Federal Fund Rate Increase Frequently Asked

... charging and publishes a consensus prime. When three-quarters of surveyed banks change their prime rate, the Wall Street Journal publishes a new consensus rate. Q: How are effective dates of rate changes determined on SchoolsFirst FCU products? A: Each of our variable rate products that are tied to ...

... charging and publishes a consensus prime. When three-quarters of surveyed banks change their prime rate, the Wall Street Journal publishes a new consensus rate. Q: How are effective dates of rate changes determined on SchoolsFirst FCU products? A: Each of our variable rate products that are tied to ...

Interest rate rise cannot cool China`s economy

... Since last year, the People's Bank of China has been forced to absorb more than US$10 billion of foreign exchange every month to maintain the fixed exchange rate. The amount in July was still as high as US$12.4 billion. This phenomenon has seriously interfered with the autonomy of China's currency p ...

... Since last year, the People's Bank of China has been forced to absorb more than US$10 billion of foreign exchange every month to maintain the fixed exchange rate. The amount in July was still as high as US$12.4 billion. This phenomenon has seriously interfered with the autonomy of China's currency p ...

mainstream theory ii - American University

... measures labor productivity and N is the labor input, so that AN can be thought of as “effective” units of labor, and Y is output.) Graphically illustrate each variable’s time path following the change. (Assume that the depreciation rate, δ, the technology growth rate, Â, and the labor force growth ...

... measures labor productivity and N is the labor input, so that AN can be thought of as “effective” units of labor, and Y is output.) Graphically illustrate each variable’s time path following the change. (Assume that the depreciation rate, δ, the technology growth rate, Â, and the labor force growth ...

Discussion of External Constraints on Monetary Policy and the Financial Accelerator

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

... (i) Scope of Regime Comparisons in This Paper Paper compares fixed rates with one particular form of flexible rates under two specific shocks. This is a little narrow: • The form of flexibility can matter a lot: E.g. money ...

– 20 No: 2013 Release Date: 16 May 2013

... Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The current policy framework and the decline in commodity prices limit the impact of the increasing e ...

... Recent data suggest that domestic and external demand are evolving in line with expectations. Domestic demand follows a healthy recovery while exports slow down due to weak global economic activity. The current policy framework and the decline in commodity prices limit the impact of the increasing e ...

ITEM

... Measures the rate of change of option value with respect to changes in the underlying asset's price The amount covered or exposed to the derivative. For 1000000 (€, futures and options corresponds to contract size etc.) multiplied by the number of contracts and for swaps and forwards corresponds to ...

... Measures the rate of change of option value with respect to changes in the underlying asset's price The amount covered or exposed to the derivative. For 1000000 (€, futures and options corresponds to contract size etc.) multiplied by the number of contracts and for swaps and forwards corresponds to ...

Week5.1 Money Markets - B-K

... Cash Investments • Text calls all these “money market” investments ...

... Cash Investments • Text calls all these “money market” investments ...

April 2016 - Paragon East Advisors

... The first third of 2016 certainly had its fair share of financial market excitement. The themes that drove markets over the last 8 months (China, Global economic growth, oil and interest rate policies) haven’t changed – what did was their direction or perception of direction. In this month’s newslet ...

... The first third of 2016 certainly had its fair share of financial market excitement. The themes that drove markets over the last 8 months (China, Global economic growth, oil and interest rate policies) haven’t changed – what did was their direction or perception of direction. In this month’s newslet ...

Slide 1

... according to the amount of trade carried out with each trading partners. For example, if the main trading partner is the UK then the action of the currency against pound is likely to be the most important movement. ...

... according to the amount of trade carried out with each trading partners. For example, if the main trading partner is the UK then the action of the currency against pound is likely to be the most important movement. ...

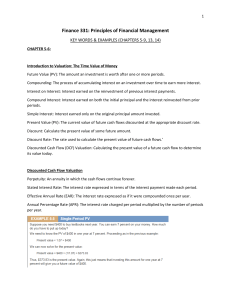

Finance Glossary

... Interest Rates and Bond Valuation Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the ...

... Interest Rates and Bond Valuation Coupon: The stated interest payment made on a bond. Face Value: The principal amount of a bond that is repaid at the end of the term. Also called Par Value. Coupon Rate: The annual coupon divided by the face value of a bond. Maturity: The specified date on which the ...

Homework 3

... between national supply of loanable funds from the private sector at any real interest rate: S = 300*r . The private sector level of demand for loanable funds is also a function of the interest rate, D = 20-100*r. a. Assume government savings is 0. Assume Elbonia’s loanable funds market is closed so ...

... between national supply of loanable funds from the private sector at any real interest rate: S = 300*r . The private sector level of demand for loanable funds is also a function of the interest rate, D = 20-100*r. a. Assume government savings is 0. Assume Elbonia’s loanable funds market is closed so ...

Document

... bonds sold outside the country of currency denomination 1. a financial instrument which gives 2 parties the right to exchange streams of income over time 2. Recent Substantial Market Growth due to use of swaps ...

... bonds sold outside the country of currency denomination 1. a financial instrument which gives 2 parties the right to exchange streams of income over time 2. Recent Substantial Market Growth due to use of swaps ...

29A.1 Deriving AD from the AE model

... In earlier math notes, we derived the formula for equilibrium GDP as the solution to the following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, ...

... In earlier math notes, we derived the formula for equilibrium GDP as the solution to the following equation: Y = C + Ig + G + Xn where C = a(W, E, B, i) + b(Y – T), Ig = f(i, r(A, B, C, K, E)) + ∆V and Xn = Xn(Yf, t, P$). In words, consumption is assumed to be a linear function of disposable income, ...

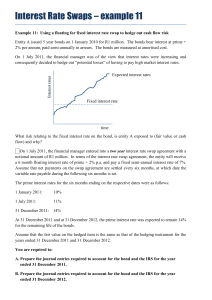

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.