Douglass. Rob has focused on these narkets fron the point of

... floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of facËors. These will include the absolute level of interest r ...

... floating rates were over 2O%, whereas today, they are below 7%. In the same time fixed rates have ranged betweet 8% and L6%. In considering whether to borrow on a fixed rate basis, a borrower ï¡il1 if possible take into account a number of facËors. These will include the absolute level of interest r ...

Exponential Function

... How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold zerocoupon $1000 bonds maturing in 3 years with an annual yield of 10%. Find the ...

... How much money must he deposit in a trust fund paying 8% compounded quarterly at the time of your birth to yield $1,000,000 when you retire at age 60? 10. Personal Finance: Zero-Coupon Bonds - FUJI Holding recently sold zerocoupon $1000 bonds maturing in 3 years with an annual yield of 10%. Find the ...

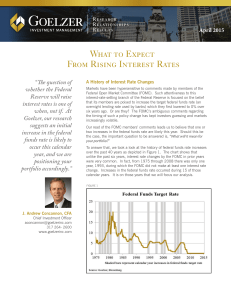

Rising Rates: The Fed Takes Next Step Toward Normal

... less than expected, rate adjustments will likely follow suit. The financial markets could continue to react to Fed policies, but that doesn't mean you should do the same. As always, it's important to maintain a long-term perspective and make sound investment decisions based on your own financial goa ...

... less than expected, rate adjustments will likely follow suit. The financial markets could continue to react to Fed policies, but that doesn't mean you should do the same. As always, it's important to maintain a long-term perspective and make sound investment decisions based on your own financial goa ...

Lesson Two Exponential and Logarithmic Word

... 3.5% every year. If the forest currently has 3,350 trees in it, how many trees were in the forest 4 years and 3 months ago? ...

... 3.5% every year. If the forest currently has 3,350 trees in it, how many trees were in the forest 4 years and 3 months ago? ...

Mortgage rates are not the when-to-buy factor Market Trend Scorecard

... As rates rise, homes may become less affordable and demand may slow. Any declines in housing will be offset by gains in other sectors of the economy. Just in the last year, gains support this expectation. The national unemployment rate (July 2014 to July 2015) has dropped from 6.2% to 5.3%. Locally ...

... As rates rise, homes may become less affordable and demand may slow. Any declines in housing will be offset by gains in other sectors of the economy. Just in the last year, gains support this expectation. The national unemployment rate (July 2014 to July 2015) has dropped from 6.2% to 5.3%. Locally ...

Rule of 72

... 72 / 10 years = 7.2% interest Students will need the internet to complete the first two columns of the activity. A variety of websites can be used to find funds and rates, although two resources are listed. Students will use the Rule of 72 to fill in the third column and answer the questions. ...

... 72 / 10 years = 7.2% interest Students will need the internet to complete the first two columns of the activity. A variety of websites can be used to find funds and rates, although two resources are listed. Students will use the Rule of 72 to fill in the third column and answer the questions. ...

Residential Lending

... 15 years1 or 30 years2. This option can work well if you plan to own your home for a long time. ADJUSTABLE-RATE MORTGAGES If you don’t plan to own your home for an extended period of time, consider an adjustable rate mortgage (ARM) with a fixed interest rate for an initial period, then it adjusts an ...

... 15 years1 or 30 years2. This option can work well if you plan to own your home for a long time. ADJUSTABLE-RATE MORTGAGES If you don’t plan to own your home for an extended period of time, consider an adjustable rate mortgage (ARM) with a fixed interest rate for an initial period, then it adjusts an ...

Sample Questions

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

... 8. The Howe family recently bought a house. The house has a 30-year, $165,000 mortgage with monthly payments and a nominal (annual) interest rate of 8 percent. What is the total dollar amount of interest the family will pay during the first three years of their mortgage? (Assume that all payments ar ...

[Int`lFinance]FinalPaper_KWAKJeeEun5

... investment banks and mortgage companies. Value crash in the financial market led two hedge funds owned by Bear Stearns who mainly invested in subprime CDOs filed for bankruptcy in July 2007. Many mortgage loan companies filed for bankruptcy and this starting crisis did not stay at sub-prime mortgage ...

... investment banks and mortgage companies. Value crash in the financial market led two hedge funds owned by Bear Stearns who mainly invested in subprime CDOs filed for bankruptcy in July 2007. Many mortgage loan companies filed for bankruptcy and this starting crisis did not stay at sub-prime mortgage ...

![[Int`lFinance]FinalPaper_KWAKJeeEun5](http://s1.studyres.com/store/data/020902525_1-8b3bd67b6fcbe05022cd6ab5ab1a1f0a-300x300.png)