Continuing Care Retirement Communities Encounter Actuarial

... The significance of the subject is widely recognized, and success in finding financial support is anticipated. A contract to perform the full project has been awarded, a pilot study has been completed, and the representative data collection and analysis will follow when funding is on hand. ...

... The significance of the subject is widely recognized, and success in finding financial support is anticipated. A contract to perform the full project has been awarded, a pilot study has been completed, and the representative data collection and analysis will follow when funding is on hand. ...

What are derivatives

... Derivatives are financial contracts, which derive their value off a spot price time-series, which is called "the underlying". The underlying asset can be equity, index, commodity or any other asset. Some common examples of derivatives are Forwards, Futures, Options and Swaps. Derivatives help to imp ...

... Derivatives are financial contracts, which derive their value off a spot price time-series, which is called "the underlying". The underlying asset can be equity, index, commodity or any other asset. Some common examples of derivatives are Forwards, Futures, Options and Swaps. Derivatives help to imp ...

Full Page with Layout Heading - Michigan Department of Education

... Bond rate equals 5.00% and published rate equals 5.25%, issuer pays zero (5.00% - 5.00% = 0.00%) Bond rate equals 5.50% and published rate equals 4.75%, issuer pays 0.75% (5.50% - 4.75% = 0.75%) Current indicative market rate is 6.20% and published rate equals 5.01% for a net rate of 1.19% Abili ...

... Bond rate equals 5.00% and published rate equals 5.25%, issuer pays zero (5.00% - 5.00% = 0.00%) Bond rate equals 5.50% and published rate equals 4.75%, issuer pays 0.75% (5.50% - 4.75% = 0.75%) Current indicative market rate is 6.20% and published rate equals 5.01% for a net rate of 1.19% Abili ...

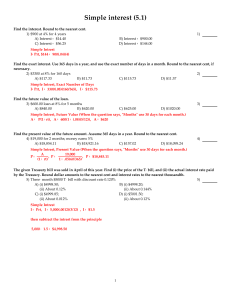

Simple interest (5.1)

... Second Part: Future Value Compound Intrest from the first 15 years. We have to compound this ammount as a lump sum for the second 15 years because it is earning intrest for the last 15 years at ...

... Second Part: Future Value Compound Intrest from the first 15 years. We have to compound this ammount as a lump sum for the second 15 years because it is earning intrest for the last 15 years at ...

Document

... for firms in the United States, as well as in some other countries that share a similar heritage, such as the United Kingdom, Australia, India, and Canada. In Continental Europe, for example, countries such ...

... for firms in the United States, as well as in some other countries that share a similar heritage, such as the United Kingdom, Australia, India, and Canada. In Continental Europe, for example, countries such ...

questions in real estate finance

... Tilt effect is when current payments reflect future expected inflation. Current FRM payments reflect future expected inflation rates. Mortgage payment becomes a greater portion of the borrower’s income and may become burdensome GPM is designed to offset the tilt effect by lowering the payments on an ...

... Tilt effect is when current payments reflect future expected inflation. Current FRM payments reflect future expected inflation rates. Mortgage payment becomes a greater portion of the borrower’s income and may become burdensome GPM is designed to offset the tilt effect by lowering the payments on an ...

Reducing the Lower Bound on Market Interest Rates

... pre-crisis levels (Gertler 2010, pp. 131-132). Thus, with central banks’ base rates approaching zero, conventional monetary policy had run out of options concerning the reduction of market interest rates. Thus a growing credit spread in combination with the zero floor to nominal interest rates cause ...

... pre-crisis levels (Gertler 2010, pp. 131-132). Thus, with central banks’ base rates approaching zero, conventional monetary policy had run out of options concerning the reduction of market interest rates. Thus a growing credit spread in combination with the zero floor to nominal interest rates cause ...

Inflation Report February 2006

... (a) For 2006 Q4 and 2007 Q4, 26 forecasters provided the Bank with forecasts for CPI inflation, GDP growth and the repo rate. For 2008 Q1, there were 22 forecasts for CPI inflation and GDP growth, and 21 for the repo rate. For the sterling ERI, there were 23 forecasts for 2006 Q4, 21 for 2007 Q4, an ...

... (a) For 2006 Q4 and 2007 Q4, 26 forecasters provided the Bank with forecasts for CPI inflation, GDP growth and the repo rate. For 2008 Q1, there were 22 forecasts for CPI inflation and GDP growth, and 21 for the repo rate. For the sterling ERI, there were 23 forecasts for 2006 Q4, 21 for 2007 Q4, an ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.