The Real Rate of Interest

... Notice that households, businesses, and governmental units are both suppliers and demanders of loanable funds. During most periods, households are net suppliers of funds, whereas the federal government is almost always a net demander of funds. Supply of Loanable Funds (SSU) Consumer savings Business ...

... Notice that households, businesses, and governmental units are both suppliers and demanders of loanable funds. During most periods, households are net suppliers of funds, whereas the federal government is almost always a net demander of funds. Supply of Loanable Funds (SSU) Consumer savings Business ...

Determinants of loan rates

... • This shows that higher risk free interest rate reduce information cost for financial systems. • Is high interest rate bad for economy? • When resource is abundant, waste of resources will not be reflected in human society. • When resource is scarce, waste of resources will accelerate the decline o ...

... • This shows that higher risk free interest rate reduce information cost for financial systems. • Is high interest rate bad for economy? • When resource is abundant, waste of resources will not be reflected in human society. • When resource is scarce, waste of resources will accelerate the decline o ...

Saving and Capital Formation

... • Substitution effect: higher interest rates make it more desirable to substitute future consumption for present consumption -that is, to save now and enjoy a higher standard of living in retirement. • Income effect: higher interest rates make it possible to attain a retirement target (e.g., a house ...

... • Substitution effect: higher interest rates make it more desirable to substitute future consumption for present consumption -that is, to save now and enjoy a higher standard of living in retirement. • Income effect: higher interest rates make it possible to attain a retirement target (e.g., a house ...

Econ 201 Intermediate Macroeconomics

... Inflation was highest in early 1980. The 12-month inflation rate peaked at 14.6% in March and April of 1980. ...

... Inflation was highest in early 1980. The 12-month inflation rate peaked at 14.6% in March and April of 1980. ...

Australian cash rate on hold – bank mortgage

... so raising interest rates just to slow the hot Sydney and Melbourne property markets would be complete madness at a time when overall growth is still fragile, underlying inflation is well below target and property price growth elsewhere is benign or weak. The best way to deal with the hot Sydney and ...

... so raising interest rates just to slow the hot Sydney and Melbourne property markets would be complete madness at a time when overall growth is still fragile, underlying inflation is well below target and property price growth elsewhere is benign or weak. The best way to deal with the hot Sydney and ...

1.1.2 SIMPLE INTEREST In practice, when calculating interest

... borrower) to pay the holder of the note (the lender) a principal amount plus interest on that principal at a specified annual interest rate for a specified length of time, at the end of which the payment is due. It is the convention in financial practice that promissory note interest is calculated o ...

... borrower) to pay the holder of the note (the lender) a principal amount plus interest on that principal at a specified annual interest rate for a specified length of time, at the end of which the payment is due. It is the convention in financial practice that promissory note interest is calculated o ...

Exit Counseling Claflin University

... How much do I have to pay? Example : $150,000 debt at 6.8% interest rate • Standard repayment: $1726.20 monthly for 120 payments • Extended repayment: – Fixed Payments: $694.07 monthly for 300 payments – Graduated Payments: Start at $566.67 and increase every two years to a maximum of $991.50 for 3 ...

... How much do I have to pay? Example : $150,000 debt at 6.8% interest rate • Standard repayment: $1726.20 monthly for 120 payments • Extended repayment: – Fixed Payments: $694.07 monthly for 300 payments – Graduated Payments: Start at $566.67 and increase every two years to a maximum of $991.50 for 3 ...

What does it mean? Common terms for home ownership factsheet

... Bridging finance - Finance obtained over a short period as a prelude to long-term funding. Higher interest rates are usually charged for this form of finance, and it has to be paid back after an agreed time. Some borrowers use bridging finance if they need money to buy a new house while they are wai ...

... Bridging finance - Finance obtained over a short period as a prelude to long-term funding. Higher interest rates are usually charged for this form of finance, and it has to be paid back after an agreed time. Some borrowers use bridging finance if they need money to buy a new house while they are wai ...

Are Businesses Ready To Deal With A Rise In Interest

... 3. Higher rates good for some; bad for others A future rise in interest rates will have an uneven impact across the different sectors of the economy, hurting consumer-reliant businesses more than those who have more diversified revenue sources. ICAEW research finds that while 30% of construction com ...

... 3. Higher rates good for some; bad for others A future rise in interest rates will have an uneven impact across the different sectors of the economy, hurting consumer-reliant businesses more than those who have more diversified revenue sources. ICAEW research finds that while 30% of construction com ...

chapter 5 review game

... other two things do you compare when shopping for food). Quality and Quantity (size) ...

... other two things do you compare when shopping for food). Quality and Quantity (size) ...

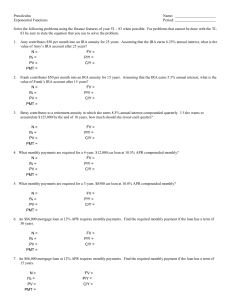

Solve the following problems using the finance

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

... 4. What monthly payments are required for a 4-year, $12,000 car loan at 10.5% APR compounded monthly? N= FV = I% = P/Y = PV = C/Y = PMT = 5. What monthly payments are required for a 3-year, $8500 car loan at 10.0% APR compounded monthly? ...

department of regulatory agencies

... 7. "Annual Percentage Rate" means the charge for credit, stated as a percentage, and expressed as an annualized rate as defined by the Truth in Lending Act. 8. "Closed-end credit" includes all consumer credit that does not fit the definition of open-end credit. Closed-end credit consists of both sa ...

... 7. "Annual Percentage Rate" means the charge for credit, stated as a percentage, and expressed as an annualized rate as defined by the Truth in Lending Act. 8. "Closed-end credit" includes all consumer credit that does not fit the definition of open-end credit. Closed-end credit consists of both sa ...

How Higher Interest Rates Affect the Economy

... Higher rates redistribute money from debtors to lenders. Some of this redistribution occurs as a result of costlier credit transactions – creditors reap the gains as borrowing becomes more expensive for government, households and businesses. In addition, some redistribution occurs as a result of job ...

... Higher rates redistribute money from debtors to lenders. Some of this redistribution occurs as a result of costlier credit transactions – creditors reap the gains as borrowing becomes more expensive for government, households and businesses. In addition, some redistribution occurs as a result of job ...

Downlaod File

... effect (IFE), the Cyprus pound should adjust to a new level of: a. $1.47. b. $1.53. c. $1.43. d. $1.57. True/False Indicate whether the statement is true or false. __ True __ 9. The relative form of purchasing power parity (PPP) accounts for the possibility of market imperfections such as transporta ...

... effect (IFE), the Cyprus pound should adjust to a new level of: a. $1.47. b. $1.53. c. $1.43. d. $1.57. True/False Indicate whether the statement is true or false. __ True __ 9. The relative form of purchasing power parity (PPP) accounts for the possibility of market imperfections such as transporta ...