LILIS ENERGY, INC. (Form: S-4/A, Received: 05/11

... high and low prices per share of Lilis common stock as reported on the Nasdaq Stock Market on May 4, 2016 and (ii) 57,851,185, the maximum total number of shares of Lilis common stock potentially issuable or expected to be issued in connection with the merger described herein. (4) The registration f ...

... high and low prices per share of Lilis common stock as reported on the Nasdaq Stock Market on May 4, 2016 and (ii) 57,851,185, the maximum total number of shares of Lilis common stock potentially issuable or expected to be issued in connection with the merger described herein. (4) The registration f ...

Corporate Actions_doc swift coordination_2015_Online

... a proposal by the issuer or a third party without convening a meeting. For example, consent to change the terms of a bond. INTR: Interest payment distributed to holders of an interest bearing asset. NOOF: if qualifier is CAEV for NOOF Offers that are not supervised or regulated by an official entity ...

... a proposal by the issuer or a third party without convening a meeting. For example, consent to change the terms of a bond. INTR: Interest payment distributed to holders of an interest bearing asset. NOOF: if qualifier is CAEV for NOOF Offers that are not supervised or regulated by an official entity ...

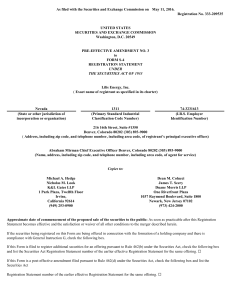

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

... - 1,483,404 shares of common stock issuable upon exercise of options outstanding at November 30, 2000, at a weighted average exercise price of $0.77 per share; - 237,257 shares issuable upon exercise of warrants outstanding at November 30, 2000, at an exercise price of $12.00 per share; and - 819,47 ...

... - 1,483,404 shares of common stock issuable upon exercise of options outstanding at November 30, 2000, at a weighted average exercise price of $0.77 per share; - 237,257 shares issuable upon exercise of warrants outstanding at November 30, 2000, at an exercise price of $12.00 per share; and - 819,47 ...

1 AS FILED WITH THE SECURITIES AND EXCHANGE

... retailing. The Company believes that the retail book industry is particularly suited to online retailing for many compelling reasons. An online bookseller has virtually unlimited online shelf space and can offer customers a vast selection through an efficient search and retrieval interface. This is ...

... retailing. The Company believes that the retail book industry is particularly suited to online retailing for many compelling reasons. An online bookseller has virtually unlimited online shelf space and can offer customers a vast selection through an efficient search and retrieval interface. This is ...

Kona Grill, Inc. - corporate

... Kona Grill restaurants offer innovative freshly prepared food, personalized service, and a contemporary ambiance that create a satisfying yet affordable dining experience that we believe is superior to many traditional casual dining restaurants. Our high-volume upscale casual restaurants feature a d ...

... Kona Grill restaurants offer innovative freshly prepared food, personalized service, and a contemporary ambiance that create a satisfying yet affordable dining experience that we believe is superior to many traditional casual dining restaurants. Our high-volume upscale casual restaurants feature a d ...

FORM 10-K - Media Corporate IR Net

... program their design directly into the PLD, using software, thereby allowing users to revise their designs relatively quickly with lower development costs. Since PLDs are programmable, they typically have a larger die size resulting in higher costs per unit compared to custom gate arrays, ASICs and ...

... program their design directly into the PLD, using software, thereby allowing users to revise their designs relatively quickly with lower development costs. Since PLDs are programmable, they typically have a larger die size resulting in higher costs per unit compared to custom gate arrays, ASICs and ...

contract design, arbitrage, and hedging in the eurodollar futures

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

... the expiration of the futures of a long position in the underlying 90-day Eurodollar time deposit and a short position in the futures. This value is supposed to be non-stochastic and zero, which is the case for virtually all other futures contracts. The only solution, y = 0, implies that the intere ...

sales and leases

... b. Conforming goods must be in accordance with contract requirements 2. Shipment of non-conforming goods is an acceptance and a breach BUT a. If seller ships non-conforming goods AND b. Seasonably (Timely) notifies buyer that the goods are an accommodation c. THEN there is no acceptance i. Buyer can ...

... b. Conforming goods must be in accordance with contract requirements 2. Shipment of non-conforming goods is an acceptance and a breach BUT a. If seller ships non-conforming goods AND b. Seasonably (Timely) notifies buyer that the goods are an accommodation c. THEN there is no acceptance i. Buyer can ...

Essays on Volatility Derivatives and Portfolio Optimization

... VIX futures, and 4)Asset allocation and generalized buy and hold trading strategies. The first three papers answer various questions relating to the volatility derivatives. Volatility derivatives are securities whose payoff depends on the realized variance of an underlying asset or an index. These i ...

... VIX futures, and 4)Asset allocation and generalized buy and hold trading strategies. The first three papers answer various questions relating to the volatility derivatives. Volatility derivatives are securities whose payoff depends on the realized variance of an underlying asset or an index. These i ...

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION

... Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended. See "Underwriting." (2) Before deducting estimated expenses of $1,000,000 payable by the Company. (3) The Company has granted to the Underwriters a 30-day option to purchase up to an additio ...

... Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended. See "Underwriting." (2) Before deducting estimated expenses of $1,000,000 payable by the Company. (3) The Company has granted to the Underwriters a 30-day option to purchase up to an additio ...

Lévy Processes in Finance: Theory, Numerics, and Empirical Facts

... Lévy processes are an excellent tool for modelling price processes in mathematical finance. On the one hand, they are very flexible, since for any time increment ∆t any infinitely divisible distribution can be chosen as the increment distribution over periods of time ∆t. On the other hand, they have ...

... Lévy processes are an excellent tool for modelling price processes in mathematical finance. On the one hand, they are very flexible, since for any time increment ∆t any infinitely divisible distribution can be chosen as the increment distribution over periods of time ∆t. On the other hand, they have ...

Optimal Hedging when the Underlying Asset Follows a

... changes in the underlying asset's value occur. In continuous-time complete markets, delta hedging is the cornerstone of any hedging strategy since it allows for perfect replication. Based on the rst derivative of the option price with respect to the underlying asset price, it requires a full charac ...

... changes in the underlying asset's value occur. In continuous-time complete markets, delta hedging is the cornerstone of any hedging strategy since it allows for perfect replication. Based on the rst derivative of the option price with respect to the underlying asset price, it requires a full charac ...

1. Assignment – contract rights are assigned for value, occasionally

... Nanakuli Paving & Rock Co. v. Shell Oil (1981) (p.651): "asphalt price protection" Trade usage case. In the past they had given then price protection. Evidence of custom and trade usage can be used and the jury can find that the parties knew or should have known of the practice at the time of the ma ...

... Nanakuli Paving & Rock Co. v. Shell Oil (1981) (p.651): "asphalt price protection" Trade usage case. In the past they had given then price protection. Evidence of custom and trade usage can be used and the jury can find that the parties knew or should have known of the practice at the time of the ma ...

JOHN C.HULL

... are likely to be new to many readers have been explained carefully, and many numerical examples have been included. The book covers both derivatives markets and risk management. It assumes that the reader has taken an introductory course in finance and an introductory course in probability and stati ...

... are likely to be new to many readers have been explained carefully, and many numerical examples have been included. The book covers both derivatives markets and risk management. It assumes that the reader has taken an introductory course in finance and an introductory course in probability and stati ...

Quantity Discounts in Single Period Supply Contracts

... end consumers. For each unit sold, the buyer receives an exogenously specified revenue of r. We assume that any additional costs incurred by the buyer, e.g. for shipping material handling, etc., are linear in the number of units sold, and these costs have been normalized to zero. We assume that the ...

... end consumers. For each unit sold, the buyer receives an exogenously specified revenue of r. We assume that any additional costs incurred by the buyer, e.g. for shipping material handling, etc., are linear in the number of units sold, and these costs have been normalized to zero. We assume that the ...

Pricing and Hedging Volatility Derivatives

... properties of variance and volatility swaps. They showed that variance swaps can be replicated by a static position in European call and put options of all strikes and a dynamic trading strategy in the underlying asset. Brockhaus and Long (2000) provided an analytical approximation for the pricing o ...

... properties of variance and volatility swaps. They showed that variance swaps can be replicated by a static position in European call and put options of all strikes and a dynamic trading strategy in the underlying asset. Brockhaus and Long (2000) provided an analytical approximation for the pricing o ...