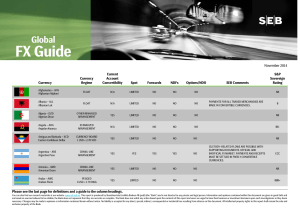

Global FX Guide

... Please see the last page for definitions and a guide to the column headings. You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and op ...

... Please see the last page for definitions and a guide to the column headings. You can also find our research materials at our website: www.mb.seb.se. This report is produced by Skandinaviska Enskilda Banken AB (publ) (the "Bank") and is not directed to any private and legal person. Information and op ...

Macroeconomics, 10e, Global Edition (Parkin) Chapter 26 The

... D) the transaction shows up in the U.S. capital account. Answer: B Topic: Financing International Trade Skill: Conceptual Question history: Previous edition, Chapter 9 AACSB: Reflective Thinking 5) Americans demand Japanese yen in order to A) buy Japanese products. B) supply American goods in Japane ...

... D) the transaction shows up in the U.S. capital account. Answer: B Topic: Financing International Trade Skill: Conceptual Question history: Previous edition, Chapter 9 AACSB: Reflective Thinking 5) Americans demand Japanese yen in order to A) buy Japanese products. B) supply American goods in Japane ...

Arbitrage in the foreign exchange market

... (1992), Fletcher and Taylor (1993), Aliber, Chowdhry and Yan (2003), and Juhl, Miles and Weidenmier (2006). We briefly review this literature in the next section. ...

... (1992), Fletcher and Taylor (1993), Aliber, Chowdhry and Yan (2003), and Juhl, Miles and Weidenmier (2006). We briefly review this literature in the next section. ...

ECB Unconventional Monetary Policy Actions: Market Impact

... Our paper relates to a number of strands of the empirical literature studying the impact of central banks’ unconventional policies on financial markets, using (high frequency) daily data. First, it relates to empirical papers quantifying the impact of policies on domestic asset prices. In this field ...

... Our paper relates to a number of strands of the empirical literature studying the impact of central banks’ unconventional policies on financial markets, using (high frequency) daily data. First, it relates to empirical papers quantifying the impact of policies on domestic asset prices. In this field ...

On the Accuracy and Efficiency of IMF Forecasts: A Survey

... This paper presents new perspectives on IMF forecast accuracy and efficiency by combining established analytical approaches with up-to-date data on forecasts and outturns and by developing new methodologies to help draw practical lessons for IMF forecasting. We find that the IMF forecasts developed ...

... This paper presents new perspectives on IMF forecast accuracy and efficiency by combining established analytical approaches with up-to-date data on forecasts and outturns and by developing new methodologies to help draw practical lessons for IMF forecasting. We find that the IMF forecasts developed ...

What We Talk About When We Talk About “Global Mindset”

... Perlmutter’s notion of geocentrism serves as an underlying construct for many of the contemporary conceptualizations of global mindset that focus on the challenge of overcoming ingrained ethnocentrism and transcending nationally-entrenched perceptions (Maznevski and Lane, 2004; Doz, et al., 2001; Ad ...

... Perlmutter’s notion of geocentrism serves as an underlying construct for many of the contemporary conceptualizations of global mindset that focus on the challenge of overcoming ingrained ethnocentrism and transcending nationally-entrenched perceptions (Maznevski and Lane, 2004; Doz, et al., 2001; Ad ...

P o l i c y Ta r... R e s e r v e B...

... Concern for the impact on the real economy can be (c) The involvement of both the Treasurer and Governor ...

... Concern for the impact on the real economy can be (c) The involvement of both the Treasurer and Governor ...

Seminar Paper No. 680 HOW SHOULD MONETARY POLICY BE by

... Although simple instrument rules prominently …gure in current research and policy discussions, and the research on simple instrument rules has contributed important insights, I …nd that a commitment to these rules is neither a desirable nor a practical way of maintaining price stability. Furthermor ...

... Although simple instrument rules prominently …gure in current research and policy discussions, and the research on simple instrument rules has contributed important insights, I …nd that a commitment to these rules is neither a desirable nor a practical way of maintaining price stability. Furthermor ...

What triggers prolonged inflation regimes? A - ECB

... for the economy, periods of high or hyper-in ation are seen to have negative repercussions which could cripple an economy as they lead to uncertainty, shorter planning horizons and possibly even a diversion of resources away from production. As a result, for policy makers, it is important to keep in ...

... for the economy, periods of high or hyper-in ation are seen to have negative repercussions which could cripple an economy as they lead to uncertainty, shorter planning horizons and possibly even a diversion of resources away from production. As a result, for policy makers, it is important to keep in ...

Last update: 09 October 2014 Swiss Chartset Chief Investment Office WM

... considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in FX rates may have an adverse ef ...

... considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in FX rates may have an adverse ef ...

Quantitative Easing and Volatility Spillovers across

... and Schwert, 1977). Thus, this control variable reflects a variety of macroeconomic, financial, and policy dimensions of the economy. In addition to the short term interest rate, we also collect US dollar exchange rates (Euro, British pound, Japanese yen, Swiss franc, Korean won, Hong Kong dollar, a ...

... and Schwert, 1977). Thus, this control variable reflects a variety of macroeconomic, financial, and policy dimensions of the economy. In addition to the short term interest rate, we also collect US dollar exchange rates (Euro, British pound, Japanese yen, Swiss franc, Korean won, Hong Kong dollar, a ...

Crisis Politics: IMF Programs in Latin America and Eastern Europe

... shows that IMF conditionality varied significantly across the two program episodes, as well as between countries within each region, depending on the economic and geopolitical interests of IMF creditor countries. Thus, during the debt crisis of the 1980s, Western concerns about international financi ...

... shows that IMF conditionality varied significantly across the two program episodes, as well as between countries within each region, depending on the economic and geopolitical interests of IMF creditor countries. Thus, during the debt crisis of the 1980s, Western concerns about international financi ...

Section 2

... Third, an augmented gravity model for FDI inflows and outflows fits the data well. The baseline regression model is able to capture over 70 percent of the variations in existing intra-APEC FDI flows. Larger economies generally receive greater volumes of FDI. Possessing a common official language is ...

... Third, an augmented gravity model for FDI inflows and outflows fits the data well. The baseline regression model is able to capture over 70 percent of the variations in existing intra-APEC FDI flows. Larger economies generally receive greater volumes of FDI. Possessing a common official language is ...

MultiFractality in Foreign Currency Markets

... In this paper we conduct an empirical investigation of the return behavior of five foreign currencies in order to detect possible discrepancies between the actual behavior of such currencies and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do ...

... In this paper we conduct an empirical investigation of the return behavior of five foreign currencies in order to detect possible discrepancies between the actual behavior of such currencies and the classical random walk. Note that we do not claim that foreign currency markets are inefficient nor do ...

Least Developed Countries Report 2009

... do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. ...

... do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. ...

International Risk Sharing in the EMU

... To begin with, there is a major obstacle to evaluating the effect of the adoption of their common currency by euro area member states: the lack of an appropriate set of countries to be used as a counterfactual pool for the scenario in which the member states had not adopted the euro. We tackle this ...

... To begin with, there is a major obstacle to evaluating the effect of the adoption of their common currency by euro area member states: the lack of an appropriate set of countries to be used as a counterfactual pool for the scenario in which the member states had not adopted the euro. We tackle this ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... current account deficit that peaks at 60 percent of GDP.7 As the authors themselves acknowledge, this figure tends to contradict strongly what is observed in reality. Following the financial liberalization reform, Spain’s current account deficit peaked at 3.4 percent of GDP. The fact that these mode ...

... current account deficit that peaks at 60 percent of GDP.7 As the authors themselves acknowledge, this figure tends to contradict strongly what is observed in reality. Following the financial liberalization reform, Spain’s current account deficit peaked at 3.4 percent of GDP. The fact that these mode ...

NBER WORKING PAPER SERIES

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

... In this study, we analyze the role played by international reserves on the short and intermediaterun REER dynamics generated by a CTOT shock. We also test the degree to which international reserves and the choice of exchange rate regime mitigates REER volatility associated with given CTOT shocks. Sp ...

Enhancing Financial Stability and Resilience

... The 2007–08 global financial crisis demonstrated that regulation focused on individual institutions alone does not adequately deal with systemic risks to the financial markets as a whole. In particular, it became apparent that the financial system has an inherent bias toward booms and busts that is ...

... The 2007–08 global financial crisis demonstrated that regulation focused on individual institutions alone does not adequately deal with systemic risks to the financial markets as a whole. In particular, it became apparent that the financial system has an inherent bias toward booms and busts that is ...

No.333 / July 2010 IIIS Discussion Paper No. 333

... although there is substantial variation across the studies in terms of methods and sample periods. Rose and Spiegel (2009a, 2009b) seek to explain output growth in 2008 jointly with several asset market indicators, while Berglof et al (2009) focus on projected output growth for 2009 for a large grou ...

... although there is substantial variation across the studies in terms of methods and sample periods. Rose and Spiegel (2009a, 2009b) seek to explain output growth in 2008 jointly with several asset market indicators, while Berglof et al (2009) focus on projected output growth for 2009 for a large grou ...

Sovereign CDS Spreads in Europe—The Role of Global

... the role of global risk aversion, specific macroeconomic fundamentals, liquidity conditions in the CDS market, and spillovers from other countries in explaining the divergent movements in CDS of different countries witnessed during this period? Has the role of these factors changed between the two m ...

... the role of global risk aversion, specific macroeconomic fundamentals, liquidity conditions in the CDS market, and spillovers from other countries in explaining the divergent movements in CDS of different countries witnessed during this period? Has the role of these factors changed between the two m ...

Real-Time Forecasting for Monetary Policy Analysis

... BVAR model have a smaller bias. The BVAR model forecasts for inflation and the repo rate perform very well both in absolute terms and relative to the DSGE model forecasts and the published forecasts. For GDP growth and the exchange rate the pattern is less clear. Which forecast is more accurate depe ...

... BVAR model have a smaller bias. The BVAR model forecasts for inflation and the repo rate perform very well both in absolute terms and relative to the DSGE model forecasts and the published forecasts. For GDP growth and the exchange rate the pattern is less clear. Which forecast is more accurate depe ...

John Maynard Keynes - Centro de Pesquisa e Economia do Seguro

... First, Keynes was a practical person, and turned to theory mainly as a means to achieve the purpose his was seeking. His goal was to develop persuasive arguments for economic policy which he recommended, which often escaped the contemporaneous conventional thinking. Second, the Keynes’s “head” was ...

... First, Keynes was a practical person, and turned to theory mainly as a means to achieve the purpose his was seeking. His goal was to develop persuasive arguments for economic policy which he recommended, which often escaped the contemporaneous conventional thinking. Second, the Keynes’s “head” was ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.