Setting aside the debate on when the exact date of an interest rate

... companies. Companies have been able to issue bonds to investors at all‐time low interest rates. While this is a good deal for companies, it’s not a great outcome for investors, who are forced to take increasingly lower compensation for the risk of lending this money. The yield on the Barclays ...

... companies. Companies have been able to issue bonds to investors at all‐time low interest rates. While this is a good deal for companies, it’s not a great outcome for investors, who are forced to take increasingly lower compensation for the risk of lending this money. The yield on the Barclays ...

What do low interest rates mean for your retirement?

... Gareth Shaw, head of consumer affairs at Saga Investment Services, commenting on August’s decrease in the Bank Rate, said: “Retirees in particular must now be thinking about moving up the risk ladder with their savings to help deliver the income they need. They should consider building a diverse por ...

... Gareth Shaw, head of consumer affairs at Saga Investment Services, commenting on August’s decrease in the Bank Rate, said: “Retirees in particular must now be thinking about moving up the risk ladder with their savings to help deliver the income they need. They should consider building a diverse por ...

Jan - Richard Wolfram, Esq.

... (An in-depth article on In re LIBOR and antitrust injury is also available under this title. The following is a preview of my article). A key ruling by a New York federal district court almost two years ago, in In re LIBORBased Financial Instruments Antitrust Litigation, can now finally proceed on a ...

... (An in-depth article on In re LIBOR and antitrust injury is also available under this title. The following is a preview of my article). A key ruling by a New York federal district court almost two years ago, in In re LIBORBased Financial Instruments Antitrust Litigation, can now finally proceed on a ...

Economics Web Newsletter - McGraw Hill Higher Education

... inflation also was low, so the pace could be leisurely. "The crucial difference between now and in the past is an extraordinary productivity acceleration," Mr. Greenspan said last April. "That means that the price pressures are not anywhere near where they would be under normal circumstances. ... It ...

... inflation also was low, so the pace could be leisurely. "The crucial difference between now and in the past is an extraordinary productivity acceleration," Mr. Greenspan said last April. "That means that the price pressures are not anywhere near where they would be under normal circumstances. ... It ...

Structured Deposit (interest rate linked) - final

... the bank to redeem or "call" the deposit before the maturity date for reasons specified in the terms and conditions of your contract. Where a SD is callable, you can expect to receive, at a minimum, the full value of your principal if the bank redeems the deposit. However, this is not the case if yo ...

... the bank to redeem or "call" the deposit before the maturity date for reasons specified in the terms and conditions of your contract. Where a SD is callable, you can expect to receive, at a minimum, the full value of your principal if the bank redeems the deposit. However, this is not the case if yo ...

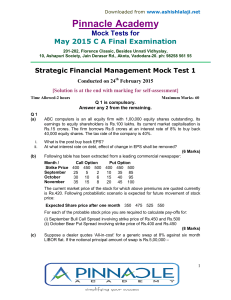

Pinnacle Academ y

... A company has decided to take a 3-year floating rate loan of $250 million to finance a project. The loan is indexed to 6-month LIBOR with a spread of 100 bp. The LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available ...

... A company has decided to take a 3-year floating rate loan of $250 million to finance a project. The loan is indexed to 6-month LIBOR with a spread of 100 bp. The LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available ...

E

... Since lending rates were fully liberalized in 2013, the complete removal of the deposit rate ceiling is the only remaining key step of interest rate liberalization.9 This ceiling is clearly binding, as evidenced by the higher rate banks are paying on wealth management products. This final move will ...

... Since lending rates were fully liberalized in 2013, the complete removal of the deposit rate ceiling is the only remaining key step of interest rate liberalization.9 This ceiling is clearly binding, as evidenced by the higher rate banks are paying on wealth management products. This final move will ...

Intergrated Bank Corporation (IBC) is a medium

... The initial teaser and future spreads passed through to bond holders – less the servicing fee – are set so that GNMA ARMs trade at par at issuance. Specifically, the currently, the teaser spread on new 10-year GNMA ARMs is 75 basis point.2 Thus, given today’s one-year CMT rate of 3.12 percent (see T ...

... The initial teaser and future spreads passed through to bond holders – less the servicing fee – are set so that GNMA ARMs trade at par at issuance. Specifically, the currently, the teaser spread on new 10-year GNMA ARMs is 75 basis point.2 Thus, given today’s one-year CMT rate of 3.12 percent (see T ...

What should we make of the negative interest rates that

... Institutional investors that manage great quantities of funds would be particularly interested in this kind of solution. This could even extend to creating a parallel currency that would be based on cash reserves held in enormous vaults. In fact, there are no limits on innovation when there is somet ...

... Institutional investors that manage great quantities of funds would be particularly interested in this kind of solution. This could even extend to creating a parallel currency that would be based on cash reserves held in enormous vaults. In fact, there are no limits on innovation when there is somet ...

Floating rate Term Deposits

... market of the whole economy. Retail investors borrow at floating rates, but invest at a fixed rate, and are therefore exposed to high interest rate risk. Since retail investors cannot hedge their interest rate risk, investing in floating-rate products appears to be the only alternative to lower this ...

... market of the whole economy. Retail investors borrow at floating rates, but invest at a fixed rate, and are therefore exposed to high interest rate risk. Since retail investors cannot hedge their interest rate risk, investing in floating-rate products appears to be the only alternative to lower this ...

Appendix A

... All the options are calculated based on net figures, recognizing that interest rate risk can be minimized by matching the maturity profiles of the borrowing and investment portfolios, so the interest rate risk of variable rate borrowing can be offset by holding variable rate investments. Options B a ...

... All the options are calculated based on net figures, recognizing that interest rate risk can be minimized by matching the maturity profiles of the borrowing and investment portfolios, so the interest rate risk of variable rate borrowing can be offset by holding variable rate investments. Options B a ...

"Why Interest Rates Will Rise," Funds Society

... point in Fed policy. Although her comments were balanced, Janet Yellen’s speech indicated a shift toward policy normalization, an end of the low volatility policy framework, and an emphasis on data dependence. In short, if the economy expands, as most economists expect, the Fed will raise interest r ...

... point in Fed policy. Although her comments were balanced, Janet Yellen’s speech indicated a shift toward policy normalization, an end of the low volatility policy framework, and an emphasis on data dependence. In short, if the economy expands, as most economists expect, the Fed will raise interest r ...

Less Than Zero: The Brave New World of Negative Interest Rates

... Two years into the experiment, it’s time for a more balanced view, says Wellesley College economist Daniel Sichel. While negative rates have hardly proved to be a panacea for the slumping global economy, neither have they wrought the sort of chaos and disaster that naysayers predicted. Far from repr ...

... Two years into the experiment, it’s time for a more balanced view, says Wellesley College economist Daniel Sichel. While negative rates have hardly proved to be a panacea for the slumping global economy, neither have they wrought the sort of chaos and disaster that naysayers predicted. Far from repr ...

HOMEWORK 3 SOLUTION Chapter 8 1. Assume that your company

... The yield required by the market on long‐term bonds may change in response to the 50 basis point increase in short‐term rates. If long‐term interest rates rise, then by pledging to sell the Eurobonds at par, CSFB will lose the difference between par and the new lower pric ...

... The yield required by the market on long‐term bonds may change in response to the 50 basis point increase in short‐term rates. If long‐term interest rates rise, then by pledging to sell the Eurobonds at par, CSFB will lose the difference between par and the new lower pric ...

Low interest rates and implications for financial stability

... Note: The table reports the projections for EU28 by the IMF reported in the World Economic Outlook for the last year in the projection horizon: 2015 for the October 2010 WEO, 2018 for the October 2013 WEO and 2012 for the April 2016 WEO. As for the European Commission, the table shows the projection ...

... Note: The table reports the projections for EU28 by the IMF reported in the World Economic Outlook for the last year in the projection horizon: 2015 for the October 2010 WEO, 2018 for the October 2013 WEO and 2012 for the April 2016 WEO. As for the European Commission, the table shows the projection ...

Equity set alongside freedom of contract: Deutsche Bank Unitech

... passed between the creditor and debtor. The issue of LIBOR manipulation by the bank is more difficult. Longmore LJ considered it arguable that ‘manipulation by the Bank of a rate by reference to which interest was calculated would be a most ...

... passed between the creditor and debtor. The issue of LIBOR manipulation by the bank is more difficult. Longmore LJ considered it arguable that ‘manipulation by the Bank of a rate by reference to which interest was calculated would be a most ...

United Overseas Bank and Citigroup Announce the

... The final tranche was an unrated US$7m Preferred Share tranche priced at par. The tranches were placed with a diversified investor base. “Raffles Place Funding, Ltd signals the on-going transformation of the Singaporean asset manager community from CDO investors into CDO managers, a maturation profi ...

... The final tranche was an unrated US$7m Preferred Share tranche priced at par. The tranches were placed with a diversified investor base. “Raffles Place Funding, Ltd signals the on-going transformation of the Singaporean asset manager community from CDO investors into CDO managers, a maturation profi ...

Five (easy) ways to prepare for rising interest rates

... The yield on Canada's benchmark 10-year government bond, for instance, has plunged to less than 1.5 per cent from about 3.5 per cent in 2011. Over the same period, the five-year yield has tumbled to less than 0.85 per cent from more than 2.5 per cent. So does that mean investors can stop thinking ab ...

... The yield on Canada's benchmark 10-year government bond, for instance, has plunged to less than 1.5 per cent from about 3.5 per cent in 2011. Over the same period, the five-year yield has tumbled to less than 0.85 per cent from more than 2.5 per cent. So does that mean investors can stop thinking ab ...

here - Reverse Market Insight

... While the LIBOR rate may often be slightly higher than a comparable maturity Treasury rate, the better margins available for LIBOR-indexed loans often make these loans a better deal for consumers. Although LIBOR may diverge from Treasury rates from time to time, the two indices have historically ...

... While the LIBOR rate may often be slightly higher than a comparable maturity Treasury rate, the better margins available for LIBOR-indexed loans often make these loans a better deal for consumers. Although LIBOR may diverge from Treasury rates from time to time, the two indices have historically ...

Negative Interest Rates Spread Worldwide

... That has been a bedrock assumption across centuries of financial history. But it is an assumption that is increasingly being tossed aside by some of the world’s central banks and bond markets. A decade ago, negative interest rates were a theoretical curiosity that economists would discuss almost as ...

... That has been a bedrock assumption across centuries of financial history. But it is an assumption that is increasingly being tossed aside by some of the world’s central banks and bond markets. A decade ago, negative interest rates were a theoretical curiosity that economists would discuss almost as ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... Diff swaps: (currency hedged basis swap) Floating for floating swap Floating rates are in different currencies All swap payments in one currency Example: swap 5 year gilt (£) yield for 5 year CMT T-note yield swap payments in $ (5-year £ gilt yield) x Notional principal ($) ...

... Diff swaps: (currency hedged basis swap) Floating for floating swap Floating rates are in different currencies All swap payments in one currency Example: swap 5 year gilt (£) yield for 5 year CMT T-note yield swap payments in $ (5-year £ gilt yield) x Notional principal ($) ...

Low interest rates pressuring US bank margins

... The US banking industry in 2011 was a strongly profitable one: return on assets rose across banks of all sizes and net income was close to pre-crisis levels. A closer look, however, reveals this profitability was mainly a result of lower loan loss provisions. Provisions declined year-over-year for t ...

... The US banking industry in 2011 was a strongly profitable one: return on assets rose across banks of all sizes and net income was close to pre-crisis levels. A closer look, however, reveals this profitability was mainly a result of lower loan loss provisions. Provisions declined year-over-year for t ...

Treasury Management Strategy

... part of the revolving facility and therefore we would not wish to repay the loan as we will be unable to redraw it at a point in the future. When the fixed rate matures this will convert to a variable rate loan based on 3 or 6 month LIBOR unless market conditions indicate that longer LIBOR periods o ...

... part of the revolving facility and therefore we would not wish to repay the loan as we will be unable to redraw it at a point in the future. When the fixed rate matures this will convert to a variable rate loan based on 3 or 6 month LIBOR unless market conditions indicate that longer LIBOR periods o ...

Why is Fed Considering Paying Banks Not To Lend to

... Attacks by populist politicians will only grow if the Federal Reserve pays banks $50 billion or $100 billion per year that would, in effect, fatten bank profits in order to not make loans to Main Street. The federal funds rate is out because that would require the Fed to shrink its balance sheet of ...

... Attacks by populist politicians will only grow if the Federal Reserve pays banks $50 billion or $100 billion per year that would, in effect, fatten bank profits in order to not make loans to Main Street. The federal funds rate is out because that would require the Fed to shrink its balance sheet of ...