Solving the Long-Range Problems of Housing and Mortgage Finance

... these new instruments, particularly the money-market mutual fund, assures that, in the next period of tight money, the competition of open market instruments is likely to be more severe than ever before. The second reason why the shelter of Regulation Q is eroding is the rising strength of consumeri ...

... these new instruments, particularly the money-market mutual fund, assures that, in the next period of tight money, the competition of open market instruments is likely to be more severe than ever before. The second reason why the shelter of Regulation Q is eroding is the rising strength of consumeri ...

What`s Ahead for EU Mortgage Markets? ELRA General Assembly

... Missing products: ERL; fixed-rate & sub-prime products In principle, there is room for improvement ...

... Missing products: ERL; fixed-rate & sub-prime products In principle, there is room for improvement ...

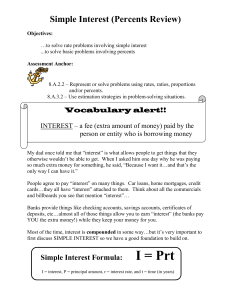

Interest rate

... EXPECTATIONS THEORY: Shape of the yield curve indicates investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

... EXPECTATIONS THEORY: Shape of the yield curve indicates investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

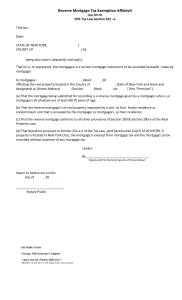

Reverse Mortgage Tax Exemption Affidavit

... NOTE: All mortgagors must be 60 years of age. If the property is held by senior over 60 as to a life estate interest only and the remainder interest(s) are held by anyone under age 60, the mortgage tax must be paid. However in 2007 the Tax Department confirmed that if the loan was a federal reverse ...

... NOTE: All mortgagors must be 60 years of age. If the property is held by senior over 60 as to a life estate interest only and the remainder interest(s) are held by anyone under age 60, the mortgage tax must be paid. However in 2007 the Tax Department confirmed that if the loan was a federal reverse ...

Chapter 14 - Capital Markets

... real rate of interest, firms would invest elsewhere decreasing supply and increasing the resource price. If resource prices rose faster than the real rate of interest, firms would increase supply and decrease its price. Equilibrium could only occur if the price increase equaled the real rate of inte ...

... real rate of interest, firms would invest elsewhere decreasing supply and increasing the resource price. If resource prices rose faster than the real rate of interest, firms would increase supply and decrease its price. Equilibrium could only occur if the price increase equaled the real rate of inte ...

(MP) and Phillips Curve

... The MP Curve: Monetary Policy and the Interest Rates Banks and financial institutions borrow from each other from one business day to the next on the interbank federal funds market. Large banks that are willing to take risks tend to borrow from risk averse small banks Banks borrow and lend th ...

... The MP Curve: Monetary Policy and the Interest Rates Banks and financial institutions borrow from each other from one business day to the next on the interbank federal funds market. Large banks that are willing to take risks tend to borrow from risk averse small banks Banks borrow and lend th ...

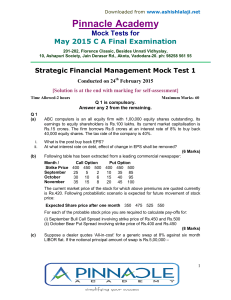

Pinnacle Academ y

... buy back its own shares using the surplus cash at a buy back price of Rs.105. This buy back price is 5% higher than theoretical buy back price. The current EPS of the company is Rs.12 per share. After the buy back the PE multiple shall rise to 8.5 times. You are required to determine: Pre-buyback MP ...

... buy back its own shares using the surplus cash at a buy back price of Rs.105. This buy back price is 5% higher than theoretical buy back price. The current EPS of the company is Rs.12 per share. After the buy back the PE multiple shall rise to 8.5 times. You are required to determine: Pre-buyback MP ...