Section 5

... • Long term interest rates are interest rates paid on long-term financial investments, like 30-year Treasury bonds. • Short-term interest rates are interest rates paid on short-term financial investments, lie 3-month CDs and 3-month Treasury bonds. • Typically long-term rates are higher due to risk. ...

... • Long term interest rates are interest rates paid on long-term financial investments, like 30-year Treasury bonds. • Short-term interest rates are interest rates paid on short-term financial investments, lie 3-month CDs and 3-month Treasury bonds. • Typically long-term rates are higher due to risk. ...

Interest Rates - Beaconsfield High School Virtual Learning

... Mr Sheridan, MD of a house building company says he fears the cut might be "too little, too late". He says it may help if the banks use the rate cuts to cut the amount his company pays to borrow money for developments. They often borrow at a rate a few points above the Bank of England base rate so l ...

... Mr Sheridan, MD of a house building company says he fears the cut might be "too little, too late". He says it may help if the banks use the rate cuts to cut the amount his company pays to borrow money for developments. They often borrow at a rate a few points above the Bank of England base rate so l ...

neophotonics corporation

... each of the Loans was drawn on the closing date of February 25, 2015. The Company used a portion of the proceeds of the Loans to repay the principal and accrued interest of the then-existing debt of the Japanese Subsidiary, which was approximately 710 million Japanese Yen (approximately $6.0 million ...

... each of the Loans was drawn on the closing date of February 25, 2015. The Company used a portion of the proceeds of the Loans to repay the principal and accrued interest of the then-existing debt of the Japanese Subsidiary, which was approximately 710 million Japanese Yen (approximately $6.0 million ...

here - EBS

... Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variabl ...

... Variations in any of these factors listed above could result in changes to our mortgage variable interest rates. This list may change over time due to reasons both within and outside of our control. If this happens, we will tell you about the change as soon as possible and publish an updated variabl ...

Questions from Chapter 3 - Purdue Agricultural Economics

... c. a plot of interest rates versus term, also called the term structure of interest rates. d. all of the above ...

... c. a plot of interest rates versus term, also called the term structure of interest rates. d. all of the above ...

FedViews

... The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews generally appears around the middle of the month. ...

... The views expressed are those of the author, with input from the forecasting staff of the Federal Reserve Bank of San Francisco. They are not intended to represent the views of others within the Bank or within the Federal Reserve System. FedViews generally appears around the middle of the month. ...

Discussion of “Credit Supply and the Housing Boom” by Alejandro Justiniano,

... market The paper’s model takes the opening to be a simple upward shift in an exogenous constraint on all mortgage finance This assumption contradicts the evidence that the traditional 30-year fixed mortgage is tightly linked to other debt markets More subtle modeling would recognize the specific imp ...

... market The paper’s model takes the opening to be a simple upward shift in an exogenous constraint on all mortgage finance This assumption contradicts the evidence that the traditional 30-year fixed mortgage is tightly linked to other debt markets More subtle modeling would recognize the specific imp ...

Discrete Math Review, Chapter 8

... 11. You plan to purchase a sailboat in four years at a cost of $12,500. How much should you invest now, at 7.3% simple interest, to have enough to purchase the boat in four years? $9,674.92 12. Find the effective interest rate on a loan at 7.25% interest compounded… a. semi-annually 7.38% b. quarter ...

... 11. You plan to purchase a sailboat in four years at a cost of $12,500. How much should you invest now, at 7.3% simple interest, to have enough to purchase the boat in four years? $9,674.92 12. Find the effective interest rate on a loan at 7.25% interest compounded… a. semi-annually 7.38% b. quarter ...

Real estate terms and definitions

... mortgage default insurance) is required if the down payment is less than 20 percent of a home's purchase price. Private mortgage insurance can add hundreds of dollars per year to loan costs. When the equity in the property increases to 20 percent, borrowers no longer need the insurance. Not to be co ...

... mortgage default insurance) is required if the down payment is less than 20 percent of a home's purchase price. Private mortgage insurance can add hundreds of dollars per year to loan costs. When the equity in the property increases to 20 percent, borrowers no longer need the insurance. Not to be co ...

here - Reverse Market Insight

... Conventional (not government insured) reverse mortgage lenders in the US often offer smaller loan amounts to reduce risks. They find it hard to compete with government insured HECM except in the “jumbo” market for homes valued above FHA loan limit of $417,000. Note: conventional market has become in ...

... Conventional (not government insured) reverse mortgage lenders in the US often offer smaller loan amounts to reduce risks. They find it hard to compete with government insured HECM except in the “jumbo” market for homes valued above FHA loan limit of $417,000. Note: conventional market has become in ...

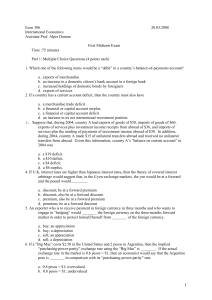

Econ 306

... 1. Which one of the following items would be a “debit” in a country’s balance-of-payments account? a. exports of merchandise b. an increase in a domestic citizen’s bank account in a foreign bank c. increased holdings of domestic bonds by foreigners d. exports of services 2. If a country has a curren ...

... 1. Which one of the following items would be a “debit” in a country’s balance-of-payments account? a. exports of merchandise b. an increase in a domestic citizen’s bank account in a foreign bank c. increased holdings of domestic bonds by foreigners d. exports of services 2. If a country has a curren ...

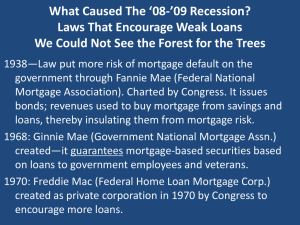

What Caused This Mess? Bad Laws Built Up Over Time

... 1938—Law put more risk of mortgage default on the government through Fannie Mae (Federal National Mortgage Association). Charted by Congress. It issues bonds; revenues used to buy mortgage from savings and loans, thereby insulating them from mortgage risk. 1968: Ginnie Mae (Government National Mortg ...

... 1938—Law put more risk of mortgage default on the government through Fannie Mae (Federal National Mortgage Association). Charted by Congress. It issues bonds; revenues used to buy mortgage from savings and loans, thereby insulating them from mortgage risk. 1968: Ginnie Mae (Government National Mortg ...

4.1 Exponential Functions

... How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold zerocoupon $1000 bonds maturing in 3 years with an annual yield of 10%. Find the ...

... How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold zerocoupon $1000 bonds maturing in 3 years with an annual yield of 10%. Find the ...