Options on Fed funds futures and interst rate volatity

... According to the CBOT, the daily volume of options on Fed Funds futures was approximately 21,908 on March 30, 2007. The CBOT also introduced a new option contract called Fed Binary Options which pays either 0 or the intrinsic value of the option. On February 7, 2007, open contracts in Binary options ...

... According to the CBOT, the daily volume of options on Fed Funds futures was approximately 21,908 on March 30, 2007. The CBOT also introduced a new option contract called Fed Binary Options which pays either 0 or the intrinsic value of the option. On February 7, 2007, open contracts in Binary options ...

Transmission of Monetary Policy Impulses on Bank

... the interest rate pass-through from central bank tools to retail interest rates. The retail interest rates are the lending and deposit rates of commercial banks and other non-bank deposit taking institutions. The second stage is the transmission of the changes in retail interest rates to the aggrega ...

... the interest rate pass-through from central bank tools to retail interest rates. The retail interest rates are the lending and deposit rates of commercial banks and other non-bank deposit taking institutions. The second stage is the transmission of the changes in retail interest rates to the aggrega ...

The Swaps Market: A Case Study Detailing Market

... euros and then making floating rate payments in euro, whereas Party A is swapping euros for dollars and will make fixed rate payments in dollars. Currency swaps clearly can allow a great deal of flexibility in managing foreign exchange operations – thus first gaining a basic understanding of the str ...

... euros and then making floating rate payments in euro, whereas Party A is swapping euros for dollars and will make fixed rate payments in dollars. Currency swaps clearly can allow a great deal of flexibility in managing foreign exchange operations – thus first gaining a basic understanding of the str ...

- TestbankU

... conditions in each market. As funds leave a country with low interest rates, this places upward pressure on that country’s interest rates. The international flow of funds caused this type of reaction. 14. Impact of War. A war tends to cause significant reactions in financial markets. Why would a war ...

... conditions in each market. As funds leave a country with low interest rates, this places upward pressure on that country’s interest rates. The international flow of funds caused this type of reaction. 14. Impact of War. A war tends to cause significant reactions in financial markets. Why would a war ...

The Role of Interest Rate Swaps in Corporate

... views of either the Federal Reserve Bank of Richmond or the Board of Governors of the Federal Reserve System. The motivation for this article grew out of discussions with Douglas Diamond. Michael Dotsey, Jeff Lacker, Roy Webb, and John Weinberg provided thoughtful criticism and helpful comments. ...

... views of either the Federal Reserve Bank of Richmond or the Board of Governors of the Federal Reserve System. The motivation for this article grew out of discussions with Douglas Diamond. Michael Dotsey, Jeff Lacker, Roy Webb, and John Weinberg provided thoughtful criticism and helpful comments. ...

Swaps - dedeklegacy.cz

... termination of a swap is the cancellation of the swap contract (in which case one counterparty compensates the other counterparty for the loss of expected profit over the remainder of the life of the swap) assignment of a swap is the sale of the swap by one of the counterparties to a third party wit ...

... termination of a swap is the cancellation of the swap contract (in which case one counterparty compensates the other counterparty for the loss of expected profit over the remainder of the life of the swap) assignment of a swap is the sale of the swap by one of the counterparties to a third party wit ...

INSTITUTE OF ECONOMIC STUDIES Faculty of social sciences of

... a higher-lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given fixed rate the difference between the two rates is the dealing spread the dealer earns on every matching pair of swaps swap rate is the average of bid and ask interest rates swap spre ...

... a higher-lower quote means that the quoting dealer is willing to transact a swap in which he receives/pays the given fixed rate the difference between the two rates is the dealing spread the dealer earns on every matching pair of swaps swap rate is the average of bid and ask interest rates swap spre ...

Decision Avoidance and Deposit Interest Rate Setting

... Secondly a large literature has emerged examining how individuals can be poor money managers (see Benartzi and Thaler 2007). This study contributes to this field by responding to concerns that firms change their behaviour to exploit observed behavioural anomalies (Frey and Eichenberger 1994) and tha ...

... Secondly a large literature has emerged examining how individuals can be poor money managers (see Benartzi and Thaler 2007). This study contributes to this field by responding to concerns that firms change their behaviour to exploit observed behavioural anomalies (Frey and Eichenberger 1994) and tha ...

Interest Rate Risk Management for Commercial

... In order to apply a comparable and widely accepted measure for the interest rate risk of banks, we follow the “standardized interest rate shock” approach also proposed within the new Basel Capital Accord (Basel II), that are published by the Basel Committee on Banking Supervision (2004). The committ ...

... In order to apply a comparable and widely accepted measure for the interest rate risk of banks, we follow the “standardized interest rate shock” approach also proposed within the new Basel Capital Accord (Basel II), that are published by the Basel Committee on Banking Supervision (2004). The committ ...

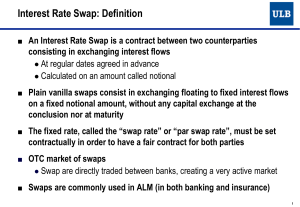

Interest Rate Swap

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

... ■ More complex contracts can be concluded in the OTC market, where e.g. ● The notional vary with time ● The contract is not spot but forward ● One or both legs are function of more than one reference rates (structured swaps) ...

Fund Transfer Pricing in a Commercial Bank

... currency into another, and safekeeping of coins. Money was initially kept in banks for security, not for profit, and was not invested into loans. Certificates were issued by banks to confirm the amount of money stored in vaults.7 Storing money allowed for facilitation of payments between bank’s cust ...

... currency into another, and safekeeping of coins. Money was initially kept in banks for security, not for profit, and was not invested into loans. Certificates were issued by banks to confirm the amount of money stored in vaults.7 Storing money allowed for facilitation of payments between bank’s cust ...

Analysis of the Discount Factors in Swap Valuation

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

... Currency swaps, introduced in the 1970s due to foreign exchange controls in Britain, have been an important tool for financing. [2] In a currency swap contract, Party A makes predetermined payments periodically to Party B in one currency like U.S. dollars, meanwhile, Party B pays a certain amount i ...

Inflation targeting framework and interest Rates

... high interest rates to private investors. This questions the effectiveness of the prime rate in influencing lending rates in the Ghanaian economy. The interest rate on deposit accounts and interbank rate falls almost directly with the prime rate but lending rates turns to be sticky downwards. Commer ...

... high interest rates to private investors. This questions the effectiveness of the prime rate in influencing lending rates in the Ghanaian economy. The interest rate on deposit accounts and interbank rate falls almost directly with the prime rate but lending rates turns to be sticky downwards. Commer ...

Influence of Interest Rates Determinants on the Performance of

... which drive up deposit rates. A decrease in the discount rate encourages banks to borrow and in turn this increases the amount available in form of reserves thereby enhancing or increasing the amount money supply in the economy. Consequently this leads to a decrease in the interest rates thereby enc ...

... which drive up deposit rates. A decrease in the discount rate encourages banks to borrow and in turn this increases the amount available in form of reserves thereby enhancing or increasing the amount money supply in the economy. Consequently this leads to a decrease in the interest rates thereby enc ...

Case Objectives - Trinity University

... creating call option gains from a rising note prices in the open market). But instead of speculating. money lenders may hedge against falling interest rates by purchasing interest rate call options to offset possible declines in lending rates. It is possible to set a minimum floor on net revenue suc ...

... creating call option gains from a rising note prices in the open market). But instead of speculating. money lenders may hedge against falling interest rates by purchasing interest rate call options to offset possible declines in lending rates. It is possible to set a minimum floor on net revenue suc ...

Risk-adjusted Covered Interest Parity: Theory and Evidence

... during turbulent periods such that they could significantly depart from CIP. For example, in a follow-up study, Frenkel and Levich (1977) found that the role played by transaction costs in accounting for the deviations in tranquil periods is not observed in the turbulent peg period of 1968-69 charac ...

... during turbulent periods such that they could significantly depart from CIP. For example, in a follow-up study, Frenkel and Levich (1977) found that the role played by transaction costs in accounting for the deviations in tranquil periods is not observed in the turbulent peg period of 1968-69 charac ...

Read the Economic Commentary "How far can the repo rate be cut?"

... cannot be negative. In addition, many financial contracts also express the interest rate as an increment on some reference rate that is often close to the repo rate. One such example is so-called floating rate notes/bonds. A note/bond usually means that the issuer of a bond pays the purchaser a spec ...

... cannot be negative. In addition, many financial contracts also express the interest rate as an increment on some reference rate that is often close to the repo rate. One such example is so-called floating rate notes/bonds. A note/bond usually means that the issuer of a bond pays the purchaser a spec ...

interest rate determination in china:past,present and future

... issuance and trading of negotiable CDs, and to gradually extend the scope of market-based pricing of liabilities of financial institutions – Between the near and medium terms, the key is to develop a relatively complete and efficient market interest rate system and to improve the monetary policy fra ...

... issuance and trading of negotiable CDs, and to gradually extend the scope of market-based pricing of liabilities of financial institutions – Between the near and medium terms, the key is to develop a relatively complete and efficient market interest rate system and to improve the monetary policy fra ...

Interest Rates

... commercial banks. Overnight Deposit Facility (ODF) Rate - the interest rate on the overnight/term deposit (i.e. Special Deposit Account) facilities at which the BSP takes deposits from commercial banks. Term Deposit Facility (TDF) Rate - the interest rate on the term deposit (i.e. 7day and 28-da ...

... commercial banks. Overnight Deposit Facility (ODF) Rate - the interest rate on the overnight/term deposit (i.e. Special Deposit Account) facilities at which the BSP takes deposits from commercial banks. Term Deposit Facility (TDF) Rate - the interest rate on the term deposit (i.e. 7day and 28-da ...

US Money Market Reform: The Scandi angle

... USD Libor rate of 0.79%, but still well above the 0.50% 1M USD Libor rate. Finally, it seems that many banks have accepted a shorter maturity on their funding. But of course such a strategy again can collide with other regulatory incentives, especially LCR requirements. Furthermore, it is important ...

... USD Libor rate of 0.79%, but still well above the 0.50% 1M USD Libor rate. Finally, it seems that many banks have accepted a shorter maturity on their funding. But of course such a strategy again can collide with other regulatory incentives, especially LCR requirements. Furthermore, it is important ...

From low to negative rates

... while this floor is not passed on to the asset side. This means that if market rates drop the asset side potentially follows suit and even drops into negative territory while the bank still pays for its refinancing. In other words: A negative interest rate environment causes the reference rate to be ...

... while this floor is not passed on to the asset side. This means that if market rates drop the asset side potentially follows suit and even drops into negative territory while the bank still pays for its refinancing. In other words: A negative interest rate environment causes the reference rate to be ...

Fed Hikes and the Impact on Spread Sectors

... rates. This outlook reflects our expectation that inflation will remain moderate (usually higher inflation is the primary reason why longer-term interest rates would rise). Subdued global growth, combined with continued slack in certain labor markets, has reduced inflationary pressures and, in some ...

... rates. This outlook reflects our expectation that inflation will remain moderate (usually higher inflation is the primary reason why longer-term interest rates would rise). Subdued global growth, combined with continued slack in certain labor markets, has reduced inflationary pressures and, in some ...

Rising Interest Rates: How Big a Threat?

... But what happens when interest rates rise suddenly? This situation last occurred in the late 1970s and early ’80s, when interest rates rose quickly and dramatically. What occurred then could happen again, with a similar impact on annuity writers. At that time, the rise in rates outpaced the ability ...

... But what happens when interest rates rise suddenly? This situation last occurred in the late 1970s and early ’80s, when interest rates rose quickly and dramatically. What occurred then could happen again, with a similar impact on annuity writers. At that time, the rise in rates outpaced the ability ...

Document

... The total notional amount of interest rate swaps is $48 trillion, among which, $17 trillion goes to USD swaps. At the same time, the total public debt (including Treasuries and local government debt) outstanding in the U.S. is $5 trillion. The total notional amount of interest rate options is ...

... The total notional amount of interest rate swaps is $48 trillion, among which, $17 trillion goes to USD swaps. At the same time, the total public debt (including Treasuries and local government debt) outstanding in the U.S. is $5 trillion. The total notional amount of interest rate options is ...

Counterparty A

... process of composition or decomposition, creates one (or more) very different financial instruments. ...

... process of composition or decomposition, creates one (or more) very different financial instruments. ...