* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 1a)Define redemption yield, spot rate and forward rate

Hedge (finance) wikipedia , lookup

Securitization wikipedia , lookup

Fixed exchange-rate system wikipedia , lookup

Derivative (finance) wikipedia , lookup

Exchange rate wikipedia , lookup

Currency intervention wikipedia , lookup

Auction rate security wikipedia , lookup

Collateralized mortgage obligation wikipedia , lookup

United States Treasury security wikipedia , lookup

Yield curve wikipedia , lookup

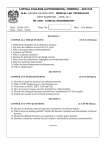

N14092-E1 The University of Nottingham BUSINESS SCHOOL A LEVEL 4 MODULE, SPRING SEMESTER 2010-2011 FIXED INTEREST INVESTMENT Time allowed TWO Hours Candidates may complete the front cover of their answer book and sign their desk card but must NOT write anything else until the start of the examination period is announced. Answer any THREE questions Only silent, self contained calculators with a Single-Line Display are permitted in this examination. Dictionaries are not allowed with one exception. Those whose first language is not English may use a standard translation dictionary to translate between that language and English provided that neither language is the subject of this examination. Subject specific translation dictionaries are not permitted. No electronic devices capable of storing and retrieving text, including electronic dictionaries, may be used. DO NOT turn examination paper over until instructed to do so ADDITIONAL MATERIAL: Normal Distribution Table and Blacks Formula INFORMATION FOR INVIGILATORS: NONE N14092-E1 2 1 2 3 N14092-E1 a) Define the spot rate, forward rate and the redemption yield. What are the main weaknesses of the redemption yield and how can they be overcome using the spot rate? [30 marks] b) Explain why the forward rate so is important in the investment making process. [20 marks] c) Define the yield curve and discuss the factors that drive it. Discuss the main theories that have proposed to explain the observed shapes of the term structure of interest rates. [50 marks] a) Discuss the differences between Dollar duration, Macaulay duration, modified duration and convexity. [25 marks] b) Estimate the Macaulay and modified duration and convexity using a suitable approximation or otherwise of a 20 year bond paying 7% coupons annually. The initial yield is 7% per annum and the par value is £1000. [35 marks] c) Using the estimated values of duration and convexity calculate the new bond price when the yield is increased firstly to 8% and then to 12% using both the duration and the duration with convexity rule. Explain your results. [40 marks] a) Explain the main differences between interest rate forwards and interest rate futures [25 marks] b) Discuss what you understand by the term, “ Price Factor”, and how it leads to the term, “Cheapest to Deliver Bond”. [25 marks] c) How would you hedge a portfolio of fixed interest securities under the following circumstances: i. You own a large position in relatively illiquid bond you want to sell ii. You have a large gain on one of your Treasuries and want to sell it, but you would like to defer the gain until the next tax year. iii. You will receive your annual bonus next month that you hope to invest in long-term corporate bonds. You believe that bond today are selling at quite attractive yields, and are concerned that bond prices will rise over the next few weeks. [25 marks] d) As a fixed interest portfolio manager you have estimated that the yield on 30-year bonds changes by 10 basis points for every 15-basis point move in the yield on 10year bonds. You hold a $100 million portfolio of 10-year maturity bonds with modified duration 8 years and desire to hedge your interest rate exposure with T-bond futures, which currently has modified duration 13 years and sell at F0 = $93. How many futures contract should you buy or sell? [25 marks] N14092-E1 N14092-E1 3 4 a) Discuss the main characteristics of a plain vanilla interest rate swap. Your explanation should include the main risks associated with such swaps. [25 marks] b) Discuss the alternative methods that can be used to value swaps. c) Companies A and B have been offered the following rates per annum on a $60 million 20-year investment: [20 marks] Company A Company B Fixed rate 2.0% 3.8% [25 marks] Floating rate LIBOR + 1% LIBOR +2% Company A requires fixed-rate investment; company B requires a floating-rate investment. Construct a swap that will net a bank, acting as intermediary, 0.2% per annum and will appear equally attractive to A and B. 5 6 d) The U.S. yield curve is flat at 1% and the euro yield curve is flat at 2%. The current exchange rate is $0.95 per euro. What will be the swap rate on an agreement to exchange currency over a 3-year period? The swap will call for the exchange of 1 million euros for a given number of dollars in each year [30 marks] a) Discuss why standard equity models cannot be used to value interest rate options. [30 marks] b) Discuss ways in which the Black-Scholes model adapted to value interest rate options? [20 marks] c) Prove that an interest rate cap can be interpreted as a portfolio of put options on zero coupon bonds. [20 marks] d) Is the modified duration of options positive? Discuss a) Discuss why credit risk modelling is more difficult than interest rate modelling. [25 marks] b) Explain what you understand by the following terms related to credit risk. (i) expected default frequency. (ii) market implied rating. (iii) distance-to-default index measure. [30 marks] [75 marks] End N14092-E1