P a p e r 1 . 2 ... f i n a n c i a l ... 1 8 F e b r u a...

... recently, the New Zealand and Australian dollars have continued to appreciate strongly (see right-hand graph below). Given the extent of the New Zealand and Australian dollar appreciations over the past three years (see left-hand graph below), we might have expected these currencies – like the Europ ...

... recently, the New Zealand and Australian dollars have continued to appreciate strongly (see right-hand graph below). Given the extent of the New Zealand and Australian dollar appreciations over the past three years (see left-hand graph below), we might have expected these currencies – like the Europ ...

C 0 - chass.utoronto

... Setting demand = supply, we have a market-determined r. Given the individual’s exposure to his own production opportunities, he may decide whether to lend or borrow money. By allowing lending and borrowing, those who need money can get financed, while those have excess fund will be able to lend out ...

... Setting demand = supply, we have a market-determined r. Given the individual’s exposure to his own production opportunities, he may decide whether to lend or borrow money. By allowing lending and borrowing, those who need money can get financed, while those have excess fund will be able to lend out ...

D.A.V. PUBLIC SCHOOL, NEW PANVEL

... Q.14.Show shows rotational symmetry in alphabet H and Z, also write an Order and angle of rotation of each. SECTION C Q.15 . Evaluate: ...

... Q.14.Show shows rotational symmetry in alphabet H and Z, also write an Order and angle of rotation of each. SECTION C Q.15 . Evaluate: ...

Document

... You are more likely to drink California wine because the franc appreciation makes French wine relatively more expensive than California wine. In the long run, the fall in the demand for a country’s exports leads to a depreciation of its currency, but the higher tariffs lead to an appreciation. There ...

... You are more likely to drink California wine because the franc appreciation makes French wine relatively more expensive than California wine. In the long run, the fall in the demand for a country’s exports leads to a depreciation of its currency, but the higher tariffs lead to an appreciation. There ...

May 2015 - Polaris Greystone

... 1. There Will Be Pressure On Real Estate Prices This is simple economics. When interest rates rise, mortgage rates go up. The more one is paying to carry debt, the less affordable real estate becomes for the buyer. Real estate prices typically drop to offset some of this increased cost. Obviously th ...

... 1. There Will Be Pressure On Real Estate Prices This is simple economics. When interest rates rise, mortgage rates go up. The more one is paying to carry debt, the less affordable real estate becomes for the buyer. Real estate prices typically drop to offset some of this increased cost. Obviously th ...

Course FM Manual by Dr. Krzysztof Ostaszewski, FSA, CERA, FSAS

... mandatory convertible. Mandatory convertible bonds have higher yields to compensate investors for the mandatory conversion. This type of bonds are issued because the issuer prefers to issue bonds instead of stocks, but wants to eventually issue shares (note that stock market generally views issuing ...

... mandatory convertible. Mandatory convertible bonds have higher yields to compensate investors for the mandatory conversion. This type of bonds are issued because the issuer prefers to issue bonds instead of stocks, but wants to eventually issue shares (note that stock market generally views issuing ...

BNZ Weekly Overview

... rather than what may necessarily lie down the track. This week we have learnt that earlier growth in car registrations has faded so if car registrations are a guide to consumer spending (dubious) then they are saying new restraint has crept in. We have also seen only a small recovery in dwelling con ...

... rather than what may necessarily lie down the track. This week we have learnt that earlier growth in car registrations has faded so if car registrations are a guide to consumer spending (dubious) then they are saying new restraint has crept in. We have also seen only a small recovery in dwelling con ...

Bond Issues

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

... • Bonds may be issued between interest dates. • Interest, for the period between the issue date and the last interest date, is collected with the issue price of the bonds (accrued interest). • At the specified interest date, interest is paid for the entire interest period (semiannual or annual). • P ...

Click here for the LONG version of the 4th Quarter Newsletter

... Note: Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. International investing involves special risks such as currency fluctuation and politica ...

... Note: Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. International investing involves special risks such as currency fluctuation and politica ...

第三章 物流管理

... Speculation in the forward market Long position(多头)is the position speculator take when they purchase a foreign currency on the spot or forward market with the anticipation of selling it at a higher future spot price. Short position(空头)is the position speculator take when they borrow or sell forwa ...

... Speculation in the forward market Long position(多头)is the position speculator take when they purchase a foreign currency on the spot or forward market with the anticipation of selling it at a higher future spot price. Short position(空头)is the position speculator take when they borrow or sell forwa ...

A managed floating exchange rate regime is an established policy

... The exchange rate regime reform in 2005 was the continuation of the reform in 1994. The essential role of a stable and healthy financial system in preventing and addressing crisis was fully recognized in the wake of the Asian financial crisis. Around 2003, when financial reform in China was at a cri ...

... The exchange rate regime reform in 2005 was the continuation of the reform in 1994. The essential role of a stable and healthy financial system in preventing and addressing crisis was fully recognized in the wake of the Asian financial crisis. Around 2003, when financial reform in China was at a cri ...

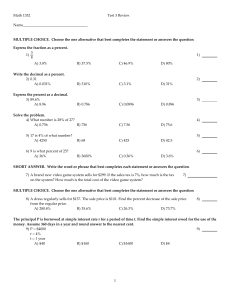

Math 1332 T3Rs11 - HCC Learning Web

... Solve the problem. Round answers to the nearest dollar. 15) The cost of a home entertainment center is $3800. We can finance this by paying $300 down and $309.17 per month for 12 months. Determine a. the amount financed; b. the total installment price; c. the finance charge. A) a. amount financed: ...

... Solve the problem. Round answers to the nearest dollar. 15) The cost of a home entertainment center is $3800. We can finance this by paying $300 down and $309.17 per month for 12 months. Determine a. the amount financed; b. the total installment price; c. the finance charge. A) a. amount financed: ...

What should we make of the negative interest rates that

... that we now see in many countries? In order to stimulate economic growth, drive up inflation and weaken their exchange rates, some central banks have opted to push back the limits of their key interest rates by venturing into negative territory. These decisions have pushed many other interest rates ...

... that we now see in many countries? In order to stimulate economic growth, drive up inflation and weaken their exchange rates, some central banks have opted to push back the limits of their key interest rates by venturing into negative territory. These decisions have pushed many other interest rates ...

Repo (Repurchase) Rate Repo rate is the rate at which banks

... Impact of Capital Inflows on Exchange Rate, Inflation and Stock Market Index When more capital flows into the country, the currency appreciates in value and the inflation increases. ...

... Impact of Capital Inflows on Exchange Rate, Inflation and Stock Market Index When more capital flows into the country, the currency appreciates in value and the inflation increases. ...

Answers to Textbook Problems

... If the Federal Reserve pushed interest rates down, with an unchanged expected future exchange rate, the dollar would depreciate (note that the article uses the term “downward pressure” to mean pressure for the dollar to depreciate). If there is a “soft landing,” and the Federal Reserve does not lowe ...

... If the Federal Reserve pushed interest rates down, with an unchanged expected future exchange rate, the dollar would depreciate (note that the article uses the term “downward pressure” to mean pressure for the dollar to depreciate). If there is a “soft landing,” and the Federal Reserve does not lowe ...

Forecasting Interest Rates

... $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = Y’ (Future Consumption = Future Income) ...

... $50,000 and you anticipate next year’s income to be $60,000. The current interest rate is 5%. In the absence of financial markets, your consumption stream would be $50,000 this year and $60,000 next year. C = Y (Current Consumption = Current Income) C’ = Y’ (Future Consumption = Future Income) ...

Account Stated CLE slideshow 10-22

... Stonebraker: Missouri’s gift to the Consumer’s Bar “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the bal ...

... Stonebraker: Missouri’s gift to the Consumer’s Bar “But where the account stated is based in part upon transactions which are illegal and void, and this is shown in defense to the action thereon, we regard it as clear that the consideration for the debtor's express or implied promise to pay the bal ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.