Wall Street hits new highs as markets bet on Fed rate rise

... indicating they were prepared to raise rates at their meeting on March 1415 regardless of Mr Trump’s budget plans. Previously, the Fed’s Open Market Committee had said that details of the White House’s intentions would play a central role in its rate decision. Markets were particularly influenced b ...

... indicating they were prepared to raise rates at their meeting on March 1415 regardless of Mr Trump’s budget plans. Previously, the Fed’s Open Market Committee had said that details of the White House’s intentions would play a central role in its rate decision. Markets were particularly influenced b ...

Daily FX & Market Commentary

... objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Any decision to purchase securities mentioned herein should be made ba ...

... objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the information, consider its appropriateness, having regard to their objectives, financial situation and needs. Any decision to purchase securities mentioned herein should be made ba ...

Chapter 4 – Loans and Credit Cards

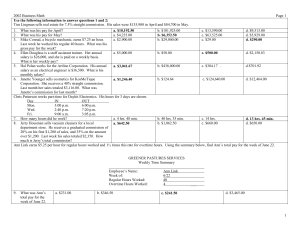

... Principal x ______________________ = Bank Discount Proceeds = Principal - ____________________________ True Rate of Interest = Interest / _________________________ ...

... Principal x ______________________ = Bank Discount Proceeds = Principal - ____________________________ True Rate of Interest = Interest / _________________________ ...

money_lecs_2_2013_v3_post

... 1. Fed buys assess backed mortgage (from bank for simplicity) 2. Bank is glad to unload it, and just holds excess reserves. 3. No impact on the money supply or on federal funds rate. A (very small) impact on mortgage interest rates. ...

... 1. Fed buys assess backed mortgage (from bank for simplicity) 2. Bank is glad to unload it, and just holds excess reserves. 3. No impact on the money supply or on federal funds rate. A (very small) impact on mortgage interest rates. ...

Calculation of Simple Interest and Maturity Value

... Any partial loan payment first covers any interest that has built up. The remainder of the partial payment reduces the loan principal. Allows the borrower to receive proper interest credits. ...

... Any partial loan payment first covers any interest that has built up. The remainder of the partial payment reduces the loan principal. Allows the borrower to receive proper interest credits. ...

Willem and the negative nominal interest rate

... at a level far above zero. Statistically, it was therefore unthinkable that the "zero" could ever be a relevant scenario. The situation in which the nominal interest rate reached zero, was academically known as the "liquidity trap", in the sense that bonds and money were perfect substitutes, such th ...

... at a level far above zero. Statistically, it was therefore unthinkable that the "zero" could ever be a relevant scenario. The situation in which the nominal interest rate reached zero, was academically known as the "liquidity trap", in the sense that bonds and money were perfect substitutes, such th ...

NBER WORKING PAPER SERIES CAPITAL MOBILITY AND DEVALUATION IN AN

... serves would be inconsistent with the requirement that real balances be lower in the new stationary state than in the original one. This time path of reserves and consumption stands in interesting contrast to the one found by Calvo (1979a) in a context of capital immobility. When there is only one a ...

... serves would be inconsistent with the requirement that real balances be lower in the new stationary state than in the original one. This time path of reserves and consumption stands in interesting contrast to the one found by Calvo (1979a) in a context of capital immobility. When there is only one a ...

chapter 3 - UniMAP Portal

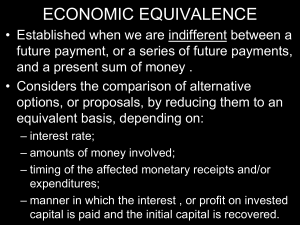

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

... • Established when we are indifferent between a future payment, or a series of future payments, and a present sum of money . • Considers the comparison of alternative options, or proposals, by reducing them to an equivalent basis, depending on: – interest rate; – amounts of money involved; – timing ...

chap010

... the bond, the greater the price change effect will be. The following table illustrates the impact of differences between yield to maturity and coupon rates on bond ...

... the bond, the greater the price change effect will be. The following table illustrates the impact of differences between yield to maturity and coupon rates on bond ...

4 ccr 725-3 mortgage loan originators and mortgage companies 1

... a. Prepayment penalties that extend past the adjustment date of any teaser rate used to calculate a borrower’s monthly mortgage payment; b. Prepayment penalties that extend past the adjustment date of any interest rate used to calculate a borrower’s monthly mortgage payment; c. Prepayment penalties ...

... a. Prepayment penalties that extend past the adjustment date of any teaser rate used to calculate a borrower’s monthly mortgage payment; b. Prepayment penalties that extend past the adjustment date of any interest rate used to calculate a borrower’s monthly mortgage payment; c. Prepayment penalties ...

Investment and Financial Markets

... • Suppose you and your employer both had set aside funds for the day you retire at age 65. Just before you retire, your employer offers you’re the following options: 1) You can have the $500,000 that was set aside, or 2) the firm would take the $500,000 and purchase you an annuity contract---a finan ...

... • Suppose you and your employer both had set aside funds for the day you retire at age 65. Just before you retire, your employer offers you’re the following options: 1) You can have the $500,000 that was set aside, or 2) the firm would take the $500,000 and purchase you an annuity contract---a finan ...

Advertising Checklist - DOC

... credit with a statement of all terms applicable to each may be used. If the ad is a multiple-page ad, does the ad include a table or schedule of all required disclosure information in one place, and does each reference to number of payments or period of repayment, the amount of any payment, or the a ...

... credit with a statement of all terms applicable to each may be used. If the ad is a multiple-page ad, does the ad include a table or schedule of all required disclosure information in one place, and does each reference to number of payments or period of repayment, the amount of any payment, or the a ...

Five Strategies for a Rising-Rate Environment

... So, if the market is correctly assuming sub-2% levels for the fed funds rate in the coming years, where does that take the U.S. ten-year Treasury rate? Long-term and short-term rates are highly correlated; thus, if forecasts of a historically low fed funds rate over the next couple of years are real ...

... So, if the market is correctly assuming sub-2% levels for the fed funds rate in the coming years, where does that take the U.S. ten-year Treasury rate? Long-term and short-term rates are highly correlated; thus, if forecasts of a historically low fed funds rate over the next couple of years are real ...

Hong Kong dollar exchange rate

... paper rose across the board during the period (Chart 7). The negative yield spreads against US Treasuries narrowed at the short end, widened at the intermediate end and remained unchanged at the long end. In particular, the three-month spread narrowed to –97 basis points and the five-year spread wid ...

... paper rose across the board during the period (Chart 7). The negative yield spreads against US Treasuries narrowed at the short end, widened at the intermediate end and remained unchanged at the long end. In particular, the three-month spread narrowed to –97 basis points and the five-year spread wid ...

Short-Term Income Fund - Investor Fact Sheet

... Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some fo ...

... Bond prices are sensitive to changes in interest rates, and a rise in interest rates can cause a decline in their prices. The value of some mortgage-backed securities may be particularly sensitive to changes in prevailing interest rates, and although the securities are generally supported by some fo ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.