Maturity and interest

... We matched P to fully fund the obligation, and we matched durations to immunize. Therefore, as long as ∆y is equal for the two sides of the balance sheet, we have achieved a perfect hedge. This is a big "if" however: it generally will not be true that yields on all assets change equally. This would ...

... We matched P to fully fund the obligation, and we matched durations to immunize. Therefore, as long as ∆y is equal for the two sides of the balance sheet, we have achieved a perfect hedge. This is a big "if" however: it generally will not be true that yields on all assets change equally. This would ...

Compiled by CA. Aditya Kumar Maheshwari AS – 30 :: Financial

... On March 30, 2006, fair value per ordinary share of A Ltd. was Rs. 45. On this dare, B Ltd. committed to buy 10000 of these shares at fair value. B Ltd. paid the price and accepted delivery of these shares on April 3, 2006. B Ltd. closed its annual accounts on March 31, 2006. Fair value of A Ltd. sh ...

... On March 30, 2006, fair value per ordinary share of A Ltd. was Rs. 45. On this dare, B Ltd. committed to buy 10000 of these shares at fair value. B Ltd. paid the price and accepted delivery of these shares on April 3, 2006. B Ltd. closed its annual accounts on March 31, 2006. Fair value of A Ltd. sh ...

Lecture 5

... able to achieve without derivatives, or could achieve only at greater cost Hedge risks that otherwise would not be possible to hedge Make underlying markets more efficient Reduce volatility of stock returns Minimize earnings volatility Reduce tax liabilities Motivate management (agency theory effect ...

... able to achieve without derivatives, or could achieve only at greater cost Hedge risks that otherwise would not be possible to hedge Make underlying markets more efficient Reduce volatility of stock returns Minimize earnings volatility Reduce tax liabilities Motivate management (agency theory effect ...

8. Non-current liabilities- bonds

... coupons), is that their book values are always based on their original effective interest rate, i.e. the market yield in effect when they were first sold. Thus, changes in market interest rates subsequent to a bond=s issuance are ignored. Use of the historical interest rate is analogous to historica ...

... coupons), is that their book values are always based on their original effective interest rate, i.e. the market yield in effect when they were first sold. Thus, changes in market interest rates subsequent to a bond=s issuance are ignored. Use of the historical interest rate is analogous to historica ...

chap009, Chapter 9 Foreign Exchange Markets

... 4%. Initially the exchange rate is C$1.10 per $1 U.S. The one year forward rate is C$1.14 per $1 U.S. What is the bank's dollar % spread if they hedge fully using forwards? Answer: Hedge by selling C$ forward. The current C$ amount is C$110 Million. In one year these loans will be worth $110 Million ...

... 4%. Initially the exchange rate is C$1.10 per $1 U.S. The one year forward rate is C$1.14 per $1 U.S. What is the bank's dollar % spread if they hedge fully using forwards? Answer: Hedge by selling C$ forward. The current C$ amount is C$110 Million. In one year these loans will be worth $110 Million ...

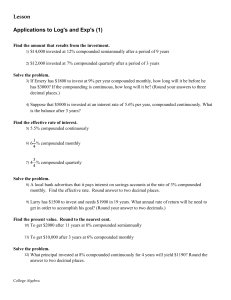

Lesson Applications to Log`s and Exp`s (1)

... 8) A local bank advertises that it pays interest on savings accounts at the rate of 3% compounded monthly. Find the effective rate. Round answer to two decimal places. ...

... 8) A local bank advertises that it pays interest on savings accounts at the rate of 3% compounded monthly. Find the effective rate. Round answer to two decimal places. ...

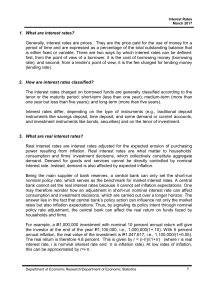

Interest Rates

... secondary market. A review of the spread between the average monthly bank lending rate charged by commercial banks (both high- and low-end) and the 91-day T-bill rate showed that banks are generally in compliance with the 500-basis point cap. 8. Can the BSP set interest rate levels? Yes, by law, the ...

... secondary market. A review of the spread between the average monthly bank lending rate charged by commercial banks (both high- and low-end) and the 91-day T-bill rate showed that banks are generally in compliance with the 500-basis point cap. 8. Can the BSP set interest rate levels? Yes, by law, the ...

Note Maturity Date - MGMT-026

... Capital leases are long-term (or non-cancelable) leases by which the lessor transfers substantially all risks and rewards of ownership to the lessee. Examples include leases of airplanes and department store buildings. ...

... Capital leases are long-term (or non-cancelable) leases by which the lessor transfers substantially all risks and rewards of ownership to the lessee. Examples include leases of airplanes and department store buildings. ...

AER Better Regulation Rate of Return Factsheet

... returns on a risk-free asset (the risk free rate) the returns to the broader market (the MRP) and the extent to which returns to equity for network businesses vary with market conditions in general (the equity beta). As at December 2013, our market risk premium (MRP) point estimate is 6.5, chosen fr ...

... returns on a risk-free asset (the risk free rate) the returns to the broader market (the MRP) and the extent to which returns to equity for network businesses vary with market conditions in general (the equity beta). As at December 2013, our market risk premium (MRP) point estimate is 6.5, chosen fr ...

Valuation of Financial Assets

... Account for uncertainty in valuation process by assigning higher capitalization rate to common stocks than to bonds or preferred stocks. ...

... Account for uncertainty in valuation process by assigning higher capitalization rate to common stocks than to bonds or preferred stocks. ...

Chapter 9

... How Monetary Policy Works • A rise in interest rates reduces consumption and investment spending because it raises the cost of borrowing, and the attraction of lending own funds rather than investing them in investment projects • It may also encourage saving • Conversely, a fall in interest rates h ...

... How Monetary Policy Works • A rise in interest rates reduces consumption and investment spending because it raises the cost of borrowing, and the attraction of lending own funds rather than investing them in investment projects • It may also encourage saving • Conversely, a fall in interest rates h ...

Solutions to Chapter 11

... to yield higher returns when the rest of the economy fares poorly. In contrast, the Leaning Tower of Pita has returns that are positively correlated with the rest of the economy. It does best in a boom and goes out of business in a recession. For this reason, Leaning Tower would be a risky investmen ...

... to yield higher returns when the rest of the economy fares poorly. In contrast, the Leaning Tower of Pita has returns that are positively correlated with the rest of the economy. It does best in a boom and goes out of business in a recession. For this reason, Leaning Tower would be a risky investmen ...

Applications Section 4.6

... 14. An investment of $2000 is made at 3.9%, compounded monthly. How long will it take for the investment to grow to $12000? 15. An investment of $4000 is made at 7.21%, compounded quarterly. How long will it take for the investment to double? 16. An investment of $400 is made at 2.25%, compounded co ...

... 14. An investment of $2000 is made at 3.9%, compounded monthly. How long will it take for the investment to grow to $12000? 15. An investment of $4000 is made at 7.21%, compounded quarterly. How long will it take for the investment to double? 16. An investment of $400 is made at 2.25%, compounded co ...

Risk Management and Financial Institutions

... Risk Management and Financial Institutions, 2e, Chapter 7, Copyright © John C. Hull 2009 ...

... Risk Management and Financial Institutions, 2e, Chapter 7, Copyright © John C. Hull 2009 ...

Macro Conference IV

... growth and ICOR, but weaker positive effects on investment ratio. Inclusion of additional variables weakened effects of interest rates on investment, but not on ICOR. Thus, efficiency effect on investment, and not effect on overall volume of investment, accounted for positive relationship between re ...

... growth and ICOR, but weaker positive effects on investment ratio. Inclusion of additional variables weakened effects of interest rates on investment, but not on ICOR. Thus, efficiency effect on investment, and not effect on overall volume of investment, accounted for positive relationship between re ...

The EGP Exchange Rate Questions

... Securities Brokerage solely for information purposes and for the use of the recipient. It is not to be reproduced under any circumstances and is not to be copied or made available to any person other than the recipient. It is distributed in the United States of America by LXM LLP USA and elsewhere i ...

... Securities Brokerage solely for information purposes and for the use of the recipient. It is not to be reproduced under any circumstances and is not to be copied or made available to any person other than the recipient. It is distributed in the United States of America by LXM LLP USA and elsewhere i ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.