It is not appropriate to discount the cash flows of a bond by the yield

... Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount b ...

... Treasury bills are pure discount securities issued by US Treasury. Treasury bills are sold with an initial maturity of one-month, 3-months, 6-months and one-year. Cash management bills are also sold very short original maturity. In the secondary market, Treasury bills are quoted on a bank discount b ...

Federal Reserve Raises Interest Rates

... and correspondingly lower gift tax obligation. While the interest rate impact is an important part of this technique, it needs to be balanced against the term of the trust. If the grantor dies before the term of the trust has expired, the property will be included in the grantor’s estate at its valu ...

... and correspondingly lower gift tax obligation. While the interest rate impact is an important part of this technique, it needs to be balanced against the term of the trust. If the grantor dies before the term of the trust has expired, the property will be included in the grantor’s estate at its valu ...

Treasury Management Strategy

... The Treasury Management strategy detailed in this report sets out the arrangements recognising that the new funding arrangements with Barclays and GBSH are now in place. Due to the high level of fixed rate debt that will be in place for the next two years it is unlikely that any material change in s ...

... The Treasury Management strategy detailed in this report sets out the arrangements recognising that the new funding arrangements with Barclays and GBSH are now in place. Due to the high level of fixed rate debt that will be in place for the next two years it is unlikely that any material change in s ...

52111imp - Aberdeenshire Council

... stable at or near current levels. Long term rates are likely to edge up if the base rate increases or there is a strong market expectation of an increase. These expectations provide a variety of options:· That short term rates will be good value compared to long term rates, and are expected to be re ...

... stable at or near current levels. Long term rates are likely to edge up if the base rate increases or there is a strong market expectation of an increase. These expectations provide a variety of options:· That short term rates will be good value compared to long term rates, and are expected to be re ...

official - Government Printing Press

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

... (b) branches oUhe State Bank of India and its Associates as per -II. In case,for any particular issue, the receiving office/s is/are restricted to centres, irwill be armouncedas part of SpeCific Loan Notification. Oi) FIls, NRIs and Qverseas Corporate bodies predominantly owned should submit their a ...

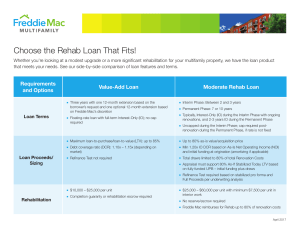

Loans Classified by Special Provision

... The first such program, FHA-245, came into being in 1978. The FHA-245 program is especially attractive to those just starting their careers and anticipating increases in their incomes. They are able to obtain a home with an initial lower monthly installment obligation than would be available under a ...

... The first such program, FHA-245, came into being in 1978. The FHA-245 program is especially attractive to those just starting their careers and anticipating increases in their incomes. They are able to obtain a home with an initial lower monthly installment obligation than would be available under a ...

Structured Deposit (interest rate linked) - final

... XYZ Bank has the right, but not the obligation, to early terminate the deposit on every Interest Payment Date, by giving notice to the depositors at least 2 Business Days prior to the Early Termination Date. The depositor s will be entitled to the applicable interest payments due on the Early Termin ...

... XYZ Bank has the right, but not the obligation, to early terminate the deposit on every Interest Payment Date, by giving notice to the depositors at least 2 Business Days prior to the Early Termination Date. The depositor s will be entitled to the applicable interest payments due on the Early Termin ...

Higher Interest Rates Are on the Horizon

... increase, as the 5-year U.S. Treasury Yield chart indicates. Borrowers should review their exposure to rising interest rates and determine whether fixed rate financing alternatives may benefit them. ...

... increase, as the 5-year U.S. Treasury Yield chart indicates. Borrowers should review their exposure to rising interest rates and determine whether fixed rate financing alternatives may benefit them. ...

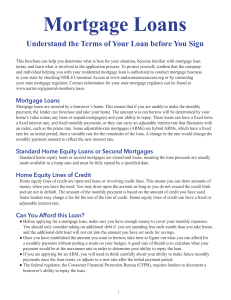

How Homeowners Choose between Fixed and Adjustable Rate

... whether the household faces liquidity constraints. Liquidity constrained households find ARMs particularly attractive because their initial payments are generally lowest; they tend to overlook the overall cost of the mortgage, and (as evidence suggests) ARM holders do not fully take into account the ...

... whether the household faces liquidity constraints. Liquidity constrained households find ARMs particularly attractive because their initial payments are generally lowest; they tend to overlook the overall cost of the mortgage, and (as evidence suggests) ARM holders do not fully take into account the ...

Grad Finale PPT - Valparaiso University

... Private Loans? • You will need to know who you borrowed private loans from and contact them regarding repayment options. • Your private loans are included on the cumulative loan report found in your exit packet. ...

... Private Loans? • You will need to know who you borrowed private loans from and contact them regarding repayment options. • Your private loans are included on the cumulative loan report found in your exit packet. ...

Compound Interest

... called principle. The rate of interest, expressed as a percent, is the amount charged for the use of the principle for a given amount of time. Theorem: If a principle P dollars is borrowed for a period of t years on a yearly interest rate r, the interest I charged is: I = P rt The interest charged a ...

... called principle. The rate of interest, expressed as a percent, is the amount charged for the use of the principle for a given amount of time. Theorem: If a principle P dollars is borrowed for a period of t years on a yearly interest rate r, the interest I charged is: I = P rt The interest charged a ...