Adjustable Rate Mortgage Disclosure

... adjustments. Please ask about our current discount or premium amount. • This type of ARM loan carries a provision for a change in the: Interest Rate and Monthly Payment. • Your payment will be based on the interest rate, loan balance and loan term. • The index used to determine your initial interest ...

... adjustments. Please ask about our current discount or premium amount. • This type of ARM loan carries a provision for a change in the: Interest Rate and Monthly Payment. • Your payment will be based on the interest rate, loan balance and loan term. • The index used to determine your initial interest ...

Interest Rate 1 Interest Rate Interest Rate What is the interest rate

... Essentially, 90 day Treasury bills mature and are extended in 13 weeks. Every week there is a 1/13th portion of the bill that is refunded. ...

... Essentially, 90 day Treasury bills mature and are extended in 13 weeks. Every week there is a 1/13th portion of the bill that is refunded. ...

test two review problems

... • what percentage of the heights are within one standard deviation of the mean? • how many heights are less than 130 cm ? • what height corresponds to the 90th percentile? 5. In the year 2000, a house had a value of $300,000. Every year the value of the house increased by exactly 5%. What was the ho ...

... • what percentage of the heights are within one standard deviation of the mean? • how many heights are less than 130 cm ? • what height corresponds to the 90th percentile? 5. In the year 2000, a house had a value of $300,000. Every year the value of the house increased by exactly 5%. What was the ho ...

How Interest Rates Work

... With every loan, there's a risk that the borrower won't be able to pay it back. The higher the risk that the borrower will default (or fail to repay the loan), the higher the interest rate. That's why maintaining a good credit score will help lower the interest rates offered to you by lenders. ...

... With every loan, there's a risk that the borrower won't be able to pay it back. The higher the risk that the borrower will default (or fail to repay the loan), the higher the interest rate. That's why maintaining a good credit score will help lower the interest rates offered to you by lenders. ...

Concept 6 Kaufman

... organization to achieve the lowest cost of capital possible. Swaps and Other Derivatives A derivative is any sort of contract that manages or adjusts the character of underlying securities whether debt or equity. They allow hospitals to maintain a flexible capital structure. Allows a hospital ...

... organization to achieve the lowest cost of capital possible. Swaps and Other Derivatives A derivative is any sort of contract that manages or adjusts the character of underlying securities whether debt or equity. They allow hospitals to maintain a flexible capital structure. Allows a hospital ...

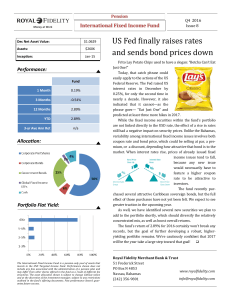

US Fed finally raises rates and sends bond prices down

... easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed inc ...

... easily apply to the actions of the US Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed inc ...

Final February 9, 2002

... b. What is the forward price of the bond for delivery six months from now? (4 marks) c. Show that if the forward price is $1 lower than in your answer to part b, there should be an arbitrage opportunity. Complete the below table.( 7marks) Arbitrage Position Immediate Cash Flow Cash Flow 1 year from ...

... b. What is the forward price of the bond for delivery six months from now? (4 marks) c. Show that if the forward price is $1 lower than in your answer to part b, there should be an arbitrage opportunity. Complete the below table.( 7marks) Arbitrage Position Immediate Cash Flow Cash Flow 1 year from ...

Total Return Swap

... According to reg. 2012, a Brazilian resident may trade derivatives with non-residents, effect payments through the free FX market (avoiding the CC-5 vehicle) and be exempt of income tax if the transaction is aimed at hedging cash flows commited in a foreign currency and / or foreign interest rate ...

... According to reg. 2012, a Brazilian resident may trade derivatives with non-residents, effect payments through the free FX market (avoiding the CC-5 vehicle) and be exempt of income tax if the transaction is aimed at hedging cash flows commited in a foreign currency and / or foreign interest rate ...

Lift Off - Kapstream

... additional 2 million jobs have been created since. The US is moving closer to a balanced budget with forecasts even calling for an eventual budget surplus, the first time in more than 13 years. Spurred by low interest rates, asset prices have risen strongly, stock markets have gained nearly 220% fro ...

... additional 2 million jobs have been created since. The US is moving closer to a balanced budget with forecasts even calling for an eventual budget surplus, the first time in more than 13 years. Spurred by low interest rates, asset prices have risen strongly, stock markets have gained nearly 220% fro ...

Review Questions

... 2) Joe and Jane each buy a two year bond with a 10% yield. After one year yields have fallen to 5%. Joe needs money for a new car so he sells his bond after one year but Jane holds hers to maturity. Who received the higher rate of return on his or her bond? Explain. 3) Use the supply and demand for ...

... 2) Joe and Jane each buy a two year bond with a 10% yield. After one year yields have fallen to 5%. Joe needs money for a new car so he sells his bond after one year but Jane holds hers to maturity. Who received the higher rate of return on his or her bond? Explain. 3) Use the supply and demand for ...

personal finance - Gen i Revolution

... Individual stocks would be considered the savings alternative with the highest risk and highest potential reward, when compared to bonds, certificates of deposit, and stock mutual funds. Certificates of deposit would be considered the savings alternative with the lowest risk and lowest potential ...

... Individual stocks would be considered the savings alternative with the highest risk and highest potential reward, when compared to bonds, certificates of deposit, and stock mutual funds. Certificates of deposit would be considered the savings alternative with the lowest risk and lowest potential ...

Document

... construction based and r.e. profit-based • Unemployment woes severe for some time • Port business could be a plus but California not in control • Budget woes not conducive to attracting new businesses • While not a leader, will make a great follower – human resources, desirability, reputation for in ...

... construction based and r.e. profit-based • Unemployment woes severe for some time • Port business could be a plus but California not in control • Budget woes not conducive to attracting new businesses • While not a leader, will make a great follower – human resources, desirability, reputation for in ...

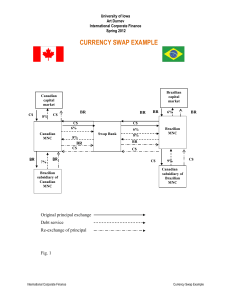

E4 - Art Durnev

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.