What is the Truth in Lending Statement?

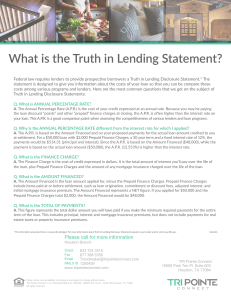

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

... statement is designed to give you information about the costs of your loan so that you can be compare these costs among various programs and lenders. Here are the most common questions that we get on the subject of Truth in Lending Disclosure Statements: Q. What is ANNUAL PERCENTAGE RATE? ...

KAVAR Canvas - Kavar Capital Partners, LLC

... The Fed wants inflation, or more importantly, it wants to avoid deflation. If the virtuous circle mentioned above were just that, then a broad-based drop in prices would jeopardize economic prosperity. The clear lack of price acceleration (the aforementioned negative CPI) has many investors worried ...

... The Fed wants inflation, or more importantly, it wants to avoid deflation. If the virtuous circle mentioned above were just that, then a broad-based drop in prices would jeopardize economic prosperity. The clear lack of price acceleration (the aforementioned negative CPI) has many investors worried ...

chap008-- - MCST-CS

... Factoring Receivables – Example • If $100,000 a month is processed at a 1% commission, and a 12% annual borrowing rate, the total effective cost is computed on an annual basis 1%......Commission 1%......Interest for one month (12% annual/12) 2%......Total fee monthly 2%......Monthly X 12 = 24% annu ...

... Factoring Receivables – Example • If $100,000 a month is processed at a 1% commission, and a 12% annual borrowing rate, the total effective cost is computed on an annual basis 1%......Commission 1%......Interest for one month (12% annual/12) 2%......Total fee monthly 2%......Monthly X 12 = 24% annu ...

It is not appropriate to discount the cash flows of a bond by the yield

... produce differences in duration, convexity and tax liability. Each of these has an impact on bond value. To appropriately price a bond it is necessary to change the perspective. Through Chapter 4 in the text a bond was treated as a package of cash flows. All cash flows were discounted with the same ...

... produce differences in duration, convexity and tax liability. Each of these has an impact on bond value. To appropriately price a bond it is necessary to change the perspective. Through Chapter 4 in the text a bond was treated as a package of cash flows. All cash flows were discounted with the same ...

Mexico

... Didn’t work. Investors too scared of an upcoming devaluation In response to these investor concerns, the Mexican government issued large amounts of short-term, dollar-denominated bonds (tesobonos). Now any devaluation would be the government’s problem. Super vulnerable to a financial market crisis; ...

... Didn’t work. Investors too scared of an upcoming devaluation In response to these investor concerns, the Mexican government issued large amounts of short-term, dollar-denominated bonds (tesobonos). Now any devaluation would be the government’s problem. Super vulnerable to a financial market crisis; ...

Douglass. Rob has focused on these narkets fron the point of

... UnforËunately the reverse also applies. Recent Developnents ...

... UnforËunately the reverse also applies. Recent Developnents ...

Changes to the personal injury discount rate and

... government’s recent change to the personal injury discount rate for insurance (known as the Ogden rate). It is a significant change which will have a substantial impact on the insurance market. We hope this brief explanation will give you an insight into the issues and the consequences, and how they ...

... government’s recent change to the personal injury discount rate for insurance (known as the Ogden rate). It is a significant change which will have a substantial impact on the insurance market. We hope this brief explanation will give you an insight into the issues and the consequences, and how they ...

Future Rate Hikes and Market Volatility

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

... believe this rate hike will occur in December believing that the Fed does not want to be a part of the election dialogue, but this is just speculation. One thing is for certain, we will continue to see market volatility and uncertainty between now and the end of the year. As I mentioned before, we h ...

Interest rate swap

An interest rate swap (IRS) is a liquid financial derivative instrument in which two parties agree to exchange interest rate cash flows, based on a specified notional amount from a fixed rate to a floating rate (or vice versa) or from one floating rate to another. Interest rate swaps can be used for both hedging and speculating.