* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download P a p e r 1 . 2 ... f i n a n c i a l ... 1 8 F e b r u a...

United States housing bubble wikipedia , lookup

Present value wikipedia , lookup

Credit rationing wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Reserve currency wikipedia , lookup

Purchasing power parity wikipedia , lookup

Interest rate swap wikipedia , lookup

Global saving glut wikipedia , lookup

International monetary systems wikipedia , lookup

Financialization wikipedia , lookup

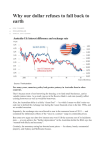

18 February 2005 Paper 1.2 Key developments in financial markets Macro-financial Advice: SUMMARY David Drage x 3819 Global long-term interest rates have fallen and yield curves have flattened since December. Although there are many contributing factors, this would tend to suggest markets are increasingly confident that inflation will remain well contained and economic growth will be solid, but unspectacular, going forward. The US dollar has rebounded since December, as markets have focused more on the relatively strong cyclical position of the US economy and less on the US current account deficit. Despite the resurgence in the US dollar, the New Zealand TWI has continued to appreciate, in line with upside surprises to recent domestic data. Markets have revised up their OCR expectations after a string of upside surprises to domestic data. Markets are pricing a slightly better than even chance of another rate rise by the middle of this year. Although mortgage rates have risen since December, market contacts suggest there is a risk of another price war this year. Clinton Watkins x 3967 Nick Smyth X 3787 Daniel Wills x 3815 Christina Leung x 3642 GLOBAL BACKDROP Global yield curves have flattened since December Global yield curves have flattened since December as markets have revised up monetary policy expectations in most economies (particularly Australia) and as long-term interest rates have generally fallen (see graph below). Global yield curves have continued to flatten since the Decmber MPS basis points change in 2 year government bond rates change in 10 year government bond rates 60 50 40 30 20 10 0 -10 -20 Australia Ref #161574 US UK NZ ECB Japan Canada 2 Markets expect the Fed to continue to be “measured” Fed Funds rate (%) The US yield curve has led the way, flattening considerably since the December MPS, as short-term interest rates have risen and long-term interest rates have fallen. Markets are confident that the Fed will continue to raise the Fed funds rate at a “measured” pace because of some slightly stronger than expected US economic data and some hawkish comments from Fed officials. Fed officials have signalled that the Fed funds rate is still accommodative. The market’s central view is that the Fed will gradually return the Fed funds rate to more ‘neutral’ levels around 3.50%, at which point the Fed can wait and see how the economy is functioning (see graph below). Markets expect the Fed will raise rates at the next 2 meetings before possibly pausing around the middle of the year (As derived from OIS rates without a term premium) 3.75 3.50 3.25 3.00 2.75 2.50 The majority of traders and analysts see the Fed funds rate at around 3.5% by the end of 2005 2.25 2.00 Just after the December MPS 1.75 1.50 Today, 18 February 1.25 1.00 0.75 Jan 04 Mar 04 May 04 The fall in US long-term interest rates a ‘conundrum’ Jul 04 Sep 04 Nov 04 Jan 05 Mar 05 May 05 Jul 05 Sep 05 Nov 05 At first glance, the relatively low level of long-term US interest rates might seem unusual. Current levels of economic growth and inflation would tend to suggest higher long-term interest rates (see graph below). Economic theory suggests that long-term (risk-free) interest rates should equal the return on capital in an economy (which is, roughly speaking, growth in real GDP), and an inflation premium. Fed Chairman Alan Greenspan recently said that the current levels of long-term rates were a “conundrum”. US 10-year interest rates seem too low compared to current US growth and inflation rates - Greenspan's 'Conundrum ' % 20 Real GDP Inflation (GDP deflator) US 10 year interest rate 15 10 5 0 -5 1980 Ref #161574 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 3 ‘Nonfundamental’ factors have pushed US longterm rates lower Market participants, as well as the Fed Chairman, agree that ‘non-fundamental’ factors have contributed to the low level of US long-term rates, although there is no consensus about how important these factors have been. These factors include investment in long-term bonds associated with the ‘carry trade’ (discussed further below), pension funds buying long-term bonds to increase the durations of their portfolios, and Asian central banks buying US government bonds as part of their foreign exchange intervention programmes. …But low US long rates might reflect lower growth expectations But long-term interest rates also tend to reflect market expectations of growth and inflation going forward. Although there are numerous explanations for why US long-term interest rates are relatively low, this would tend to suggest that markets expect inflation will remain well contained and economic growth will be solid, but unspectacular, going forward. The market’s view of US economic growth, as suggested by long-term real interest rates, appears considerably lower than consensus forecasts (see graph below). Consensus forecasts seem far more optimistic about US growth prospects than do markets % 5.0 4.0 3.0 US real yields (TIPS) 2.0 US GDP growth (3yr avg) with consensus for 05 and 06... with lowest forecasts for 05 and 06 1.0 with highest forecasts for 05 and 06 0.0 1997 1998 Equity markets have continued to rise, buoyed by strong corporate earnings 1999 2000 2001 2002 2003 2004 2005 2006 2007 In contrast to the falling US long-term interest rates, US equity markets have risen since the December MPS, boosted by solid corporate earnings and some stronger than expected macroeconomic data. Two-thirds of corporates have reported earnings that beat expectations, and earnings growth was broad-based across industries (all industries reported positive earnings growth). US corporate earnings were again very strong in the December quarter, although markets expect earnings to moderate going forward % growth (S&P500 earnings announcement data) 30 20 10 0 Estimate with 73% firms having reported -10 Estimated earnings growth (start of the quarter) -20 Actual earnings growth Ref #161574 3Q 05 2Q 05 1Q 05 4Q 04 3Q 04 2Q 04 1Q 04 4Q 03 3Q 03 2Q 03 1Q 03 4Q 02 3Q 02 2Q 02 1Q 02 4Q 01 3Q 01 2Q 01 1Q 01 4Q 00 3Q 00 2Q 00 1Q 00 -30 4 But markets expect earnings growth to moderate going forward But broad equity market trends also tend to support a story of contained inflation expectations and solid, but unspectacular, growth prospects. First, annual growth in equity prices has moderated over the past few quarters (see graph below). Second, current and future earnings growth has been revised down in the consumer sector. The consumer sector is pro-cyclical and is therefore considered a barometer of economic conditions. Third, markets expect growth in corporate earnings to slow from current levels over the year ahead (see graph above). Growth in equity prices is moderating, maybe reflecting lower GDP expectations going forward % change yoy 10 Real GDP year on year % change % change yoy 60 S&P500 year on year % change advanced 2 quarters 8 40 6 20 4 2 0 0 -20 -2 -4 1980 -40 1982 1984 Corporate bond spreads have narrowed… 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 Consistent with recent strong corporate earnings, corporate bond spreads have continued to narrow since December (see graph below). The corporate bond spread reflects the greater risk that corporate bonds carry relative to government bonds. Although corporate earnings suggest that US balance sheets are in relatively strong shape, the very narrow level of spreads has started to worry some policymakers. Fed Chairman Alan Greenspan and ECB president JeanClaude Trichet have recently said that some investors might be taking excessive risks. US corporate bond spreads have reached near record low levels, implying that markets are confident about the economy's future prospects % US real GDP (LHS) Merril Lynch high yield corporate bond spread (RHS, inverted) 6 basis points 0 5 200 4 400 3 2 600 1 800 0 1000 -1 -2 1987 Ref #161574 consensus forecasts 1200 1989 1991 1993 1995 1997 1999 2001 2003 2005 5 …driven in part by low shortterm rates – the ‘carry trade’ A key driver behind the strong demand for corporate bonds and other risky assets has been the low level of global short-term interest rates over the past few years. Many investors have borrowed money at low short-term interest rates and invested the money in assets that pay a higher return, including corporate bonds and long-term government bonds. Some analysts believe that this investment in long-term US government bonds has played a significant role in keeping longterm US rates so low. The popularity of the ‘carry trade’ suggests that investors are implicitly counting on continued solid economic growth and a restrained Fed tightening cycle. Markets revise up monetary policy expectations slightly Markets have revised up monetary policy expectations slightly in most economies as central banks have remained upbeat on economic outlooks. Markets expect most major central banks will tighten rates around the middle of this year, with the exceptions of the US Federal Reserve (as discussed earlier) and the Reserve Bank of Australia. Central bank actions and expected policy moves Central Bank [Next rate decision] US Reserve Federal Expected timing of next move Market Prices Analysts +25 in Mar 2005 +25 in Mar 2005 Net change in policy rate since January 2004 [Last move] +150 Level of policy rate 2.50 % [+25 on 3 Feb 2005] [14 December] Reserve Bank of New Zealand +25 in June 2005 on hold in 2005 +150 6.50 % [+25 on 28 Oct 2004] [10 March] Reserve Bank of Australia +25 in March 2005 +25 in 2005 March 0 5.25 % [+25 on 3 Dec 2003] [2 March] Bank of England [10 February] European Bank Central On hold until mid 2005 +25 in mid/late 2005 +100 +25 in mid 2005 +25 in 2005 0 Sept [+25 on 2004] 4.75 % 5 August 2.00 % [-25 on 6 Jun 2003] [3 March] Bank of Canada [1 March] Markets revise up Australian interest rate expectations Ref #161574 +25 in mid 2005 +25 in mid/late 2005 -25 2.50 % [+25 on 18 Oct 2004] The exception to the global trend recently has been Australia. A recent string of stronger than expected Australian economic data and some hawkish comments from the Reserve Bank of Australia (RBA) have caused markets to substantially revise up Australian interest rate expectations. With the RBA recently making it clear that rate rises are back on the near-term agenda, markets have priced in two tightenings over the next three meetings. Despite a rise in long-term interest rates, the Australian yield curve remains inverted, suggesting that markets expect the Australian economy to slow going forward. 6 RBA cash rate expectations have increased considerably since December after strong economic data and hawkish comments from the RBA Basis points (RBA cash rate expectations based on OIS rates, without a term premium) % 100 6.00 5.75 5.50 Change since 10 December (RHS) 90 December 10 80 Today, February 18 70 60 50 5.25 40 5.00 30 20 4.75 10 0 Markets less concerned with oil prices Nov-05 Sep-05 Jul-05 May-05 Mar-05 Dec-04 Oct-04 Aug-04 Jun-04 Apr-04 Feb-04 Nov-03 Sep-03 Jul-03 4.50 Oil prices have played a less important role in interest rate and growth expectations since the December MPS. Oil prices have risen since December, mainly because of OPEC threatening to cut production, and cold weather in the US north-east, a large consumer of heating oil. However, oil prices remain well below the highs reached in the middle of 2004 (see graph below). Oil prices have risen since the December MPS, although current prices are well below the highs in mid-2004 $/barrel (West texas intermediate, first crude oil contract) 60 average since December MPS = $45 per barrel 55 50 average in 2004 = $41 per barrel 45 40 35 30 25 20 15 Jan-02 May-02 Markets are beginning to anticipate higher oil prices for longer Ref #161574 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 Markets appear more comfortable that oil prices will remain around current levels going forward, as suggested by a narrowing in the spread between near-dated and long-dated oil futures contracts (see graph below). The spread between near-dated and long-dated oil futures contracts is suggestive of how much markets expect oil prices to change going forward. Undoubtedly, recent comments from OPEC officials have contributed to this sentiment. The OPEC president said that the world economy can sustain oil prices at current levels and implied that OPEC would cut production to maintain current oil prices. 7 One-year ahead oil prices are now relatively close to current oil prices, suggesting markets are getting used to the idea of oil near $50 per barrel (20 day moving average of the spread between the 12th and 1st crude oil futures contracts) $/barrel -6 expect oil prices to rise in the future -4 -2 0 2 4 6 expect oil prices to fall in the future 8 10 12 1989 1991 1993 1995 1997 1999 2001 2003 2005 CURRENCY MARKETS US dollar has appreciated since December… The US dollar has rebounded since the December MPS, and particularly since the New Year, as cyclical factors such as interest rate differentials have played a more important role in currency markets. Short-term US interest rates are now higher than those in Canada and the Eurozone. Throughout the latter part of 2004, structural factors, in particular the US twin current account and fiscal deficits, dominated the minds of currency traders, and caused the US dollar to depreciate. The resurgence of the US dollar has now caused some uncertainty over where the US dollar will go from here – will the market’s focus return to the twin deficits, or will expectations of further Fed tightenings continue to support the US dollar? The two contrasting views in currency markets are outlined briefly in the table below. Expect the US dollar to depreciate going forward The recent US dollar rebound is mainly the result of investors closing out bets that the US dollar will depreciate rather than investors putting on bets that the US dollar will appreciate. Therefore, the recent US dollar appreciation should not be taken as an indication of confidence in the currency. The US dollar needs to depreciate further to entice foreigners to lend money to the US to fund the US current account deficit. Ref #161574 Expect the US dollar to appreciate going forward Currency traders are now focusing more on the relative cyclical positions of countries. US economic prospects look far rosier than many of its trading partners. US short-term interest rates are now higher in the US than in Europe, and Canada. Therefore, traders will find it more expensive to bet on the US dollar depreciating against these currencies. 8 This uncertainty in currency markets is reflected in the small net position that speculative investors are holding on the US dollar (see graph below). Speculative investors tend to build up large positions when they are confident about the future direction of the currency. …Causing uncertainty in currency markets Speculative investors are holding almost a zero net position on the US dollar, implying they are uncertain whether it will appreciate of depreciate net position (The speculative position is calculated as a weighted average of the net positions of the Euro, Yen, Pound, CAD and Swiss Franc where the weights are determined by dollar index, DXY) 20000 DXY 125 investors expect USD appreciation 120 10000 115 0 110 -10000 105 -20000 100 -30000 95 -40000 investors expect USD depreciation 90 -50000 85 speculative positioning on US dollar (LHS) DXY, dollar index (RHS) -60000 80 2001 2002 Asian currencies up, European currencies down 2003 2004 2005 In contrast to much of 2004, Asian currencies have performed much better than European currencies over the last three months (see graph below). Why the turnaround? First, Asian countries have been under increased political pressure from European and American officials to bear more of the US dollar adjustment process to the US current account deficit. China has been the main focus of the political attention because many officials believe its fixed exchange rate is undervalued against the US dollar. Second, speculation that China might revalue its currency higher has contributed slightly to Asian currency strength. Despite the speculation, Chinese officials have remained adamant that they will move in their own time – markets expect this to occur sometime next year. Asian currencies have been among those to appreciate most against the US dollar since the December MPS , along with the Australian and New Zealand dollars 6.2 Brazil Real Australian Dollar South Korean Won Mexican Peso Taiwan Dollar New Zealand Dollar Japanese Yen Singapore Dollar Canadian Dollar British Pound Euro Danish Krone Swedish Krone South African Rand Swiss Franc Norwegian Krone 5.2 4.0 3.0 2.8 2.2 1.0 1.0 -0.2 -1.5 -1.8 -1.9 -2.5 -2.6 -3.0 -4.1 -6 Ref #161574 -4 -2 0 2 4 6 (percentage change in currency against the US dollar since December MPS ) 8 9 But NZ and Australian dollars continue to rise Despite Asian currencies bearing more of the US dollar adjustment process recently, the New Zealand and Australian dollars have continued to appreciate strongly (see right-hand graph below). Given the extent of the New Zealand and Australian dollar appreciations over the past three years (see left-hand graph below), we might have expected these currencies – like the European currencies – to have borne relatively less of the US dollar adjustment process recently. The continued appreciations of the New Zealand and Australian dollars are indicative of the strong cyclical positions of their respective economies and upward revisions to interest rate expectations. % change in currency blocs since the US TWI peaked at the start of 2002 European and Australasian currencies have % change borne the brunt of the US dollar weakness since early 2002 (when the US TWI peaked) 70 % change in currency blocs since the December MPS Although Asian currencies have been bearing more of the US dollar weakness recently, Australasian % change currencies have still appreciated strongly 5 4 3 2 1 0 -1 -2 -3 60 50 40 30 20 10 0 Asia Canada and UK Uridashi issuance very strong Europe NZ and Australia Asia Canada and UK Europe NZ and Australia Consistent with strong foreign demand for New Zealand and Australian investments, Uridashi and Eurokiwi bond issuance has continued at a rapid pace since December. In New Zealand’s case, issuance has already hit record levels this month. Issuance not only creates demand for New Zealand dollars, but the capital inflows contribute to funding New Zealand’s current account deficit. However, recent issuance has built up a large volume of maturities from 2006 to 2008, which represents a downside risk to the New Zealand dollar, particularly if narrower interest rate differentials lead to less issuance over that period. Uridashi and Eurokiwi bond issuance hit record highs in 2004 and has continued to be very strong in early 2005 Issues Maturities 27,500 Outstanding (RHS) 3,000 25,000 2,500 22,500 2,000 20,000 1,500 17,500 1,000 15,000 500 12,500 0 10,000 -500 7,500 -1,000 5,000 -1,500 2,500 -2,000 1994 0 Australian dollar offsetting some of the rise in the NZ TWI Ref #161574 1996 1998 2000 2002 2004 2006 2008 Total outstanding (NZ$million) Bonds maturing/issued (NZ$million) 3,500 2010 The New Zealand TWI has continued to strengthen since December, and is now nearing historically high levels. The only currency that has offset the rise in the TWI since December has been the Australian dollar, which has appreciated significantly, in line with markets revising up Australian interest rate expectations. 10 The New Zealand dollar had fallen recently against the Australian dollar, as markets revise up Australian interest rate expectations (the interest rate referred to is an equally weighted average of the first three bank bill futures rates) Spread between NZ and AU interest rates (LHS) spread/bp NZD/AUD NZD/AUD (RHS) 160 0.96 140 Interest rate expectations have driven recent moves in the NZD/AUD 120 0.94 0.92 100 80 0.9 60 0.88 40 0.86 20 0.84 0 -20 Jan-03 0.82 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 As shown in the chart below, the New Zealand TWI is generally expected to depreciate during 2005. While a weak US dollar environment and New Zealand's relatively high interest rates are generally expected to provide some ongoing support, analysts point to the prospect of slowing growth and a widening current account deficit as reasons for the NZ dollar to weaken. The December MPS TWI projections remain broadly in line with analyst views, but are towards the upper end of the range - the December MPS H2 2005 average of 67¾ contrasts with a median analyst forecast of 64.0 for December 2005. The December MPS TWI projections for 2005 are towards the upper end of current market views Analysts expect the TWI to fall in 2005 TWI 70 December MPS projection 67 Median analyst forecast 64 61 Range of analyst forecasts 58 55 Mar-03 Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05 Sep-05 Dec-05 NEW ZEALAND MARKETS Markets revise up OCR expectations Ref #161574 Markets have significantly revised up OCR expectations since the December MPS (see graph below) after a string of upside surprises to domestic economic data (including employment, inflation, and house price data). Markets are now pricing in a 40% chance of a rate rise at the March meeting and 55% chance of a 11 rate rise by the middle of this year. Market expectations differ from the broad analyst consensus that the OCR will remain on hold throughout 2005 (although a minority of analysts expect another rate rise). Markets are now pricing in a rate rise over the first half of this year after a string of upside surprises to domestic data % (OCR expectations based on OIS rates, without a term premium) Basis points 50 6.75 Change since December MPS (RHS) 6.50 45 Just after the January OCR Review 6.25 40 Today, 18 February 35 Just after the December MPS 6.00 30 5.75 25 20 5.50 15 5.25 10 5.00 5 0 NZ yield curve inverts further Dec-05 Oct-05 Sep-05 Jul-05 Jun-05 Apr-05 Mar-05 Jan-05 Dec-04 Oct-04 Sep-04 Jul-04 Jun-04 Apr-04 Mar-04 Jan-04 Dec-03 Oct-03 Sep-03 Jul-03 Jun-03 Apr-03 Mar-03 4.75 Although OCR expectations have risen, the New Zealand yield curve has continued to invert. That is, short-term rates have risen further whereas long-term rates have been held down by low global rates (as discussed earlier). The inverted yield curve is consistent with expectations that the New Zealand economy will slow going forward as the full effects of the rate rises in 2004 flow through to economic activity. The NZ yield curve has inverted further since the December MPS, suggesting that markets believe the NZ economy will slow going forward Basis points % (spread between 10-year and 1-year government bond yields) 300 4 250 positive slope 200 5 150 100 6 50 0 -50 -100 1999 Mortgage war ends, but for how long? Ref #161574 7 10-year 1-year interest rate spread (LHS) 2000 2001 2002 OCR (RHS) 2003 inverted slope 2004 8 2005 Fixed mortgage rates have increased since December as New Zealand swap rates have increased and as banks have called an end to the mortgage war. Banks tend to hedge the funding costs of their fixed rate mortgages through the swap market, so the rise in swap rates (particularly the two year rate) has increased the cost of providing mortgages. Despite the rise in funding costs, 12 market contacts suggest that the mortgage war could resume sometime this year and drive down retail mortgage rates. Two year fixed mortgage rates have rebounded from their preChristmas lows, as the mortgage price war came to an end % 9.0 2yr fixed mortgage rate 2yr swap rate 2yr govt bond yield 8.5 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 2000 2001 2002 2003 2004 2005 For the time being, the effective mortgage rate continues to rise gradually - in line with the projections made in the December MPS (as shown in the chart below). However, should longer term wholesale interest rates remain relatively low and/or the mortgage war resume, there is a risk that the effective mortgage rate will evolve more in line with the low scenario. In line with the December MPS projections, the effective mortgage rate has gradually risen % 9.0 Effective Mortgage Rate OCR 8.5 High scenario Low scenario 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 Dec 98 Ref #161574 Jun 99 Dec 99 Jun 00 Dec 00 Jun 01 Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 Jun 05 Dec 05 Jun 06 Dec 06