* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download Pinnacle Academ y

History of the Federal Reserve System wikipedia , lookup

Securitization wikipedia , lookup

Financial economics wikipedia , lookup

Greeks (finance) wikipedia , lookup

Internal rate of return wikipedia , lookup

Pensions crisis wikipedia , lookup

Business valuation wikipedia , lookup

Lattice model (finance) wikipedia , lookup

Yield spread premium wikipedia , lookup

Financialization wikipedia , lookup

Interbank lending market wikipedia , lookup

Libor scandal wikipedia , lookup

Annual percentage rate wikipedia , lookup

Credit rationing wikipedia , lookup

Adjustable-rate mortgage wikipedia , lookup

Present value wikipedia , lookup

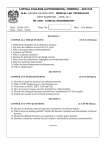

Downloaded from www.ashishlalaji.net Pinnacle Academy Mock Tests for May 2015 C A Final Examination 201-202, Florence Classic, Besides Unnati Vidhyalay, 10, Ashapuri Society, Jain Derasar Rd., Akota, Vadodara-20. ph: 98258 561 55 Strategic Financial Management Mock Test 1 Conducted on 24th February 2015 [Solution is at the end with marking for self-assessment] Time Allowed-2 hours Maximum Marks- 60 Q 1 is compulsory. Answer any 2 from the remaining. Q1 (a) i. ii. ABC computers is an all equity firm with 1,00,000 equity shares outstanding. Its earnings to equity shareholders is Rs.100 lakhs. Its current market capitalisation is Rs.15 crores. The firm borrows Rs.6 crores at an interest rate of 8% to buy back 40,000 equity shares. The tax rate of the company is 40%. What is the post buy back EPS? At what interest rate on debt, effect of change in EPS shall be removed? (6 Marks) (b) Following table has been extracted from a leading commercial newspaper: Month / Call Option Put Option Strike Price 400 450 500 400 450 500 September 25 5 2 10 35 85 October 30 10 6 15 40 95 November 35 15 8 20 45 100 The current market price of the stock for which above premiums are quoted currently is Rs.420. Following probabilistic scenario is expected for future movement of stock price: Expected Share price after one month 350 475 525 550 For each of the probable stock price you are required to calculate pay-offs for: (i) September Bull Call Spread involving strike price of Rs.450 and Rs.500 (ii) October Bear Put Spread involving strike price of Rs.400 and Rs.450 (8 Marks) (c) Suppose a dealer quotes ‘All-in-cost’ for a generic swap at 8% against six month LIBOR flat. If the notional principal amount of swap is Rs.5,00,000 – 1 Downloaded from www.ashishlalaji.net i. Calculate semi-annual fixed payment. ii. Find the first floating rate payment for (i) above if the six month period from the effective date of swap to the settlement date comprises 181 days and that the corresponding LIBOR was 6% on the effective date of swap. iii. In (ii) above, if the settlement is on ‘Net’ basis, how much the fixed rate payer would pay to the floating rate payer? Generic swap is based on 30 / 360 days basis. (d) (6 Marks) A company has decided to take a 3-year floating rate loan of $250 million to finance a project. The loan is indexed to 6-month LIBOR with a spread of 100 bp. The LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed interest rate is 7%. For the purpose of your calculations, premium cost should be amortized over a period of 2.5 year using fixed interest rate as discount rate. Show the effective cost of the capped loan. (8 Marks) Q2 (a) An import house in India has bought goods from Switzerland for CHF 10,00,000. The exporter has given the Indian company two options: (i) Pay immediately without any interest charge (ii) Pay after 3 months with interest of 5 % p.a. The importer’s bank charges 14 % p.a. on overdrafts. Exchange rates are expected as under: Spot (CHF / INR) 3-months forward: 30.00 / 30.50 31.10 / 31.60 What should the company do? (b) i. ii. (8 Marks) A Ltd. has currently 10 lakh shares outstanding. It has surplus cash of Rs.315 lakhs of which it wants to distribute 50% to its shareholders. The company has decided to buy back its own shares using the surplus cash at a buy back price of Rs.105. This buy back price is 5% higher than theoretical buy back price. The current EPS of the company is Rs.12 per share. After the buy back the PE multiple shall rise to 8.5 times. You are required to determine: Pre-buyback MPS, Market Capitalisation and PE Multiple Post-buyback MPS, Market Capitalisation and EPS (8 Marks) Q3 (a) Following financial data are available for PQR Ltd. for the year 2013: Amount (Rs. in lakhs) 8 % Debentures 10 % Bonds (2012) Equity Share (Rs.10 each) Reserves and Surplus 125 50 100 300 2 Downloaded from www.ashishlalaji.net Total Assets Assets turnover ratio Effective interest rate Effective tax rate Operating Margin Dividend Payout ratio Current MPS Required rate of return of investors 600 1.1 8% 40% 10% 16.67% 14 15% You are required to – i. ii. iii. iv. Draw income statement for the year Calculate its sustainable growth rate Calculate fair price for the share using dividend discount model Decide whether the company’s share be purchased (8 Marks) (b) A Inc. and B Inc. intend to borrow $ 2,00,000 and $ 2,00,000 in ¥ respectively for a time horizon of one year. Prevalent interest rates are: Company ¥ Loan $ Loan A Inc. 5% 9% B Inc. 8% 10 % Prevalent exchange rate is $ 1 = ¥ 120. The two companies enter in a currency swap under which it is agreed that B Inc. shall pay to A Inc. 1 % over the ¥ Loan interest rate, which the later will have to pay as a result of currency swap whereas A Inc. will reimburse interest to B Inc. only to the extent of 9%. Assuming stability of exchange rate, determine the net gain or loss to each of the party due to currency swap. (8 Marks) Q4 It is 31st December. Cleff plc needs to borrow £6 million in three months’ time for a period of 6 months. It is expected that interest rate shall either move up to 14.5% or may fall to 12% per year. Cleff is concerned about rising interest rates. • • • • FRA 3 X 9 is quoted by bank at 12.25% / 12.55 %. Futures are quoted at 13% and standard size is £50,000 with tenure of 3 months. Cap is quoted at 12.75% at flat premium of 1%. Floor is quoted at 12.15% at flat premium of 1%. You are required to carry out analysis of following methods of hedging interest rate risk: i. ii. iii. iv. Forward Rate Agreement (FRA) Interest Rate Futures Interest Rate Guarantee (Cap) Interest Rate Collar (16 Marks) 3 Downloaded from www.ashishlalaji.net Solution of SFM Mock Test 1 Conducted on 24th February 2015 Q1 (a) Pre buy back EPS = 100 / 1 lakh shares = Rs.100 (i) Post buy back EPS = [(100 / 0.6) – (600 X 8%)] – 40% / 0.6 lakh shares = Rs.118.67 (3 Marks) (ii) Post buy back EPS = [(100 / 0.6) – (600 X r%)] – 40% / 0.6 lakh shares = 100 i.e. 100 X 0.6 = [166.67 – Interest] – 40% i.e. 60 = 100 – 0.6 Interest i.e. Interest = 40 / 0.6 = Rs.66.67 lakhs Thus, interest rate = 66.67 / 600 = 11.11 % (3 Marks) (b) (i) September Bull Call Spread: This shall involve buying 450 September Call paying premium of Rs.5 and selling 500 September Call receiving premium of Rs.2. Thus, net premium paid is Rs.3 Expected Share price after one month Strike of long call Strike of short call Gross Pay-off: Long Call Short Call Net Premium paid Net Pay-off 350 450 500 475 450 500 525 450 500 550 450 500 0 0 (3) (3) 25 0 (3) 22 75 (25) (3) 47 100 (50) (3) 47 (4 Marks) (ii) October Bear Put Spread: This shall involve buying 450 October Put paying premium of Rs.40 and selling 400 October Put receiving premium of Rs.15. Thus, net premium paid is Rs.25 Expected Share price after one month Strike of long put Strike of short put Gross Pay-off: Long Put Short Put Net Premium paid Net Pay-off 350 450 400 475 450 400 525 450 400 550 450 400 100 (50) (25) 25 0 0 (25) (25) 0 0 (25) (25) 0 0 (25) (25) (4 Marks) (c) (i) Semi-annual fixed payment = 5,00,000 X 8% X 180 / 360 = Rs.20,000 (ii) Semi-annual floating payment = 5,00,000 X 6% X 181 / 360 = Rs.15,083 (iii) Net amount payable by fixed to floating payer = 20,000 – 15,083 = Rs.4,917 (2½ + 2½ + 1 Marks) 4 Downloaded from www.ashishlalaji.net (d) The given loan is indexed to 6-month LIBOR. Thus, reset period is 6 months. Loan is for 3 years; so this will comprise 6 reset dates. Upfront premium paid = 250 X 3.75% = $ 9.375 million 7 % is to be used for discounting above premium for the purpose of amortization. Reset period is 6 months i.e. discount rate for six months shall be 3.5%. Loan is for 3 years but amortization is to be carried out over 2.5 years i.e. for 5 time periods of six months. Upfront premium 9.375 Amortization charge of premium = -------------------------- = -------- = $ 2.0764 million PVF (3.5%, 5) 4.515 (2 Marks) Analysis of Cap: Reset LIBOR Period 1 2 3 4 5 6 5.75% 5.5% 6% 6.25% 6.5% 6.75% Actual Cap Difference Borrowing Strike Recovered Rate Rate From Bank (LIBOR + 1%) 6.75% 7% --6.5% 7% --7% 7% --7.25% 0.25% 7% 7.5% 0.5% 7% 7.75% 0.75% 7% (2 Marks) Determination of Effective Cost of Capped Loan: Reset Period 1 2 3 4 5 6 Actual Actual Borrowing Interest Rate Paid for (LIBOR + 1%) 6 months 6.75% 6.5% 7% 7.25% 7.5% 7.75% Receipt From Cap 8.4375* ----8.1250 ----8.7500 ----9.0625 0.3125** 9.3750 0.6250 9.6875 0.9375 Effective Premium Effective Interest Amortized Cost Paid Of Cap 8.4375 8.1250 8.7500 8.7500 8.7500 8.7500 2.0764 2.0764 2.0764 2.0764 2.0764 --------- 10.5139 10.2014 10.8264 10.8264 10.8264 8.7500 * 250 X 6.75% X 6 / 12 and so on ** 250 X 0.25 % X 6 / 12 and so on (4 Marks) Solution prepared by CA. Ashish Lalaji 5 Downloaded from www.ashishlalaji.net Q2 (a) (i) Pay immediately: Amount paid spot for settlement of dues [10,00,000 X 30.50] 3,05,00,000 Add: Overdraft interest [3,05,00,000 X 14% X 3/12] Total amount paid 10,67,500 3,15,67,500 (4 marks) (ii) Pay after 3 months: Interest shall be charged by exporter of SF 12,500 [10,00,000 X 5% X 3/12]. Thus, amount paid of SF 10,12,500 at 3 m fwd of Rs.31.60 / SF i.e. Rs.3,19,95,000. Recommendation: Pay immediately. (4 marks) (b) (i) Actual buy back price = 1.05 (Theoretical Buy Back Price) i.e. Theoretical buy back price = 105 / 1.05 = Rs.100 Now, cash to be distributed to buy back shares = 315 X 50% i.e. Rs.157.5 lakhs. Thus, no. of shares repurchased = 157.5 / 105 = 1.5 lakh shares. Now, Theoretical buy back price = MN / N – n i.e. 100 = M(10) / 10 – 1.5 i.e. M = Rs.85. Thus, pre-buy-back MPS is Rs.85 Pre-buy back Market Capitalisation = 85 X 10 lakh shares = Rs.850 lakhs Pre-buy back PE multiple = 85 / 12 = 7.08 times (6 Marks) (ii) Post-buy back EPS = 12 X 10 / 8.5 lakh shares = Rs.14.12 Post-buy back MPS = 14.12 X PE ratio 8.5 = Rs.120.02 Post-buy back Market Capitalisation = 120.02 X 8.5 lakh shares = Rs.1,020 lakhs (2 Marks) Q3 (a) Assets turnover ratio = Sales / Total Assets 1.1 = Sales / 600 Sales = Rs.660 lakhs Operating margin is 10%, which means operating costs are 90% of sales i.e. Rs.594 lakhs. Total Borrowings = Debentures + Bonds = 125 + 50 = Rs.175 lakhs Effective interest rate is 8% i.e. interest cost = 175 X 8% = Rs.14 lakhs (2 Marks) Solution prepared by CA. Ashish Lalaji 6 Downloaded from www.ashishlalaji.net (i) Income Statement for the year 2013: Amount (Rs. in lakhs) Sales Less: Operating Cost EBIT Less: Interest EBT Less: Tax @ 40% PAT Less: Dividend @ 16.67% Retained Earnings 660.0 594.0 66.0 14.0 52.0 20.8 31.2 5.2 26.0 (2 Marks) (ii) Sustainable growth rate refers to stable dividend growth rate, g g = b.r = 83.33 X 7.8% = 6.5 % where b = retention ratio = 1 – D/P ratio = 1 - .1667 = 0.8333 i.e. 83.33% r = Return on equity = 31.2 / 100 + 300 i.e. 7.8% (2 Marks) (iii) Current DPS = 5.2 / 10 = Re.0.52 P0 = D1 / ke – g = 0.52 (.065) / 15 % - 6.5 % = Rs.6.52 (1 Mark) (iv) True worth of the share is Rs.6.52 but is trading in the market at Rs.14. The share is overpriced and hence not worth buying. (1 Mark) (b) Facts given in the case are presented as under: Party Desired Currency Actual Cost in Currency Desired Borrowed Currency Cost of Actual Currency Borrowed A USD YEN 9% 5% B YEN USD 8% 10 % Determination of effective cost after swap: A pays on YEN at 5%. As per the terms of the swap, B shall pay to A 1% higher than it i.e. A shall receive 6% from B. However, A shall pay 9% to B. Hence, effective cost after swap is – A: 5 + 9 – 6 = 8%. This cost is on USD. B: 10 + 6 – 9 = 7%. This cost is on YEN. (2 Marks) Solution prepared by CA. Ashish Lalaji 7 Downloaded from www.ashishlalaji.net Determination of Net Gain due to Swap: A Inc. Amount ($) Interest cost without swap ($2,00,000 X 9%) Interest cost after swap ($2,00,000 X 8%) Savings due to swap 18,000 16,000 2,000 B Inc. Interest cost without swap ($2,00,000 X 120 X 8%) Interest cost after swap ($2,00,000 X 120 X 7%) Savings due to swap Amount (¥) 19,20,000 16,80,000 2,40,000 (6 Marks) Q4 (i) Analysis of FRA: FRA shall be contracted at 12.55%. If interest rate is 14.5% then difference of 1.95% shall be received from bank and if interest rate is 12% then difference of .55% shall be paid to bank. Effective interest paid is – £ in millions (a) Interest rate after 3 months (b) Actual interest on £6 million for 6 months (c) FRA: Receipt (6 X 1.95% X 6 / 12) Payment (6 X .55% X 6 / 12) (d) Effective interest paid 14.5% 0.4350 12% 0.3600 0.0585 --------0.3765 --------0.0165 0.3765 (3 Marks) (ii) Analysis of Interest Rate Futures: Futures are currently quoted at 13 % i.e. at £87 (100 – 13%) No. of contracts Principal Tenure of Loan / Deposit = ---------------------- X ---------------------------------Contract Size Tenure of Futures = [60,00,000 / 50,000] X [6 / 3] = 240 Deal size = 240 X 50,000 = 1,20,00,000 i.e. £12 million As borrower is worried about rising interest rates, Cleff plc shall short futures. (2 Marks) Solution prepared by CA. Ashish Lalaji 8 Downloaded from www.ashishlalaji.net Net pay-off from futures is determined as under: (a) Spot rate after 3 months (for buying) (b) Contracted futures price for selling (c) Gain / (Loss) (d) Deal size (£ in million) (e) Total Gain / (Loss) (c X d X 3/12) (£ in million) 85.50 (100 - 14.5%) 87.00 1.5 % 12 0.045 88.00 (100 - 12%) 87.00 -1% 12 (0.03) (2 Marks) Effective interest paid is – £ in millions (a) Interest rate after 3 months (b) Actual interest on £6 million for 6 months (c) Interest rate futures Receipt Payment (d) Effective interest paid 14.5% 0.435 12% 0.360 0.045 --------0.390 --------0.030 0.390 (2 Marks) (iii) Analysis of Cap: Cap is available at 12.75 %. Premium paid = 6 X 1% = £ 0.06 million If interest rate is 14.5 % then cap shall be exercised to receive 1.75 % from bank. If interest rate is 12% then cap shall be allowed to expire. Effective interest paid is – £ in millions (a) Interest rate after 3 months (b) Actual interest on £6 million for 6 months (c) Cap receipt (6 X 1.75% X 6 / 12) (d) Effective interest paid (e) Premium paid (f) Effective cost of capped loan 14.5% 0.4350 0.0525 0.3825 0.0600 0.4425 12% 0.3600 --------0.3600 0.0600 0.4200 (3 Marks) (iv) Analysis of Collar: Cap shall be purchased at 12.75% and floor shall be sold at 12.15%. Premium for both is 1%. Thus, net premium paid shall be nil. If interest rate is 14.5 % then cap shall be exercised to receive 1.75 % from bank. If interest rate is 12% then cap shall be allowed to expire. If interest rate is 14.5 % then floor shall be allowed to expire by the buyer. If interest rate is 12% then floor shall be exercised by the buyer and hence 0.15% shall be payable to the bank. (2 Marks) 9 Downloaded from www.ashishlalaji.net Effective interest paid is – £ in millions (a) Interest rate after 3 months (b) Actual interest on £6 million for 6 months (c) Cap receipt (6 X 1.75% X 6 / 12) (d) Floor payment (6 X 0.15% X 6 / 12) (e) Effective interest paid 14.5% 0.4350 0.0525 --------0.3825 12% 0.3600 --------0.0045 0.3645 (2 Marks) Solution prepared by CA. Ashish Lalaji Be free to send your suggestions / comments to CA. Ashish Lalaji at 9825856155 / [email protected] 10