ppt_montreal_crise

... Bernhard, William, Lawrence Broz and William Roberts Clark, “The Political Economy of Monetary Institutions”, International Organization, 56(4), 2002, p. 698 ...

... Bernhard, William, Lawrence Broz and William Roberts Clark, “The Political Economy of Monetary Institutions”, International Organization, 56(4), 2002, p. 698 ...

chapter one - ResearchOnline@JCU

... hedging programs, which are both financial and operational in nature. It is notable that there has been an increase in financial hedging techniques such as derivatives and foreign-currency denominated debt, and operational hedging such as diversifying and spreading subsidiaries across foreign countr ...

... hedging programs, which are both financial and operational in nature. It is notable that there has been an increase in financial hedging techniques such as derivatives and foreign-currency denominated debt, and operational hedging such as diversifying and spreading subsidiaries across foreign countr ...

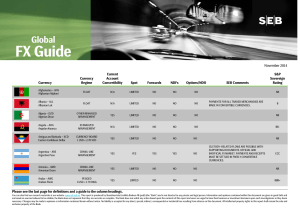

Global FX Guide

... are based on sources believed to be reliable; the Bank does not represent that they are accurate or complete. The Bank does not solicit any action based upon the contents of this report and users are urged to base their business or investment decisions upon such investigations as they deem necessary ...

... are based on sources believed to be reliable; the Bank does not represent that they are accurate or complete. The Bank does not solicit any action based upon the contents of this report and users are urged to base their business or investment decisions upon such investigations as they deem necessary ...

mmi07 Cheung 4357324 en

... mercantilist approach, pursue the export-led growth strategy followed by the post-war Europe and Japan, and, hence, accumulate international reserves. According to their view, international reserve accumulation is a by-product of the development strategy that promotes exports with an undervalued cur ...

... mercantilist approach, pursue the export-led growth strategy followed by the post-war Europe and Japan, and, hence, accumulate international reserves. According to their view, international reserve accumulation is a by-product of the development strategy that promotes exports with an undervalued cur ...

Arbitrage in the foreign exchange market

... Arbitrage is one of the fundamental pillars of financial economics. ...

... Arbitrage is one of the fundamental pillars of financial economics. ...

NBER WORKING PAPER SERIES

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

MultiFractality in Foreign Currency Markets

... and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do we assert that the EMH does not hold. We acknowledge that market efficiency is currently the central theory of financial economics, at least until a new theory is proposed as a better explan ...

... and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do we assert that the EMH does not hold. We acknowledge that market efficiency is currently the central theory of financial economics, at least until a new theory is proposed as a better explan ...

Document

... (1) no separate legal tender: The currency of another country circulates as the sole legal tender (formal dollarization), or the member belongs to a currency union in which the same legal tender is shared by the members of the union. (2) currency board: A monetary regime based on an explicit legis ...

... (1) no separate legal tender: The currency of another country circulates as the sole legal tender (formal dollarization), or the member belongs to a currency union in which the same legal tender is shared by the members of the union. (2) currency board: A monetary regime based on an explicit legis ...

International Monetary Review

... devaluation of 12%, according to data from the Bank for International Settlements. The movement has accelerated since the ECB started large purchases of government bonds earlier this month, much of which involves encouraging foreign official holders to sell their euro reserves, often being exchanged ...

... devaluation of 12%, according to data from the Bank for International Settlements. The movement has accelerated since the ECB started large purchases of government bonds earlier this month, much of which involves encouraging foreign official holders to sell their euro reserves, often being exchanged ...

Independent-Transactions

... of past transactions or events. [Footnote references omitted.] 78823 other entities in the future as a result of past transactions or 87331 of past transactions or events. [Footnote references omitted.] 103815 obligation to pay exists as a result of past events or transactions…104773 as a result of ...

... of past transactions or events. [Footnote references omitted.] 78823 other entities in the future as a result of past transactions or 87331 of past transactions or events. [Footnote references omitted.] 103815 obligation to pay exists as a result of past events or transactions…104773 as a result of ...

Lessons Combined - Federal Reserve Education

... matured, the bondholder is paid back. Investment banks receive a fee for these services. • Lender of last resort – The Federal Reserve’s role in providing short-term loans to financial institutions or markets to help calm financial panics. Explain that when banks want to borrow money, they usually ...

... matured, the bondholder is paid back. Investment banks receive a fee for these services. • Lender of last resort – The Federal Reserve’s role in providing short-term loans to financial institutions or markets to help calm financial panics. Explain that when banks want to borrow money, they usually ...

Dreher ge08 6483485 en

... disburse its money even though implementation of conditions has been poor, for example because it feels that significant progress has been made, or even for political reasons. It is not surprising that authors who concentrate on proxies that examine the percentage of IMF loans agreed but left undraw ...

... disburse its money even though implementation of conditions has been poor, for example because it feels that significant progress has been made, or even for political reasons. It is not surprising that authors who concentrate on proxies that examine the percentage of IMF loans agreed but left undraw ...

NBER WORKING PAPER SERIES THE FUTURE OF EMU: WHAT DOES

... THE FUTURE OF EMU. WHAT DOES THE HISTORY OF MONETARY UNIONS TELL US? ...

... THE FUTURE OF EMU. WHAT DOES THE HISTORY OF MONETARY UNIONS TELL US? ...

Essays in International Economics

... features of the Croatian economy in our model we extend the framework of Goncalves (2007). An analytical expression of optimal reserves is derived and calibrated for Croatia in order to evaluate the adequacy of the Croatian National Bank foreign reserves. We show that the precautionary demand for re ...

... features of the Croatian economy in our model we extend the framework of Goncalves (2007). An analytical expression of optimal reserves is derived and calibrated for Croatia in order to evaluate the adequacy of the Croatian National Bank foreign reserves. We show that the precautionary demand for re ...

FX Options and Structured Products

... solve and can serve as incentives to further research and testing. Solutions to the exercises are not part of this book, however they will be published on the web page of the book, www.mathfinance.com/FXOptions/. ...

... solve and can serve as incentives to further research and testing. Solutions to the exercises are not part of this book, however they will be published on the web page of the book, www.mathfinance.com/FXOptions/. ...

Exchange Rate Policies in Arab Countries

... exchange rate regime, the conclusions they yield are not model-free. In this respect, we review and assess certain aspects of traditional as well as newer results in the context of Arab countries. The growing consensus emerged among policymakers and academics alike, that there may not be a single ri ...

... exchange rate regime, the conclusions they yield are not model-free. In this respect, we review and assess certain aspects of traditional as well as newer results in the context of Arab countries. The growing consensus emerged among policymakers and academics alike, that there may not be a single ri ...

Reserve currency

A reserve currency (or anchor currency) is a currency that is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The reserve currency is commonly used in international transactions and often considered a hard currency or safe-haven currency. People who live in a country that issues a reserve currency can purchase imports and borrow across borders more cheaply than people in other nations because they don't need to exchange their currency to do so.By the end of the 20th century, the United States dollar was considered the world's most dominant reserve currency, and the world's need for dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion per year. However, the U.S. dollar's status as a reserve currency, by increasing in value, hurts U.S. exporters.