,400 / 736 = 14.1 or 15 contracts STEP 1 : Utility buys 15 Jul. futures contracts at an average price of $28.50 per Mwh. Utility now has a long position of 15 contracts. STEP 2 : Utility now buys 10,400 Mwh of physical electricity from “X” Power Marketer for $28.80 per Mwh. Now, the utility needs to liquidate (or close out) the futures hedge (or long position) by selling futures. (Remember, the hedge was initiated by buying futures). Utility sells 15 contracts on exchange for average price of $28.80 Mwh, as prices have risen as anticipated by the trader. What is the utility’s final adjusted price? FUTURES $28.50 Long Hedge futures average price - $28.80 futures sold at current price $ .30 Futures or hedge gain PHYSICAL $28.80 Purchase from Power marketer - .30 hedge gain ( see above ) $28.50 Final adjusted price for utility LONG HEDGE REFINER PERSPECTIVE: A refiner has to buy 3,000 barrels a day or 90,000 barrels a month of crude oil every month to run the refinery and naturally is very concerned about possible increases in the price of crude oil, especially during the winter months. Therefore, the refiner decides to hedge its purchases for December’s runs by buying crude oil futures to lock in the purchase price of December crude oil or executes a long hedge. EXAMPLE: 1,000 barrels = 1 NYMEX futures contract for light sweet crude oil 90,000 barrels = 90 contracts STEP 1: In October, the refiner buys 90 contracts for future delivery (December) at an average price of $19.50 per barrel. The refiner now has a long position of 90 contracts. STEP 2: In late November, the refiner buys 90,000 barrels of crude oil from a producer for $19.80 a barrel to meet its December demand. STEP 3: At the same time as step 2, the refiner liquidates its futures hedge or offsets the long position by selling futures contracts. The refiner sells 90 contracts on the exchange for an average price of $19.80 a barrel since prices have risen as anticipated by the refiner. FUTURES $(19.50) 19.80 $ .30 long hedge futures average price futures sold at current price futures gain PHYSICAL $19.80 .30 $19.50 purchase from the producer futures gain final adjusted price for the refiner Hedging Short Hedge Action now later P P Cash buy cash sell cash GAIN LOSS Futures short futures long futures LOSS GAIN Hedging Short Hedge - Anticipatory Action now later P P Cash nothing sell cash 0 0 Futures short futures long futures LOSS GAIN Hedging Short Hedge - Fixed Price Action purchase price Prices Prices Increase Decrease $ 22.00 $ 22.00 establish short hedge 25.00 - 25.00 - conclude physical sale 29.00 - 24.00 - close hedge position 29.00 24.00 Effective Sales Price Margin Gain or loss on futures Gain or loss on cash $ $ $ $ 25.00 3.00 4.00 7.00 $ 25.00 $ 3.00 $ 1.00 $ 2.00 Hedging Short Hedge - Floating Price Prices Action Prices Increase Decrease $ 25.00 - $ 25.00 - conclude physical sale 26.00 - 24.00 - close hedge position 26.00 24.00 Effective Sales Price $ 25.00 $ 25.00 Loss on Futures $ 1.00 establish short hedge Gain on Futures $ 1.00 SHORT HEDGE PRODUCER PERSPECTIVE: A natural gas producer has production of 10,000 MMBTU?D or 300,000 MMBTU monthly and naturally is very concerned about declining prices. Therefore, in order to lock in December sales price for natural gas, the producer sells December’s production in the futures market or executes a short hedge. EXAMPLE: 10,000 MMBTU = 1 NYMEX futures contract for natural gas 300,000 MMBTU = 30 contracts STEP 1: In August, the producer sells 30 contracts for future delivery (December) at an average price of $2.662 per MMBTU. The producer now has a short position of 30 contracts. STEP 2: In late November, the producer sells 300,000 MMBTU of natural gas to an LDC for $2.43 an MMBTU for physical delivery. STEP 3: At the same time as step 2, the producer liquidates its futures hedge or offsets the short position by buying futures contracts. The producer buys 30 contracts on the exchange for an average price of $2.43 per MMBTU since prices have declined as anticipated by the producer. HEDGE ANALYSIS $2.662 ( 2.43) $ .232 sells 30 Dec. contracts buys 30 Dec. contracts hedge gain PHYSICAL $2.43 - .232 $2.662 sold gas to an LDC hedge gain final adjusted price SHORT HEDGE INDEPENDENT POWER PRODUCER PERSPECTIVE: The bulk power sales manager has excess power for the next two months and is concerned about falling prices in the forward market. The current futures market price would provide a profitable return for power plant operations. After reviewing sales commitments and forecasted operating conditions with her schedulers, the sales manager realizes there is available capacity. Therefore, in order to lock in the current price of the electricty, the independent power producer decides to sell the excess power equivalent in the futures market by executing a short hedge. If the forward price for power continues to fall, the futures hedge will be offset as needed when the physical power is sold. 736Mwh = 1 futures contract 7,360Mwh = 10 futures contract STEP 1 : Sell 10 Palo Verde futures contracts at an average price of $24.50 per Mwh. Producer now has short position of 10 contracts. STEP 2 : Producer now sells 7,360Mwh of its excess power of to Wooly Navel Citrus Juice Company for $24.10 per Mwh. Now, the producer needs to offset, or liquidate, the short hedge by buying futures. Remember -- the producer is hedged with a short futures position. Producer buys 10 futures contracts at the average price of $24.10 per Mwh as prices have fallen as anticipated by the bulk power sales manager. FUTURES $24.50 Short Hedge futures average price - 24.10 Futures purchased at current price $ .40 Futures or hedge result PHYSICAL $24.10 Sale to Customer + .40 Hedge result ( see above ) $24.50 Final adjusted price for power producer SHORT HEDGE PRODUCER PERSPECTIVE: A producer has production of 3,000 barrels a day or 90,000 barrels a month of crude oil and is very concerned about possible decreases in the price of crude oil, e.g., because of a mild winter. Therefore, in order to lock in December sales price for crude oil, the producer sells December’s production in the futures market or executes a short hedge. EXAMPLE: 1,000 barrels = 1 NYMEX futures contract for light sweet crude oil 90,000 barrels = 90 contracts STEP 1: In October, the producer sells 90 contracts for future delivery (December) at an average price of $19.50 per barrel. The producer now has a short position of 90 contracts. STEP 2: In late November, the producer sells 90,000 barrels of crude oil to a refinery for $19.10 a barrel. STEP 3: At the same time as step 2, the producer liquidates its futures hedge or offsets the short position by buying futures contracts. The producer buys 90 contracts on the exchange for an average price of $19.10 a barrel since prices have fallen as anticipated by the producer. FUTURES $19.50 (19.80) $ .40 short hedge futures average price futures purchased at current price futures gain PHYSICAL $19.10 sale to refinery HEDGE $19.10 + .40 $19.50 sale of production to the refinery futures gain final adjusted price for the producer Hedging Hedging - Spreads • Calendar Spreads • Intermarket Spread Hedging Intermarket Spreads • Crack Spread (gasoline, heating oil and crude oil) • Spark Spread (electricity and natural gas) NYMEX SPARK SPREAD • A specialized form of intermarket spread between natural gas and electricity • Involves the simultaneous purchase and sale of natural gas and electricity futures contracts • Protects or “locks in” a margin for current or future generation. Options Option • A contingent claim. Two Types of Options • • Calls Puts Options Option Buyer (holder or long) In exchange for making a payment of money (the premium), the owner (buyer) of an option has the right, but not the obligation, to buy (call option) or to sell (put option) a specified quantity of the underlying commodity at a specified price at a specified time in the future. Options Option Seller (writer or short) In exchange for receiving a payment of money (the premium), the writer (seller) of an option has the obligation to provide (call option) or receive (put option) a specified volume of the underlying commodity at a specified price at a specified time in the future. Options Buyer of a call option . . . expects the price of the underlying commodity to increase during the period of the option contract. Options Seller of a call option . . . expects the price of the underlying commodity to either remain at the current level or to decline during the period of the option contract. Options Buyer of a put option . . . expects the price of the underlying commodity to decrease during the period of the option contract. Options Seller of a put option . . . expects the price of the underlying commodity to either remain at the current level or to increase during the period of the option contract. Options Types of Options • American Option exercisable any time before expiration • European Option exercisable only on expiration date • Average Rate Option price of underlying set by an averaging procedure Options At-the-money Whenever the price of the underlying is the same as the strike price of the option. In-the-money Whenever the price of the underlying is above the strike price of a call option or below the strike price of a put option. Out-of-the-money Whenever the price of the underlying is the below the strike price of a call option option or above the strike price of a put option. Options Option Price = Premium Two Components Intrinsic Value - The amount by which an option is in-the-money. Time Value - The amount by which the price of an option exceeds its intrinsic value. Options Option Variables • • • • • • Premium Strike Price Underlying Commodity Time Until Expiration Volatility Interest Rate =E =U =T = = Options Put-Call Parity C - P = U - E where: C = P = U= E = Call Premium Put Premium Price of the Underlying commodity Exercise or Strike Price of the Option Options Synthetic Options Call Put + Call Put -Put -Call + Put Underlying Underlying Call Underlying Underlying = = = = = = Synthetic Long Synthetic Call Synthetic Put -Synthetic Short -Synthetic Call -Synthetic Put