1 - BrainMass

... You want to borrow $1,000 from a friend for one year, and you propose to pay her $1,120 at the end of the year. She agrees to lend you the $1,000, but she wants you to pay her $10 of interest at the end of each of the first 11 months plus $1,010 at the end of the 12th month. How much higher is the e ...

... You want to borrow $1,000 from a friend for one year, and you propose to pay her $1,120 at the end of the year. She agrees to lend you the $1,000, but she wants you to pay her $10 of interest at the end of each of the first 11 months plus $1,010 at the end of the 12th month. How much higher is the e ...

derivative security - the School of Economics and Finance

... …Led to New and Big Markets Exchange-traded derivatives Figure 1.3 Millions of futures contracts traded annually at the Chicago Board of Trade (CBT), Chicago Mercantile Exchange (CME), and the New York Mercantile Exchange (NYMEX), 1970–2006. The CME and CBT ...

... …Led to New and Big Markets Exchange-traded derivatives Figure 1.3 Millions of futures contracts traded annually at the Chicago Board of Trade (CBT), Chicago Mercantile Exchange (CME), and the New York Mercantile Exchange (NYMEX), 1970–2006. The CME and CBT ...

Chapter 14 (13) Exchange Rate Determination

... foreign currency deposits. – When the domestic currency depreciates, the initial cost of investing in foreign currency deposits increases • Appreciation of the domestic currency today raises the expected return of deposits on foreign currency deposits. – When the domestic currency appreciates, the i ...

... foreign currency deposits. – When the domestic currency depreciates, the initial cost of investing in foreign currency deposits increases • Appreciation of the domestic currency today raises the expected return of deposits on foreign currency deposits. – When the domestic currency appreciates, the i ...

questions in real estate finance

... accelerated prepayment decreases yield Coupon rates reflect market rates at time of issue High coupon pass-throughs suffer price compression due to prepayment expectations ...

... accelerated prepayment decreases yield Coupon rates reflect market rates at time of issue High coupon pass-throughs suffer price compression due to prepayment expectations ...

Personal Finance

... The percentage of the value of a balance or debt that one pays or is paid each time period. For example, if one holds a bond with a face value of $1,000 and a 3% interest rate payable each quarter, one receives $30 each quarter. The percentage of the interest rate remains constant (usually), but the ...

... The percentage of the value of a balance or debt that one pays or is paid each time period. For example, if one holds a bond with a face value of $1,000 and a 3% interest rate payable each quarter, one receives $30 each quarter. The percentage of the interest rate remains constant (usually), but the ...

The bright side of higher rates

... Interest rates on U.S. government bonds have increased with market expectations of a Federal Reserve rate hike in December. Rising rates on longer-term bonds reflect optimism about the U.S. economy — growth is accelerating and consumer prices show signs of increasing following an extended period of ...

... Interest rates on U.S. government bonds have increased with market expectations of a Federal Reserve rate hike in December. Rising rates on longer-term bonds reflect optimism about the U.S. economy — growth is accelerating and consumer prices show signs of increasing following an extended period of ...

download soal

... 5. Return investasi bisa berbentuk dua hal yaitu 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will se ...

... 5. Return investasi bisa berbentuk dua hal yaitu 6. Calculate the expected returns for the stock. Its current price is $ 125. Its next expected dividend is $ 21. And you expect to sell it for $ 137 in one year. 7. An analyst projects that a stock will pay a $ 2 dividend next year and that it will se ...

MCQ4 - uob.edu.bh

... a. shift the demand for loanable funds downward. b. shift the supply of loanable funds downward. c. shift the demand and supply for loanable funds upward decreasing interest rates. d. shift the demand and supply for loanable funds upward increasing interest rates. 9. If the actual rate of inflation ...

... a. shift the demand for loanable funds downward. b. shift the supply of loanable funds downward. c. shift the demand and supply for loanable funds upward decreasing interest rates. d. shift the demand and supply for loanable funds upward increasing interest rates. 9. If the actual rate of inflation ...

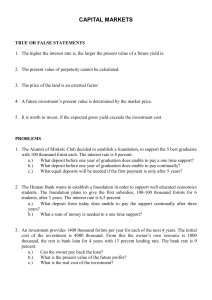

capital markets

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

... forints. He wants to finance it from bank loan. He can choose a 3-year loan with 16 percent interest rate or he can pay back 1 million in every year (three times). In this case the lending rate is 20 percent. The expected yield is 1,5 million per year. Interest rate is 10 percent. a.) Which loan wou ...

Lecture5a - Harbert College of Business

... in the purchasing power of their wealth. – If investors feel the prices of real goods will increase (inflation), it will take increased interest rates to encourage them to place their funds in financial assets. ...

... in the purchasing power of their wealth. – If investors feel the prices of real goods will increase (inflation), it will take increased interest rates to encourage them to place their funds in financial assets. ...

Investing in Stocks Chapter Sixteen

... bond that pays 5.5% interest based on a face value of $1,000 until maturity in 2017. Also assume new corporate bond issues of comparable quality are currently paying 7%. The approximate market value of your Verizon bond is $786 calculated as follows: Dollar amount of annual interest = $1,000 x 5.5% ...

... bond that pays 5.5% interest based on a face value of $1,000 until maturity in 2017. Also assume new corporate bond issues of comparable quality are currently paying 7%. The approximate market value of your Verizon bond is $786 calculated as follows: Dollar amount of annual interest = $1,000 x 5.5% ...

Impact of lower US growth on eastern Europe Willem Buiter

... Respect normal fluctuation margins for ERM without severe tensions for at least 2 years before the examination. No devaluation ‘on own initiative’. [Question: can one ‘respect normal fluctuation margins for ERM’ without being an ERM and therefore an EMU member? If not, at least 2 years of ERMII plus ...

... Respect normal fluctuation margins for ERM without severe tensions for at least 2 years before the examination. No devaluation ‘on own initiative’. [Question: can one ‘respect normal fluctuation margins for ERM’ without being an ERM and therefore an EMU member? If not, at least 2 years of ERMII plus ...

Night of the Living Dead? George Osborne will deliver his second

... As the clearing banks repair their balance sheets, and future bad debt provisions become far less of an issue, they will have far less hesitation in pushing the many business waifs and strays on their portfolios into an appropriate insolvency procedure. ...

... As the clearing banks repair their balance sheets, and future bad debt provisions become far less of an issue, they will have far less hesitation in pushing the many business waifs and strays on their portfolios into an appropriate insolvency procedure. ...

Homework 1

... If a excess demand suddenly appears at the current market price, which of the following could NOT be a possible cause? A) Supply has decreased suddenly and the market has not yet reached a new equilibrium. B) Demand has increased suddenly and the market has not yet reached a new equilibrium. C) Supp ...

... If a excess demand suddenly appears at the current market price, which of the following could NOT be a possible cause? A) Supply has decreased suddenly and the market has not yet reached a new equilibrium. B) Demand has increased suddenly and the market has not yet reached a new equilibrium. C) Supp ...

The Relationship Between Rising Rates And Rising Ringgit

... return. Raising interest rates isn’t a bad thing. It is an indicator of a stronger economy which can now (2006) take on higher interest rates. Factors to Support Rising Rates … It is common knowledge that Malaysia is very much behind the curve when it comes to raising interest rates. Malaysia rais ...

... return. Raising interest rates isn’t a bad thing. It is an indicator of a stronger economy which can now (2006) take on higher interest rates. Factors to Support Rising Rates … It is common knowledge that Malaysia is very much behind the curve when it comes to raising interest rates. Malaysia rais ...

How do Interest Rates Work - Wealthcare Securities Pvt. Ltd.

... The views expressed in this lesson are for information purposes only and do not construe to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of ...

... The views expressed in this lesson are for information purposes only and do not construe to be any investment, legal or taxation advice. The lesson is a conceptual representation and may not include several nuances that are associated and vital. The purpose of this lesson is to clarify the basics of ...

Exponential Worksheet Exponential Growth and Decay 1. Assume

... 9. A promissory note will pay $30,000 at maturity 10 years from now. How much should you be willing to pay for the note now if the note gains value at a rate of 9% compounded semi-annually? ...

... 9. A promissory note will pay $30,000 at maturity 10 years from now. How much should you be willing to pay for the note now if the note gains value at a rate of 9% compounded semi-annually? ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.