* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Document

Financial economics wikipedia , lookup

Pensions crisis wikipedia , lookup

History of the Federal Reserve System wikipedia , lookup

Greeks (finance) wikipedia , lookup

Business valuation wikipedia , lookup

Quantitative easing wikipedia , lookup

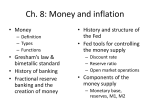

Stagflation wikipedia , lookup

Monetary policy wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Financialization wikipedia , lookup

Money supply wikipedia , lookup

Interbank lending market wikipedia , lookup

Interest rate swap wikipedia , lookup

Continuous-repayment mortgage wikipedia , lookup

Credit rationing wikipedia , lookup

Time value of money wikipedia , lookup

Interest Rates and Bond Prices Chapter 5 © 2003 South-Western/Thomson Learning Learning Objectives Why the interest rate represents the time value of money What are compounding and discounting Why interest rates and bond prices are inversely related Slide 2 Learning Objectives The major determinants of interest rates The relationship between nominal and real interest rates How interest rates fluctuate over the business cycle Slide 3 The Time Value of Money Money represents purchasing power … Short of funds for goods or services? 1. Borrow now and purchase now 2. Save now and purchase later The higher the interest rates the less appealing is #1 the more appealing is #2 Slide 4 The Time Value of Money Lending in present Borrowing in future ENABLES ENABLES Spending in the future the sum of what is lent plus the interest earned Slide 5 Spending in the present, but requires paying back in the future what is borrowed plus interest Compounding and Discounting Compounding Future Values What is the future value of money lent (or borrowed) today AMOUNT REPAID = PRINCIPAL + INTEREST amount of interest INTEREST = PRINCIPAL x INTEREST RATE Slide 6 Compounding and Discounting substituting equation into yields AMOUNT REPAID = PRINCIPAL + ( PRINCIPAL x INTEREST RATE ) AMOUNT REPAID = PRINCIPAL x ( 1 + i ) V1 = V0 ( 1 + i ) Slide 7 Compounding and Discounting V1 = the funds to be received by the lender at the end of one year V0 = the funds lent now This is present value Slide 8 Compounding and Discounting In the second year V2 = V0 (1 + i )2 Vn = V0 (1 + i )n Slide 9 Discounting: Present Values Discounting is backward-looking What is the PRESENT VALUE of money to be received (or paid) in the future? expressed V0 = Vn / (1 + i )n Slide 10 Discounting: Present Values RECAP Compounding: finding the value of a future sum. Discounting: finding the present value of a future sum Future value: Vn of a sum, V0 invested today for n years is V0 ( 1 + i )n Present value: V0, of the sum Vn, to be received in n years is Vn / ( 1 + i )n Slide 11 Interest Rates, Bond Prices, and Present Value To compute the present value of each coupon payment and the present value of the final repayment of the face value on the maturity date. P = C1 / ( 1 + i )1 + C2 / ( 1 + i )2 + … + Cn / ( 1 + i )n + F / ( 1 + i )n Slide 12 P = the price (present value) of the bond C = the coupon payment on the bond (C1 in year 1, C2 in year 2 etc. F = the face or par value of the bond i = the interest rate n = the number of years to maturity (on a five-year bond, n=5) Interest Rates, Bond Prices, and Present Value Discount from par - raises the yield on the bond, called the yield to maturity Premium above par – a price above par value There is an inverse relationship between the price of outstanding bonds trading in the secondary market and the prevailing level of market interest rates. If bond prices are rising, then interest rates are falling, and vice versa. Slide 13 Interest Rates, Bond Prices, and Present Value RECAP The price of the bond is the discounted value of the future stream of income over the life of the bond. When the interest rate increases, the price of the bond decreases. When the interest rate decreases, the price of the bond increases. Slide 14 Determinants of Interest Rates Demand for loanable funds – downward-sloping demand curve indicates that DSU’s are willing to borrow more at lower interest rates Supply of loanable funds – originates The household, business, government and foreign SSUs who are prepared to lend The Fed, which, in its ongoing attempts to manage the economy’s performance, supplies reserves Slide 15 Exhibit 5–3 The Supply of and Demand for Funds Slide 16 Determinants of Interest Rates Changes in the demand for loanable funds Movements in gross domestic product (GMP) When GMP rises Firms & households become more willing and able to borrow Firms expand inventory & engage in investment spending Slide 17 Households willing to borrow, increased incomes, and/or improved employment outlook Exhibit 5–4 A Shift in the Demand for Funds Slide 18 Determinants of Interest Rates Changes in the demand for loanable funds Increase their purchases of goods and services, particularly Auto Durable goods Items that require financing Houses Easier to make the interest and principal payments on new debt Increase in anticipated productivity of capital investment Slide 19 • Lead to a greater demand for capital investment & hence increase the demand for loanable funds Determinants of Interest Rates Changes in the supply of funds Monetary policy Disequilibrium – the quantity supplied of funds exceeds the quantity demanded As interest rates fall, DSUs & SSUs revise their borrowing and lending plans Increase in the money supply will lower the interest rates Decrease in the money supply will raise the interest rates Slide 20 A Shift in the Supply of Funds i = f ( Y+,M¯ ) The interest rate is a positive function of income or GDP, Y and negative function of the money supply, M Slide 21 Exhibit 5–5 A Shift in the Supply of Funds Slide 22 Determinants of Interest Rates RECAP The demand for loanable funds originates from DSUs The quantity demanded is inversely related to the interest rate The supply of loanable funds originates from SSUs and from Fed The quantity supplied is directly related to the interest rate If the money supply increases, the supply of loanable funds increases and the interest rate falls: i = f ( Y+,M¯ ) Slide 23 Inflation and Interest Rates Lenders are concerned about Nominal interest Inflation Slide 24 Inflation and Interest Rates Nominal interest rate is not an adequate measure of the real return on an interestbearing financial asset unless there is assurance of price stability. Appropriate measure is the real interest rate, which is the return on the asset corrected for changes in the purchasing power of money. Slide 25 Inflation and Interest Rates Money illusion is said to occur when investors react to nominal changes even though no changes in real interest rates or other real variables have occurred. i = r + pe The equation says that nominal interest rate has parts: a real interest rate, r, and an inflation premium Slide 26 i = r - pe Inflation and Interest Rates Major price indexes Consumer Price Index (CPI) CPI is designed to measure changes in the cost of goods and services purchased by a typical urban consumer Producer Price Index (PPI) PPI measures the changes in the cost of goods and services purchased by a typical producer Inflation rate is generally measured by the Slide 27 percentage change in one of these price indexes. Inflation and Interest Rates Expectations of inflation affect portfolio choices that help determine the demand and supply of loanable funds i = f ( Y+,M¯, p+ e ) Nominal interest rate is positively related to the expected inflation rate Slide 28 Inflation and Interest Rates RECAP Slide 29 The nominal interest rate is the real interest rate plus the expected inflation rate Money illusion occurs when investors react to nominal changes when no real changes occurred If expected inflation increases, the nominal interest rate will rise Nominal interest rates are correlated with expected inflation i = f ( Y+,M¯, p+ e ) The Cyclical Movement of Interest Rates Slide 30 Stages of the business cycle are the recession trough, expansion, and peak Interest rates tend to fluctuate procyclically-that is, they move with the business cycle, rising during expansions and falling during recessions