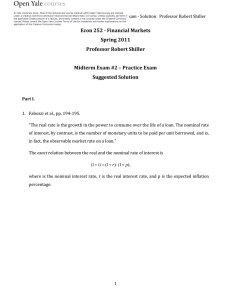

Practice Exam Solutions

... (a) The credit enhancement (provided by the senior-subordinate structure) of tranche 5 is the sum of the principal amounts for tranches 6 through 8 plus the overcollateralization. As the sum of the principal amounts for tranches 6 through 8 equals $65,000,000, it follows from the credit enhancement ...

... (a) The credit enhancement (provided by the senior-subordinate structure) of tranche 5 is the sum of the principal amounts for tranches 6 through 8 plus the overcollateralization. As the sum of the principal amounts for tranches 6 through 8 equals $65,000,000, it follows from the credit enhancement ...

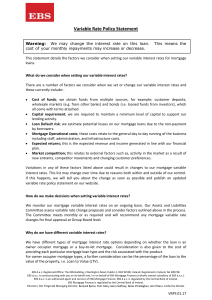

"Why Interest Rates Will Rise," Funds Society

... cause some erosion in value. The effect will depend on what happens to the credit spread – the interest paid to investors for assuming credit risk. If the credit spread narrows, the overall effect may be slight. If it widens, the market could be hit with a double whammy. Historically, the credit spr ...

... cause some erosion in value. The effect will depend on what happens to the credit spread – the interest paid to investors for assuming credit risk. If the credit spread narrows, the overall effect may be slight. If it widens, the market could be hit with a double whammy. Historically, the credit spr ...

MODEL MCQs – CAIIB, PAPER-2, MOD

... j) extreme cyclical variations k) secular trend l) seasonal variations m) all of these 60) the repetitive movement around a trend line in a 4- month period is best described by n) seasonal variation o) secular trend p) cyclical fluctuation q) irregular variation ...

... j) extreme cyclical variations k) secular trend l) seasonal variations m) all of these 60) the repetitive movement around a trend line in a 4- month period is best described by n) seasonal variation o) secular trend p) cyclical fluctuation q) irregular variation ...

1. You were hired as a consultant to Keys Company, and you were

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

... 5. The Nunnally Company has equal amounts of low-risk, average-risk, and high-risk projects. Nunnally estimates that its overall WACC is 12%. The CFO believes that this is the correct WACC for the company’s average-risk projects, but that a lower rate should be used for lower risk projects and a hig ...

Name Last 4 (PSU ID) ______ First 2 letters of

... next year, ending purchases around midyear. e) (5 points) We talked in class how having a press conference after an FOMC meeting could be 'handy' if the Fed Chair needed to practice damage control or clarify something that was part of the FOMC statement that is released shortly before the Fed Chair ...

... next year, ending purchases around midyear. e) (5 points) We talked in class how having a press conference after an FOMC meeting could be 'handy' if the Fed Chair needed to practice damage control or clarify something that was part of the FOMC statement that is released shortly before the Fed Chair ...

Common Error - Frost Middle School

... exchange market for the United States dollar. Based on your indicated change in real output in part (b), show and explain how the supply of the United States dollar will be affected in the foreign exchange market. The properly labeled graph should contain yen per dollar on the vertical axis, the qua ...

... exchange market for the United States dollar. Based on your indicated change in real output in part (b), show and explain how the supply of the United States dollar will be affected in the foreign exchange market. The properly labeled graph should contain yen per dollar on the vertical axis, the qua ...

FREE Sample Here

... At $284 billion, French exports of goods exceed imports by $28 billion. Exports of services also exceed imports, by $17 billion. Altogether, exports of goods and services exceed imports by $45 billion. This positive figure is strengthened by positive net income received, but partly offset by negativ ...

... At $284 billion, French exports of goods exceed imports by $28 billion. Exports of services also exceed imports, by $17 billion. Altogether, exports of goods and services exceed imports by $45 billion. This positive figure is strengthened by positive net income received, but partly offset by negativ ...

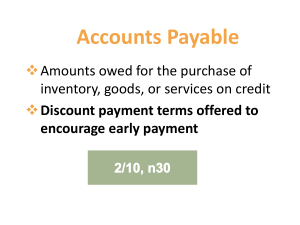

Example - Cengage

... International standards have a lower threshold for those items that must be reported so thus more items will be recorded on the balance sheet. International standards require the amount of the recorded liability be discounted (recorded at present value). The term “contingent liability” is only ...

... International standards have a lower threshold for those items that must be reported so thus more items will be recorded on the balance sheet. International standards require the amount of the recorded liability be discounted (recorded at present value). The term “contingent liability” is only ...

Click here to free sample

... of goods in two countries to see if an exchange rate conforms to absolute PPP, or whether it is overvalued or undervalued in real terms. As mentioned in Chapter 2, this can only be done for some individual goods that are clearly comparable (“law of one price”), and the estimation for different goods ...

... of goods in two countries to see if an exchange rate conforms to absolute PPP, or whether it is overvalued or undervalued in real terms. As mentioned in Chapter 2, this can only be done for some individual goods that are clearly comparable (“law of one price”), and the estimation for different goods ...

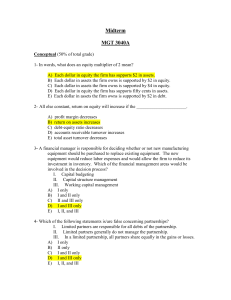

Answers to Midterm 3040A

... D) Net new bonds are sold and outstanding common stock is repurchased. E) Net new bonds are sold and short-term notes payable are paid off. ...

... D) Net new bonds are sold and outstanding common stock is repurchased. E) Net new bonds are sold and short-term notes payable are paid off. ...

speech speech by governor lars rohde at danske bank markets

... Later in 2015 – when the pressure had abated – we again intervened in the FX market. But this time by purchasing kroner thereby bringing FX reserves back down. As I will return to in a minute, the substantially negative official interest rates have implied that large bank deposits by firms and inst ...

... Later in 2015 – when the pressure had abated – we again intervened in the FX market. But this time by purchasing kroner thereby bringing FX reserves back down. As I will return to in a minute, the substantially negative official interest rates have implied that large bank deposits by firms and inst ...

financial management

... The prize in last week‟s lottery was estimated to be worth GHC35 million. If you were lucky enough to win, then it will pay you GHC1.75 million per year over the next 20 years. Assume that the first instalment is received immediately. ...

... The prize in last week‟s lottery was estimated to be worth GHC35 million. If you were lucky enough to win, then it will pay you GHC1.75 million per year over the next 20 years. Assume that the first instalment is received immediately. ...

CHAPTER 1: INTRODUCTION

... Real vs. financial assets (Real assets are physical assets and include agricultural commodities, metals and sources of energy; financial assets are stocks, bonds/loans, and currencies) ...

... Real vs. financial assets (Real assets are physical assets and include agricultural commodities, metals and sources of energy; financial assets are stocks, bonds/loans, and currencies) ...

A Brief Exposition of the IS-MP Curves: A Replacement for the

... The world economy is today in shambles. Equally, but perhaps less consequentially, the short-run macro models used today are in crisis. This note focuses on an updated approach to the central tool of short-run macro, the IS-LM analysis and IS-LM curves. This applies primarily to the closed economy, ...

... The world economy is today in shambles. Equally, but perhaps less consequentially, the short-run macro models used today are in crisis. This note focuses on an updated approach to the central tool of short-run macro, the IS-LM analysis and IS-LM curves. This applies primarily to the closed economy, ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.