* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download money_lecs_2_2013_v3_post

Securitization wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Interest rate swap wikipedia , lookup

Present value wikipedia , lookup

Credit rationing wikipedia , lookup

Credit card interest wikipedia , lookup

Interest rate ceiling wikipedia , lookup

Fractional-reserve banking wikipedia , lookup

Quantitative easing wikipedia , lookup

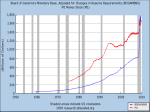

Central banking and the Fed 1 Student balance sheets Generally good job Make sure you understand: - If Liab > Assets, NW is negative - Do not include future income on balance sheet. - Income (flow) v assets (stock) - Include depreciated capital (computer = $1000, depreciation = $600, value of K = $400) 2 Money and finance: The superstars of all time Irving Fisher, Yale (1867-1947) Milton Friedman, Chicago (1912-2006) James Tobin, Yale (1918-2002) 3 How the Fed influences financial markets • Supply of money and reserves determined by central bank (Fed, ECB, …) • Demand for transactions money (M1) from medium of exchange; • Equilibrium of supply and demand for money/reserves → shortterm nominal risk-free interest rate. 4 iff DR SR -Supply and demand diagram for federal funds on daily basis Federal funds interest rate - Fed supplies funds through its open market operations (OMOs) iff* DR SR R* Bank reserves 5 Actual Financial Balance Sheets (pre-crisis 2008:Q1) Central Bank Assets Securities Loans from banks Other Total Commercial banks Liabilities 631 151 150 932 Cu 770 Bank Reserves Vault Cash Deposits Other Total 66.9 46 21 Assets Liabilities Reserves Checkable deposits 66.9 568 Govt sec. 1111 Savings accounts Mortgages 3683 Other 4442 Other 6613 Equity 920 5544 95.1 932 Total 11,474 Total 11,474 Note: the current Fed balance sheet is extremely different and not representative, so I have used an older balance sheet. 6 Actual Financial Balance Sheets (pre-crisis 2008:Q1) Central Bank Assets Securities Loans from banks Commercial banks Liabilities 631 151 Cu Bank Reserves 770 66.9 Assets Liabilities Reserves Checkable deposits 66.9 Govt sec. 1111 Savings accounts Mortgages 3683 Other Banks are required toVault hold reserves against transactions balances. Other 150 Cash 46 Other 6613 Equity Reserves are Total Deposits 21 cash Other plus deposits 932 Total 568 5544 4442 920 at95.1 the Fed. 932 Total 11,474 Total 11,474 Normally, R = hD, where h is required reserve ratio. Note: the current Fed balance sheet is extremely different and not representative, so I have used an older balance sheet. 7 Mechanics of OMO: The Fed buys a security… Fed Commercial banks and primary dealers Assets Bonds Liabilities 1000 Bank borrowings 0 Cu Assets 900 Reserves (bank deposits) 100 Liabilities Reserves (bank deposits) 100 Investments 1000 Checkable deposits Equity 1000 100 8 … and this increases reserves … Fed Commercial banks and primary dealers Assets Bonds Liabilities 1000 +10 Bank borrowings 0 Cu Assets 900 Reserves (bank deposits) 100 +10 Liabilities Reserves (bank deposits) 100 +10 Investments Checkable deposits 1000 -10 Equity 1000 100 1. Fed buys bond. 2. Dealer deposits funds in bank. 3. This creates a credit in the account of the bank at the Fed and voilà! the Fed has created reserves. (red) 9 … and normally this increases investments and M Fed Commercial banks and primary dealers Assets Bonds Liabilities 1000 +10 Bank borrowings 0 Cu Assets 900 Reserves (bank deposits) 100 +10 Reserves (bank deposits) 100 +10 Liabilities Checkable deposits Investments 1000 +100 -10 1. Fed buys bond. 2. Dealer deposits funds in bank. 3. This creates a credit in the account of the bank at the Fed and voilà! the Fed has created reserves. (red) 4. In normal times, the bank lends out the excess, and this leads to money creation (blue). Today, this just increases reserves. Equity 1000 +100 100 10 iff DR SR S’R Increase in reserves lowers federal funds interest rate Federal funds interest rate iff* iff** DR SR R* Bank reserves 11 How does the Fed actually administer monetary policy? 1. 2. 3. 4. Federal Open Market Committee (FOMC) meets 8 times per year to determine the appropriate monetary policy. FOMC = 7 Governors + 5 voting Presidents of regional Federal Reserve Banks + 7 non-voting Presidents. In “normal times,” major Fed instrument is the federal funds target interest rate. This is the overnight interest rate on bank reserves lent and borrowed by banks. The primary decision is the target rate for the federal funds rate. - E.g., in July 2013: “.. the Committee decided to keep the target range for the federal funds rate at 0 to ¼ percent.” 12 5. Actual mechanism: • • • • • Open market operations are arranged by the Domestic Trading Desk at the Federal Reserve Bank of New York (“the Desk”) Every morning, staff decided if an OMO is needed to keep rate near target. Fed contacts the “primary dealers” (e.g., Goldman Sachs, BNP Paribas, Morgan Stanley, etc.) and asks them to make offers Fed generally makes temporary purchases (“repos” = purchase and forward sale, or the reverse) at 10:30 each day, but generally does not enter more than once per day. Because the Fed intervenes only daily, the FF rate can deviate from the target. 6. Then supply and demand for reserves take over 13 iff DR Supply and demand diagram for federal with interest rate target Federal funds interest rate Federal funds rate target iff* DR Bank reserves 14 iff DR Supply and demand diagram for federal with interest rate target Federal funds interest rate Federal funds rate target iff* DR Bank reserves 15 Today’s zero interest and excess reserves 16 iff DR SR S’R Federal funds interest rate iff* iff** DR SR R* Bank reserves 17 When Fed buys reserves today, it just increases excess reserves Fed Commercial banks and primary dealers Assets Bonds Liabilities 1000 +10 Bank borrowings 0 Cu Assets 900 Reserves (bank deposits) 100 +10 Liabilities Reserves (bank deposits) 100 +10 Investments 1000 -10 Checkable deposits Equity 1000 100 1. Fed buys assess backed mortgage (from bank for simplicity) 2. Bank is glad to unload it, and just holds excess reserves. 3. No impact on the money supply or on federal funds rate. A (very small) impact on mortgage interest rates. 18 The federal funds rate hits the zero lower bound 19 Excess reserves 20 Make sure you understand this graph! 3,600 9 8 Excess reserves Federal funds rate 2,800 7 2,400 6 2,000 5 1,600 4 1,200 3 800 2 400 1 0 0 90 92 94 96 98 00 02 04 06 08 10 Fed funds rate (%) Excess Reserves (billions) 3,200 12 21 Recent Fed policies • The Fed has taken many steps to stimulate the economy after the deep recession. But the economy was growing slowly, and unemployment was still high. • What would you do? • It decided to undertake “Operation Forward Guidance.” • This involved making statements about future Fed policy (see next slide). 22 Operation Forward Guidance June 2011: The Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent. The Committee continues to anticipate that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate for an extended period. July 2013: the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. 23 Impact of forward guidance on 8/9/2011 on interest rates 3.00 Treasury rates 2.50 Before 8/9 2.00 After 8/9 1.50 1.00 0.50 1 mo 3 mo 6 mo 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr Maturity 24 Recent term structure interest rates (Treasury) 5 4 3 2 1 Expectations theory says that short rates are expected to rise in coming years. Note that this can explain why Fed makes statement about future rates (look back at Fed statement.) 0 25 Yield to maturity (% per year) Older term structure interest rates (Treasury) 20 9/18/2009 9/17/2008 18 9/19/2006 May-81 In period of very tight money (198182) short rates were very high, and people expected them to fall. 16 14 12 10 8 6 4 2 0 0 5 10 15 20 25 30 Term or maturity of bond 26 Note on theory of the term structure Many businesses and households borrow risky long-term (mortgages, bonds, etc.). These differ from the federal funds rate in two respects: - term structure (discuss now) - risk premium (postpone) The elementary theory of the term structure is the “expectations theory.” It says that long rates are determined by expected future short rates. Two period example (where rt,T is rate from period t to T): (*) (1+r0,2)2 = (1+r0,1) [1+E(r1,2)] With risk neutrality and other conditions, (*) determines term structure. (Finance people find many deviations, but good first approximation.) 27 Example Short rates: 1 year T-bond = 0.41 % per year 2 year T-bond = 1.03 % per year Implicit expected future rate from 1 to 2 is: (1+r0,2)2 = (1+r0,1) [1+E(r1,2)] (1+.0103)2 = (1+ .0041) [1+E(r1,2)] This implies: E(r1,2) = 1.65 % per year [Again, finance specialists point to deviations from this simple theory.] 28 So what was the purpose of Operation Forward Guidance? To lower long run interest rates by lowering expected future short term rates! Problem for students: Go back to two period example above. Assume that second period expected rate goes to 0.3%. What happens to two-period interest rate? 29 Fed funds to short rates 9 Federal funds rate 3 month Treasury bill rate 8 7 6 5 4 3 2 1 0 90 92 94 96 98 00 02 04 06 08 10 12 30 Short rates to long rates 9 10 year T bond 3 month T bill 8 7 6 5 4 3 2 1 0 90 92 94 96 98 00 02 04 06 08 10 12 31 Real interest rate for businesses Real interest rate for businesses rb = risky rate – inflation rate = iff + term premium + risk premium -inflation 32 The real interest rate for business: the cost of capital today is back to normal! Real interest rate for businesses 10 9 Financial crisis 8 7 6 5 4 3 2 1 90 92 94 96 98 00 02 04 06 08 10 12 33