1a)Define redemption yield, spot rate and forward rate

... exchange rate is $0.95 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap will call for the exchange of 1 million euros for a given number of dollars in each year [30 marks] ...

... exchange rate is $0.95 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap will call for the exchange of 1 million euros for a given number of dollars in each year [30 marks] ...

Quiz 3

... interest rate above the world interest rate, and is open to borrowing/lending in the international market. If this country balances its governmental budget, borrowing from the international market falls 5. An increase in a nation’s capital stock (amount of capital employed by firms) makes labor more ...

... interest rate above the world interest rate, and is open to borrowing/lending in the international market. If this country balances its governmental budget, borrowing from the international market falls 5. An increase in a nation’s capital stock (amount of capital employed by firms) makes labor more ...

How the Bond Market Affects Mortgage Rates

... The duration and interest rate paid on new issues of these bonds depends upon the financial strategy of the Government in power. The accumulated outstanding amounts of these bond issues, past and present, is known as "the National Debt". New issues are constantly required either to refinance maturin ...

... The duration and interest rate paid on new issues of these bonds depends upon the financial strategy of the Government in power. The accumulated outstanding amounts of these bond issues, past and present, is known as "the National Debt". New issues are constantly required either to refinance maturin ...

INTERNATIONAL CAPITAL MOVEMENTS: OLD AND NEW DEBATES On Alternative Exchange Regimes

... Kong (IMF, 2008, De Facto Classification of Exchange Rate Regimes and Monetary Policy ...

... Kong (IMF, 2008, De Facto Classification of Exchange Rate Regimes and Monetary Policy ...

Chapter 3: The IS

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...

... • It is the situation in which the money demand is perfectly elastic. Usually, liquidity trap occurs at very low interest rate. • An increase in money supply cannot change the interest rate when there is a liquidity trap. • When there is a liquidity trap, the fiscal policy is more effective since th ...

1 - BrainMass

... the purchase price of inventory items increases by 20 percent the sales forecast is revised by 15 percent fixed order costs are reduced by 25 percent the carrying cost of an item increased as a percentage of purchase price all of the above would cause average inventory holding to decrease ...

... the purchase price of inventory items increases by 20 percent the sales forecast is revised by 15 percent fixed order costs are reduced by 25 percent the carrying cost of an item increased as a percentage of purchase price all of the above would cause average inventory holding to decrease ...

Answers to Chapter 23 Questions

... 5. The expected change in the spot position = -8 (.01/1.07) 10,400,000 = -$777,570. This would mean a price change from 104 to 96.2243 per $100 face value. By entering into a two month forward contract to sell a $10,000,000 of 15 year bonds at 104, the FI will have hedged its spot position. If r ...

... 5. The expected change in the spot position = -8 (.01/1.07) 10,400,000 = -$777,570. This would mean a price change from 104 to 96.2243 per $100 face value. By entering into a two month forward contract to sell a $10,000,000 of 15 year bonds at 104, the FI will have hedged its spot position. If r ...

ch01 - Class Index

... Futures contracts involve a promise to exchange a product for cash by a set ...

... Futures contracts involve a promise to exchange a product for cash by a set ...

REAL ESTATE ECONOMICS - Chapter Quizzes

... Real Estate Economics – 5th Edition - by Huber, Messick, and Pivar Chapter 3 Quiz Copyright January 2011, Educational Textbook Company 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. ...

... Real Estate Economics – 5th Edition - by Huber, Messick, and Pivar Chapter 3 Quiz Copyright January 2011, Educational Textbook Company 1. A demand deposit that must be paid by the depositor’s bank to the payee upon presentation is known as: a. cash. b. check. c. money order. d. all of the above. 2. ...

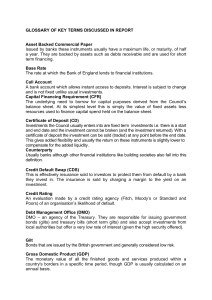

GLOSSARY OF KEY TERMS DISCUSSED IN

... Investments the Council usually enters into are fixed term investments i.e. there is a start and end date and the investment cannot be broken (and the investment returned). With a certificate of deposit the investment can be sold (traded) at any point before the end date. This gives added flexibilit ...

... Investments the Council usually enters into are fixed term investments i.e. there is a start and end date and the investment cannot be broken (and the investment returned). With a certificate of deposit the investment can be sold (traded) at any point before the end date. This gives added flexibilit ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.