The Money Demand Curve

... Long-term Interest Rates • Long-term interest rates don’t necessarily move with short-term interest rates. • If investors expect short-term interest rates to rise, investors may buy short-term bonds even if long-term bonds offer a higher interest rate. • In practice, long-term interest rates reflec ...

... Long-term Interest Rates • Long-term interest rates don’t necessarily move with short-term interest rates. • If investors expect short-term interest rates to rise, investors may buy short-term bonds even if long-term bonds offer a higher interest rate. • In practice, long-term interest rates reflec ...

foreign currency fixed deposit (fcfd) deposit / maturity

... 2. I/We acknowledge that the withdrawal of GBP or US$ FDs may be made on maturity date and the exchange rate used (if any) will be based on the day of withdrawal. 3. I/We acknowledge that the withdrawal of FDs in other currencies may be made on maturity date only if the Bank receive at least 2 Busin ...

... 2. I/We acknowledge that the withdrawal of GBP or US$ FDs may be made on maturity date and the exchange rate used (if any) will be based on the day of withdrawal. 3. I/We acknowledge that the withdrawal of FDs in other currencies may be made on maturity date only if the Bank receive at least 2 Busin ...

1 Introduction 2 Analytical Framework

... However, rj , K j and ε̄j are firm-specific and must satisfy equations (1) and (2). In making its investment (that is, K j − (1 − δ)K0j ) and its financing (loan contract) decisions, the firm takes these constraints into account. Since these decisions are made before ε is known, that is, when all fi ...

... However, rj , K j and ε̄j are firm-specific and must satisfy equations (1) and (2). In making its investment (that is, K j − (1 − δ)K0j ) and its financing (loan contract) decisions, the firm takes these constraints into account. Since these decisions are made before ε is known, that is, when all fi ...

Treasury Management Strategy

... cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to keep a facility available. ...

... cash balances, it is considered more cost effective not to have an approved overdraft facility than to incur fees to keep a facility available. ...

DERIVATIVES-II

... Agreement to buy or sell an asset at a certain time for a certain price. Traded on the exchange. Forward contract is not traded on the market and it is usually between two financial institutions, One of the parties has a long position who agrees to buy the underlying asset at a certain price, the pa ...

... Agreement to buy or sell an asset at a certain time for a certain price. Traded on the exchange. Forward contract is not traded on the market and it is usually between two financial institutions, One of the parties has a long position who agrees to buy the underlying asset at a certain price, the pa ...

interest rates and your fixed income investments

... fundamentals than by interest rate fluctuations, since credit quality is typically more of a factor. International bonds also tend to react to credit fundamentals, as well as currency changes and foreign economic conditions, rather than U.S. interest rates. Adjustable-rate mortgages and floating-rat ...

... fundamentals than by interest rate fluctuations, since credit quality is typically more of a factor. International bonds also tend to react to credit fundamentals, as well as currency changes and foreign economic conditions, rather than U.S. interest rates. Adjustable-rate mortgages and floating-rat ...

Determinants of Interest Rates

... Rises with the term to maturity Bonds of different maturities are substitutes but not perfect • Interest rates on different maturity bonds move together • Yield curves tend to slope upward when short-term rates are low and to be inverted when short-term rates are high; • Yield curves typically slope ...

... Rises with the term to maturity Bonds of different maturities are substitutes but not perfect • Interest rates on different maturity bonds move together • Yield curves tend to slope upward when short-term rates are low and to be inverted when short-term rates are high; • Yield curves typically slope ...

Institute of Actuaries of India INDICATIVE SOLUTIONS November 2012 Examinations

... To hedge a floating loan, we should sell an Eurodollar future as in case of increase in rate, as due to increase in rate, the contract quote will decrease, which will result in positive value for us. As BB wants to hedge the floating loan on its book, it should sell Eurodollar futures or buy forward ...

... To hedge a floating loan, we should sell an Eurodollar future as in case of increase in rate, as due to increase in rate, the contract quote will decrease, which will result in positive value for us. As BB wants to hedge the floating loan on its book, it should sell Eurodollar futures or buy forward ...

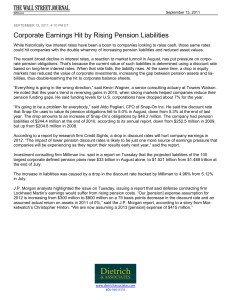

Chapter 5

... Ex. A bank has determined that the Radlers can afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years ...

... Ex. A bank has determined that the Radlers can afford monthly house payments of at most $750. The bank charges interest at a rate of 8% per year on the unpaid balance, with interest computations made at the end of each month. If the loan is to be amortized in equal monthly installments over 15 years ...

Econ 371: Answer Key for Problem Set 1 (Chapter 12-13)

... interest payment and the larger future current account surpluses need to be. This can also be explained using another current account accounting. (See Table 12-2 for an example.) CA = export - import + net income transfer from abroad In this case, the net income transfer is the ”negative” value of t ...

... interest payment and the larger future current account surpluses need to be. This can also be explained using another current account accounting. (See Table 12-2 for an example.) CA = export - import + net income transfer from abroad In this case, the net income transfer is the ”negative” value of t ...

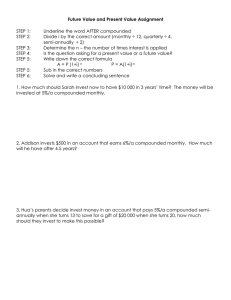

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

Time Value of Money

... Assume instead, the Lottery commission offered to pay you $500,000 every 6 months (semi-annually) for the next 5 years. At an annual interest rate of 6%, what would be the present value of that annuity assuming you chose to accept all the winnings in one check today. ...

... Assume instead, the Lottery commission offered to pay you $500,000 every 6 months (semi-annually) for the next 5 years. At an annual interest rate of 6%, what would be the present value of that annuity assuming you chose to accept all the winnings in one check today. ...

InterestRate assignment

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

... A person is purchasing an item with their credit card. Launch an input dialog window and have the user enter a short description of the item they are purchasing. Remember the JOptionPane.showInputDialog method that we used in an earlier class? Have the user input the amount of the purchase (in whole ...

1+i

... 1. Use nominal interest minus consensus inflation forecast 2. Use the yield on inflation protected securities. ...

... 1. Use nominal interest minus consensus inflation forecast 2. Use the yield on inflation protected securities. ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.